What is a Marketing Research Report and How to Write It?

Table of contents

There is nothing more embarrassing for a marketer than to hear a client say “…this doesn’t quite address the business questions that we need to answer.” And unfortunately, this is a rather common occurrence in market research reporting that most marketers would care to admit.

So, why do most market research reports fail to meet client expectations? Well, in most cases, because there is more emphasis on methodology and analytic techniques used to craft the report rather than relying on data visualization, creative story-telling, and outlining actionable direction/steps.

Now, our next big question is, how do you avoid your client’s dreaded deer-in-the-headlights reaction when presenting such a report? This blog post will answer this and much more, as we go through the following:

What Is a Market Research Report?

Why is market research important, differences between primary and secondary market research, types of market research, market research reports advantages and disadvantages, how to do market research, how to prepare a market research report: 5 steps, marketing research report templates, marketing research reports best practices, bring your market research reports a step further with databox.

The purpose of creating a market research report is to make calculated decisions about business ideas. Market research is done to evaluate the feasibility of a new product or service, through research conducted with potential consumers. The information obtained from conducting market research is then documented in a formal report that should contain the following details:

- The characteristics of your ideal customers

- You customers buying habits

- The value your product or service can bring to those customers

- A list of your top competitors

Every business aims to provide the best possible product or service at the lowest cost possible. Simply said, market research is important because it helps you understand your customers and determine whether the product or service that you are about to launch is worth the effort.

Here is an example of a customer complaint that may result in more detailed market research:

Suppose you sell widgets, and you want your widget business to succeed over the long term. Over the years, you have developed many different ways of making widgets. But a couple of years ago, a customer complained that your widgets were made of a cheap kind of foam that fell apart after six months. You didn’t think at the time that this was a major problem, but now you know it.

The customer is someone you really want to keep. So, you decide to research this complaint. You set up a focus group of people who use widgets and ask them what they think about the specific problem. After the conducted survey you’ll get a better picture of customer opinions, so you can either decide to make the changes regarding widget design or just let it go.

PRO TIP: How Well Are Your Marketing KPIs Performing?

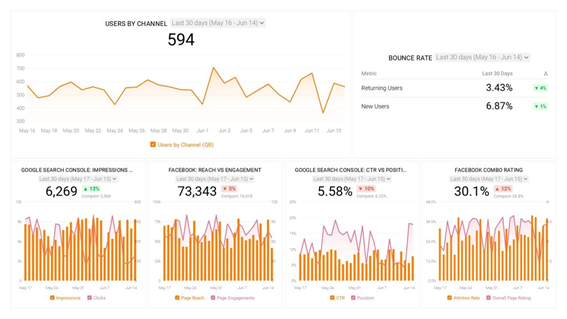

Like most marketers and marketing managers, you want to know how well your efforts are translating into results each month. How much traffic and new contact conversions do you get? How many new contacts do you get from organic sessions? How are your email campaigns performing? How well are your landing pages converting? You might have to scramble to put all of this together in a single report, but now you can have it all at your fingertips in a single Databox dashboard.

Our Marketing Overview Dashboard includes data from Google Analytics 4 and HubSpot Marketing with key performance metrics like:

- Sessions . The number of sessions can tell you how many times people are returning to your website. Obviously, the higher the better.

- New Contacts from Sessions . How well is your campaign driving new contacts and customers?

- Marketing Performance KPIs . Tracking the number of MQLs, SQLs, New Contacts and similar will help you identify how your marketing efforts contribute to sales.

- Email Performance . Measure the success of your email campaigns from HubSpot. Keep an eye on your most important email marketing metrics such as number of sent emails, number of opened emails, open rate, email click-through rate, and more.

- Blog Posts and Landing Pages . How many people have viewed your blog recently? How well are your landing pages performing?

Now you can benefit from the experience of our Google Analytics and HubSpot Marketing experts, who have put together a plug-and-play Databox template that contains all the essential metrics for monitoring your leads. It’s simple to implement and start using as a standalone dashboard or in marketing reports, and best of all, it’s free!

You can easily set it up in just a few clicks – no coding required.

To set up the dashboard, follow these 3 simple steps:

Step 1: Get the template

Step 2: Connect your HubSpot and Google Analytics 4 accounts with Databox.

Step 3: Watch your dashboard populate in seconds.

Marketing research requires both primary and secondary market research. But what does that mean and what are the main differences?

Primary market research takes in information directly from customers, usually as participants in surveys. Usually, it is consisted of:

- Exploratory Primary Research – This type of research helps to identify possible problem areas, and it’s not focused on discovering specific information about customers. As with any research, exploratory primary research should be conducted carefully. Researchers need to craft an interviewing or surveying plan, and gather enough respondents to ensure reasonable levels of statistical reliability.

- Specific Primary Research – This type of research is one of the best ways to approach a problem because it relies on existing customer data. Specific research provides a deeper, more thorough understanding of the problem and its potential solutions. The greatest advantage of specific research is that it lets you explore a very specific question, and focus on a specific problem or an opportunity.

Secondary market research collects information from other sources such as databases, trend reports, market or government statistics, industry content, etc. We can divide secondary market research into 3 categories:

- Public market data – Public sources range from academic journals and government reports to tax returns and court documents. These sources aren’t always easy to find. Many are available only in print in libraries and archives. You have to look beyond search engines like Google to find public source documents.

- Commercial data – Those are typically created by specialized agencies like Pew, Gartner or Forrester. the research agencies are quite expensive, but they provide a lot of useful information.

- Internal data – Your organization’s databases are gold mines for market research. In the best cases, your salespeople can tell you what they think about customers. Your salespeople are your direct sources of information about the market. Don’t underestimate your internal data.

In general, primary research is more reliable than secondary research, because researchers have to interview people directly. But primary research is expensive and time-consuming. Secondary research can be quicker and less expensive.

There are plenty of ways to conduct marketing research reports. Mostly, the type of research done will depend on your goals. Here are some types of market research often conducted by marketers.

Focus Groups

Product/service use research, observation-based research, buyer persona research, market segmentation research, pricing research, competitive analysis research, customer satisfaction and loyalty research, brand awareness research, campaign research.

An interview is an interactive process of asking and answering questions and observing your respondent’s responses. Interviews are one of the most commonly used tools in market research . An interview allows an organization to observe, in detail, how its consumers interact with its products and services. It also allows an organization to address specific questions.

A focus group is a group of people who get together to discuss a particular topic. A moderator leads the discussion and takes notes. The main benefit of focus groups is that they are quick and easy to conduct. You can gather a group of carefully-selected people, give them a product to try out, and get their feedback within a few hours/days.

Product or service use research helps you obtain useful information about your product or service such as:

- What your current customers do with the product/service

- Which features of the product/service are particularly important to your customers

- What they dislike about the product/service

- What they would change about the product/service

Observation-based research helps you to observe your target audience interacting with your product or service. You will see the interactions and which aspects work well and which could be improved. The main point is to directly experience the feedback from your target audience’s point of view.

Personas are an essential sales tool. By knowing your buyers’ pain points and the challenges they face, you can create better content, target messaging, and campaigns for them. Buyer persona research is based on market research, and it’s built around data that describes your customers’ demographics, behaviors, motivations, and concerns. Sales reporting software can significantly help you develop buyer personas when you gain insights after you collected all information.

Market segmentation research is carried out to better understand existing and potential market segments. The objective is to determine how to target different market segments and how they differ from each other. The three most important steps in writing a market segmentation research report are:

- Defining the problem

- Determining the solution [and]

- Defining the market

Related : 9 Customer Segmentation Tips to Personalize Ecommerce Marketing and Drive More Sales

A price that is too high, or too low, can kill a business. And without good market research, you don’t really know what is a good price for your product. Pricing research helps you define your pricing strategy.

In a competitive analysis, you define your “competition” as any other entity that competes with you in your market, whether you’re selling a widget or a piece of real estate. With competitive analysis research, you can find out things like:

- Who your competitors are

- What they’ve done in the past

- What’s working well for them

- Their weaknesses

- How they’re positioned in the market

- How they market themselves

- What they’re doing that you’re not

Related : How to Do an SEO Competitive Analysis: A Step-by-Step Guide

In today’s marketplace, companies are increasingly focused on customer loyalty. What your customers want is your product, but, more importantly, they want it delivered with a service that exceeds their expectations. Successful companies listen to their customers and respond accordingly. That’s why customer satisfaction and loyalty research is a critical component of that basic equation.

Related : 11 Tactics for Effectively Measuring Your Customer Service ROI

Who you are, what you stand for, what you offer, what you believe in, and what your audience thinks of you is all wrapped up in brand. Brand awareness research tells what your target audience knows about your brand and what’s their experience like.

A campaign research report is a detailed account of how your marketing campaign performed. It includes all the elements that went into creating the campaign: planning, implementation, and measurement.

Here are some of the top advantages and disadvantages of doing market research and crafting market research reports.

- Identify business opportunities – A market research report can be used to analyze potential markets and new products. It can give information about customer needs, preferences, and attitudes. Also, it compare products and services.

- A clear understanding of your customers – A market report gives company’s marketing department an in-depth picture about customers’ needs and wants. This knowledge can be used to improve products, prices, and advertising.

- Mitigates risks – 30% of small businesses fail within the first two years. Why is this so? The answer is that entrepreneurs are risk takers. However, there are risks that could be avoided. A good marketing research will help you identify those risks and allow you to mitigate them.

- Clear data-driven insights – Market research encompasses a wide range of activities, from determining market size and segment to forecasting demand, and from identifying competitors to monitoring pricing. All of these are quantified and measurable which means that gives you a clear path for building unique decisions based on numbers.

