- Sample Resumes

Banking Resume Samples & Templates

After researching possible banking careers and knowing which type of job interests you most, it’s the perfect time to put that knowledge to good use. Prior to landing an interview, you need to create an appealing sample resume . Take some time to contemplate what you would like to say to your potential employers about yourself. But what if you’re struggling on how you will express yourself, especially your skills and achievements to them? Don’t worry! We’re here to help you jumpstart your journey in your banking career. Just check our templates below and carefully read this article as we share valuable steps that can help you in this matter.

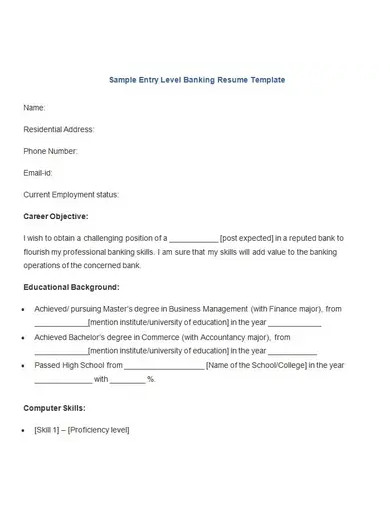

Banking Resume

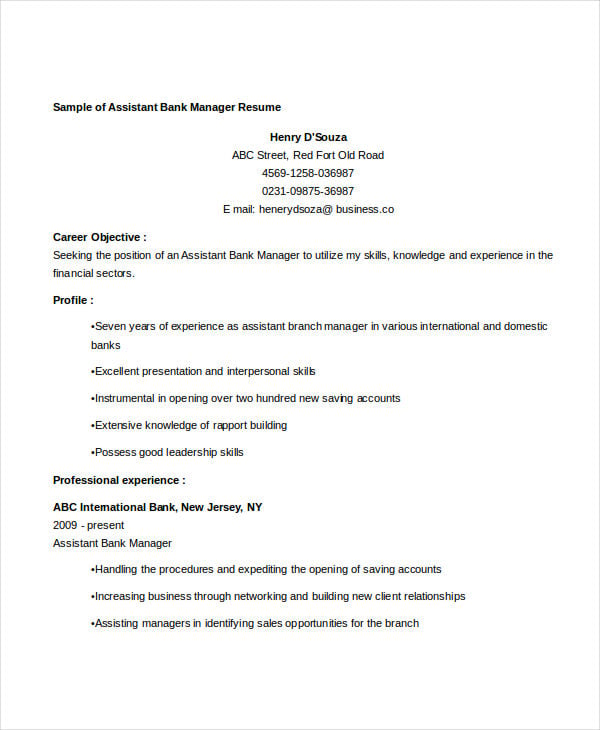

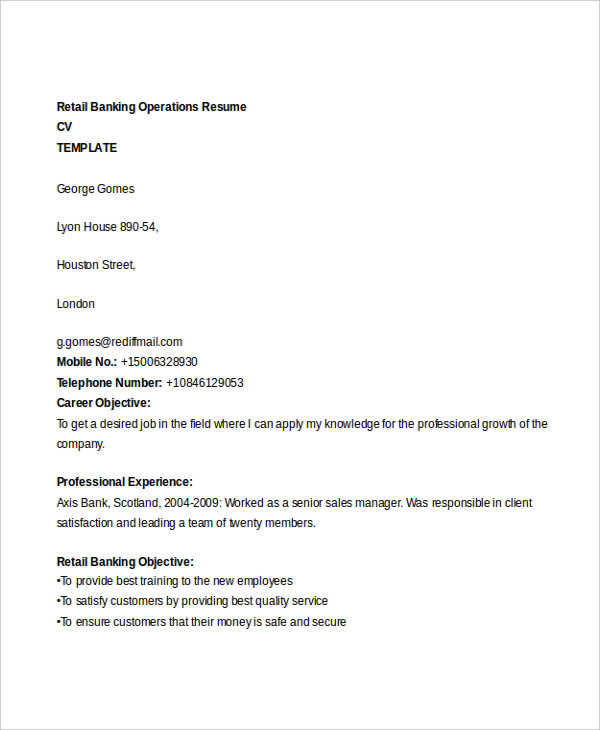

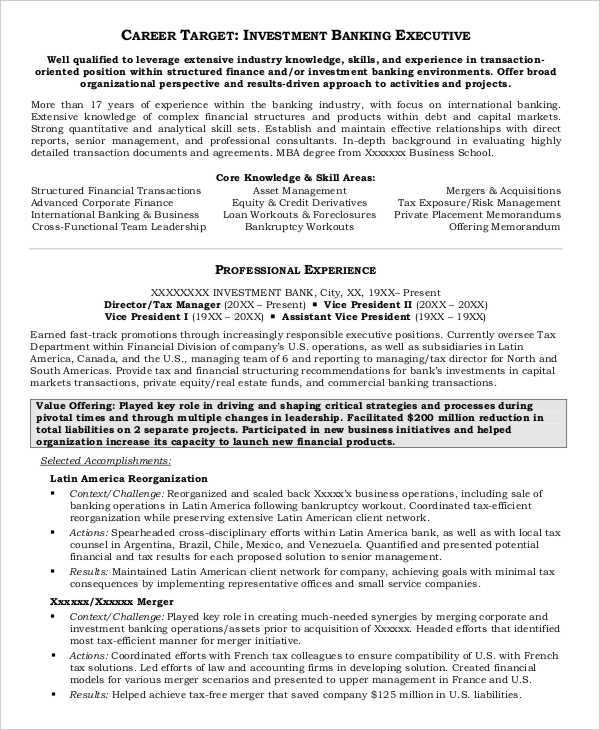

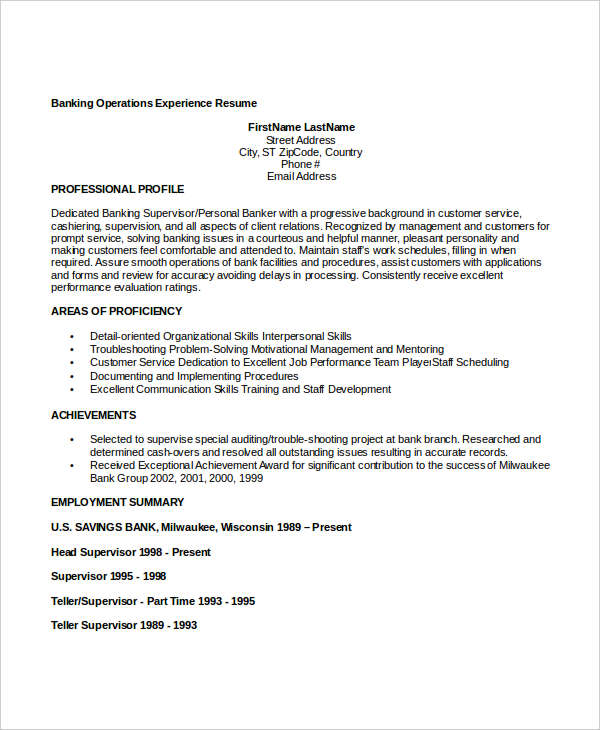

Resume for bank jobs with experience, resume for banking operations, investment banking resume, profile summary for banking resume, browse more templates on banking resume, 1. banking cv format in word free download, 2. banking resume format word, 3. resume for bank job fresher in word format, 4. banking cv format in word, 5. resume format for bank job in word file download, how do i write a cv for banking, 6. banking resume template free download, 7. free cv template for banking job, 8. bank resume format pdf, 9. bank resume format pdf download, 10. bank job cv format pdf, 11. resume format for bank job, what is the key skill for bank job, 12. banking resume sample, what is a banking resume, how to create a banking resume, 1. focus on clarity and brevity, 2. feature your accomplishments and contributions, 3. be honest at all times, 4. proofread and revise your resume, what skills are required for banking jobs, what should i put on my resume for banking, what is bank resume, how do i write a bank resume, what do banks look for in a resume, what are the best jobs in banking.

Download Banking Resume Bundle

123 Financial Street

New York, NY 10001

[email protected]

(555) 123-4567

Professional Summary

Dedicated and results-oriented banking professional with over 10 years of experience in financial services. Proven track record of managing customer accounts, executing financial transactions, and ensuring compliance with regulatory requirements. Excellent communication, analytical, and problem-solving skills, with a strong commitment to delivering exceptional customer service.

Professional Experience

Senior Relationship Manager

Chase Bank, New York, NY January 2018 – Present

- Managed and maintained a portfolio of 200 high-net-worth clients, ensuring personalized service and addressing their financial needs.

- Executed complex financial transactions, including loans, mortgages, and investments, ensuring accuracy and compliance with banking regulations.

- Analyzed financial statements, credit reports, and loan applications to assess risk and make informed lending decisions.

- Provided financial advice and guidance to clients on a range of products and services, including savings accounts, credit cards, and investment opportunities.

- Led a team of 10 banking associates, providing training, mentoring, and performance evaluations to ensure high levels of productivity and customer satisfaction.

- Achieved a 15% increase in client portfolio value, contributing to the overall success and profitability of the branch.

Banking Associate

Wells Fargo, New York, NY June 2012 – December 2017

- Processed daily transactions, including deposits, withdrawals, and transfers, with a focus on accuracy and efficiency.

- Assisted customers with account inquiries, resolving issues promptly and providing detailed information about bank products and services.

- Conducted thorough financial analysis and due diligence for loan applications, ensuring compliance with bank policies and regulatory requirements.

- Supported the implementation of new banking software, training staff on system functionalities and troubleshooting technical issues.

- Developed and maintained strong relationships with customers, fostering trust and loyalty through excellent service and personalized financial solutions.

Bachelor of Science in Finance

New York University, New York, NY Graduated: 2012

Certifications

- Certified Financial Planner (CFP) – 2015

- Chartered Financial Analyst (CFA) – 2017

- Anti-Money Laundering (AML) Certification – 2016

- Strong knowledge of banking regulations and compliance requirements

- Proficient in financial analysis and risk assessment

- Excellent customer service and relationship management skills

- Skilled in financial software and banking applications (e.g., QuickBooks, SAP)

- Exceptional problem-solving and decision-making abilities

- Effective communication and interpersonal skills

- Detail-oriented with strong organizational skills

Professional Affiliations

- Member, American Bankers Association

- Member, Financial Planning Association

- Member, Chartered Financial Analyst Institute

Available upon request.

Download In

PDF Word Google Docs

456 Finance Avenue, Chicago, IL 60601 | [email protected] | (312) 456-7890

Banking Operations Manager

Seasoned banking professional with over 12 years of experience driving operational success by managing and motivating teams, ensuring financial profitability, and optimizing efficiency. Proficient in compliance and risk management with a solid background in financial analysis. Known for enhancing productivity through strategic planning and continuous improvement initiatives.

- Regulatory Compliance & Governance

- Financial Analysis & Reporting

- Risk Management & Mitigation

- Customer Service Excellence

- Team Leadership & Development

- Operational Efficiency

- Process Improvement

- Project Management

- Budgeting & Forecasting

- Performance Tracking

- Strategic Planning

- Vendor Management

- Data Analysis & Interpretation

- Technology Integration

- Fraud Detection & Prevention

- Communication & Collaboration

- Training & Development

- Relationship Building

Work History

Bank of America, Chicago, IL March 2016 – Present

- Oversaw daily operations of the branch, ensuring compliance with regulatory standards and internal policies.

- Led a team of 20 employees, providing training and development to enhance performance and achieve business objectives.

- Implemented process improvements that increased efficiency by 25% and reduced operational costs by 18%.

- Managed customer relationships, resolving issues promptly and maintaining a high level of satisfaction.

- Coordinated with different departments to streamline operations and improve service delivery.

Senior Operations Analyst

Citibank, Chicago, IL July 2010 – February 2016

- Conducted detailed financial analysis and generated reports for senior management.

- Monitored and assessed operational risks, implementing strategies to mitigate potential issues.

- Developed and maintained operational policies and procedures to ensure consistency and compliance.

- Collaborated with IT to integrate new banking software, enhancing data accuracy and processing speed.

- Provided support during audits and regulatory examinations, ensuring all documentation was complete and accurate.

