- Share full article

Advertisement

Supported by

Guest Essay

The Problems With China’s Economy Start at the Top

By Eswar Prasad

Mr. Prasad is a professor in the Dyson School at Cornell University.

This is a perilous moment for China. The numbers portray a stalling economy , but there is a far more profound concern. Chinese consumers and businesses are losing confidence that their government has the ability to recognize and fix the economy’s deep-seated problems. If President Xi Jinping’s government doesn’t tackle this fundamental issue, any other measures will have little impact in arresting the downward spiral.

Mr. Xi’s government has prioritized state enterprises , which hew closely to the Chinese Communist Party line and are under direct government control, over the private sector. Technology companies, including highflying fintech businesses like Ant Group, that were seen as having grown too big and powerful have been forced to break up into smaller units and are now subject to more state control. The crackdown, which intensified after Mr. Xi tightened his grip on power late last year when the legislature amended the Constitution , allowing him to extend his reign, has also enveloped private companies in education and other sectors . In addition, the government’s apparent hostility toward foreign businesses amid rising geopolitical and economic tensions with the United States and other Western countries — which could affect China’s ability to maintain access to global markets and technology — are worsening the loss of confidence.

The government’s unwillingness to modify its increasingly untenable “zero Covid” policy, followed by the abrupt reversal of that policy last December, further undercut confidence in the policymaking process. This confidence problem is apparent in the tepid private investment and weak household consumption over the past year. Reflecting their concerns about economic prospects, households are saving more and spending less on big-ticket items like cars . China’s currency, the renminbi, is depreciating in value as capital flows out of the country and foreigners become less willing to invest in China.

The worrying cognitive dissonance between the government and entrepreneurs became apparent during a recent trip I took to China. It was striking how officials in Beijing seemed relatively sanguine about the economy and argued that, in recent months, enough had been done to reassure entrepreneurs that they were seen as making important contributions to the economy. Entrepreneurs, on the other hand, thought that the government’s actions spoke louder than its words and that actions taken to cut successful businesses down to size were clear indications of its hostility toward private enterprise.

The reality, which Beijing seems to acknowledge only grudgingly, is that the private sector is crucial to keep the economy chugging. The labor force is shrinking , which leaves productivity as the key driver of growth. Private enterprises, which made the country a global leader in digital payments for instance, have tended to be far more innovative and productive than doddering state enterprises. The government’s desire to encourage domestic innovation and shift the economy toward higher-tech and green technologies cannot rely just on large state enterprises.

Small- and medium-size companies, particularly in the more labor-intensive services sector, are important for employment as well. Despite rapid growth in gross domestic product in recent decades, the Chinese economy has not been able to generate many new jobs, because much of that growth has come from manufacturing investment, and the government has been trying to cut jobs from bloated state enterprises. At a time of slowing growth this becomes a particular concern, as evidenced by the surging youth unemployment rate , which poses risks to social stability.

The increasingly centralized and often wayward nature of policymaking under Mr. Xi has also hurt confidence. One example comes from the property sector, which Beijing has long relied on as a pivotal source of growth — and which had become marked by speculative activity , in part because of government policies that increased the availability of mortgage financing. The Chinese government has rightly let some air out of this bubble, including by limiting financing for multiple home purchases and by tightening eligibility restrictions.

Some property developers told me that they understood the rationale behind the government’s actions but not the abrupt way in which some policy changes were introduced, leaving them little time to adjust. This has reportedly led to a sharp fall in housing prices and construction activity, which the government has now tried to compensate for by reversing some of the restrictions. Such abrupt policy shifts hardly inspire confidence. One view is that officials in Beijing “live above the clouds,” lacking a full understanding of how their attitudes and policies affect businesses.