Disadvantages

- It’s not cheap – Although market research can be done for as little as $500, large markets like the United States can run into millions of dollars. If a research is done for a specific product, the budget may be even much higher. The budget also depends on the quality of the research. The more expensive it is, the more time the research will take.

- Some insights could be false – For example, if you are conducting a survey, data may be inadequate or inaccurate because respondents can, well, simply be dishonest and lie.

Here are the essential steps you need to take when doing market research:

Define your buyer persona

Identify a persona group to engage, prepare research questions for your market research participants, list your primary competitors, summarize your findings.

The job of a marketing persona is to describe your ideal customer and to tell you what they want, what motivates them, what frustrates them, and what limits them. Finding out these things means you have a better chance of designing your products, services, marketing messages, and brand around real customers. There is no one right way to create a buyer persona, though.

For example, if you’re in an industry focused on education, you could include things like:

- Educational level

- Education background

It’s recommended that you create 3-5 buyer personas for your products, based on your ideal customer.

This should be a representative sample of your target customers so you can better understand their behavior. You want to find people who fit both your target personas and who represent the broader demographic of your market. People who recently made a purchase or purposefully decided not to make one are a good sample to start with.

The questions you use determine the quality of your results. Of course, the quality of your results also depends on the quality of your participants.

Don’t ask questions that imply a yes or no answer. Instead, use open questions. For example, if you are researching customers about yogurt products, you could ask them: „ What have you heard about yogurt ?” or “ What do you think of yogurt ?“.

Avoid questions that use numbers, such as “ How many times a week do you eat yogurt ?”

Avoid questions that suggest a set of mutually exclusive answers, such as “ Do you like yogurt for breakfast, lunch, or dinner ?”

Avoid questions that imply a scale, such as “ Do you like chocolate-flavored yogurt ?”

Market researchers sometimes call one company the top competitor, another middle competitor, and the third one small competitor. However you classify them, you want to identify at least three companies in each category. Now, for each business on your list, list its key characteristics. For example, if your business sells running shoes, a key characteristic might be the product’s quality.

Next, make a list of your small business’s competitive advantages. These include the unique qualities or features of your business that make it the best choice of customers for the products or services it offers. Make a list of these competitive advantages and list them next to the key characteristics you listed for your business.

You have just finished writing your marketing research report. Everything is out there quantified or qualified. You just have to sum it up and focus on the most important details that are going to make a big impact on your decisions. Clear summary leads to a winning strategy!

Related : How to Prepare a Complete Marketing Report: The KPIs, Analysis, & Action Plan You Need

Here’s how to prepare a market research report in 5 simple steps:

Step 1: Cluster the data

Step 2: prepare an outline, step 3: mention the research methods, step 4: include visuals with narrative explanations, step 5: conclude the report with recommendations.

Your first step is to cluster all the available information into a manageable set. Clustering is the process of grouping information together in a way that emphasizes commonalities and minimizes differences. So, in market research, this will help to organize all the information you have about a product, service, or target market and identify your focus areas.

A marketing research report should be written so that other people can understand it:

- Include background information at the beginning to explain who your audience is and what problem you are trying to solve for them.

- In the body of the report, include a description of the methodology – Explain to the reader how your research was done, what was involved, and why you selected the methodology you used.

- Also in the body of the report, include the results of your market research. These may be quantitative or qualitative, but either way they should answer the questions you posed at the beginning.

- Include the executive summary – A summary of the entire report.

The market research methodology section includes details on the type of research, sample size, any limitations of the studies, research design, sample selection, data collection procedures, and statistical analyses used.

Visuals are an essential part of the presentation. Even the best-written text can be difficult to understand. Charts and graphs are easier to understand than text alone, and they help the reader see how the numbers fit the bigger picture.

But visuals are not the whole story. They are only one part of the presentation. Visuals are a cue for the reader. The narrative gives the story, not just the numbers.

Recommendations tend to follow logically from conclusions and are a response to a certain problem. The recommendation should always be relevant to the research rationale, that is, the recommendation should be based on the results of the research reported in the body of the report.

Now, let’s take a look at some dashboard reporting templates you could use to enhance your market research:

- Semrush (Position Tracking) Report

Brand Awareness Report

Sales pipeline performance report, customer success overview report, stripe (mrr & churn) report, semrush (position tracking) report template.

This free SEMRush dashboard template will help you monitor how your website’s search visibility on search engines evolves on a monthly basis. This dashboard contains all of the information you need to make changes and improve the ranking results of your business in Google Search.

This Brand Awareness Report will help you to get a sense of your brand awareness performance in Google Analytics, Google Organic Search, and Facebook. Use this dashboard to track brand awareness the same way you track other marketing campaigns.

Are your sales and marketing funnel healthy and growing? How is your sales and marketing funnel performing? What are the key conversion rates between your lifecycle stages? With a pipeline performance dashboard , you’ll get all of the answers quickly.

This Customer Success Overview Dashboard allows you to analyze how your customer service team’s responsiveness impacts your business. Use this dashboard to assess the correlation between your customer service performance and churn rate.

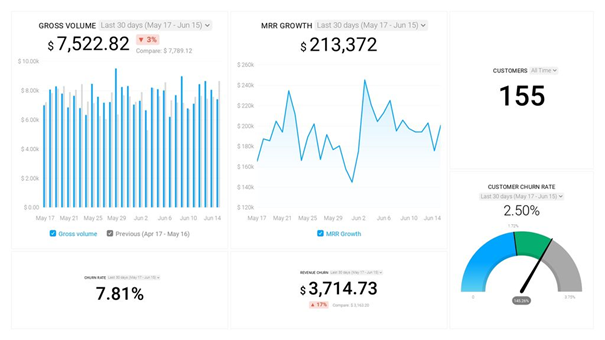

This Stripe dashboard tracks your churn rate and MRR growth in real-time and shows you which customers (and how many of them) you have at any given point in time. All you have to do to get started is to connect your Stripe account.

As we said earlier, there are no strict rules when it comes to writing marketing research reports. On the other hand, you must find your focus if you want to write a report that will make a difference. Here are some best practices you should keep in mind when writing a research report.

- Objectives – The objective of a market research report is to define the problems, identify key issues, and suggest recommendations for further research. If you answer them successfully, you’re on the right way.

- Don’t worry about the format – Be creative. The report could be in a form of a PowerPoint presentation, Excel sheet, interactive dashboard or even a video. Use the format that best fits your audience, but make sure to make it easy to read.

- Include an executive summary, scorecard , or a dashboard – This is really important because time is money, and most people don’t have time to waste. So, how to put everything important in a short role? Address all of the objectives and put them in a graphic dashboard or scorecard. Also, you can write an executive summary template (heart of the report) that can be easily updated and read by managers or CEOs.

- Use storytelling – A good story always makes a great point because it’s so memorable. Your research report results can double the effect with a catchy story.

- Keep it short – It’s not a secret that we are reading so little in the digital era. Use a lot of white space and bullet points. Too much text on a page means less focus for the reader.

- Be organized – Maintain the order of information. It’s important for the reader to navigate through the report easily. If they want to find some details or specific information it would be great to divide all sections with appropriate references.

- Methodological information – Methodological details could be boring. Include only the most important details that the reader needs to know to understand the big picture.

- Use images (or other visualizations) whenever you can – A good picture speaks for 1.000 words! If you can communicate the point visually, don’t hesitate to do it. It would be a lot easier for those who don’t like a lot of text to understand your results. But don’t push them where you can’t.

- Create readable graphs – The crown of marketing research reports is a comprehensive graph. Make sure to design precise and attractive graphs that will power up and round your story.

- Use the Appendix – You can include all secondary information such as methodological details and other miscellaneous data in the Appendix at the end of the report.

Market research reports are all about presenting your data in an easy-to-understand way and making calculated decisions about business ideas. But this is something easier said than done.

When busy stakeholders and executives grab a report, they need something that will give them an idea of the results – the big picture that addresses company wide-business goals.

Can a PowerPoint presentation or a PDF report meet those expectations? Most likely not. But a dashboard can.

Keep in mind that even with the best market analysis in the world, your market research report won’t be actionable if you don’t present the data efficiently and in a way that everyone understands what the next steps are. Databox is your key ally in the matter.

Databox dashboards are designed to help you present your market research data with clarity – from identifying what is influencing your business, and understanding where your brand is situated in the market, to gauging the temperature of your niche or industry before a new product/service launch.

Present your research results with efficient, interactive dashboards now by signing up for a free trial .

Get practical strategies that drive consistent growth

12 Tips for Developing a Successful Data Analytics Strategy

What Is Data Reporting and How to Create Data Reports for Your Business

What Is KPI Reporting? KPI Report Examples, Tips, and Best Practices

Build your first dashboard in 5 minutes or less

Latest from our blog

- Playmaker Spotlight: Tory Ferrall, Director of Revenue Operations March 27, 2024

- New in Databox: Safeguard Your Data With Advanced Security Settings March 18, 2024

- Metrics & KPIs

- vs. Tableau

- vs. Looker Studio

- vs. Klipfolio

- vs. Power BI

- vs. Whatagraph

- vs. AgencyAnalytics

- Product & Engineering

- Inside Databox

- Terms of Service

- Privacy Policy

- Talent Resources

- We're Hiring!

- Help Center

- API Documentation

What is a Marketing Research Report and How to Write It

In essence, a market research report is a document that reveals the characteristics of your ideal customers, their buying habits, the value your product or service can bring to them, and the list of your top competitors.

The marketing research report paints a picture of what kinds of new products or services may be the most profitable in today’s highly competitive landscape. For products or services already available, a marketing research report can provide detailed insights as to whether they are meeting their consumers’ needs and expectations. It helps understand the reasons why consumers buy a particular product by studying consumer behavior, including how economic, cultural, societal, and personal factors influence that behavior.