University of Illinois at Chicago, Chicago, IL Graduated: 2010

- Certified Financial Planner (CFP) – 2016

- Chartered Financial Analyst (CFA) – 2018

- Anti-Money Laundering (AML) Certification – 2017

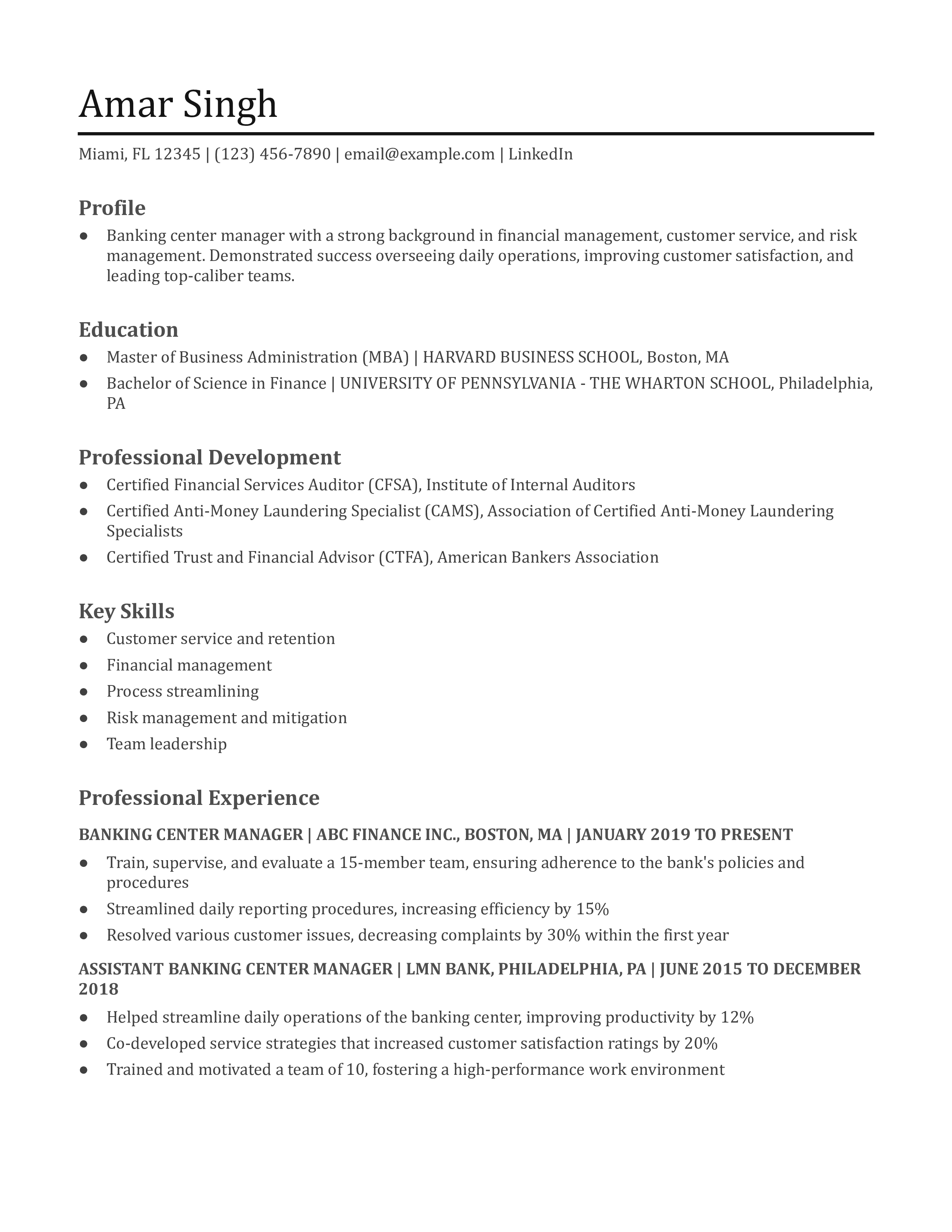

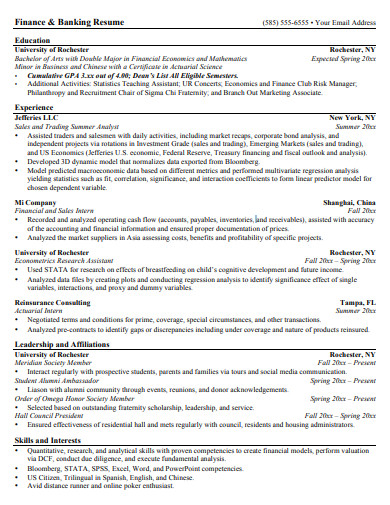

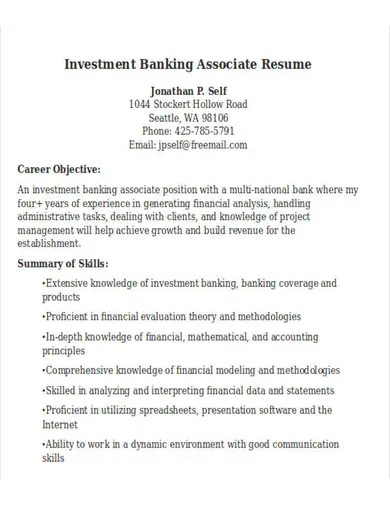

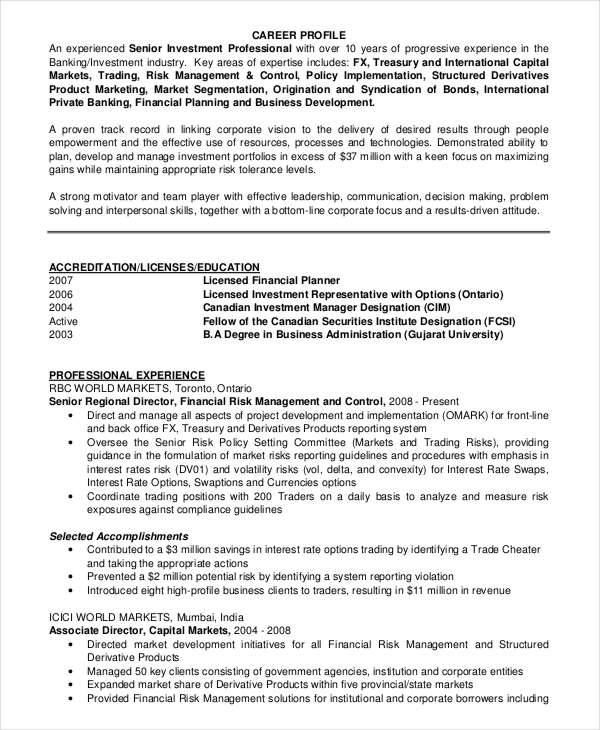

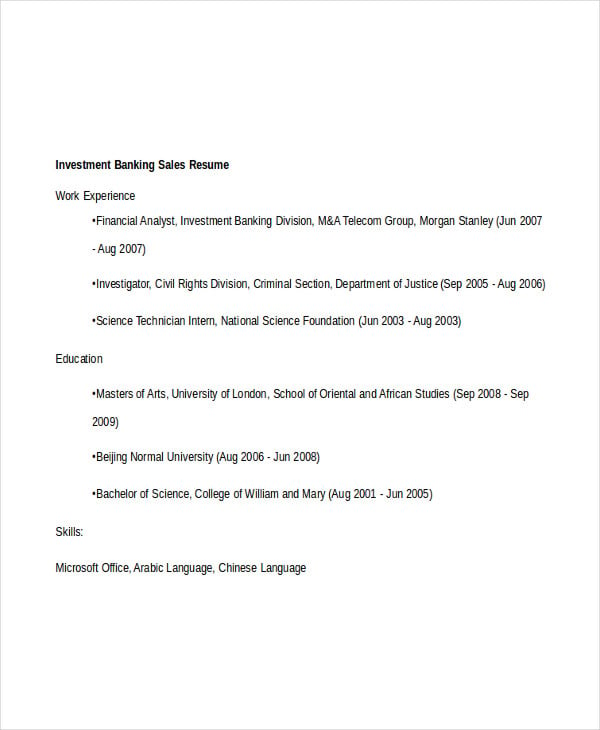

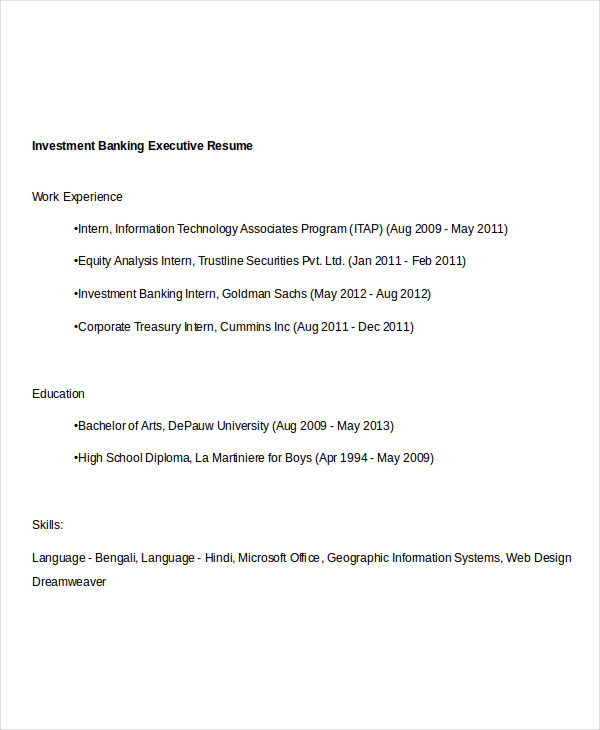

Investment Banking Professional

Master of Business Administration (MBA) in Finance

University of Chicago Booth School of Business, Chicago, IL Graduated: 2016

- Relevant Coursework: Corporate Finance, Financial Statement Analysis, Investment Banking, Mergers & Acquisitions

Bachelor of Science in Economics

University of Illinois at Urbana-Champaign, Urbana, IL Graduated: 2012

- Honors: Magna Cum Laude

- Relevant Coursework: Microeconomics, Macroeconomics, Econometrics, Financial Markets

Work Experience

Investment Banking Associate

Goldman Sachs, Chicago, IL July 2016 – Present

- Advised on and executed mergers and acquisitions, leveraged buyouts, and other strategic transactions.

- Conducted detailed financial modeling, valuation, and due diligence for clients in various industries.

- Prepared pitch books, client presentations, and transaction documentation.

- Collaborated with senior bankers to provide strategic advisory services to clients.

- Played a key role in a $500 million M&A transaction, leading financial analysis and client communication.

Financial Analyst

J.P. Morgan, New York, NY June 2012 – June 2014

- Analyzed financial statements and conducted industry research to support investment decisions.

- Developed complex financial models to forecast company performance and valuation.

- Assisted in the preparation of pitch books and transaction proposals.

- Participated in the execution of equity and debt offerings.

- Contributed to a $300 million IPO by conducting valuation and preparing investor materials.

- Financial Modeling & Valuation

- Mergers & Acquisitions

- Strategic Advisory

- Due Diligence

- Industry Research

- Client Relationship Management

- Pitch Book Preparation

- Financial Statement Analysis

- Capital Markets

- Advanced Excel and PowerPoint

- Chartered Financial Analyst (CFA) – Level III Candidate

- Series 7 and Series 63 Licensed

- Member, CFA Institute

- Member, Chicago Finance Society

Additional Information

- Fluent in Spanish and Mandarin.

- Volunteer at Financial Literacy Program, educating underprivileged communities on personal finance.

- Active participant in industry conferences and networking events.

Phone: (312) 456-7890 Email: [email protected] Website: www.johndoe.com LinkedIn: linkedin.com/in/johndoe Address: 456 Finance Avenue, Chicago, IL 60601

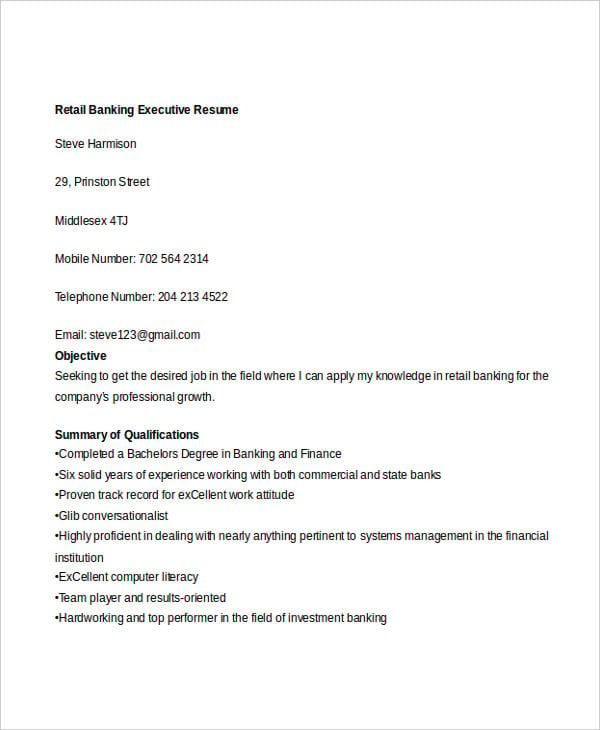

Profile Summary

Experienced Banking Professional with a successful career in managing customer accounts, executing financial transactions, and ensuring compliance with regulatory standards. Proficient in financial analysis, risk management, and strategic planning to drive operational efficiency and profitability. Adept at building and maintaining productive relationships with clients and colleagues, leveraging strong communication and problem-solving skills to enhance service delivery and achieve business objectives. Committed to excellence and continuous improvement, with a track record of exceeding performance targets and fostering customer satisfaction.

- Risk Management & Compliance

- Relationship Management

- Financial Software Proficiency

- Problem Solving & Decision Making

Banking Operations Manager Bank of America, Chicago, IL March 2016 – Present

- Managed daily operations of the branch, ensuring compliance with regulatory standards and internal policies.

Senior Operations Analyst Citibank, Chicago, IL July 2010 – February 2016

Bachelor of Science in Finance University of Illinois at Chicago, Chicago, IL Graduated: 2010

Size: A4 & US

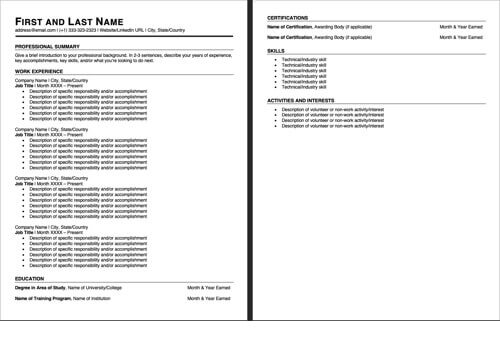

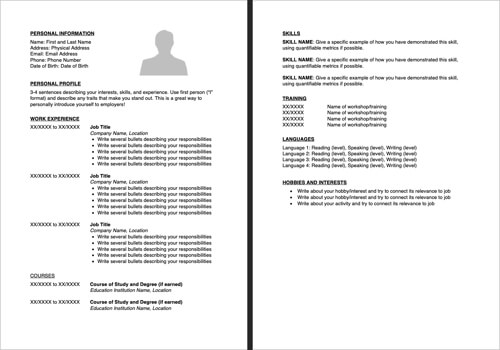

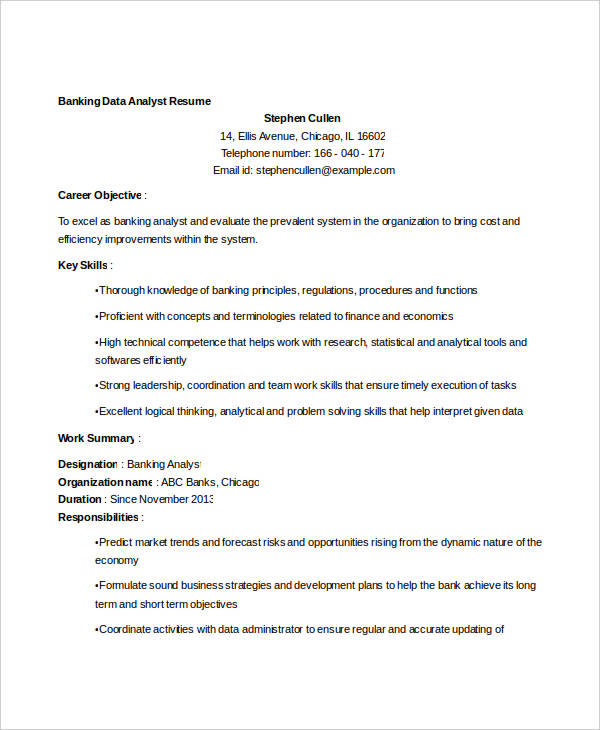

Writing a compelling CV (Curriculum Vitae) for a banking position is essential to make a strong impression on potential employers. Here’s a guide on how to structure and write an effective banking CV:

- Contact Information: Include your full name, phone number, email address, and LinkedIn profile (if applicable). Ensure this information is accurate and up-to-date.

- Personal Statement: Write a concise personal statement or objective that highlights your career goals, skills, and what you bring to a banking role.

- Professional Summary: Provide a brief summary of your banking experience, key skills, and achievements. Tailor this section to showcase your suitability for the specific banking position you’re applying for.

- Skills: Create a dedicated section for key skills relevant to the banking industry. Include both technical skills (e.g., financial analysis, risk management) and soft skills (e.g., communication, teamwork).

- Job title and dates of employment.

- Name of the company or financial institution.

- Key responsibilities and achievements.

- Quantify your achievements whenever possible (e.g., “Managed a portfolio of X clients”).

- Education: Include your educational background, starting with the most recent degree. Mention the institution, degree earned, graduation date, and any relevant honors or awards.

- Certifications and Training: Highlight any relevant certifications, such as Chartered Financial Analyst (CFA), Certified Public Accountant (CPA), or banking-specific courses.

- Achievements: Dedicate a section to showcase your notable achievements in the banking industry. This could include successful projects, improvements in efficiency, or recognition received.

- Professional Memberships: Mention any memberships in relevant professional organizations or banking associations.

- Technical Proficiency: List any software, tools, or financial systems you are proficient in, such as Excel, Bloomberg, or other banking software. You can also see more on Bank Teller Resume .