Private enterprises see worrying signs of rhetoric that could have practical consequences. Mr. Xi’s “common prosperity” initiative , introduced in 2021 and officially described as an effort to quell public disquiet about rising income and wealth inequality, has been interpreted by successful entrepreneurs as being directed squarely at them. The initiative, which has spurred regulatory and anti-corruption crackdowns, has served as a cudgel against private businesses as well as banks and even government officials straying from the party line.

The government’s response to the drumbeat of concerns about rising youth unemployment was to scrub the release of those data. In doing so, it seems to believe that the spread of bad news is behind the loss of confidence. Similarly, even as it becomes apparent that prices for goods and services are falling because of weak demand and excess capacity in some industries, the government has pushed back against talk of deflation. Investors and analysts outside China have said that they have recently been denied access to some of the services provided by Wind Information, a private database with corporate and financial data that had been used to flag concerns about China’s financial markets.

While it has not publicly acknowledged the severity of the economic situation, there are signs that the Chinese government is aware that the confluence of domestic and external difficulties is creating a deflationary spiral that will become increasingly challenging to reverse.

The central bank recently cut interest rates , but cheaper and more plentiful credit will not get households or private businesses to spend more if they are anxious about the future. The move could also worsen currency depreciation and capital flight. Measures to cut income taxes and strengthen spending on health and education could help marginally bolster household consumption. Still, such measures might not amount to more than Band-Aids.

The real challenge is for the government to explicitly recognize that without a strong relationship with its private sector, its hopes of transforming the economy into a high-tech one capable of generating more productivity and employment growth are unrealistic. It needs to back this recognition up with concrete measures to support the private sector, including financial-sector liberalization that will help direct more resources to private businesses rather than state-owned ones. Transparency about information and about its policymaking process will help the government a lot more.

President Xi might favor a command and control system, but he is learning that private-sector confidence is the hardest thing to control. And yet it is vital for realizing his visions for the Chinese economy.

The Times is committed to publishing a diversity of letters to the editor. We’d like to hear what you think about this or any of our articles. Here are some tips . And here’s our email: [email protected] .

Follow The New York Times Opinion section on Facebook , Twitter (@NYTopinion) and Instagram .

Eswar Prasad is a professor in the Dyson School at Cornell University, a senior fellow at the Brookings Institution and the author of “The Future of Money.”

Source photograph by Phill Magakoe/Agence France-Presse — Getty Images.

Final dates! Join the tutor2u subject teams in London for a day of exam technique and revision at the cinema. Learn more →

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Economics news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Economics Resources

Resource Selections

Currated lists of resources

- Practice Exam Questions

Chinese Economy Exemplar Student Essay

Last updated 21 Mar 2021

- Share on Facebook

- Share on Twitter

- Share by Email

Between 2011 and 2013 China poured 6.6 gigatons of cement – more than the amount used by the USA during the entire 20 th century. That single statistic encapsulates both the successes and failures of 21 st Century China.

On the one hand you have the unprecedented levels of supply side investment building up the capital stock and fueling growth. Yet on the other hand you have the excess that has lead to serious concerns.

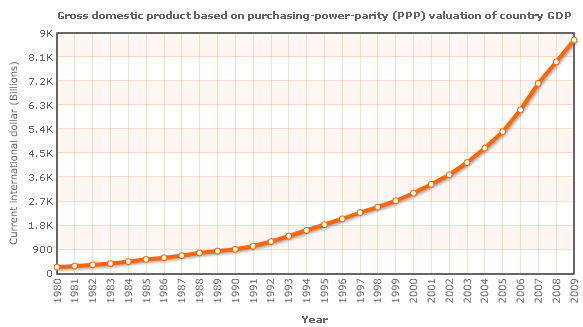

One fundamental success of the modern Chinese story has been growth. Since 2009 alone its economy has more than doubled in size, and it has increased 11 times over since 1998 to grow to $11.01 trillion in 2015. It is claiming an increasing share of world output (as measured by GDP). Adjusted for purchasing power parity, China has overtaken the USA to account for a 17.65% share, the worlds largest. The nation has accounted for 1/3 of global growth this millennium.