Furthermore, the purpose of writing a marketing research report is to make calculated decisions about business ideas – whether they’re worth pursuing or not. This requires one primary skill which is observing the pattern which is hidden in the User Generated Content (UGC) written in different tones and perspectives on the social web.

Simply put, writing a market research report is a vital part of planning business activities and serves as a neat way to assimilate all the information about your target market and prospective customers.

Now, there are two key varieties of marketing research report formats – primary and secondary.

Primary vs. Secondary Market Research

Let’s take a look at the main recipes of how to make a market research report in detail:

Primary Research

This method of marketing research involves gathering firsthand information about your market and prospective clients. You study your customers directly by conducting:

- Interviews (either by telephone or face-to-face)

- Surveys and polls (online or by email)

- Questionnaires (online or by email)

- Focus groups discussions with a sample of potential customers and getting their direct feedback

Some crucial questions that you need to ask your prospective customers in your primary research are:

- What are the factors that motivate you to purchase this product or service?

- What do you like or dislike about this type of product or service already available on the market?

- Are there any areas you’d like to suggest for improvement?

- What according to you is the appropriate price for this product or service?

Primary research also involves analyzing competitors’ strategies, so you can find gaps and weaknesses that you can turn into your strengths.

Secondary Research

The second method of writing a marketing research report is all about analyzing the data that has already been published and using the available information on the web. That is, secondary research is done from reliable reports and statistics found on the websites of other organizations or authority blogs in your industry.

Sources can be:

- Public: This includes all the free sources like social media and forums, Google Trends, YouGov, and government sources such as the United States Census Bureau.

- Commercial: This includes industry insights compiled by research agencies like Pew, Gartner, Forrester, and so on. Typically, these are paid.

- Internal: This is the historical market data your organization already has in-house, such as the Net Promoter Score, customer churn rate, and so on.

Secondary data can help you identify competitors, establish benchmarks, and determine target customer segments or demographics – people who live a certain lifestyle, their income and buying patterns, age group, location, etc.

Market Research Reports Advantages and Disadvantages

Before we discuss how to write a marketing research report, let’s quickly take a look at market research report benefits and also some of the limitations in marketing research reports.

Advantages of Market Research Report

Here are the top reasons why you should invest in creating a market research report.

1. Gives a Better Understanding of Your Customers

The answers to questions like who will buy your product, what are the customers’ pain points, what motivates their buying behavior, and so on will be effectively answered with a market research report. Essentially, it will help you map out the full profile of your ideal customer and consequently, allow you to create tailored products and marketing campaigns.

2. Helps Spot Business Opportunities

As already mentioned, market research will give you insights about your competitors’ strategies, so you can find gaps in their offerings that you can turn into your product’s strengths. You may also find other business opportunities such as potential partnerships with brands that sell complementary products, or an opportunity to better upsell or cross-sell your products. For example, a keyword research report from a SaaS SEO agency provides an opportunity to acquire organic search ranking by creating in-depth, high-converting, and funnel-oriented content.

3. Minimizes Risks

Starting or running a business is synonymous with risk. In fact, nearly half of all small businesses with employees don’t survive for more than five years. Conducting proper market research frequently will allow you to stay on top of trends, and not waste your efforts and resources in things that would likely be fruitless.

For instance, before you launch a new product, conducting market research gives you a much better idea of the demand for your product. Or if an existing product is seeing a big drop in sales, market research helps you determine the root cause of the issue.

4. Facilitates Data-Driven Decision Making

When it comes to business decisions – data over guesswork, always. So, based on your market research results, you can make more informed decisions regarding the pricing, distribution channels, and marketing budget of your products.

Disadvantages of Market Research Report

As with anything, there are a couple of downsides to conducting marketing research as well.

1. Could Be an Expensive Activity

Conducting a comprehensive, in-depth research is usually a costly activity in terms of both time and money. To research the right audience with the right questions requires you to invest a lot of time. If you wish to use data by commercial market research agencies or get help from one such agency in conducting primary research, be prepared to spend a substantial amount.

2. Insights Gathered Could Be Inadequate or Even Inaccurate

Another problem often faced in marketing research is a lack of respondents. While you can figure out who is your target audience, getting them to fill out surveys and questionnaires can indeed be challenging. Plus, you’re using data you collected for drawing conclusions, which may be unreliable.

For example, by the time you act on the data you collected, it may have become outdated. This translates into poor decision making and the whole process may become counterproductive.

How to Prepare Market Research Report

Now, here are some concrete steps and guidelines for writing a marketing research report.

Step 1: Cluster the Data

First off, compile all the relevant data you’ve accumulated from your primary and/or secondary research efforts. Survey results, interview answers, statistics from third-party sources – bring it all together and then analyze the information to sketch out the profile of your target market.

Step 2: Prepare an Outline

Next, create a skeleton of the report so that you understand what information will go where. An outline with sections and subsections will help you structure your marketing research report properly. A typical report includes an introduction, background and methodology, executive summary, results, and a conclusion with links to all references.

With an outline in front of you, start by writing the front matter of your report – an introduction that provides a brief overview of your business and the reason you conducted the market research. Include a summary of the market research process and the results you have analyzed. For instance, you might have been gauging the feasibility of a new product, so summarize that your market research report is for a new product launch.

Step 3: Mention the Research Methods

An important next step is to clearly mention the methods used to conduct the research. That is, if you conducted polls, specify the number of polls, the percentage of responses, the types of people or businesses targeted, and the questions included in the poll. Tag all the resources for demographic information, such as census data.

Step 4: Include Visuals With Narrative Explanation

Visuals such as charts and graphs are an important part of any research paper. They make sure that the findings are easy to comprehend.

So, create tables, graphs, and/or charts illustrating the results of the research. Accompany it with a narrative explanation of the visual data. Highlight the inferences you made based on this data.

Step 5: Conclude the Report With Recommendations

Finally, conclude your report with a section that lists actionable recommendations based on the research results to facilitate decision making. For example, all the numbers may point to the conclusion that your customers desire a particular feature that no other product on the market is currently offering. In this case, it is clear that it’s a good idea to invest your resources in providing that feature and gain a competitive edge.

At the very end of the report, include reference links to all the sources and an appendix for supplementary materials and further reading.

Marketing Research Report Templates

Before you go, check out some templates and samples you can use to better understand the marketing research report structure, and maybe even use them to kickstart your report instead of preparing one from scratch.

- Market Research Report for New Product Launch

- Market Research Report for Restaurant (competitor analysis)

- Social Media Market Research Report

Writing a marketing research report is a tried-and-true way to gain a solid understanding of your target audience and competitors while enabling you to make more informed decisions and minimize investment risks. Sure, it may take considerable time, effort, and even money to conduct thorough research and prepare a report, but when done well, the ROI of it all is well worth it.

Shahid Abbasi is a Senior SEO and Content Marketing Analyst at Growfusely, a SaaS content marketing agency specializing in content and data-driven SEO.

Ready for SaaS tronomical organic growth?

Let's find out if we're the SaaS content marketing company you’re looking for.

How To Present Your Market Research Results And Reports In An Efficient Way

Table of Contents

1) What Is A Market Research Report?

2) Market Research Reports Examples

3) Why Do You Need Market Research Reports

4) How To Make A Market Research Report?

5) Types Of Market Research Reports

6) Challenges & Mistakes Market Research Reports

Market research analyses are the go-to solution for many professionals, and for good reason: they save time, offer fresh insights, and provide clarity on your business. In turn, market research reports will help you to refine and polish your strategy. Plus, a well-crafted report will give your work more credibility while adding weight to any marketing recommendations you offer a client or executive.

But, while this is the case, today’s business world still lacks a way to present market-based research results efficiently. The static, antiquated nature of PowerPoint makes it a bad choice for presenting research discoveries, yet it is still widely used to present results.

Fortunately, things are moving in the right direction. There are online data visualization tools that make it easy and fast to build powerful market research dashboards. They come in handy to manage the outcomes, but also the most important aspect of any analysis: the presentation of said outcomes, without which it becomes hard to make accurate, sound decisions.

Here, we consider the benefits of conducting research analyses while looking at how to write and present market research reports, exploring their value, and, ultimately, getting the very most from your research results by using professional market research software .

Let’s get started.

What Is a Market Research Report?

A market research report is an online reporting tool used to analyze the public perception or viability of a company, product, or service. These reports contain valuable and digestible information like customer survey responses and social, economic, and geographical insights.

On a typical market research results example, you can interact with valuable trends and gain insight into consumer behavior and visualizations that will empower you to conduct effective competitor analysis. Rather than adding streams of tenuous data to a static spreadsheet, a full market research report template brings the outcomes of market-driven research to life, giving users a data analysis tool to create actionable strategies from a range of consumer-driven insights.

With digital market analysis reports, you can make your business more intelligent more efficient, and, ultimately, meet the needs of your target audience head-on. This, in turn, will accelerate your commercial success significantly.

Your Chance: Want to test a market research reporting software? Explore our 14-day free trial & benefit from interactive research reports!

How To Present Your Results: 4 Essential Market Research Report Templates

When it comes to sharing rafts of invaluable information, research dashboards are invaluable.

Any market analysis report example worth its salt will allow everyone to get a firm grip on their results and discoveries on a single page with ease. These dynamic online dashboards also boast interactive features that empower the user to drill down deep into specific pockets of information while changing demographic parameters, including gender, age, and region, filtering the results swiftly to focus on the most relevant insights for the task at hand.

These four market research report examples are different but equally essential and cover key elements required for market survey report success. You can also modify each and use it as a client dashboard .