- Languages: If applicable, mention any languages you are proficient in, especially if they are relevant to the banking sector.

- References: Conclude your CV with a note about references being available upon request.

- Tailor your CV for each specific banking job application , emphasizing the skills and experiences most relevant to the position.

- Use action verbs and quantifiable achievements to make your CV impactful.

- Keep your CV concise and focused, aiming for a length of 1-2 pages.

- Proofread your CV for errors and consistency.

Remember, a well-crafted CV should effectively communicate your qualifications, experience, and suitability for the banking role you’re pursuing.

Size: 104 KB

Size: 10 KB

Size: 44 KB

Size: 45 KB

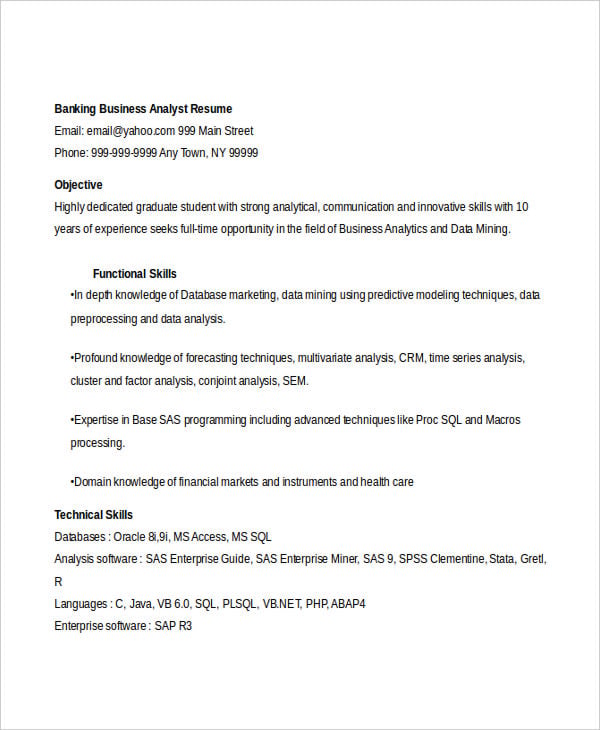

A key skill for a bank job is “Financial Analysis.” Bank professionals need the ability to analyze financial data, assess risk, and make informed decisions. Proficiency in financial analysis involves evaluating financial statements, assessing creditworthiness, understanding market trends, and making recommendations for investments or lending. Strong financial analysis skills are essential for roles such as financial analysts, investment bankers, loan officers, and other positions in the banking sector. This skill ensures effective decision-making, risk management, and contributes to the overall financial health and success of the bank and its clients.

Size: 68 KB

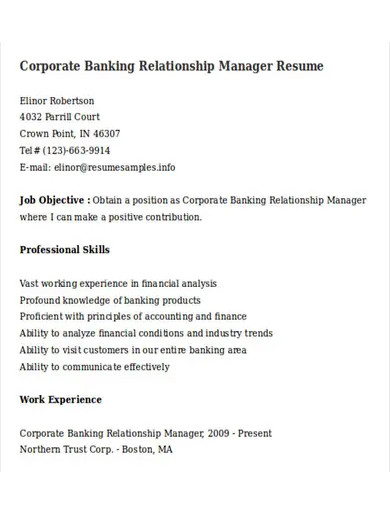

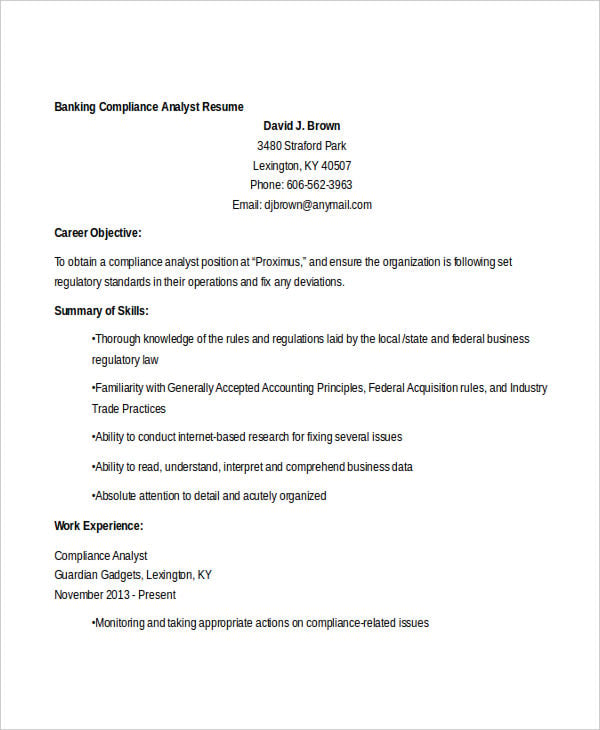

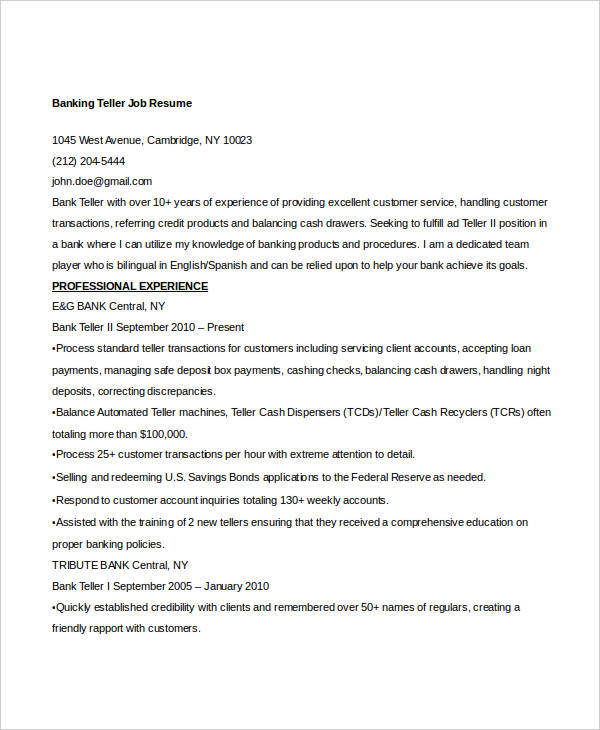

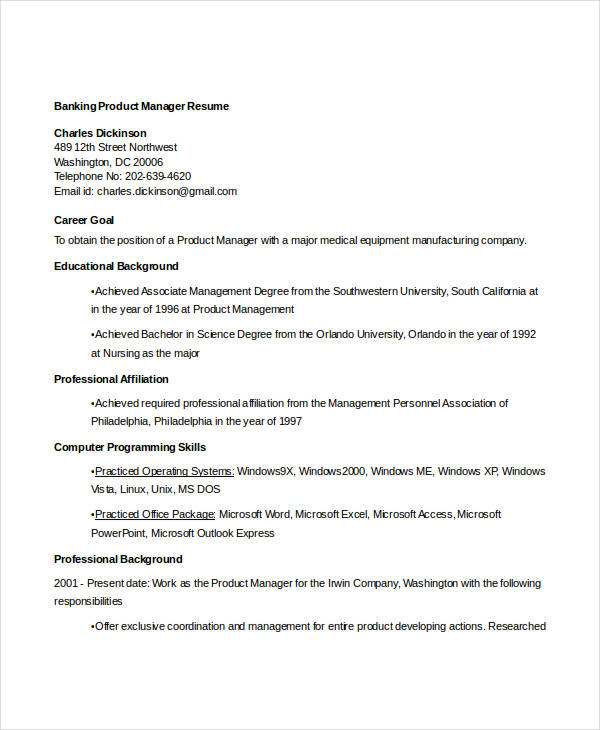

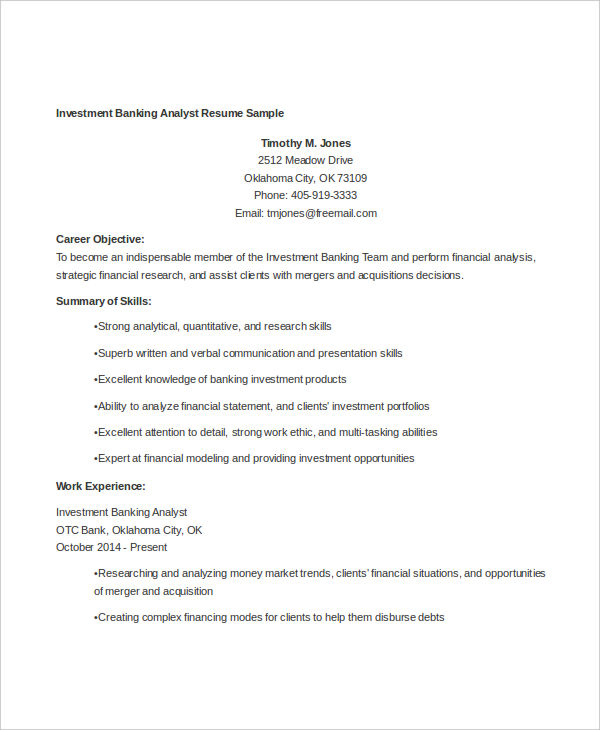

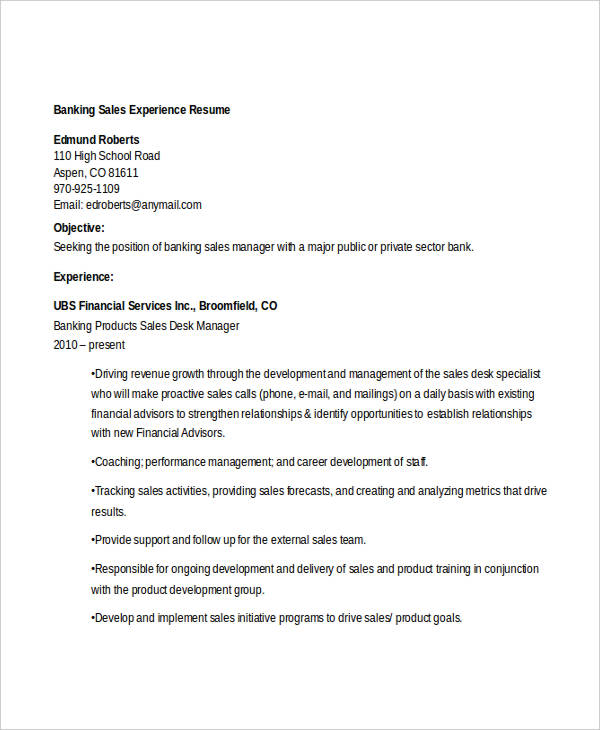

A banking resume is a document that contains the detailed information of a person’s skills, competencies, education, work experience, and other achievements for his or her application in a specific job in the banking or financial field.

Usually, students who graduated with diploma, bachelor or master degree in banking and financial management, or in stocks and accountancy are the ones who need to have their banking resume if they intend to work for consumer or commercial banks .

It is very important that you are able to craft a strong resume that stands out and will lead to interviews and job offers. Banking today is one of the most competitive and exciting industries in the world and they compete not only with all other banks, but with non-bank companies which include financial investment contract companies as stated by the book “ Careers in Banking and Finance .”

Here are the following steps that guide you after downloading:

Isaac Newton once said that “truth is ever to be found in the simplicity, and not in the multiplicity and confusion of things.” So, write your resume clearly as you use easy-to-understand words and terms. Keep the information direct and concise. Avoid making your resume very fancy and over the top.

Do you have an accomplishment that significantly showcases you as an exceptional and helpful employee to your company? What valuable contributions have you made to your current or former employers? In this part, define and feature your accomplishments and contributions as these things will help you to catch the attention of potential employers.

It is true that ‘honesty is the best policy.’ You need to write your real skills and authentic work experiences in your resume because if you include a skill that you’re not really good at, it will show on the outcomes of your future task list and job duties . Thus, be honest at all times. Although you are still lacking in some areas today, you will eventually pick up some work skills and experience while working.

Before submitting your resume , give it some rounds of careful review. This will help you to see any possible mistakes and typographical errors and correct them immediately. Proofreading is an essential step as you refine the quality of your resume.

Here are the top skills that are needed for banking jobs:

- Analytical skills

- Determination

- Attention to detail

- Commercial awareness

- Technical skills

- Stress management strategy

On your banking resume, include key details such as your professional summary, relevant skills (e.g., financial analysis, risk management), work experience, education, certifications, and notable achievements in the finance sector.

A bank resume is a document outlining an individual’s qualifications, skills, and work experience related to the banking industry. It typically includes information about education, certifications, and professional achievements.

Write your previous cash book handling experience, even if it is not your most recent experience. Highlight your customer profile service skills and include your tech skills. Consider choosing the best sample resume format for your career.

Having a strong knowledge of core computer program description and a proficiency for working with technology are important factors that common banks need. Then, you should add your expertise in data entry and in using Microsoft Office apps like Word, Excel, PowerPoint, and Outlook.

The best jobs in banking are financial analyst , personal financial adviser business plan , relationship manager, accountant, auditor, and branch manager.

In conclusion, as you strive hard in getting a professional career in the banking field, remember these words cited from an article : “The pain you feel today is the strength you will feel tomorrow. For every challenge encountered there is opportunity for growth.” Therefore, you should keep your focus to your goals and dreams. The difficulties you are facing today will surely outweigh what you will attain in the future. Therefore, to help you create an effective resume, follow the guide and aforementioned tips in this article and download our banking professional resume template today! We hope that you do your best so that you will be at the top of the ladder.

Related Posts

Free 11+ sample civil engineer resume templates in pdf | ms word | psd | indesign | publisher | pages, free 13+ sample electrician resume templates in ms word | pdf, free 22+ sample nursing resume templates in ms word | illustrator | indesign | pages | psd | ms publisher | pdf, free 6+ sample security guard resume templates in pdf | ms word, free 35+ sample accountant resume templates in ms word | indesign | pages | photoshop | ms publisher | pdf, free 10+ accountant resume samples in pdf, free 42+ professional fresher resume templates in pdf | ms word, free 15+ director cv samples in ms word | pages | psd | publisher | pdf, free 10+ sample mba resume templates in ms word | pdf, free 22+ sample nursing resume templates in pdf | ms word, free 13+ sample customer service resume templates in ms word | pdf, free 9+ sample pharmacist resume templates in pdf, free 8+ receptionist resume samples in ms word | pdf, free 28+ simple resume format in ms word | pdf, free 8+ sample hospitality resume templates in ms word | pdf, free 6+ banking ombudsman complaint forms in pdf, free 51+ resume samples in pdf ms word, free 7+ sample general objective for resume templates in pdf, free 11+ bank reconciliation samples and templates in ms word ....