China's centrality to the global economy consequently gives it huge influence around the world; it has a big voice in institutions like the UN (as a permanent member of the Security Council) and the World Bank, and also has significant leverage when brokering trade deals – access to Chinese markets and capital is increasingly attractive. China is currently negotiating 9 different bi-lateral trade deals with countries from the Maldives to Norway and existing deals with dozens of others. This is one example of the positive multiplier effect of growth, as these trade deals lay the foundations for further growth.

You can evaluate this by saying that this growth has come at a cost – China has some of the worst environmental problems in the world. According to the world bank 53 billion tonnes of untreated industrial and household sewage make there way into China’s waterways, 70% of which are affected. The situation has gotten so bad that China will face water scarcity by 2030 unless serious interventions are undertaken, with 300 million people already without access to safe water. Substances from cadmium to arsenic have been found in river water. Although anti-pollution laws exist, in many regions they are lightly enforced with businesses often given significant leeway due to their economic importance.

In response China has committed $625 billion to better managing the environment, but considering the range of issues it faces this may not be enough. To water scarcity, you can add; desertification, overgrazing, soil salinization, soil erosion a loss of biodiversity and air pollution. Many of these challenges have arisen due to increasingly intensified farming practices that are required to feed China’s ever-growing population., particularly the middle classes that are now demanding far more meat than the Chinese agricultural system was ever expected to produce. As animal farming is far more land and water intensive than crop farming, these problems are more likely to get worse than better.

Air pollution is a particularly salient issue in China. It is home to 16 of the worlds 20 most polluted cities and leads the world in smog-related respiratory and cardio-vascular disease deaths. 25.5 million tonnes of acid rain falls every year, thanks to the sulfur dioxide and black carbon that pours out of China’s thousands of coal fired power stations (provide 70% of total power) and steel/chemical plants. More people own a car in China than ever before and that has been the major contribution in the last two decades, with exhaust emissions added to an already toxic mess. Beijing suffered major public relations damage in the run-up to the 2008 Olympics over concerns surrounding the Beijing smog, and air quality concerns could become a road-block to further events of this magnitude. The contribution to global warming is also of great concern, as is the burden of the pollution related disease on the economy.

As the Chinese economy ages, its workforce will become sicker and it does not need the extra burden of workers missing days and needing hospital care.

It is also leveraging this growth into broadening its soft power. It has the third most voting power in both the World Bank and the IMF – evidence of the dividends of this is the decision by the IMF to make the renminbi a part of the Special Drawing Rights basket of currencies, a major step in the renminbi's rise to global reserve currency status. Not satisfied with influencing existing institutions, China has founded the Asian Infrastructure Investment Bank, which many have touted as a rival to the World Bank. With the combined weight of 21 Asian nations behind it and free from US or UN influence, the bank has attracted western support from the likes of the UK and the USA.

The bank fits neatly into the Chinese Governments biggest project 'The New Silk Road' which is designed to increase trade with Eurasia and Africa. China has been investing billions in East Africa over the last 20 years, with $26 billion spent in 2013 alone, mostly in resource exploitation, but returns are limited by the poor capital stock of the region. The same Is true across much of central Asia. China is more familiar than any country of the power of supply side investment, so is happy to lend money and expertise, safe in the knowledge that they would share directly in the benefits of improved access and smoother supply chains, as well as closer ties with grateful governments. Perhaps the best indicator of China's soft power success was the USA's refusal to join the AAIB, perhaps out of wariness of China's increasing sway.

Another, perhaps under-appreciated success of modern China has been the major rise in living standards. Relative to the USA, China was on a par with India in the early 1990s with just 5% of US GDP per capita (PPP). It is now overtaking Brazil, the one-time darling of development economists, and is approaching the 30% mark, a significant improvement in such as short space of time. Through large scale urbanization and growth China has reduced the poverty rate (measured as living on less than $1.25 a day) from 85% in 1981 to 27% in 2004, emancipating over 600 million people, with millions more escaping poverty since.