While there are numerous types of dashboards that you can choose from to adjust and optimize your results, we have selected the top 3 that will tell you more about the story behind them. Let’s take a closer look.

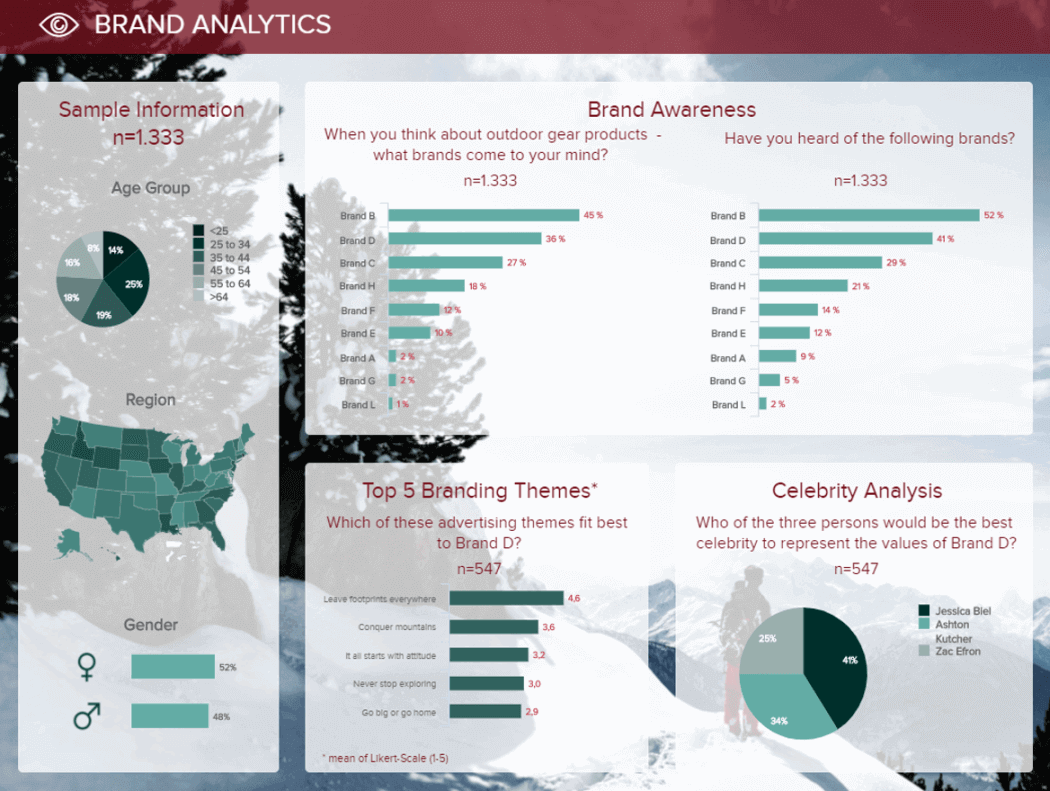

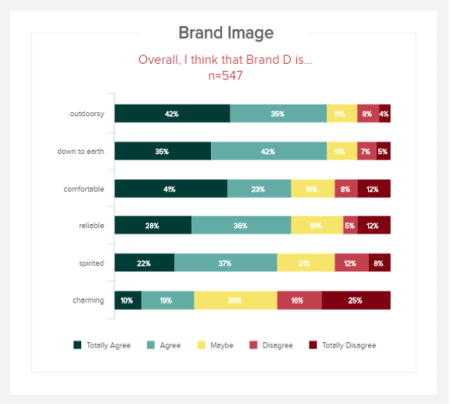

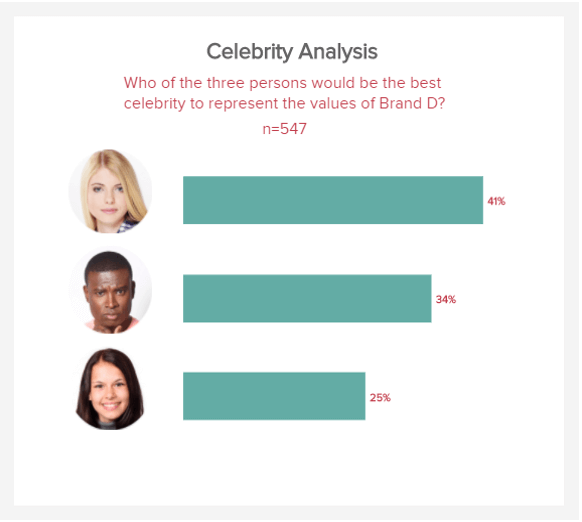

1. Market Research Report: Brand Analysis

Our first example shares the results of a brand study. To do so, a survey has been performed on a sample of 1333 people, information that we can see in detail on the left side of the board, summarizing the gender, age groups, and geolocation.

**click to enlarge**

At the dashboard's center, we can see the market-driven research discoveries concerning first brand awareness with and without help, as well as themes and celebrity suggestions, to know which image the audience associates with the brand.

Such dashboards are extremely convenient to share the most important information in a snapshot. Besides being interactive (but it cannot be seen on an image), it is even easier to filter the results according to certain criteria without producing dozens of PowerPoint slides. For instance, I could easily filter the report by choosing only the female answers, only the people aged between 25 and 34, or only the 25-34 males if that is my target audience.

Primary KPIs:

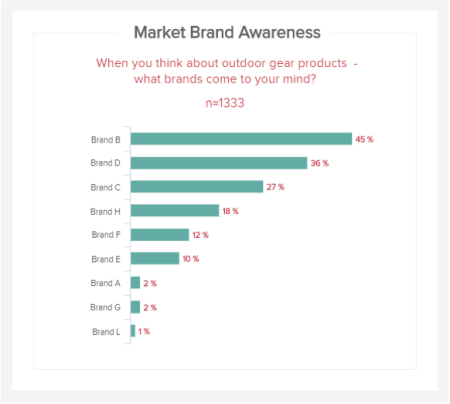

a) Unaided Brand Awareness

The first market research KPI in this most powerful report example comes in the form of unaided brand awareness. Presented in a logical line-style chart, this particular market study report sample KPI is invaluable, as it will give you a clear-cut insight into how people affiliate your brand within their niche.

As you can see from our example, based on a specific survey question, you can see how your brand stacks up against your competitors regarding awareness. Based on these outcomes, you can formulate strategies to help you stand out more in your sector and, ultimately, expand your audience.

b) Aided Brand Awareness

This market survey report sample KPI focuses on aided brand awareness. A visualization that offers a great deal of insight into which brands come to mind in certain niches or categories, here, you will find out which campaigns and messaging your target consumers are paying attention to and engaging with.

By gaining access to this level of insight, you can conduct effective competitor research and gain valuable inspiration for your products, promotional campaigns, and marketing messages.

c) Brand image

When it comes to research reporting, understanding how others perceive your brand is one of the most golden pieces of information you could acquire. If you know how people feel about your brand image, you can take informed and very specific actions that will enhance the way people view and interact with your business.

By asking a focused question, this visual of KPIs will give you a definitive idea of whether respondents agree, disagree, or are undecided on particular descriptions or perceptions related to your brand image. If you’re looking to present yourself and your message in a certain way (reliable, charming, spirited, etc.), you can see how you stack up against the competition and find out if you need to tweak your imagery or tone of voice - invaluable information for any modern business.

d) Celebrity analysis

This indicator is a powerful part of our research KPI dashboard on top, as it will give you a direct insight into the celebrities, influencers, or public figures that your most valued consumers consider when thinking about (or interacting with) your brand.

Displayed in a digestible bar chart-style format, this useful metric will not only give you a solid idea of how your brand messaging is perceived by consumers (depending on the type of celebrity they associate with your brand) but also guide you on which celebrities or influencers you should contact.

By working with the right influencers in your niche, you will boost the impact and reach of your marketing campaigns significantly, improving your commercial awareness in the process. And this is the KPI that will make it happen.