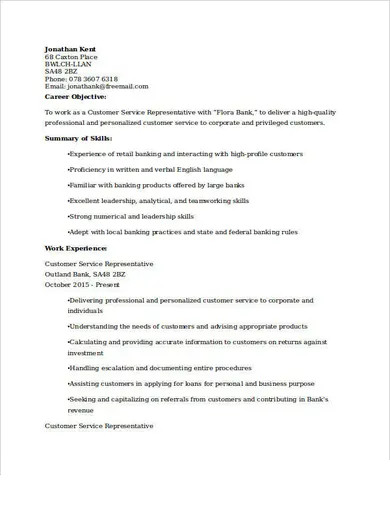

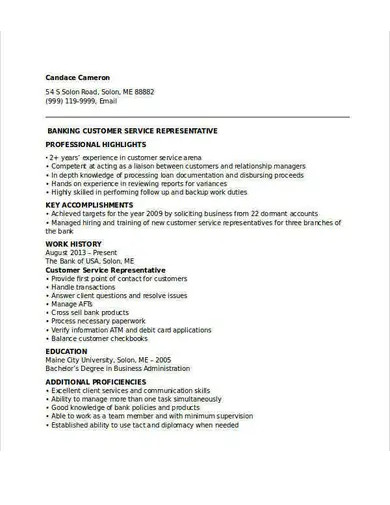

- Banking resume examples

Banking Resume examples

28 Banking resume examples found

All examples are written by certified resume experts, and free for personal use. Copy any of the Banking resume examples to your own resume, or use one of our free downloadable Word templates. We recommend using these Banking resume examples as inspiration only, while creating your own resume.

Learn more about: how to write a perfect resume

While in college, took on a part-time position as a cashier for a local grocery store.

- Established cordial relationships with patrons to provide premium services and build loyalty.

- Efficiently processed all payment transactions in form of cash, checks, and coupons.

- Provided assistance to customers to help them in their selection of available items.

- Managed relations with clients and provided them with information on special offers and promotions.

Bank teller

Performed financial transactions including receiving checks and cash for deposit to savings and checking accounts, verifying deposit amounts, examining checks for endorsement and negotiability. Ensure compliance with security and regulation procedures for the protection of cash and other assets.

- Entered transactions into bank records utilizing the online teller terminal.

- Cashed customer checks and paid money from savings and checking accounts upon verification of signatures and customer account balances.

- Inspected all negotiable items including checks, money orders, and saving withdrawals to determine their negotiability.

- Achieved an excellent drawer balancing record of zero shortages or overages throughout tenure.

- Lowered average wait-time by 15%, leading to highest customer satisfaction scores.

- Educated customers on online service offerings and mobile applications.

- Assisted account holders access technology to enhance banking convenience via multiple self-service channels.

Personal banker

Generated $1 M deposits in one year. Developed a relationship and sales plan for a diverse customer base. Provided a broad range of services including portfolio management, investment management, and credit and personal banking products.

- Performed effective life cycle planning and developed marketing strategies for targeted clients; identified new business opportunities and grew customer base through cross-selling products and services to existing clients.

- Processed and approved all mortgage loan, credit card, and credit line applications for Personal and Professional customers; compiled and verified application information, reviewed agreements for accuracy and compliance, and monitored time-critical turnaround requirements.

- Provided excellent quality customer service, utilizing Gallop scoring and Mystery Shops.

Loan officer

Multifaceted role requiring critical thinking and relations management skills to support seamless financial processes.

- Compiled loan and credit documents required for appraisals to process loan applications.

- Led one-on-one client consultations to compile and assess clients’ financial standing and eligibility for loans.

- Managed information systems, ensuring the accuracy of each loan application incompliance with established standards of practice.

- Analyzed current trends and changes in regards to the financial market and policies to provide clients with the most up-to-date information.

Investment banker

Oversaw $5+ billion investment portfolio of complex fixed-income instruments including Collateralized Mortgage Obligations, Mortgage-Backed Securities, Asset-Backed Securities Hybrid ARMs, Corporate Debt, and Money Market Instruments. Established strategic initiatives to enhance liquidity, profitability while complying with asset/liability management objectives. Educated senior management regarding portfolio management and liquidity.

- Executed the investment operations and strategies of the bank streamlining portfolio structure, asset allocation, and risk profile.

- Provided leadership to all trade execution and portfolio servicing activities including trade review, settlement, and documentation, corporate actions, cash, and collateral management across a range of products including bonds, swaps, and exchange-traded derivatives.

- Monitored the compliance of financial instruments with established policies, procedures, and regulations.

- Served as a voting member of the Bank's Asset/Liability Committee for establishing strategic objectives and managing the Bank's risk profile.

- Presented results, strategies, and recommendations to Bank and association senior management, ALCO, and the Board of Directors.

- Instrumented processes for the ongoing assessment of liquidity and marketability of portfolio holdings.

- Worked closely with funding and derivatives personnel in the formulation and execution of debt and derivatives strategies that support the bank's asset/liability objectives.

- Created and maintained policies and procedures, regulatory compliance, and Sarbanes Oxley compliance documentation.

Loan processor

Oversaw a variety of Loan Servicing functions including Commercial, Real Estate, and Consumer loans. Processed final closing and distribution of paid loans and payoff demand statements. Guided lenders and staff regarding documentation, commercial loan booking, and underwriting compiled and stored credit and collateral files as per state, federal, and banking regulations. Analyzed loan data, documentation, and calculations per GAAP standards; identified risks and recommended policies /procedures to correct deficiencies and improve performance.

- Conducted system data quality audits for all loans and transferred loan specifications to the Fiserv banking system; updated rate changes, borrowing base, loan grades, and payment changes into the system.

- Resolved issues related to the overall financial integrity of banking institutions including loan investment, portfolios, capital, earnings, and large troubled accounts.

- Performed routine credit transactions including new loan funding, advances, payments, payoff, paydown, and fee waivers.

Challenging position providing comprehensive assistance to bank customers whilst supporting corporate goals.

- Oversaw the onboarding and training of new recruits in the company’s specified procedural standards to ensure compliance and the delivery of premium service all over.

- Evaluated customers’ financial reports to identify needs and recommend strategic financial products and opportunities to facilitate their financial goals.

- Consistently surpassed sales targets by leveraging practiced customer service and sales skills.

- Worked collaboratively with colleagues to uphold defined company policies and facilitate corporate goals.

Provided account services to customers by receiving deposits and loan payments, cashing checks, issuing savings withdrawals, recording night and mail deposits, and selling cashier's checks, answering customer questions, and referring to other bank services. Ensured compliance with bank operations and security procedures by participating in all dual-control functions.

- Cross-sell bank products by answering routine inquiries, analyzing customers' needs, promoted banking products and services, and directed customers to a branch representative as needed.

- Managed cash transactions through reconciliation, counted and packaged currency and coins, turned excess cash and mutilated currency to head teller, maintained supply of cash and currency.

Responsible for a portfolio of 20 million and achieved a growth of 2 million monthly through cross-selling bank products encompassing Individual Accounts, Personal Loans, Credit Cards, etc.

- Meticulously monitored clients’ accounts and delivered comprehensive reports to keep them up-to-date on recent developments.

- Consistently achieved defined targets by liaising with colleagues and international branches to generate sales leads for new services.

- Researched and updated all required materials needed to facilitate transactions for clients.

- Facilitated a 20% annual portfolio growth by establishing and nurturing client relationships.

Analytics intensive positon, requiring relations and adaptive skills to effectively perform duties in support of a fast-paced workspace.

- Trained under the supervision of seasoned professionals to hone skills and deliver the best service to clients.

- Created and maintained individual accounts/files in accordance with established standards.

- Provided comprehensive consultations to clients on policies, procedures and requirements in regards to their loans.

- Routinely drafted and delivered detailed reports to superiors to keep them updated on progresses, issues and concerns.

- Easy step-by-step builder

- Professional templates

- Try for free!

Professional resume templates

Make a resume that wins you interviews! Choose one of these professionally-designed resume templates and follow 3 easy steps to complete.

Create a perfect resume in a few minutes

- Field-tested resume templates created by experts

- Powered by Resume.io

- Try now for free!

Free resume templates

- Free for personal use

- Direct download as a Microsoft Word document

- Created by a CPRW certified resume expert

- Optimized for applicant tracking system (ATS) screening

Choosing a correct resume format and template

Resume template

Download our American style resume template. Chronological resume format. Download a functional resume template .

Learn more about the differences between a resume and a CV .

CV template

Download our British/European style cv template. Similar to a resume but more commonly used in Europe, Asia and Africa.

Download cv-template.docx 29.34 KB

Resume Worded | Proven Resume Examples

- Resume Examples

- Finance Resumes

- Investment Banking Resume Guide & Examples

Banker Resume Examples: Proven To Get You Hired In 2024

Jump to a template:

- Commercial Banker

- Personal Banker

Get advice on each section of your resume:

Jump to a resource:

- Banker Resume Tips

Banker Resume Template

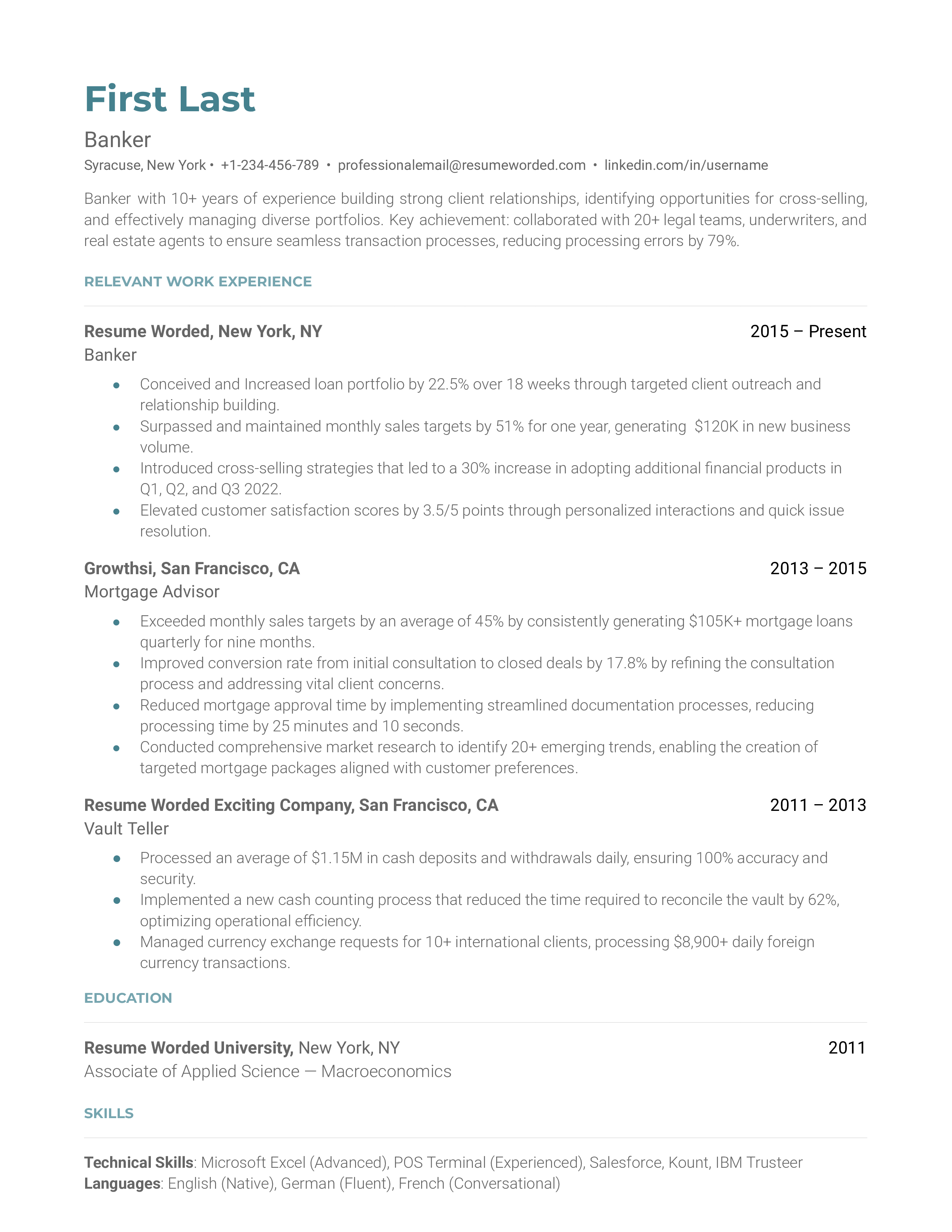

Download in google doc, word or pdf for free. designed to pass resume screening software in 2022., banker resume sample.

The banking industry is all about trust, relationship management, and understanding complex financial systems. A strong resume for a Banker role should reflect your ability to handle these tasks. Recently, the industry has been leaning heavily on technological innovation with online banking and digital transactions becoming standard. Also, sustainability and ethical banking practices are gaining traction. So, while it's essential to demonstrate your fundamental banking knowledge and financial acumen, showcasing your proficiency in the latest banking technologies and awareness of ethical banking practices could give you an added advantage. When crafting your resume, bear in mind that bankers are detail-oriented and value effective communication. Therefore, your resume needs to be impeccably neat, clear, and concise. It needs to quickly communicate your qualifications, experience, and skills relevant to the banking world.

We're just getting the template ready for you, just a second left.

Recruiter Insight: Why this resume works in 2022

Tips to help you write your banker resume in 2024, showcase technical skills and digital proficiency.

Banking is no longer just about traditional financial services; it's rapidly going digital. Mention any experience or familiarity with banking software, online transaction systems, or fintech innovations. This shows you’re not just adaptable, but also forward-thinking.

Highlight understanding of ethical banking norms

As the industry shifts towards ethical banking practices and sustainable investing, it’s crucial to demonstrate your knowledge in this area. If you’ve been involved in any projects or initiatives related to ethical banking, sustainable finance, or corporate social responsibility (CSR), make sure it's there on your resume.

As a banker, your role is about more than just crunching numbers; you're expected to provide financial guidance, build relationships with clients, and work effectively in a highly regulated environment. Digital banking continues to grow so it's critical to understand latest technological trends and how they fit within the banking industry. By being mindful of these factors, you can tailor your resume to reflect the skills and experience that make you stand out in the evolving banking landscape. In crafting an effective banker resume, remember to emphasize your financial acumen and your customer service expertise. Don't just list out your duties; instead, quantify your achievements. It's a competitive field, so giving concrete evidence of your successes will definitely make your application more compelling.

Demonstrate knowledge of banking regulations

In your resume, you should clearly state your understanding and application of banking regulations. Mention specific regulatory projects you've managed or contributed to. This shows that you can navigate the complexities of banking law, a crucial skill for any banker.

Showcase your digital literacy

In light of the digital banking trend, demonstrating that you’re tech-savvy is a plus. List any software, tools or technologies you’ve used or learned that are relevant to banking. If you’ve been part of a project involving digital banking or fintech, make sure to include this in your list of accomplishments.