This increased wealth is most apparent in the 300 million strong middle class that could double by 2021. A larger middle class means that China has begun to rebalance its economy away from the cheap unit labour cost exports of the past, into a powerful tertiary sector founded upon domestic demand. The future of China looks less like FoxConn and more like Baidu.

Find more statistics at Statista

Whilst total poverty may have fallen, relative income inequality has in fact worsened. A rising tide may lift all boats, but is does not lift them equally. The One-Child policy reinforced existing gender inequality, with men still having a significant advantage over women through all stages of life. Rapid urbanization has also created a growing gap between rural and urban populations, with government investment on infrastructure and services focused on population centres. The differences between Shanghai and an interior farming region are now extremely acute, which in the long run could lead to social and political tension. China’s Gini coefficient has risen far and fast, from 0.3 in the 1980s to 0.53 2013. The continued health of the one party system could be called into question if growth falters and the middle and working classes see their living standards stop rising,

Finally, China in recent years has made big progress in diversifying its economy as it matured. The image of China as low quality manufacturing hub filled with sweatshops is now woefully outdated. Thanks to the agglomeration effects of the Special Economic Zones first created in the 80's, China has become a centre of innovation and economic complexity. It is at the forefront of mobile technology, with brands like Huawei and China Mobile recognised the world over. These corporations have huge international presence with Huawei alone investing $1.5 Billion in Africa over the last 20 years.

By becoming a more multi-faceted economy that was less dependent of exporting cheap manufactured goods to the West, China is better placed to absorb exogenous shocks. It was notable that China did not suffer as badly as many other major economies during the 2008 financial crisis (admittedly in part due to a strong fiscal stimulus plan).

While private companies may be thriving in the new China, state-owned enterprises are not doing as well. Like many SOEs, they struggle with x-inefficiency and without a profit motive they do not contribute to the innovation that would provide China with a competitive advantage in global trade. This is arguably seen in the well-earned reputation of SOE’s for having no respect for foreign intellectual property laws, as the SOE’s cannot develop their own ideas. Consequently, they hold back the economy, cornering parts of the economy the private sector could take further, as well as capturing the skilled workers in secure, well payed government jobs when their talents would be better exercised in a more competitive environment. It is also true that returns to investment are falling in China as the economy becomes steadily more leveraged. Areas of rapid growth are becoming fewer and further between (hence the expansion into East Africa) and household debt to GDP has more than doubled in ten years. The shock of the Shanghai stock crash of 2015 has lead to growing fears that Chinese economy is more fragile than previously thought. Its latest boom certainly bears the hallmarks of a crash waiting to happen; a large housing bubble and an overleveraged population.

In the short run, China appears to be a great success; combining rapid growth with poverty reduction, political stability and increased global standing. Yet in the long run its challenges are at risk of overwhelming it. The burden of an ageing, unbalanced population, the risk of the middle income trap, environmental issues and an over-leveraged economy is a potent cocktail of problems that threatens the long-term economic success and political stability.

Johnny Wallace

- BRIC Economies

- Economic Growth

- Balanced growth

You might also like

Growth and Development in the Ivory Coast

20th October 2014

Slowing German economy must raise investment

19th October 2014

Is the Great Catch Up slowing down?

9th October 2014

Inequality and consequences for economic growth

6th October 2014

After the BRICs, the GIPSIs: Tackling Europe’s Problems

10th September 2014

Russia increases policy interest rates to 8%

27th July 2014

China accepts creative destruction

22nd May 2014

Capitalism has made the world a more equal place

15th May 2014

Our subjects

- › Criminology

- › Economics

- › Geography

- › Health & Social Care

- › Psychology

- › Sociology

- › Teaching & learning resources

- › Student revision workshops

- › Online student courses

- › CPD for teachers

- › Livestreams

- › Teaching jobs

Boston House, 214 High Street, Boston Spa, West Yorkshire, LS23 6AD Tel: 01937 848885

- › Contact us

- › Terms of use

- › Privacy & cookies

© 2002-2024 Tutor2u Limited. Company Reg no: 04489574. VAT reg no 816865400.