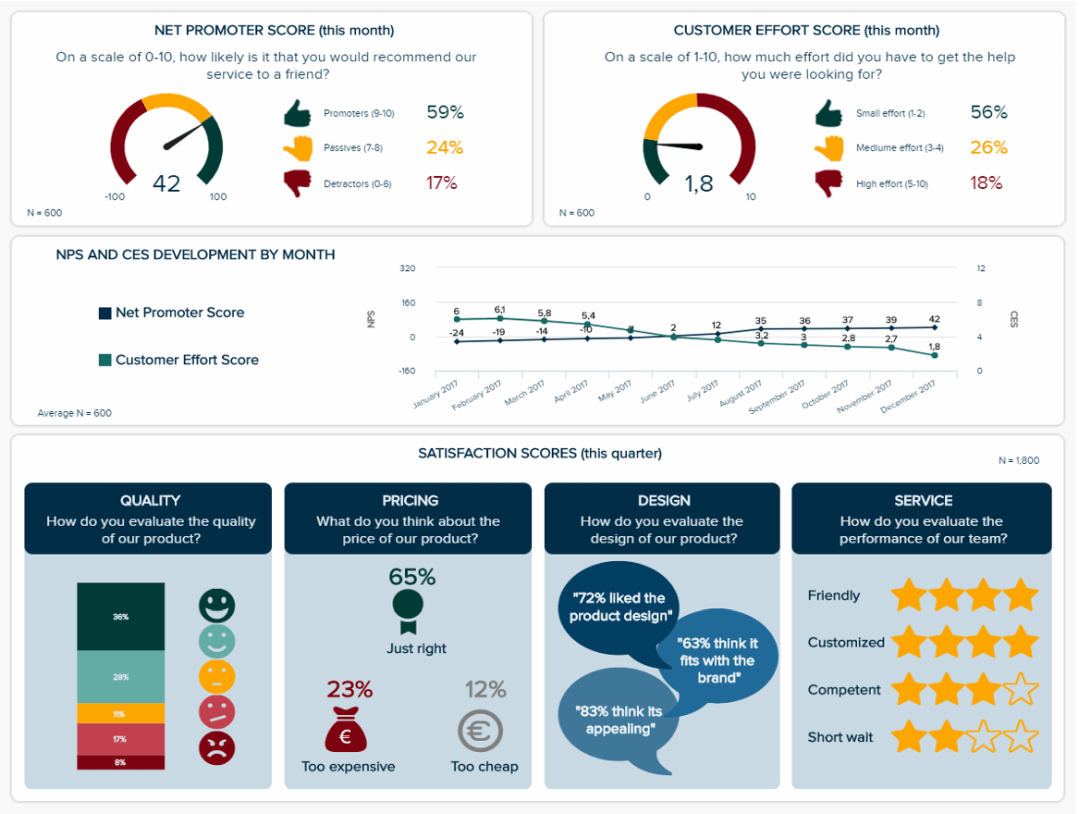

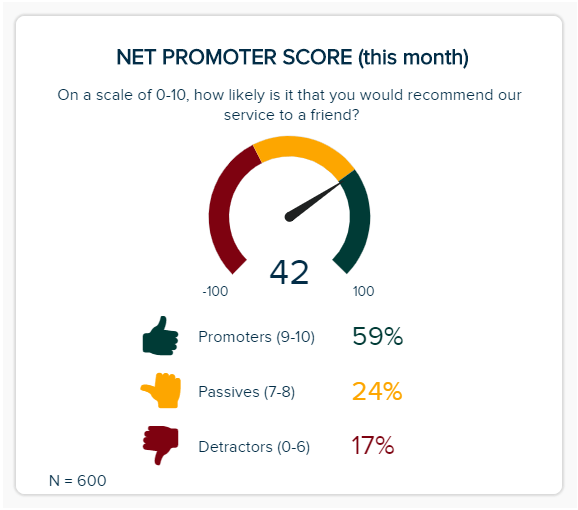

2. Market Research Results On Customer Satisfaction

Here, we have some of the most important data a company should care about: their already-existing customers and their perception of their relationship with the brand. It is crucial when we know that it is five times more expensive to acquire a new consumer than to retain one.

This is why tracking metrics like the customer effort score or the net promoter score (how likely consumers are to recommend your products and services) is essential, especially over time. You need to improve these scores to have happy customers who will always have a much bigger impact on their friends and relatives than any of your amazing ad campaigns. Looking at other satisfaction indicators like the quality, pricing, and design, or the service they received is also a best practice: you want a global view of your performance regarding customer satisfaction metrics .

Such research results reports are a great tool for managers who do not have much time and hence need to use them effectively. Thanks to these dashboards, they can control data for long-running projects anytime.

Primary KPIs :

a) Net Promoter Score (NPS)

Another pivotal part of any informative research presentation is your NPS score, which will tell you how likely a customer is to recommend your brand to their peers.

Centered on overall customer satisfaction, your NPS Score can cover the functions and output of many departments, including marketing, sales, and customer service, but also serve as a building block for a call center dashboard . When you’re considering how to present your research effectively, this balanced KPI offers a masterclass. It’s logical, it has a cohesive color scheme, and it offers access to vital information at a swift glance. With an NPS Score, customers are split into three categories: promoters (those scoring your service 9 or 10), passives (those scoring your service 7 or 8), and detractors (those scoring your service 0 to 6). The aim of the game is to gain more promoters. By gaining an accurate snapshot of your NPS Score, you can create intelligent strategies that will boost your results over time.

b) Customer Satisfaction Score (CSAT)

The next in our examples of market research reports KPIs comes in the form of the CSAT. The vast majority of consumers that have a bad experience will not return. Honing in on your CSAT is essential if you want to keep your audience happy and encourage long-term consumer loyalty.

This magnificent, full report KPI will show how satisfied customers are with specific elements of your products or services. Getting to grips with these scores will allow you to pinpoint very specific issues while capitalizing on your existing strengths. As a result, you can take measures to improve your CSAT score while sharing positive testimonials on your social media platforms and website to build trust.

c) Customer Effort Score (CES)

When it comes to presenting research findings, keeping track of your CES Score is essential. The CES Score KPI will give you instant access to information on how easy or difficult your audience can interact with or discover your company based on a simple scale of one to ten.

By getting a clear-cut gauge of how your customers find engagement with your brand, you can iron out any weaknesses in your user experience (UX) offerings while spotting any friction, bottlenecks, or misleading messaging. In doing so, you can boost your CES score, satisfy your audience, and boost your bottom line.

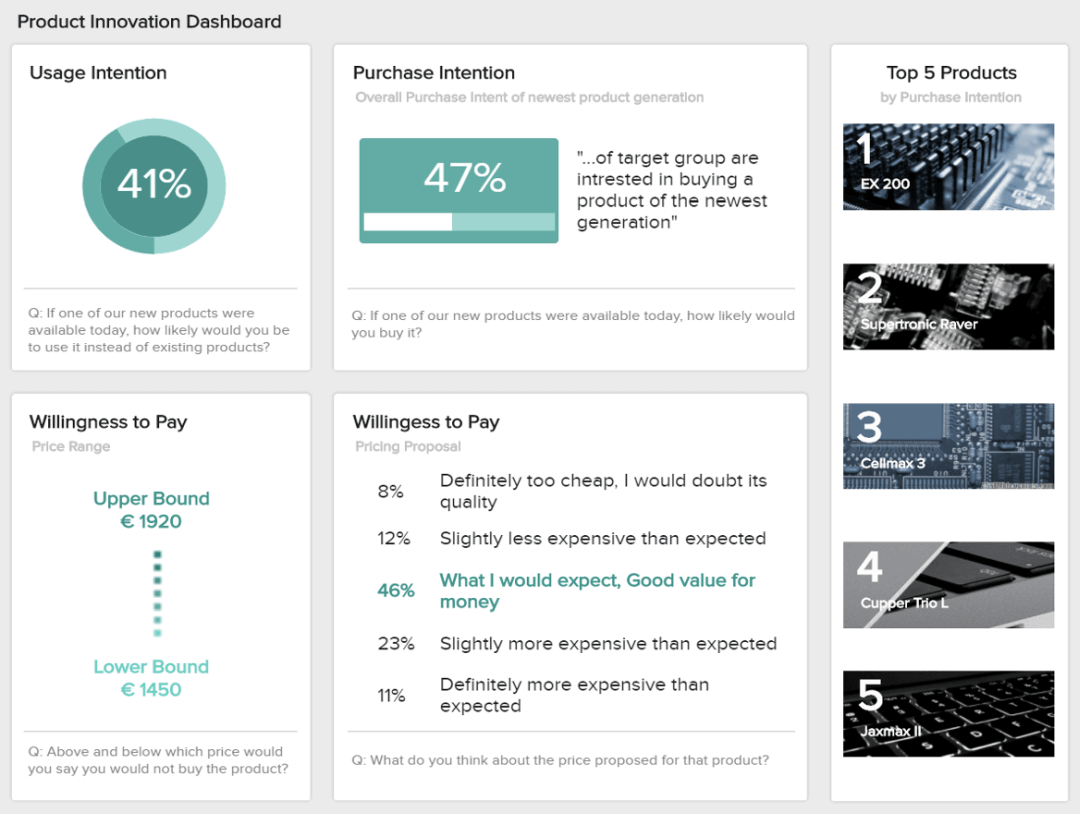

3. Market Research Results On Product Innovation

This final market-driven research example report focuses on the product itself and its innovation. It is a useful report for future product development and market potential, as well as pricing decisions.

Using the same sample of surveyed people as for the first market-focused analytical report , they answer questions about their potential usage and purchase of the said product. It is good primary feedback on how the market would receive the new product you would launch. Then comes the willingness to pay, which helps set a price range that will not be too cheap to be trusted nor too expensive for what it is. That will be the main information for your pricing strategy.

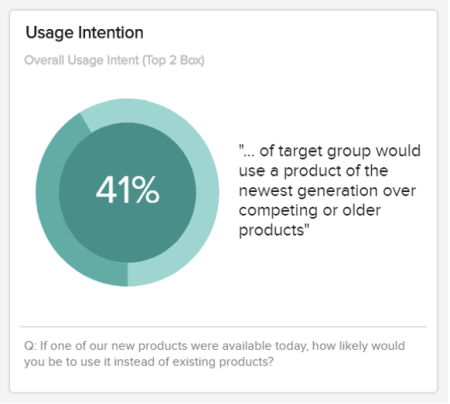

a) Usage Intention

The first of our product innovation KPI-based examples comes in the form of usage intention. When you’re considering how to write a market research report, including metrics centered on consumer intent is critical.

This simple yet effective visualization will allow you to understand not only how users see your product but also whether they prefer previous models or competitor versions . While you shouldn’t base all of your product-based research on this KPI, it is very valuable, and you should use it to your advantage frequently.

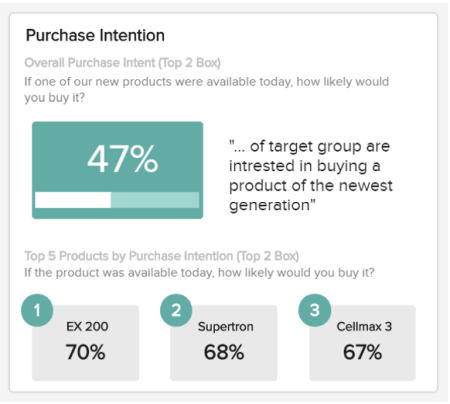

b) Purchase Intention

Another aspect to consider when looking at how to present market research data is your audience’s willingness or motivation to purchase your product. Offering percentage-based information, this effective KPI provides a wealth of at-a-glance information to help you make accurate forecasts centered on your product and service offerings.