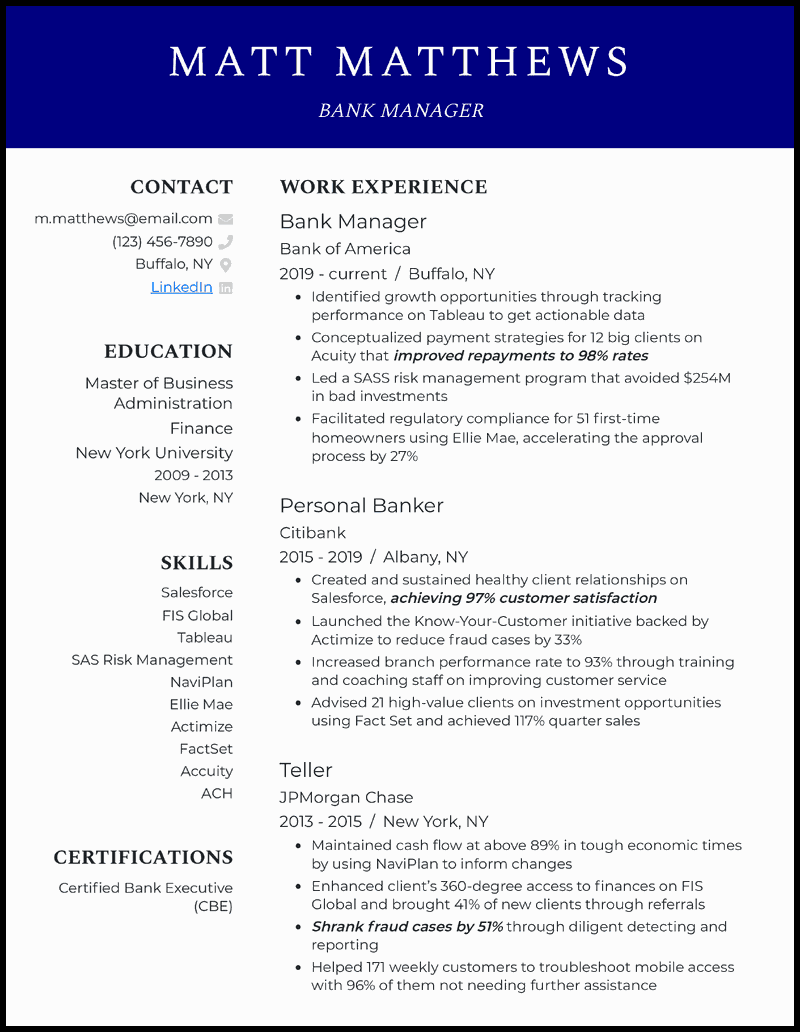

Commercial Banker Resume Sample

Personal banker resume sample.

We spoke with hiring managers at top banks like JPMorgan Chase, Bank of America, and Wells Fargo to understand what they look for in a banker's resume. The following tips will help you create a strong resume that stands out from other applicants and gets you interviews.

Highlight your banking experience and skills

Recruiters want to see that you have relevant experience and skills for the banking role you are applying for. Emphasize your banking experience and skills in your resume, such as:

- 5+ years of experience in retail banking, managing customer accounts and transactions

- Expertise in financial analysis, risk assessment, and lending products

- Strong knowledge of banking regulations and compliance requirements

Quantify your achievements wherever possible to show the impact you made. Instead of generic statements, use specific examples like:

- Managed customer accounts

- Skilled in financial analysis

- Managed 200+ customer accounts with $10M+ in assets, consistently meeting sales targets

- Conducted financial analysis for 50+ commercial lending deals, averaging $5M per deal

Tailor your resume to the specific banking role

Banking is a broad field with many different roles, such as retail banking, commercial banking, investment banking, and risk management. Tailor your resume to the specific role you are applying for. Here are some examples:

- For a retail banking role, focus on your experience with customer service, sales, and account management.

- For a commercial banking role, highlight your experience with business lending, financial analysis, and relationship management.

- For an investment banking role, emphasize your experience with financial modeling, deal execution, and client presentations.

Customizing your resume shows the recruiter that you understand the role and have the relevant skills and experience.

Use industry-specific keywords

Many banks use applicant tracking systems (ATS) to screen resumes for relevant keywords before a recruiter even looks at them. Include banking-specific keywords in your resume to increase your chances of passing the ATS screening. Some examples:

- Risk assessment

- Financial analysis

- Lending products

- Regulatory compliance

- Customer relationship management

Sprinkle these keywords throughout your resume in the relevant sections, such as your professional summary, skills, and work experience. However, avoid keyword stuffing or using keywords that do not apply to your actual experience.

Show your career progression

Recruiters want to see that you have progressed in your banking career and taken on increasing responsibilities. Show your career progression by listing your work experience in reverse-chronological order, with your most recent and relevant experience first.

For each job, include your title, the company name, dates of employment, and a few bullet points highlighting your key responsibilities and achievements. Use action verbs to describe what you did and the results you achieved. Here's an example:

Commercial Banking Relationship Manager, ABC Bank, 2018-2022 Managed a portfolio of 50+ mid-sized business clients with $100M+ in total loans Conducted financial analysis and risk assessment for new loan applications, resulting in a 20% increase in loan volume Developed and implemented a new client onboarding process, reducing onboarding time by 30%

Include relevant education and certifications

In addition to work experience, recruiters also look for relevant education and certifications on a banker's resume. Include your degree(s), major(s), and any relevant coursework or projects. Here are some examples:

- Bachelor of Science in Finance, XYZ University, 2015

- Coursework: Financial Accounting, Corporate Finance, Investment Analysis

- Capstone project: Developed a financial model for a $50M real estate investment

Also include any relevant banking certifications you have earned, such as:

- Chartered Financial Analyst (CFA)

- Certified Treasury Professional (CTP)

- Certified Anti-Money Laundering Specialist (CAMS)

These certifications show your expertise and commitment to the banking profession.

Demonstrate your soft skills

In addition to technical skills, banks also look for candidates with strong soft skills, such as communication, teamwork, and leadership. Demonstrate your soft skills by including examples in your work experience bullet points. Here are some examples:

- Collaborated with a cross-functional team of 10+ bankers, credit analysts, and underwriters to structure and close a $25M syndicated loan deal

- Presented quarterly portfolio performance reports to senior management, highlighting key risks and opportunities

- Mentored and trained 5 junior bankers on financial analysis and credit underwriting, resulting in a 50% reduction in errors

You can also include a separate skills section on your resume to highlight your key soft skills, such as:

- Relationship building

- Problem-solving

- Attention to detail

Writing Your Banker Resume: Section By Section

summary.

A resume summary for a banker is an optional section that provides a brief overview of your professional experience, skills, and career goals. While a summary is not required, it can be a useful tool to provide context for your resume and highlight your most relevant qualifications. However, it's important to avoid using an objective statement, as these are outdated and focus on what you want rather than what you can offer the employer.

When writing your banker resume summary, focus on your key strengths, accomplishments, and the value you can bring to the role. Tailor your summary to the specific position you're applying for and the financial institution's needs. Keep it concise, no more than a few sentences or a short paragraph.

To learn how to write an effective resume summary for your Banker resume, or figure out if you need one, please read Banker Resume Summary Examples , or Banker Resume Objective Examples .

1. Highlight your banking expertise and specializations

In your resume summary, showcase your specific areas of expertise within the banking industry. This helps employers quickly understand your focus and how you can contribute to their organization. Consider the following examples:

- Experienced banker with a proven track record of success.

- Skilled professional with experience in various banking roles.

Instead, be more specific and highlight your key areas of specialization:

- Commercial banker with 5+ years of experience in loan origination and portfolio management.

- Investment banker specializing in mergers and acquisitions for technology startups.

By focusing on your specific expertise, you demonstrate your value to potential employers and help them envision how you can contribute to their team.

2. Emphasize your achievements and impact

When crafting your banker resume summary, focus on your achievements and the impact you've made in your previous roles. Quantify your results whenever possible to provide concrete evidence of your success.

Experienced relationship manager with strong communication and interpersonal skills. Proven ability to build and maintain client relationships.

While this summary mentions relevant skills, it lacks specific achievements and impact. Instead, consider a summary that highlights quantifiable results:

Accomplished relationship manager with a track record of growing client portfolio by 30% and increasing revenue by $5M+ annually. Skilled in developing strategic partnerships and providing exceptional client service to high-net-worth individuals.

By emphasizing your achievements and impact, you demonstrate your value to potential employers and set yourself apart from other candidates.

Experience

The work experience section is the heart of your resume. It's where you demonstrate your qualifications and show the hiring manager how you've applied your skills to produce results. When writing your work experience section, aim to create a compelling narrative that paints a clear picture of your career trajectory and accomplishments.

1. Highlight banking experience and skills

When describing your work experience, focus on the aspects of your roles that are most relevant to banking. This could include:

- Managing client accounts and portfolios

- Conducting financial analysis and risk assessments

- Developing investment strategies and providing financial advice

- Collaborating with cross-functional teams to deliver banking solutions

By emphasizing your banking-specific experience and skills, you demonstrate your qualifications for the role and make it easier for the hiring manager to visualize you in the position.

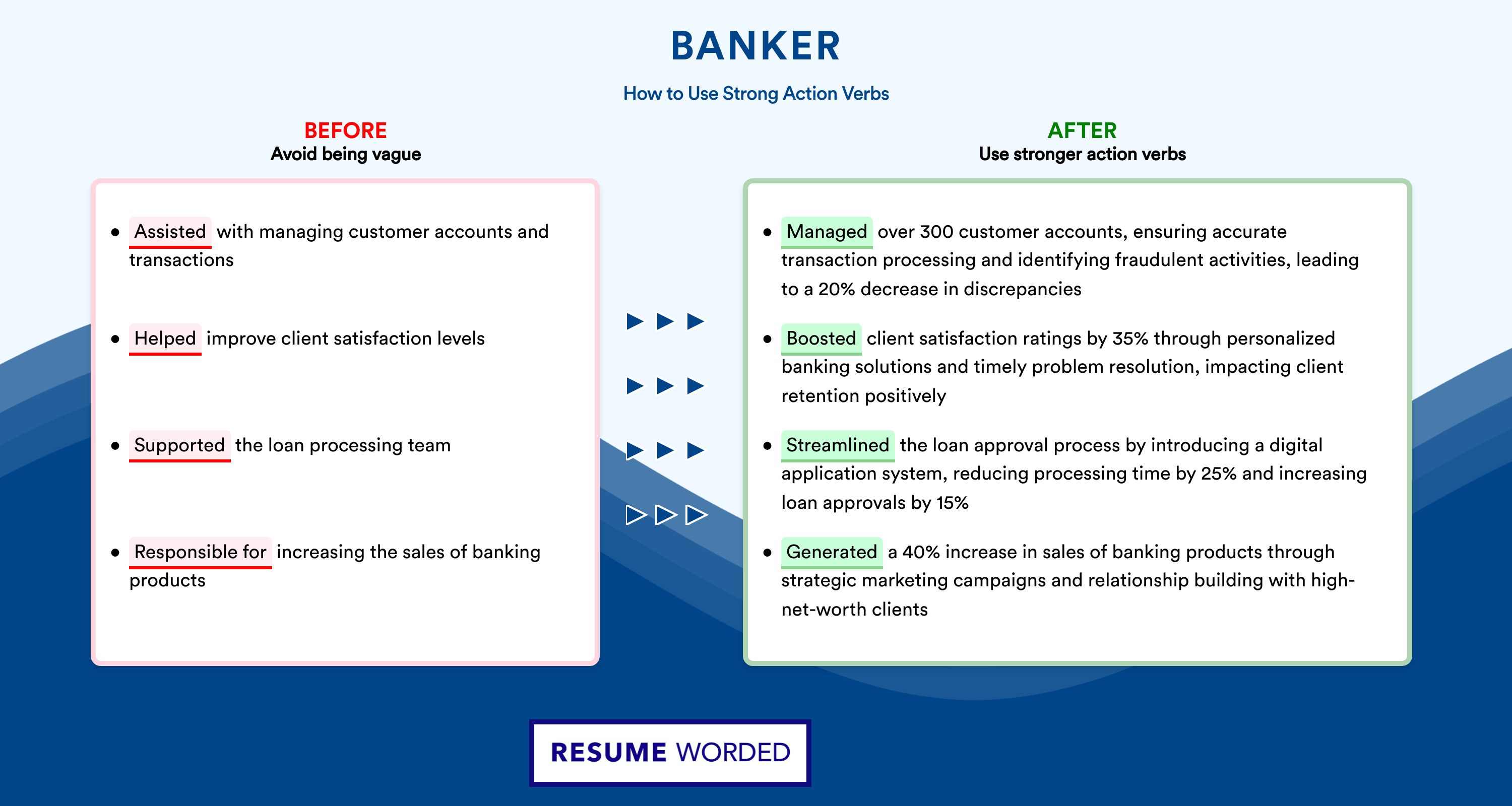

2. Use strong banking action verbs

When describing your achievements, use strong action verbs that resonate with the banking industry. Compare the following examples:

- Responsible for managing client portfolios

- Worked on financial analysis and risk assessment

Instead, use powerful verbs that convey your impact:

- Spearheaded the management of a $50M client portfolio, implementing strategies that generated a 15% return on investment

- Conducted in-depth financial analysis and risk assessments, identifying potential threats and opportunities for clients

Action verbs like "spearheaded," "implemented," "generated," "conducted," and "identified" create a stronger impression of your contributions and leadership.

After writing your work experience section, use our Score My Resume tool to get instant feedback on the strength of your resume based on criteria hiring managers care about, including your use of action verbs.

3. Quantify your banking accomplishments

Whenever possible, use metrics to quantify your achievements and provide context for your contributions. Numbers help hiring managers understand the scope and impact of your work. For example:

Managed a portfolio of 50+ high-net-worth clients, overseeing $250M in assets and achieving an average annual return of 12%

If you don't have access to specific metrics, you can still provide context by using numbers or percentages, such as:

- Collaborated with a team of 15 bankers to develop and implement a new risk assessment framework

- Streamlined the account opening process, reducing average processing time by 30%

4. Demonstrate career growth in banking

Showcase your career progression within the banking industry by highlighting promotions, increased responsibilities, and key projects. This demonstrates your ability to learn, grow, and take on new challenges. For example:

Promoted to Senior Financial Analyst after consistently exceeding performance targets and demonstrating strong leadership skills. In this role, led a team of five analysts in developing and implementing a new investment strategy that increased client portfolio returns by an average of 10%.

By showcasing your career growth, you signal to hiring managers that you have the potential to continue advancing and making valuable contributions to their organization.