Chinese Economy Essays

Driving advancement – auto simulated intelligence development and patent regulation elements in the chinese economy., popular essay topics.

- American Dream

- Artificial Intelligence

- Black Lives Matter

- Bullying Essay

- Career Goals Essay

- Causes of the Civil War

- Child Abusing

- Civil Rights Movement

- Community Service

- Cultural Identity

- Cyber Bullying

- Death Penalty

- Depression Essay

- Domestic Violence

- Freedom of Speech

- Global Warming

- Gun Control

- Human Trafficking

- I Believe Essay

- Immigration

- Importance of Education

- Israel and Palestine Conflict

- Leadership Essay

- Legalizing Marijuanas

- Mental Health

- National Honor Society

- Police Brutality

- Pollution Essay

- Racism Essay

- Romeo and Juliet

- Same Sex Marriages

- Social Media

- The Great Gatsby

- The Yellow Wallpaper

- Time Management

- To Kill a Mockingbird

- Violent Video Games

- What Makes You Unique

- Why I Want to Be a Nurse

- Send us an e-mail

- Call to +1 844 889-9952

Overview of the Chinese Economy

According to the National Bureau of Statistics of China (2008), China has gained a GDP growth of 10.2% at the end of the financial year 2007 with an average annual growth rate of Foreign Direct Investments (FDI) of 9.1% and an export growth rate of 25.4%. With such tremendous growth, China becomes one of the most impressive economies in the world. Due to the practice of dual policy of capitalism and socialism, as well as to liberalization of its economic aspects, China has turned into a more attractive place for Foreign Direct Investment. The foreign companies, however, are facing some threats here.

The Chinese government, in its turn, is also trying to minimize the threats for these companies. This paper aims to identify the threats, which foreign companies in China face, and to outline the preventive measures taken by the authorities to deal with these threats.

Overview of the Present Chinese Economy

The CIA fact sheet (2009) has registered dramatic changes in China over the past 30 years. The country has moved from the centrally planned system to a mixed economy of public and private practice simultaneously. Earlier, the internal market of China kept closed for international trade, but now its orientation has changed towards a market-based open economy. The private sector has been developing extensively; owing to the reforms of the 1970s, it started playing a major role in not only the local but also in the international market. The previous economy of the country focused on the collectivized agricultural system; it, however, has collapsed with time.

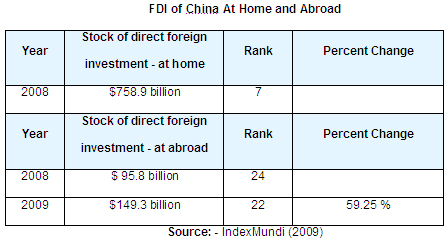

Afterward, liberalization and decentralization took place. This has significantly reduced the prices, increased fiscal policies, as well as autonomy for state business entities; in addition, liberalization and decentralization structured the banking system with high diversification, contributed to the development of stock markets and rapid growth of the private sector and made the market open for international trade and investment. The gradual introduction of the reforms into the economy of China has tangibly improved its economic performance. The following table presents the growth of the FDI over the past two years:

This table allows tracing a significant increase in FDI in China. Thus, in 2008, the stock of direct foreign investment constituted $95.5 billion, while already in a year it increased by $53.5 billion. This means that economic reforms in China were quite successful.