Analyzing this information regularly will give you the confidence and direction to develop strategies that will steer you to a more prosperous future, meeting the ever-changing needs of your audience on an ongoing basis.

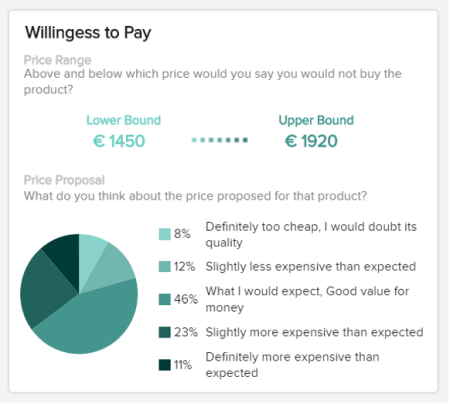

c) Willingness To Pay (WPS)

Our final market research example KPI is based on how willing customers are to pay for a particular service or product based on a specific set of parameters. This dynamic visualization, represented in an easy-to-follow pie chart, will allow you to realign the value of your product (USPs, functions, etc.) while setting price points that are most likely to result in conversions. This is a market research presentation template that every modern organization should use to its advantage.

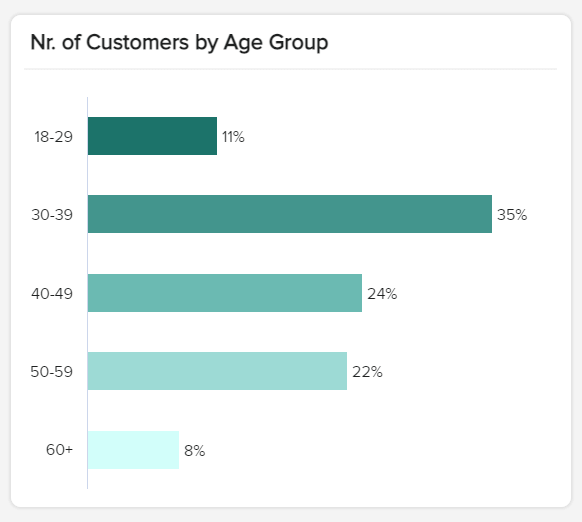

4. Market Research Report On Customer Demographics

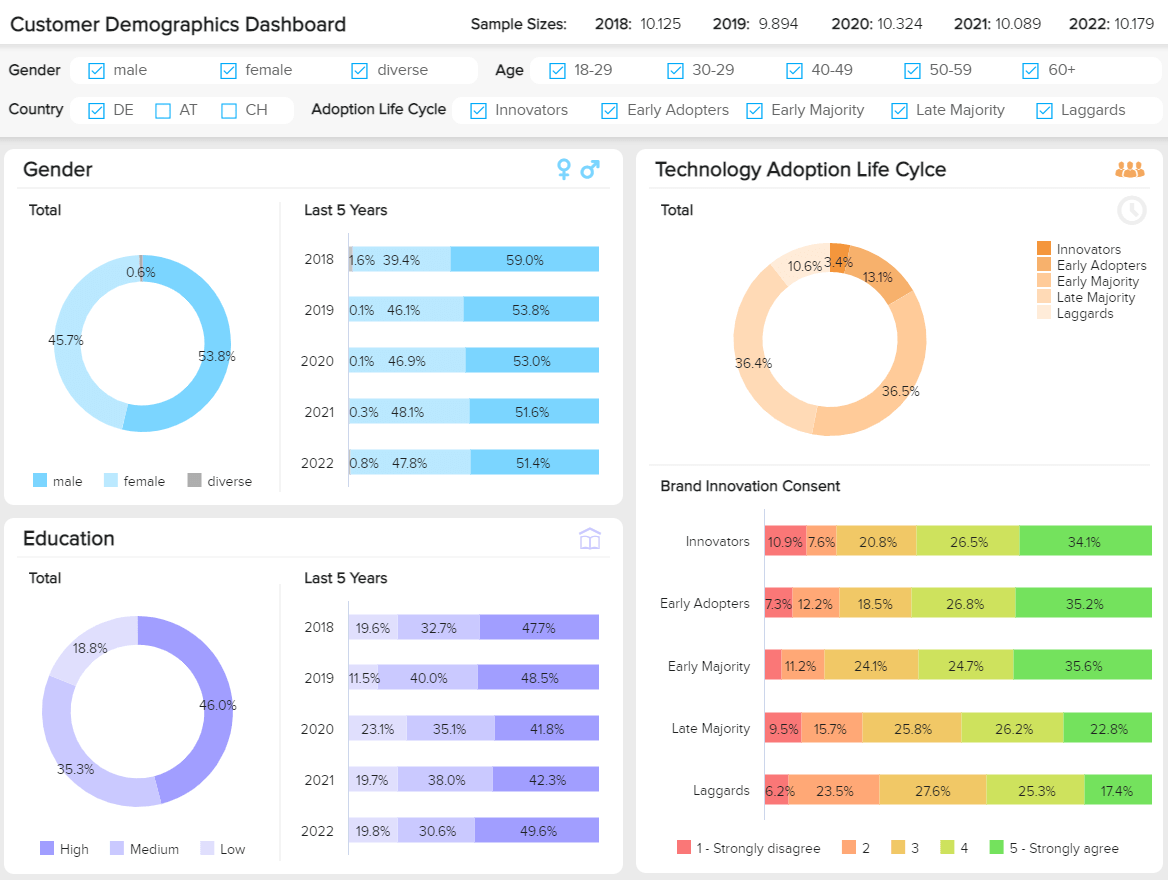

This particular example of market research report, generated with a modern dashboard creator , is a powerful tool, as it displays a cohesive mix of key demographic information in one intuitive space.

By breaking down these deep pockets of consumer-centric information, you can gain the power to develop more impactful customer communications while personalizing every aspect of your target audience’s journey across every channel or touchpoint. As a result, you can transform theoretical insights into actionable strategies that will result in significant commercial growth.

Every section of this responsive marketing research report works in unison to build a profile of your core audience in a way that will guide your company’s consumer-facing strategies with confidence. With in-depth visuals based on gender, education level, and tech adoption, you have everything you need to speak directly to your audience at your fingertips.

Let’s look at the key performance indicators (KPIs) of this invaluable market research report example in more detail.

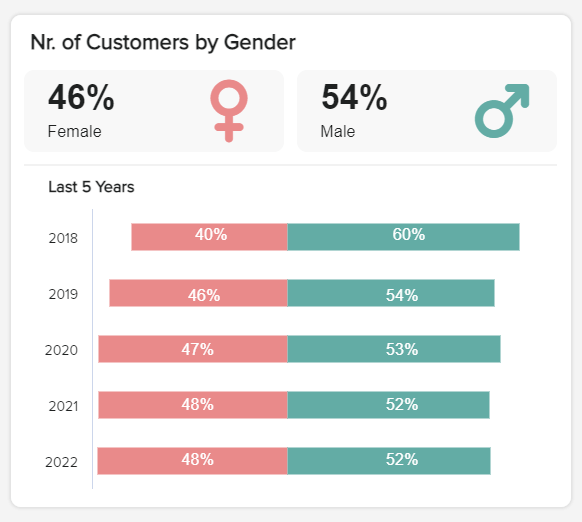

a) Customer By Gender

This KPI is highly visual and offers a clear-cut representation of your company’s gender share over time. By gaining access to this vital information, you can deliver a more personalized experience to specific audience segments while ensuring your messaging is fair, engaging, and inclusive.

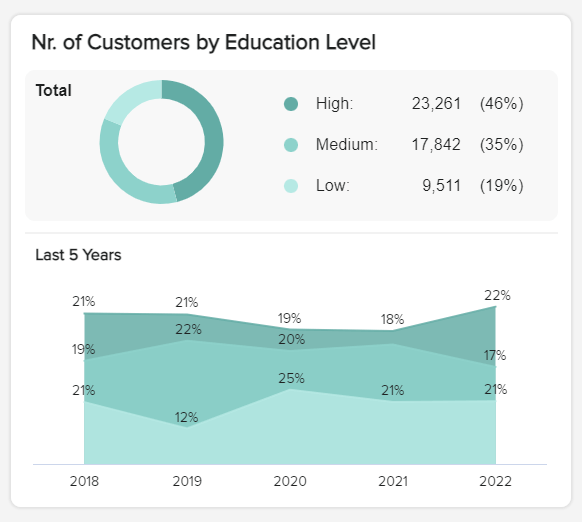

b) Customers by education level

The next market analysis report template is a KPI that provides a logical breakdown of your customers’ level of education. By using this as a demographic marker, you can refine your products to suit the needs of your audience while crafting your content in a way that truly resonates with different customer groups.