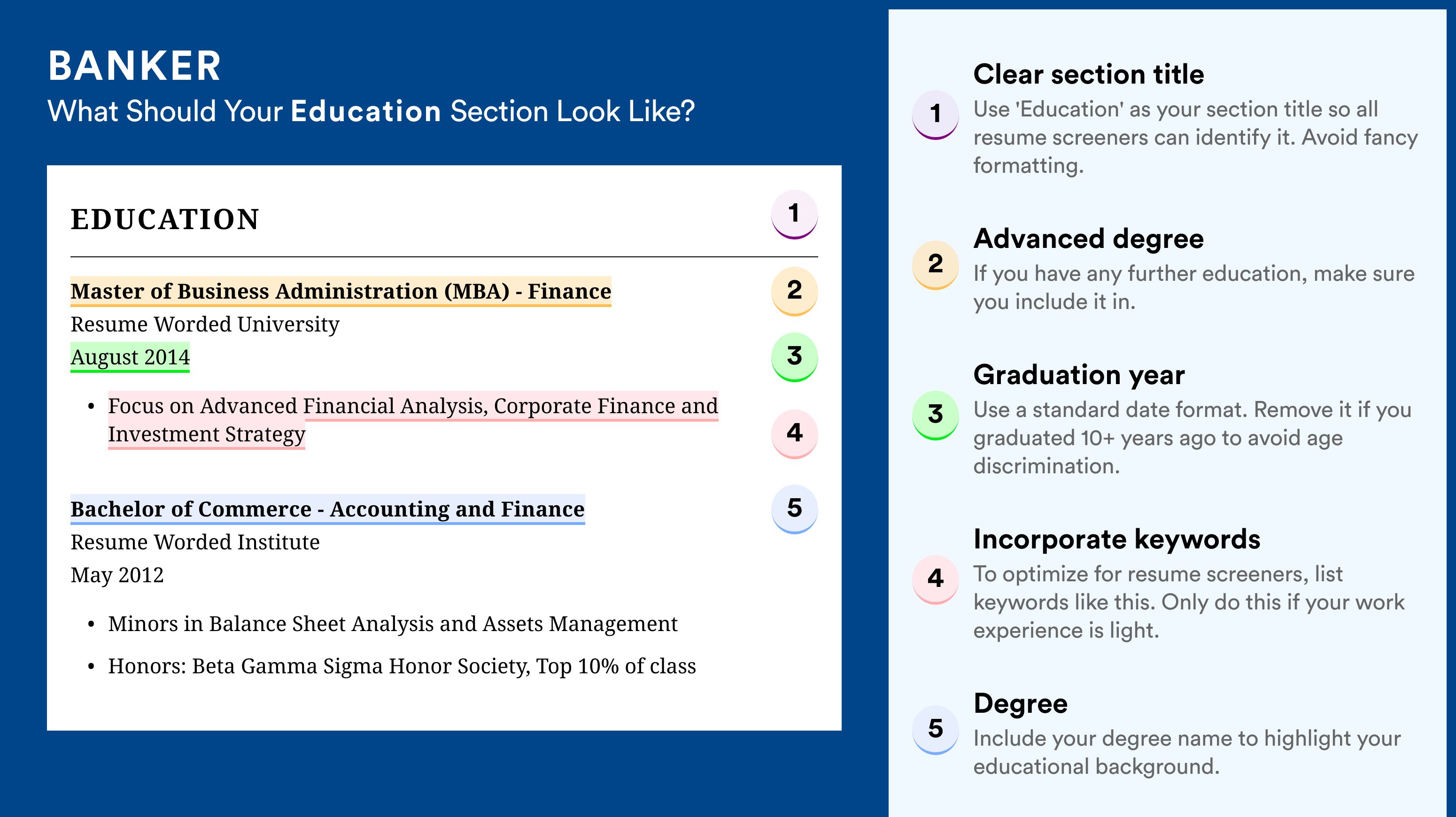

Education

Your education section is a key part of your resume as a banker. It shows hiring managers that you have the necessary knowledge and qualifications for the role. In this section, we'll cover what to include and how to format your education section to make it stand out.

1. List your degrees in reverse chronological order

Start with your most recent degree first, and work backwards. This is the standard format for resumes in the banking industry.

For each degree, include:

- Name of the degree (e.g. Bachelor of Science in Finance)

- Name of the university

- Graduation year

- GPA (if above 3.5)

Here's an example of how to format your degrees:

- Master of Business Administration (MBA), XYZ University, 2020

- Bachelor of Science in Finance, ABC University, 2016

2. Highlight relevant coursework for entry-level bankers

If you are a recent graduate or have limited work experience, you can strengthen your education section by listing relevant coursework. This shows hiring managers that you have specific knowledge that applies to the banking role.

However, avoid listing every course you've taken. Instead, choose 3-5 courses that are most relevant to the job description.

Here's an example:

Bachelor of Science in Finance, DEF University, 2022 Relevant Coursework: Financial Modeling, Investment Banking, Corporate Finance, Financial Accounting

3. Keep it concise for experienced bankers

If you are a senior-level banker with many years of experience, your education section should be brief. Hiring managers will be more interested in your professional accomplishments than your degrees from many years ago.

Here's an example of what not to do:

- Master of Business Administration, XYZ University, 1995-1997

- Bachelor of Arts in Economics, ABC College, 1991-1995

- Online Course in Advanced Excel for Finance, 2005

Instead, keep it short and sweet:

- MBA, XYZ University

- B.A. Economics, ABC College

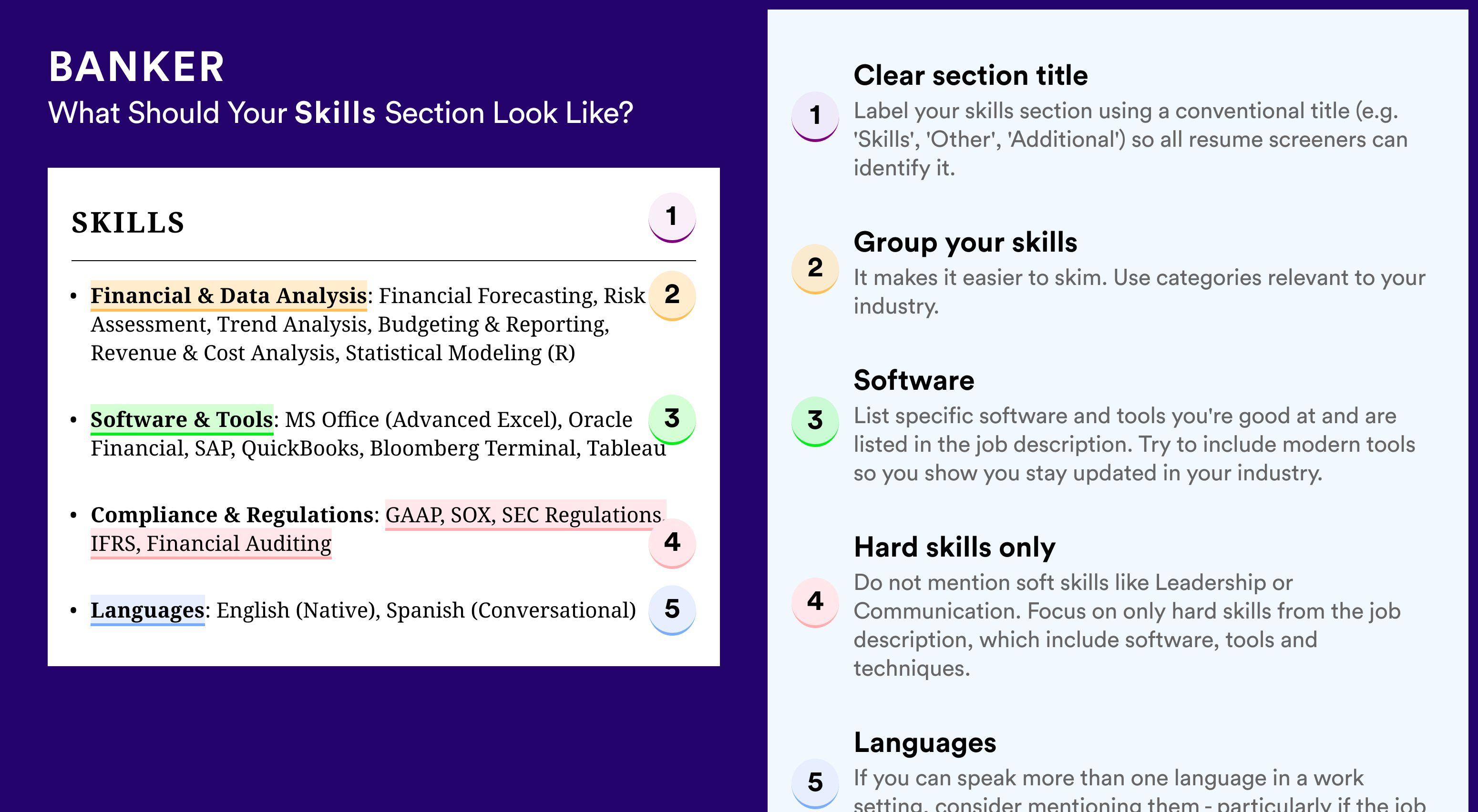

Skills

The skills section of your banker resume is a critical component that showcases your abilities and qualifications to potential employers. It's important to highlight the most relevant and valuable skills that align with the job requirements and demonstrate your expertise in the banking industry. In this section, we'll provide you with tips and examples to help you craft a compelling skills section that will catch the attention of hiring managers and increase your chances of landing an interview.

1. Prioritize banking-specific skills

When listing your skills, focus on those that are directly related to the banking industry and the specific job you're applying for. Highlight your expertise in areas such as financial analysis, risk management, loan processing, and customer service.

Here's an example of a well-structured skills section for a banker resume:

Financial Analysis : Financial modeling, financial statement analysis, credit analysis, budgeting and forecasting Risk Management : Risk assessment, fraud detection, compliance, anti-money laundering (AML) Loan Processing : Loan origination, underwriting, documentation, closing Customer Service : Relationship building, problem-solving, communication, sales

To ensure your skills section is tailored to the job, review the job description carefully and incorporate the key skills and qualifications mentioned. Using our Targeted Resume tool can help you identify the most important skills to include based on the specific job posting.

2. Avoid generic or outdated skills

When crafting your skills section, steer clear of listing generic or outdated skills that don't add value to your resume. For example, instead of simply stating "computer skills," be specific and mention the relevant software or tools you're proficient in, such as financial analysis software or customer relationship management (CRM) systems.

Computer skills Microsoft Office Communication Teamwork

Instead, showcase your skills in a more targeted and impactful way:

Financial Software : Bloomberg Terminal, Thomson Reuters Eikon, Morningstar CRM Systems : Salesforce, Oracle CRM, Microsoft Dynamics Data Analysis : Excel (Advanced), SQL, Tableau

Keep in mind that hiring managers often use Applicant Tracking Systems (ATS) to filter resumes based on the presence of specific skills and keywords. By including relevant and up-to-date skills, you increase your chances of passing the ATS screening and reaching the next stage of the hiring process.

3. Quantify your skills with proficiency levels

To provide hiring managers with a clear understanding of your skill levels, consider including proficiency indicators next to each skill. This can be done using terms like "Expert," "Advanced," "Intermediate," or "Beginner," or by using a visual scale, such as stars or bars.

Here's an example of how you can incorporate proficiency levels into your skills section:

Financial Analysis (Expert) Risk Management (Advanced) Loan Processing (Intermediate) Customer Service (Expert)

By quantifying your skills, you provide hiring managers with a quick and easy way to assess your capabilities and determine if you're a good fit for the role.

To ensure your skills section is effective and impactful, consider using our Score My Resume tool, which provides instant expert feedback on your resume, including an assessment of your skills section. The tool checks your resume against 30+ key criteria that hiring managers look for and offers suggestions for improvement.

Skills For Banker Resumes

Here are examples of popular skills from Banker job descriptions that you can include on your resume.

- DCF Valuation

- Financial Analysis

- Capital Markets

- Python (Programming Language)

- Due Diligence

- S&P Capital IQ

- Financial Modeling

Skills Word Cloud For Banker Resumes

This word cloud highlights the important keywords that appear on Banker job descriptions and resumes. The bigger the word, the more frequently it appears on job postings, and the more likely you should include it in your resume.

How to use these skills?

Similar resume templates, investment banking.

- C-Level and Executive Resume Guide

- Accounts Payable Resume Guide

- Collections Specialist Resume Guide

- Bookkeeper Resume Guide

- Financial Advisor Resume Guide

Resume Guide: Detailed Insights From Recruiters

- Investment Banking Resume Guide & Examples for 2022

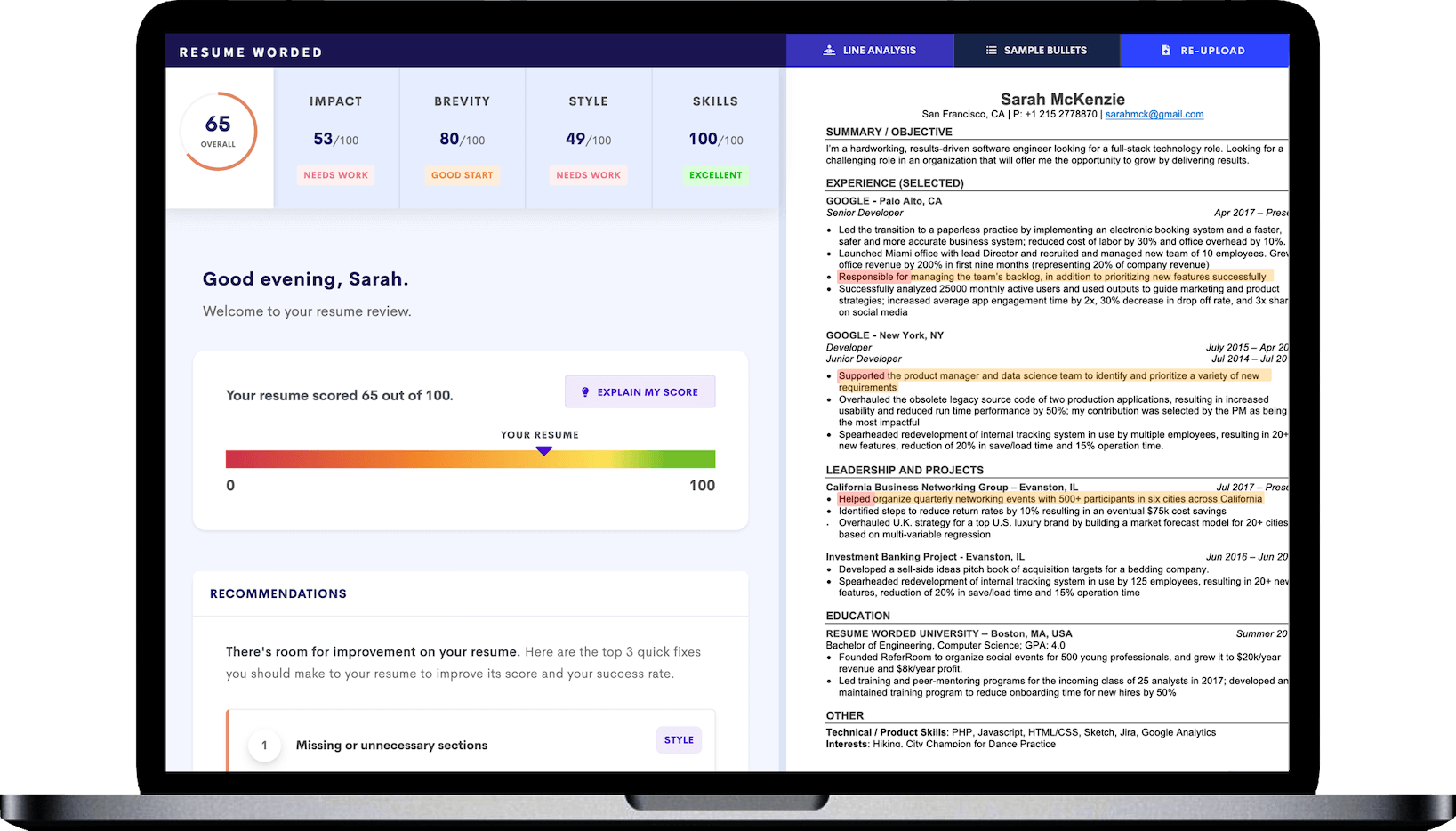

Improve your Banker resume, instantly.