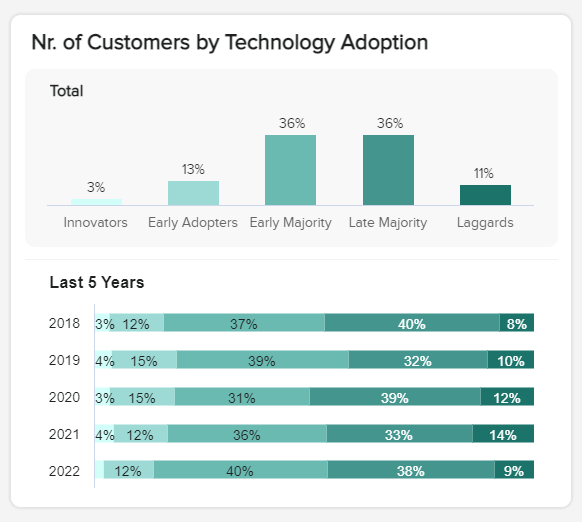

c) Customers by technology adoption

Particularly valuable if you’re a company that sells tech goods or services, this linear KPI will show you where your customers are in terms of technological know-how or usage. By getting to grips with this information over time, you can develop your products or services in a way that offers direct value to your consumers while making your launches or promotions as successful as possible.

d) Customer age groups

By understanding your customers’ age distribution in detail, you can gain a deep understanding of their preferences. And that’s exactly what this market research report sample KPI does. Presented in a bar chart format, this KPI will give you a full breakdown of your customers’ age ranges, allowing you to build detailed buyer personas and segment your audience effectively.

Why Do You Need Market Research Reports?

As the adage goes, “Look before you leap“ – which is exactly what a research report is here for. As the headlights of a car, they will show you the pitfalls and fast lanes on your road to success: likes and dislikes of a specific market segment in a certain geographical area, their expectations, and readiness. Among other things, a research report will let you:

- Get a holistic view of the market : learn more about the target market and understand the various factors involved in the buying decisions. A broader view of the market lets you benchmark other companies you do not focus on. This, in turn, will empower you to gather the industry data that counts most. This brings us to our next point.

- Curate industry information with momentum: Whether you’re looking to rebrand, improve on an existing service, or launch a new product, time is of the essence. By working with the best market research reports created with modern BI reporting tools , you can visualize your discoveries and data, formatting them in a way that not only unearths hidden insights but also tells a story - a narrative that will gain a deeper level of understanding into your niche or industry. The features and functionality of a market analysis report will help you grasp the information that is most valuable to your organization, pushing you ahead of the pack in the process.

- Validate internal research: Doing the internal analysis is one thing, but double-checking with a third party also greatly helps avoid getting blinded by your own data.

- Use actionable data and make informed decisions: Once you understand consumer behavior as well as the market, your competitors, and the issues that will affect the industry in the future, you are better armed to position your brand. Combining all of it with the quantitative data collected will allow you to more successful product development. To learn more about different methods, we suggest you read our guide on data analysis techniques .

- Strategic planning: When you want to map out big-picture organizational goals, launch a new product development, plan a geographic market expansion, or even a merger and acquisition – all of this strategic thinking needs solid foundations to fulfill the variety of challenges that come along.

- Consistency across the board: Collecting, presenting, and analyzing your results in a way that’s smarter, more interactive, and more cohesive will ensure your customer communications, marketing campaigns, user journey, and offerings meet your audience’s needs consistently across the board. The result? Faster growth, increased customer loyalty, and more profit.

- Better communication: The right market research analysis template (or templates) will empower everyone in the company with access to valuable information - the kind that is relevant and comprehensible. When everyone is moving to the beat of the same drum, they will collaborate more effectively and, ultimately, push the venture forward thanks to powerful online data analysis techniques.

- Centralization: Building on the last point, using a powerful market research report template in the form of a business intelligence dashboard will make presenting your findings to external stakeholders and clients far more effective, as you can showcase a wealth of metrics, information, insights, and invaluable feedback from one centralized, highly visual interactive screen.

- Brand reputation: In the digital age, brand reputation is everything. By making vital improvements in all of the key areas above, you will meet your customers’ needs head-on with consistency while finding innovative ways to stand out from your competitors. These are the key ingredients of long-term success.

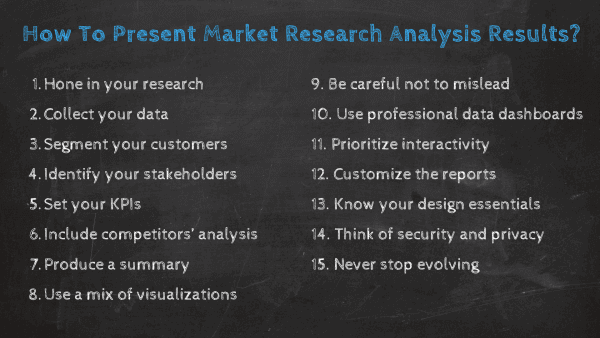

How To Present Market Research Analysis Results?

Here we look at how you should present your research reports, considering the steps it takes to connect with the outcomes you need to succeed:

- Collect your data

As with any reporting process, you first and foremost need to collect the data you’ll use to conduct your studies. Businesses conduct research studies to analyze their brand awareness, identity, and influence in the market. For product development and pricing decisions, among many others. That said, there are many ways to collect information for a market research report. Among some of the most popular ones, we find:

- Surveys: Probably the most common way to collect research data, surveys can come in the form of open or closed questions that can be answered anonymously. They are the cheapest and fastest way to collect insights about your customers and business.

- Interviews : These are face-to-face discussions that allow the researcher to analyze responses as well as the body language of the interviewees. This method is often used to define buyer personas by analyzing the subject's budget, job title, lifestyle, wants, and needs, among other things.

- Focus groups : This method involves a group of people discussing a topic with a mediator. It is often used to evaluate a new product or new feature or to answer a specific question that the researcher might have.

- Observation-based research : In this type of research, the researcher or business sits back and watches customers interact with the product without any instructions or help. It allows us to identify pain points as well as strong features.

- Market segmentation : This study allows you to identify and analyze potential market segments to target. Businesses use it to expand into new markets and audiences.

These are just a few of the many ways in which you can gather your information. The important point is to keep the research objective as straightforward as possible. Supporting yourself with professional BI solutions to clean, manage, and present your insights is probably the smartest choice.

2. Hone in on your research:

When looking at how to source consumer research in a presentation, you should focus on two areas: primary and secondary research. Primary research comes from your internal data, monitoring existing organizational practices, the effectiveness of sales, and the tools used for communication, for instance. Primary research also assesses market competition by evaluating the company plans of the competitors. Secondary research focuses on existing data collected by a third party, information used to perform benchmarking and market analysis. Such metrics help in deciding which market segments are the ones the company should focus its efforts on or where the brand is standing in the minds of consumers. Before you start the reporting process, you should set your goals, segmenting your research into primary and secondary segments to get to grips with the kind of information you need to work with to achieve effective results.

3. Segment your customers:

To give your market research efforts more context, you should segment your customers into different groups according to the preferences outlined in the survey or feedback results or by examining behavioral or demographic data.

If you segment your customers, you can tailor your market research and analysis reports to display only the information, charts, or graphics that will provide actionable insights into their wants, needs, or industry-based pain points.

- Identify your stakeholders:

Once you’ve drilled down into your results and segmented your consumer groups, it’s important to consider the key stakeholders within the organization that will benefit from your information the most.

By looking at both internal and external stakeholders, you will give your results a path to effective presentation, gaining the tools to understand which areas of feedback or data are most valuable, as well as most redundant. As a consequence, you will ensure your results are concise and meet the exact information needs of every stakeholder involved in the process.

- Set your KPIs:

First, remember that your reports should be concise and accurate - straight to the point without omitting any essential information. Work to ensure your insights are clean and organized, with participants grouped into relevant categories (demographics, profession, industry, education, etc.). Once you’ve organized your research, set your goals, and cleaned your data, you should set your KPIs to ensure your report is populated with the right visualizations to get the job done. Explore our full library of interactive KPI examples for inspiration.

- Include competitor’s analysis

Whether you are doing product innovation research, customer demographics, pricing, or any other, including some level of insights about competitors in your reports is always recommended as it can help your business or client better understand where they stand in the market. That being said, competitor analysis is not as easy as picking a list of companies in the same industry and listing them. Your main competitor can be just a company's division in an entirely different industry. For example, Apple Music competes with Spotify even though Apple is a technology company. Therefore, it is important to carefully analyze competitors from a general but detailed level.

Providing this kind of information in your reports can also help you find areas that competitors are not exploiting or that are weaker and use them to your advantage to become a market leader.

- Produce your summary:

To complement your previous efforts, writing an executive summary of one or two pages that will explain the general idea of the report is advisable. Then come the usual body parts:

- An introduction providing background information, target audience, and objectives;

- The qualitative research describes the participants in the research and why they are relevant to the business;

- The survey research outlines the questions asked and answered;

- A summary of the insights and metrics used to draw the conclusions, the research methods chosen, and why;

- A presentation of the findings based on your research and an in-depth explanation of these conclusions.

- Use a mix of visualizations:

When presenting your results and discoveries, you should aim to use a balanced mix of text, graphs, charts, and interactive visualizations.

Using your summary as a guide, you should decide which type of visualization will present each specific piece of market research data most effectively (often, the easier to understand and more accessible, the better).

Doing so will allow you to create a story that will put your research information into a living, breathing context, providing a level of insight you need to transform industry, competitor, or consumer info or feedback into actionable strategies and initiatives.

- Be careful not to mislead

Expanding on the point above, using a mix of visuals can prove highly valuable in presenting your results in an engaging and understandable way. That being said, when not used correctly, graphs and charts can also become misleading. This is a popular practice in the media, news, and politics, where designers tweak the visuals to manipulate the masses into believing a certain conclusion. This is a very unethical practice that can also happen by mistake when you don’t pick the right chart or are not using it in the correct way. Therefore, it is important to outline the message you are trying to convey and pick the chart type that will best suit those needs.

Additionally, you should also be careful with the data you choose to display, as it can also become misleading. This can happen if you, for example, cherry-pick data, which means only showing insights that prove a conclusion instead of the bigger picture. Or confusing correlation with causation, which means assuming that because two events happened simultaneously, one caused the other.

Being aware of these practices is of utmost importance as objectivity is crucial when it comes to dealing with data analytics, especially if you are presenting results to clients. Our guides on misleading statistics and misleading data visualizations can help you learn more about this important topic.

- Use professional dashboards:

To optimize your market research discoveries, you must work with a dynamic business dashboard . Not only are modern dashboards presentable and customizable, but they will offer you past, predictive, and real-time insights that are accurate, interactive, and yield long-lasting results.

All market research reports companies or businesses gathering industry or consumer-based information will benefit from professional dashboards, as they offer a highly powerful means of presenting your data in a way everyone can understand. And when that happens, everyone wins.

Did you know? The interactive nature of modern dashboards like datapine also offers the ability to quickly filter specific pockets of information with ease, offering swift access to invaluable insights.

- Prioritize interactivity

The times when reports were static are long gone. Today, to extract the maximum value out of your research data, you need to be able to explore the information and answer any critical questions that arise during the presentation of results. To do so, modern reporting tools provide multiple interactivity features to help you bring your research results to life.

For instance, a drill-down filter lets you go into lower levels of hierarchical data without generating another graph. For example, imagine you surveyed customers from 10 different countries. In your report, you have a chart displaying the number of customers by country, but you want to analyze a specific country in detail. A drill down filter would enable you to click on a specific country and display data by city on that same chart. Even better, a global filter would allow you to filter the entire report to show only results for that specific country.

Through the use of interactive filters, such as the one we just mentioned, you’ll not only make the presentation of results more efficient and profound, but you’ll also avoid generating pages-long reports to display static results. All your information will be displayed in a single interactive page that can be filtered and explored upon need.

- Customize the reports

This is a tip that is valuable for any kind of research report, especially when it comes to agencies that are reporting to external clients. Customizing the report to match your client’s colors, logo, font, and overall branding will help them grasp the data better, thanks to a familiar environment. This is an invaluable tip as often your audience will not feel comfortable dealing with data and might find it hard to understand or intimidating. Therefore, providing a familiar look that is also interactive and easier to understand will keep them engaged and collaborative throughout the process.

Plus, customizing the overall appearance of the report will also make your agency look more professional, adding extra value to your service.

- Know your design essentials

When you’re presenting your market research reports sample to internal or external stakeholders, having a firm grasp on fundamental design principles will make your metrics and insights far more persuasive and compelling.

By arranging your metrics in a balanced and logical format, you can guide users toward key pockets of information exactly when needed. In turn, this will improve decision-making and navigation, making your reports as impactful as possible.

For essential tips, read our 23 dashboard design principles & best practices to enhance your analytics process.

- Think of security and privacy

Cyberattacks are increasing at a concerning pace, making security a huge priority for organizations of all sizes today. The costs of having your sensitive information leaked are not only financial but also reputational, as customers might not trust you again if their data ends up in the wrong hands. Given that market research analysis is often performed by agencies that handle data from clients, security and privacy should be a top priority.

To ensure the required security and privacy, it is necessary to invest in the right tools to present your research results. For instance, tools such as datapine offer enterprise-level security protocols that ensure your information is encrypted and protected at all times. Plus, the tool also offers additional security features, such as being able to share your reports through a password-protected URL or to set viewer rights to ensure only the right people can access and manipulate the data.

- Keep on improving & evolving

Each time you gather or gain new marketing research reports or market research analysis report intel, you should aim to refine your existing dashboards to reflect the ever-changing landscape around you.

If you update your reports and dashboards according to the new research you conduct and new insights you connect with, you will squeeze maximum value from your metrics, enjoying consistent development in the process.

Types of Market Research Reports: Primary & Secondary Research

With so many market research examples and such little time, knowing how to best present your insights under pressure can prove tricky.

To squeeze every last drop of value from your market research efforts and empower everyone with access to the right information, you should arrange your information into two main groups: primary research and secondary research.

A. Primary research

Primary research is based on acquiring direct or first-hand information related to your industry or sector and the customers linked to it.

Exploratory primary research is an initial form of information collection where your team might set out to identify potential issues, opportunities, and pain points related to your business or industry. This type of research is usually carried out in the form of general surveys or open-ended consumer Q&As, which nowadays are often performed online rather than offline .

Specific primary research is definitive, with information gathered based on the issues, information, opportunities, or pain points your business has already uncovered. When doing this kind of research, you can drill down into a specific segment of your customers and seek answers to the opportunities, issues, or pain points in question.

When you’re conducting primary research to feed into your market research reporting efforts, it’s important to find reliable information sources. The most effective primary research sources include:

- Consumer-based statistical data

- Social media content

- Polls and Q&A

- Trend-based insights

- Competitor research

- First-hand interviews

B. Secondary research

Secondary research refers to every strand of relevant data or public records you have to gain a deeper insight into your market and target consumers. These sources include trend reports, market stats, industry-centric content, and sales insights you have at your disposal. Secondary research is an effective way of gathering valuable intelligence about your competitors.

You can gather very precise, insightful secondary market research insights from:

- Public records and resources like Census data, governmental reports, or labor stats

- Commercial resources like Gartner, Statista, or Forrester

- Articles, documentaries, and interview transcripts

Another essential branch of both primary and secondary research is internal intelligence. When it comes to efficient market research reporting examples that will benefit your organization, looking inward is a powerful move.

Existing sales, demographic, or marketing performance insights will lead you to valuable conclusions. Curating internal information will ensure your market research discoveries are well-rounded while helping you connect with the information that will ultimately give you a panoramic view of your target market.

By understanding both types of research and how they can offer value to your business, you can carefully choose the right informational sources, gather a wide range of intelligence related to your specific niche, and, ultimately, choose the right market research report sample for your specific needs.

If you tailor your market research report format to the type of research you conduct, you will present your visualizations in a way that provides the right people with the right insights, rather than throwing bundles of facts and figures on the wall, hoping that some of them stick.

Taking ample time to explore a range of primary and secondary sources will give your discoveries genuine context. By doing so, you will have a wealth of actionable consumer and competitor insights at your disposal at every stage of your organization’s development (a priceless weapon in an increasingly competitive digital age).

Dynamic market research is the cornerstone of business development, and a dashboard builder is the vessel that brings these all-important insights to life. Once you get into that mindset, you will ensure that your research results always deliver maximum value.

Common Challenges & Mistakes Of Market Research Reporting & Analysis

We’ve explored different types of market research analysis examples and considered how to conduct effective research. Now, it’s time to look at the key mistakes of market research reporting. Let’s start with the mistakes.

The mistakes

One of the biggest mistakes that stunt the success of a company’s market research efforts is strategy. Without taking the time to gather an adequate mix of insights from various sources and define your key aims or goals, your processes will become disjointed. You will also suffer from a severe lack of organizational vision.

For your market research-centric strategy to work, everyone within the company must be on the same page. Your core aims and objectives must align throughout the business, and everyone must be clear on their specific role. If you try to craft a collaborative strategy and decide on your informational sources from the very start of your journey, your strategy will deliver true growth and intelligence.

- Measurement

Another classic market research mistake is measurement – or, more accurately, a lack of precise measurement. When embarking on market intelligence gathering processes, many companies fail to select the right KPIs and set the correct benchmarks for the task at hand. Without clearly defined goals, many organizations end up with a market analysis report format that offers little or no value in terms of decision-making or market insights.

To drive growth with your market research efforts, you must set clearly defined KPIs that align with your specific goals, aims, and desired outcomes.

- Competition

A common mistake among many new or scaling companies is failing to explore and examine the competition. This will leave you with gaping informational blindspots. To truly benefit from market research, you must gather valuable nuggets of information from every key source available. Rather than solely looking at your consumers and the wider market (which is incredibly important), you should take the time to see what approach your direct competitors have adopted while getting to grips with the content and communications.

One of the most effective ways of doing so (and avoiding such a monumental market research mistake) is by signing up for your competitors’ mailing lists, downloading their apps, and examining their social media content. This will give you inspiration for your own efforts while allowing you to exploit any gaps in the market that your competitors are failing to fill.

The challenges

- Informational quality

We may have an almost infinite wealth of informational insights at our fingertips, but when it comes to market research, knowing which information to trust can prove an uphill struggle.

When working with metrics, many companies risk connecting with inaccurate insights or leading to a fruitless informational rabbit hole, wasting valuable time and resources in the process. To avoid such a mishap, working with a trusted modern market research and analysis sample is the only way forward.

- Senior buy-in

Another pressing market research challenge that stunts organizational growth is the simple case of senior buy-in. While almost every senior decision-maker knows that market research is an essential component of a successful commercial strategy, many are reluctant to invest an ample amount of time or money in the pursuit.

The best way to overcome such a challenge is by building a case that defines exactly how your market research strategies will offer a healthy ROI to every key aspect of the organization, from marketing and sales to customer experience (CX) and beyond.

- Response rates

Low interview, focus group, or poll response rates can have a serious impact on the success and value of your market research strategy. Even with adequate senior buy-in, you can’t always guarantee that you will get enough responses from early-round interviews or poll requests. If you don’t, your market research discoveries run the risk of being shallow or offering little in the way of actionable insight.

To overcome this common challenge, you can improve the incentive you offer your market research prospects while networking across various platforms to discover new contact opportunities. Changing the tone of voice of your ads or emails will also help boost your consumer or client response rates.

Bringing Your Reports a Step Further

Even if it is still widespread for market-style research results presentation, using PowerPoint at this stage is a hassle and presents many downsides and complications. When busy managers or short-on-time top executives grab a report, they want a quick overview that gives them an idea of the results and the big picture that addresses the objectives: they need a dashboard. This can be applied to all areas of a business that need fast and interactive data visualizations to support their decision-making.