Use our free resume checker to get expert feedback on your resume. You will:

• Get a resume score compared to other Banker resumes in your industry.

• Fix all your resume's mistakes.

• Find the Banker skills your resume is missing.

• Get rid of hidden red flags the hiring managers and resume screeners look for.

It's instant, free and trusted by 1+ million job seekers globally. Get a better resume, guaranteed .

Banker Resumes

- Template #1: Banker

- Template #2: Banker

- Template #3: Banker

- Template #4: Commercial Banker

- Template #5: Personal Banker

- Skills for Banker Resumes

- Free Banker Resume Review

- Other Finance Resumes

- Banker Interview Guide

- Banker Sample Cover Letters

- Alternative Careers to a Investment Banking Specialist

- All Resumes

- Resume Action Verbs

Download this PDF template.

Creating an account is free and takes five seconds. you'll get access to the pdf version of this resume template., choose an option..

- Have an account? Sign in

E-mail Please enter a valid email address This email address hasn't been signed up yet, or it has already been signed up with Facebook or Google login.

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number. It looks like your password is incorrect.

Remember me

Forgot your password?

Sign up to get access to Resume Worded's Career Coaching platform in less than 2 minutes

Name Please enter your name correctly

E-mail Remember to use a real email address that you have access to. You will need to confirm your email address before you get access to our features, so please enter it correctly. Please enter a valid email address, or another email address to sign up. We unfortunately can't accept that email domain right now. This email address has already been taken, or you've already signed up via Google or Facebook login. We currently are experiencing a very high server load so Email signup is currently disabled for the next 24 hours. Please sign up with Google or Facebook to continue! We apologize for the inconvenience!

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number.

Receive resume templates, real resume samples, and updates monthly via email

By continuing, you agree to our Terms and Conditions and Privacy Policy .

Lost your password? Please enter the email address you used when you signed up. We'll send you a link to create a new password.

E-mail This email address either hasn't been signed up yet, or you signed up with Facebook or Google. This email address doesn't look valid.

Back to log-in

These professional templates are optimized to beat resume screeners (i.e. the Applicant Tracking System). You can download the templates in Word, Google Docs, or PDF. For free (limited time).

access samples from top resumes, get inspired by real bullet points that helped candidates get into top companies., get a resume score., find out how effective your resume really is. you'll get access to our confidential resume review tool which will tell you how recruiters see your resume..

Writing an effective resume has never been easier .

Upgrade to resume worded pro to unlock your full resume review., get this resume template (+ 8 others), plus proven bullet points., for a small one-time fee, you'll get everything you need to write a winning resume in your industry., here's what you'll get:.

- 📄 Get the editable resume template in Google Docs + Word . Plus, you'll also get all 8 other templates .

- ✍️ Get sample bullet points that worked for others in your industry . Copy proven lines and tailor them to your resume.

- 🎯 Optimized to pass all resume screeners (i.e. ATS) . All templates have been professionally designed by recruiters and 100% readable by ATS.

Buy now. Instant delivery via email.

instant access. one-time only., what's your email address.

I had a clear uptick in responses after using your template. I got many compliments on it from senior hiring staff, and my resume scored way higher when I ran it through ATS resume scanners because it was more readable. Thank you!

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

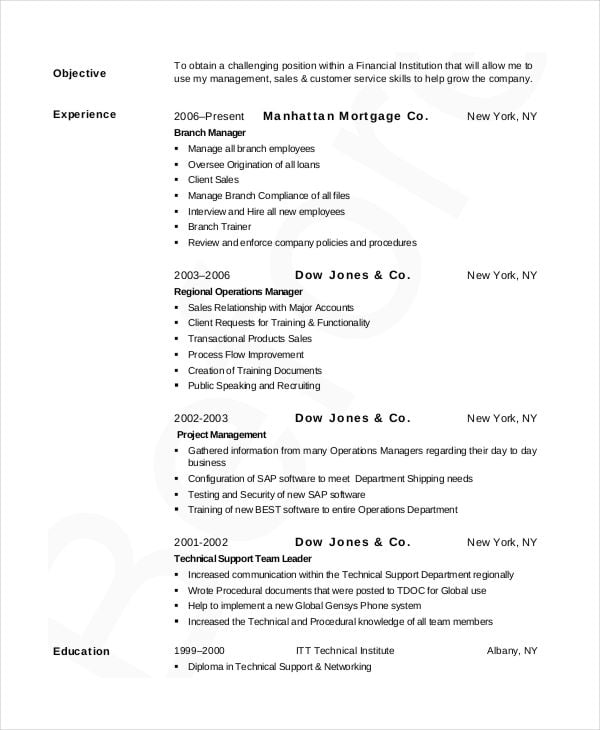

Banking Resume Examples and Templates for 2024

Banking Text-Only Resume Templates and Examples

1. write a dynamic profile summarizing your banking qualifications, 2. outline your banking experience in a compelling list, 3. include banking-related education and certifications, 4. list your banking-related skills and proficiencies, how to pick the best banking resume template, frequently asked questions: banking resume examples and advice.

- Entry-Level

- Senior-Level

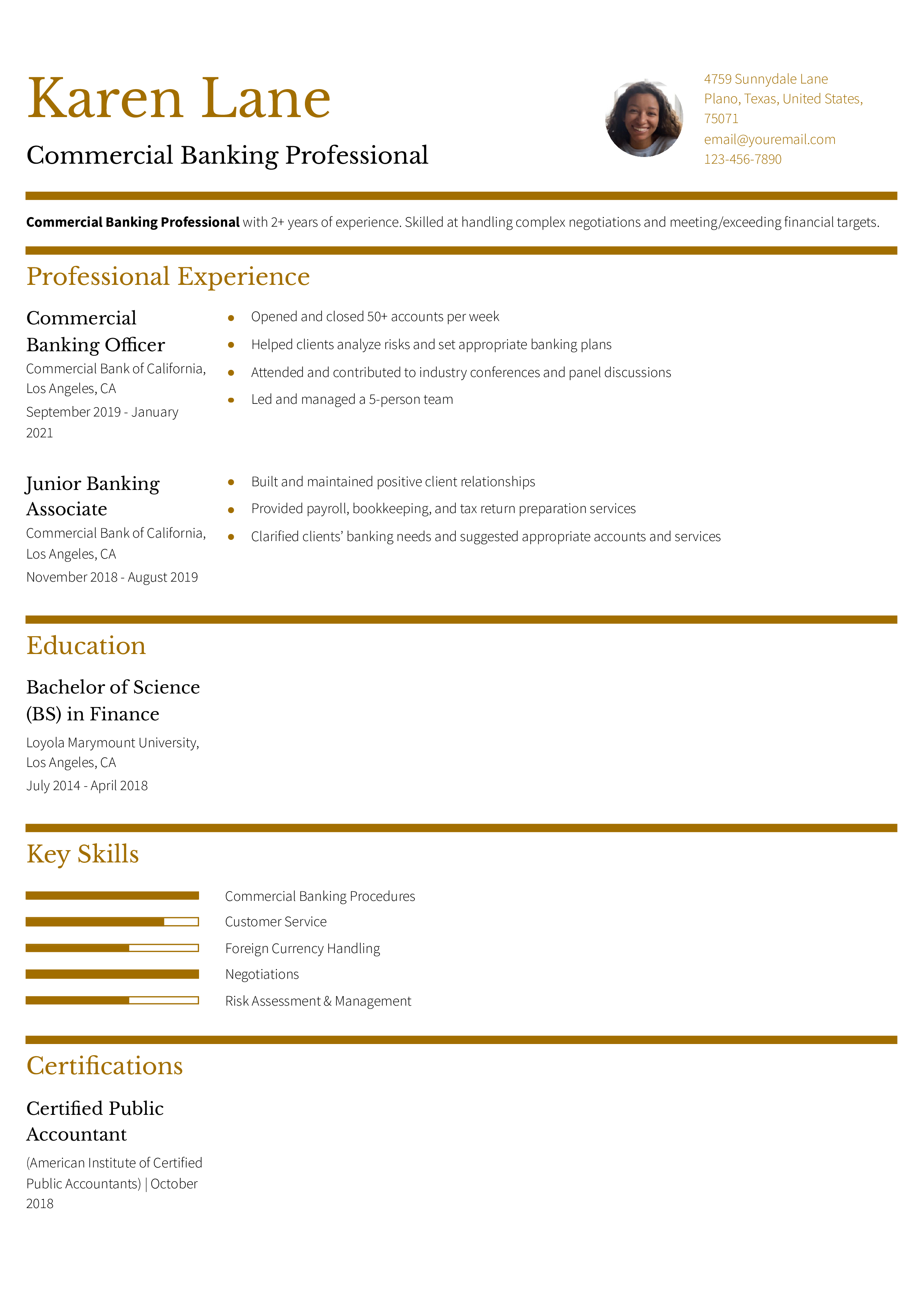

Karen Lane (655) 863-6548 | [email protected] | 72 Light Lane, Los Angeles, CA 90003

Commercial Banking Professional with 2+ years of experience. Skilled at handling complex negotiations and meeting/exceeding financial targets.

- Commercial Banking Procedures

- Customer Service

- Foreign Currency Handling

- Negotiations

- Risk Assessment & Management

- Team Leadership

- Wealth Management

Professional Experience

Commercial Bank of California, Los Angeles, CA | November 2018 to January 2021

Commercial Banking Officer (September 2019 to January 2021)

- Opened and closed 50+ accounts per week

- Helped clients analyze risks and set appropriate banking plans

- Attended and contributed to industry conferences and panel discussions

- Led and managed a 5-person team

Junior Banking Associate (November 2018 to August 2019)

- Built and maintained positive client relationships

- Provided payroll, bookkeeping, and tax return preparation services

- Clarified clients’ banking needs and suggested appropriate accounts and services

Education & Credentials

Bachelor of Science (BS) – Finance, Loyola Marymount University, Los Angeles, CA

Certified Public Accountant, American Institute of Certified Public Accountants

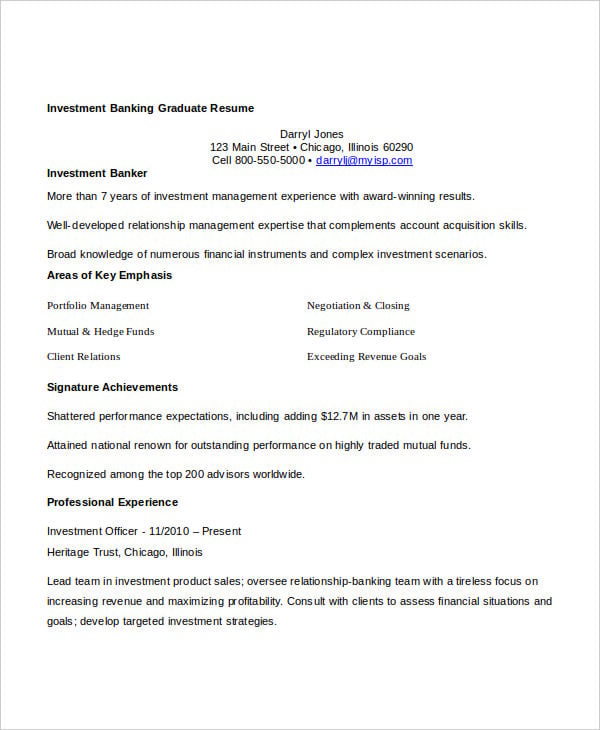

Jerry Jones (738) 274-2648 | [email protected] | 91 Riverside Avenue, Los Angeles, California, 90001

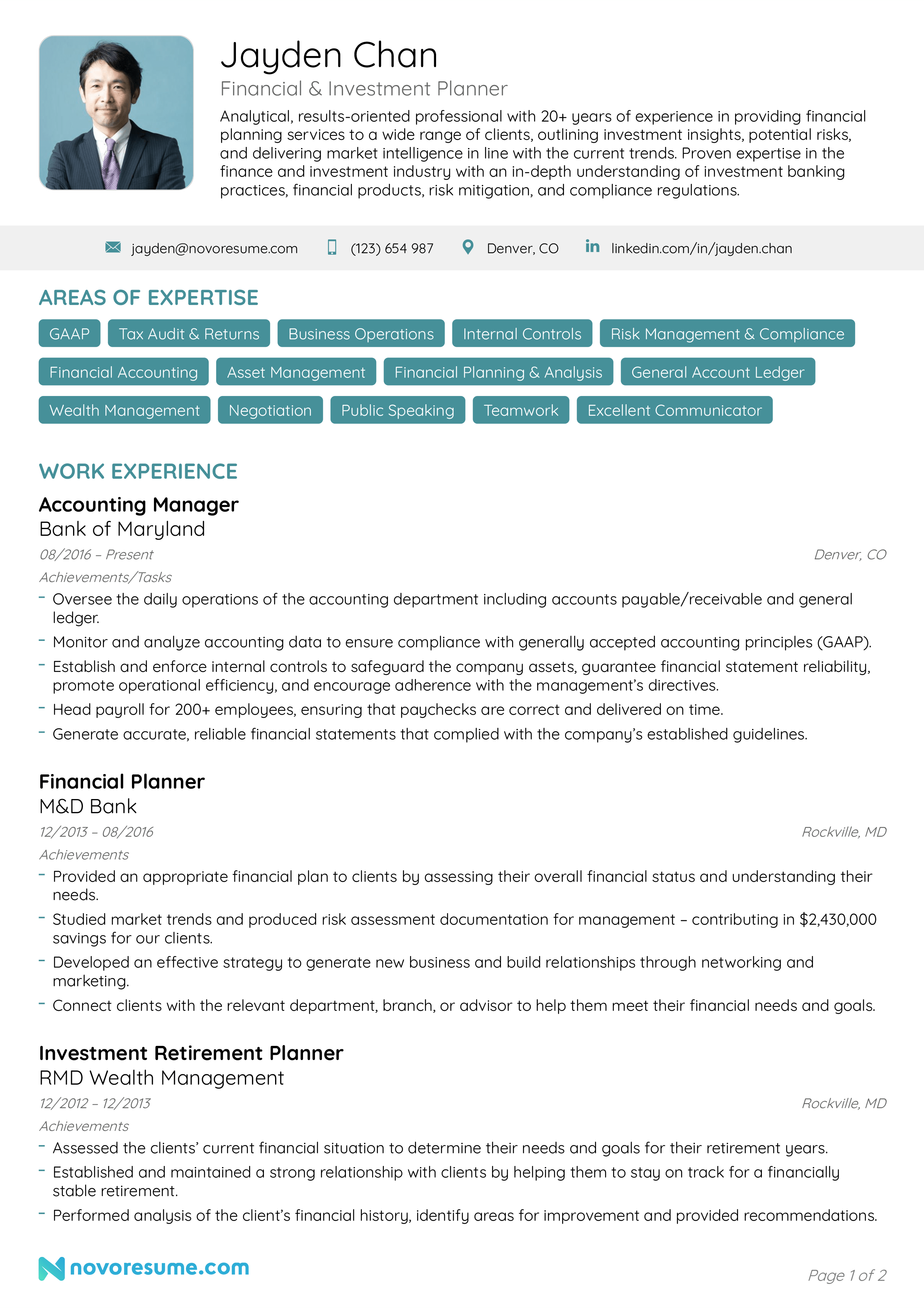

High achieving and analytical investment banker with seven years of experience in the banking industry. Proven ability to work alongside a wide variety of clients to provide useful investment insights and outline any potential risks. Possesses a bachelor’s degree in finance from California State University and a master’s degree from Claremont McKenna College. Excellent communication skills, in-depth knowledge of the current trends in the investment banking industry, and success-orientated attitude.

Investment Banker, 1st Capital Bank, Los Angeles, CA June 2017 – March 2021

- Oversaw and managed the relationship-banking team, which resulted in a 15% increase in revenue and increased profitability

- Prepared and organized the execution of equity transactions

- Successfully achieved the 2020 target of $15M

- Participated in industry conferences and panel discussions

Investment Associate, American First National Bank, Los Angeles, CA November 2014 – June 2017

- Helped to increase the yearly revenue by 6% via regular client-orientated sales events

- Performed company equity research

- Contributed to the preparation of fact-based growth opportunity reports

Master of Finance Claremont McKenna College, Claremont, CA, September 2012 – July 2013

Bachelor of Science in Finance California State University, Northridge, CA, September 2009 – July 2012

- Risk management and compliance

- Wealth management

- Knowledge of commercial and private banking

- Team leadership

- Exceptional communication skills

- Impressive ability to build and maintain working relationships

Certifications:

- CFA Institute certified Chartered Financial Analyst (CFA), August 2013

Monica Reese (246) 802-4680 | [email protected] | 135 Main Avenue, San Francisco, CA 35791

Commercial Banking Associate with 10+ years’ experience providing quality services to personal and business clients. Expertly address and solve client problems, drawing on deep knowledge of bank products. Confident leader who trains and motivates junior associates to deliver consistent positive results. Bilingual: Fluent in English and Spanish.

Commercial Banking Associate, Bank of San Francisco, San Francisco, CA | November 2017 to Present

- Lead and performance-manage a team of 12 associates

- Help customers open new bank accounts and access online services

Highlights:

- Consistently earned 98%+ client satisfaction rating

- Drove a 45% increase in customer use of online services

- Trained and mentored 7 new hires in 2021

Banking Associate, Bank of America, San Francisco, CA | September 2012 to October 2017

- Delivered prompt, thorough service to 50+ small business clients

- Gathered information for new account holders by completing CIP and Enhanced Due Diligence forms

- Clarified each client’s needs and suggested appropriate credit cards, personal loans, and other bank products

- Consistently ranked in top 5% of team for upselling

Bachelor of Science in Business Administration (Finance), University of San Francisco, CA | 2012

- Customer Service & Relations

- New Hire Training & Mentoring

- Regulatory Compliance

- Task Prioritization

Fluency in Spanish

How To Write a Banking Resume

An effective banking resume should demonstrate a thorough understanding of financial regulations and services, as well as customer service ability . Whether you’re new to the banking industry or taking the next step in your career, a solid resume that highlights your skills and achievements can help land your next job.

The first section of your resume is one of the most important because it’s what hooks the hiring manager and makes them interested enough to keep reading. The profile summary section goes at the top of your resume after the header with your name and contact information. It is designed to give a reviewer an overall idea of who you are and what you can offer. Draw attention to your most valuable qualities, such as extensive experience or the ability to speak more than one language.

Senior-Level Profile Example

Commercial banking associate with over 10 years of experience providing quality services to personal and business clients. Expertly address and solve client problems, drawing on deep knowledge of bank products. Confident leader who trains and motivates junior associates to deliver consistent positive results. Bilingual: Fluent in English and Spanish.

Entry-Level Profile Example

Commercial banking professional with over two years of experience. Skilled at handling complex negotiations and meeting/exceeding financial targets.

The professional experience section of your resume should explain what your duties and responsibilities have been in previous positions. Also, it must be a soft sales pitch about the value you can bring to your next position. It can be helpful to separate each job listing into sections: one for your job duties and one to highlight achievements. What’s worth mentioning depends on the position you’re applying for, but most banking positions rely on customer satisfaction and efficiency, so these are good places to start.

Senior-Level Professional Experience Example

Commercial Banking Associate Bank of San Francisco, San Francisco, CA | November 2017 – present

- Consistently earned 98% and higher client satisfaction rating

- Trained and mentored seven new hires in 2021

Entry-Level Professional Experience Example

Commercial Banking Officer Commercial Bank of California, Los Angeles, CA | November 2018 – January 2021

- Opened and closed over 50 accounts per week

- Led and managed a five-person team

A degree in finance or business or accounting-related certifications can put you ahead of the pack when applying for a job in the banking industry. Some jobs may require a certain educational background, such as being a certified financial planner. Customer-facing positions like tellers may focus more on cash-handling experience and sales skills. List your education and any relevant credentials or certifications clearly on your resume so the hiring manager can determine if you have the necessary qualifications.

- [Degree Name]

- [School Name], [City, State Abbreviation] – [Graduation Month and Year]

- Bachelor of Science in Finance

- California State University, Northridge, CA – July 2012

Certifications

- [Certification Name], [Awarding Organization], [Completion Year]

- Certified Chartered Financial Analyst, CFA Institute, 2013

The objective of your resume is to show the person reviewing it you’re a good fit for the position and that you will add value once you’re hired. Make it easy to see your skills and proficiencies. A bulleted list works well for this and can be divided into two sections: technical and banking-related skills and general professional skills.

| Action Verbs | |

|---|---|

| Client relationship management | Compliance with banking regulations |

| Credit risk assessment | Cross-selling abilities |

| Customer service skills | Data-driven decision making |

| Financial statement analysis | Fraud detection and prevention |

| Investment portfolio management | Loan underwriting |

| Regulatory reporting | Retail banking operations |

| Risk management | Sales skills |

Using a banking resume template lets you spend more time crafting compelling copy that positions you as a top candidate and less time messing with spacing and bolding. But all templates aren’t created equal. Look for non-fussy designs that prioritize readability and organization. Your resume is a professional document, and a hiring manager must quickly and easily determine if you’re a match for the position. Use headings, bullets, and lines for easier skimming.

What are common action verbs for banking resumes? -

Action verbs take your bullets from bland descriptions of your job duties to compelling marketing materials for yourself as an applicant. It’s important to use various action verbs to avoid repetition and keep your resume as engaging as possible. If you’re getting stuck while writing this section, try these options that work well for banking positions. Another useful technique is to quickly read through the job description and identify any matching phrasing for the job responsibilities.

| Action Verbs | |

|---|---|

| Analyzed | Assisted |

| Documented | Educated |

| Highlighted | Informed |

| Liaised | Prepared |

| Presented | Proposed |

| Qualified | Trained |

| Underwrote | Valued |

How do you align your resume with a job description? -

Targeting your resume to a specific job description can increase the chances that a hiring manager identifies you as a good fit. Look for keywords, qualifications, skills, and other must-haves listed in the job description and use these when creating your resume. Consider including a specific software in your list of key skills or adding a bullet point in your work experience section that highlights your knowledge of loans and other related products. This is especially important for those applying for competitive positions, such as loan officers , who are expected to experience just average growth, and tellers , who are expected to see a 12% decline through 2031.

What is the best banking resume format? -

The right format for a banking resume depends on how much experience you have, what kind of position you’re applying for, and the company, but you can’t go wrong with a reverse chronological format in this industry. This traditional design will be what most hiring managers expect and lets you list your work history, skills, and education in an organized, easy-to-read manner. You can also play around with this format, such as listing key skills first or using a double-column design to make more use of white space.

Craft your perfect resume in minutes

Get 2x more interviews with Resume Builder. Access Pro Plan features for a limited time!

Including a cover letter with your resume shows you're serious about the position and willing to put in extra effort. It provides an additional opportunity to describe your achievements and qualifications. If you need help writing a banking cover letter , this guide provides tips and examples.

Jacob Meade

Certified Professional Resume Writer (CPRW, ACRW)

Jacob Meade is a resume writer and editor with nearly a decade of experience. His writing method centers on understanding and then expressing each person’s unique work history and strengths toward their career goal. Jacob has enjoyed working with jobseekers of all ages and career levels, finding that a clear and focused resume can help people from any walk of life. He is an Academy Certified Resume Writer (ACRW) with the Resume Writing Academy, and a Certified Professional Resume Writer (CPRW) with the Professional Association of Resume Writers & Career Coaches.

Check Out Related Examples

Chief Financial Officer (CFO) Resume Examples and Templates

Finance Resume Examples and Templates

Personal Banker Resume Examples and Templates

Build a Resume to Enhance Your Career

- How Many Jobs Should You List on a Resume? Learn More

- How to Add a Resume to LinkedIn Learn More

- How to Show Analytical Skills on Your Resume Learn More

Essential Guides for Your Job Search

- How to Write a Resume Learn More

- How to Write a Cover Letter Learn More

- Thank You Note Examples Learn More

- Resignation Letter Examples Learn More

- Resume templates Simple Professional Modern Creative View all

- Resume examples Nurse Student Internship Teacher Accountant View all

- Resume Builder

- Cover Letter Templates Simple Professional Modern Creative View all

- Cover letter examples Nursing Administrative Assistant Internship Graduate Teacher View all

- Cover Letter Builder

- Resume examples

Banker resume examples & templates

The perils of ATS

The world of financial services has always been a lucrative career path, and today's interconnected global economy makes that truer than ever. If you’re a specialist in banking or are looking to become one, a stellar resume is the key to landing a top job with a great salary, benefits and work environment.

.jpg)

Surveys have shown that hiring managers usually spend only a few seconds reading a resume, so there’s little room for error and little time to make an impact. This is a basis for Resume.io’s ever-expanding collection of tips and tools. It includes more than 350 occupation-specific resume writing guides, plus corresponding resume examples that job seekers are welcome to customize.

This guide, along with sample wording from a banker resume example, is designed to help anyone in the banking industry find a job that’s the right fit. Read along, and learn how to craft a resume that demonstrates your readiness to compete in the globalized banking business. What we’ll cover:

- The state of the banking industry today, with potential salaries and job outlook

- The correct resume structure and how to choose the best format

- How to write a resume profile that makes you stand out from the job-hunting crowd

- How to present your employment history, education and skills to get employers’ attention

- Resume layout and design tips for looking the part of a professional

What does a banker do?

The word “banker” is used to describe a range of business and financial occupations that are discussed here. To define the word broadly, bankers are responsible for storing and managing other people’s money, making banking services available to them, and using their money to generate income for the bank through investments and interest on loans.

Compared to its beginnings, banking today is incredibly complex, having been revolutionized by the digital era. Today we buy and sell online, pay bills electronically, and invest in stock, bonds, CDs and even cryptocurrencies. Loans are usually essential to buy a home, finance an education or purchase a car, and the use of credit cards to make purchases is widespread, even for expenses we can cover with cash.

Bankers help individuals and businesses navigate the complexities of the modern financial world. Job seekers in these fields have lots of options, and lots of competition. The best starting point is an outstanding resume that makes you look better than other candidates.

Not everyone agrees on what a “banker” actually is. Here are some of the major breakdowns in the sector of banking and financial services:

- Personal and retail bankers: Bank branches need tellers to assist customers with routine transactions like cashing checks or withdrawing, depositing or transferring money. Personal bankers also assist with opening savings or checking accounts, advising clients on moving money into higher-yield investment accounts, and processing loan applications.

- Commercial bankers assist business and institutional clients with financing, cash flow and liquidity issues. Loan officers are tasked with determining whether potential borrowers are creditworthy based on their business models and the value of the collateral they put up.

- Investment bankers assist larger businesses with raising capital from investors, assessing their debt load, complying with government regulations and in some cases restructuring, initial public offerings, and mergers and acquisitions.

- Merchant bankers, like private equity companies, use their own capital to invest directly in promising companies in consideration of a substantial share of the profits of companies that succeed.

The U.S. Bureau of Labor Statistics (BLS) lists personal financial advisers , management analysts and financial analysts as the top 3 paid specializations in the banking/financial sector as of 2021, earning $94,170, $93,000 and $$81,410 a year, respectively. However, the rest of financial service jobs also have above average pay rates, ranging from $56,700 to $79,940. So clearly, this is an excellent field to be in regardless of your focus.

U.S. employment in business and financial careers is expected to grow by 8% from 2020 to 2030, adding some 750,800 jobs, according to the BLS. In all U.S. business and financial occupations, the median yearly salary in May 2021 was $76,570. According to Payscale , the average annual salary for all bankers is $72,000.

How to write a banker resume

All resumes, regardless of occupation, contain these components, confined to a single page.

- Employment history section

- Education section

- Skills section

We’ll be taking a closer look shortly at each resume section and how to optimize its impact.

Choosing the best resume format for bankers

The most commonly used chronological resume format is recommended for bankers, or anyone whose career path has followed a series of employee positions. It’s the format that recruiters prefer too, for being easy to review. It’s the most straightforward way to organize your job history highlights in bullet points below employer headings, dated in reverse chronological order.

Other resume formats may be suitable for job seekers wanting to emphasize specialized or transferable skills rather than employers. A functional resume, or the more versatile hybrid (combination) format, is sometimes preferred for those who have worked independently as a consultant or wish to do so.

Now, let’s discuss how to optimize the impact of your banker resume in each section, one at a time.

Resume header

Don’t overlook the importance of a distinctive resume header design — ideally the same as your cover letter so they look like a matching pair.

The header sets your job application apart from everyone else’s, like your own visual brand. It draws the reader’s eyes to the place on the page where your name, occupation and contact information are prominently displayed. This will be easier for duly impressed recruiters to come back to when they’re ready to get in touch with you for an interview. And the white space offsetting your resume header makes the page much more inviting to read.

Banker resume profile example: Your ‘elevator pitch’

You’re probably familiar with the term “elevator pitch.” You get in an elevator with someone you want to influence and you have to do so before that person gets off. Brief but persuasive, and no words wasted — that’s also the idea of a resume profile, sometimes known as a summary .

This is your first, best opportunity to tell potential employers about your aptitudes and interests. While resumes are dominated by lists of past jobs, schools and skills, the profile section allows you to use your own words to do some modest boasting. It should project confidence, competence and professionalism.

Also, remember that a resume is not a one-size-fits-all document; the wording should be tailored to each prospective employer’s wants and needs. And while there’s limited room for flexibility in your employment or education history, there’s more wiggle room in the profile. If you’re a specialist in bitcoin but this is irrelevant to the job you’re seeking, it may better not to mention this and instead stress something that the employer actually is seeking.

Remember too that errors in spelling, grammar or punctuation are a total deal-killer. In fact, hiring managers cite bad English as the No. 1 reason resumes are rejected (see below). If English is not your strength, find an expert editor to review your work before you torpedo your own chances.

In a 2018 Harris Poll conducted for CareerBuilder.com, 75% of 1,138 hiring managers surveyed said they had caught an obvious lie on a resume. These were the other most common reasons cited by employers for hitting “delete” on a resume submission:

- Typos or bad grammar: 77%