Threats Faced by the Foreign Companies

Some of the foreign investors refuse to invest in China due to certain threats that they may face. These threats are as follows:

Intellectual property rights

Though certain legislation concerning the protection of intellectual property rights exists in China, the government still does not pay sufficient attention to this issue. Here are some data demonstrating the present status of IPR 1 in China:

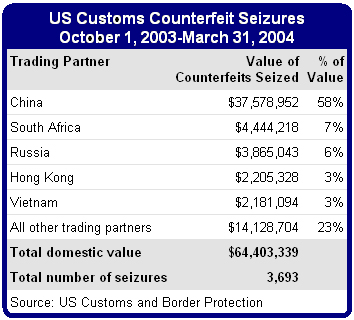

Several countries, the USA in particular, aim to fight IPR infringement. The following figure demonstrates that the value of counterfeits seized by the US customers in China is the highest, which means that the IPR infringement rates in this country are also rather high:

Thus, the cases of IPR infringement in China are numerous, which often serves as a sufficient ground for foreign investors to invest in other countries (Yu, 2007). This, however, is only one of the threats that foreign investors may face in China.

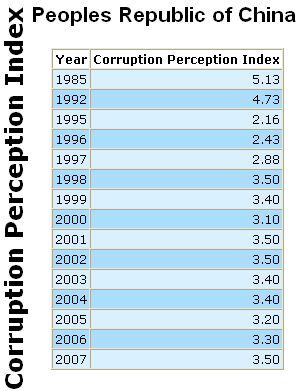

The Chinese government has more than 1200 laws and directives against corruption. Most of them rarely find any implementation this is why the corruption rates in the country are ever-increasing. Already in the 1980s corruption affected foreign investment rates in China by striking the country’s infrastructure, real estate, procurement, and financial services. A foreign company had to pay a huge amount of money illegally to the corrupted officers before starting the business. At present, the direct costs of corruption are almost 86 billion USD per annum. Foreign investors are losing many of their strengths to maintain the monetary demands of the corrupted officers. They have to face efficiency losses for bribing and disturbance in set up; their operations are not concerning the environment or the people of the country.

Besides, the local business entities also practice corruption, which made it almost impossible for foreign investors to compete with them. Therefore, the economic reforms carried out in the country some time ago are to blame for the high rates of corruption at present and, correspondingly, for the mistrust of foreign investors (Chow, 2005). This table shows the growth of the corruption rates in the country over the past two decades:

As reported by China Digital Times (2006), the sixteenth Congress of the CCP 2 has sentenced about 100 ministers and high-level officials for corruption; the total number of punished officials was 47,306. This shows that the country is trying to fight corruption, though the present high rates of it still deter the flow of foreign investments into the country.

Local competitors

In addition to the abovementioned problems, foreign investors also face high competition on the part of Chinese businesses. After entering into the free economy, the local companies acquired great autonomy, which implies that now they design their operational strategies according to their own needs. Moreover, Chinese people prefer Chinese products to international ones, which results in lower demand for these products.

Besides, there are several successful companies in China. For instance, Motorola has started its Chinese operation in 1998 and now it has to combat the China Local vendor of telecommunication products; at the same time, Motorola has to face the global major mobile phone manufacturers like Nokia, Samsung, Sony Eriksson, and LG working in China (China Contact, 2000).

Foreign competitors

All foreign companies are facing the same problems and prospects in China, but the competition among the foreign companies themselves is not the same. Some multinational companies are coming with huge investments and the operation of most of them is quite profitable. In 2006 about 81% of the total foreign companies gained satisfactory profit. Many foreign companies have marketed their products or services that may be considered national. China has now implemented the major views of WTO, which also pressurizes the competition within the foreign investors. The foreign companies face competition mainly in the case of having skilled laborers as the Chinese people prefer the local companies, rather than the foreign ones (The US China Business council, 2007).

Protectionism

Johnson (2009) argued that protectionism is a new stimulus program of the Chinese government, which is discriminating against the non-Chinese companies in China. In this program, maximum business leaders are trying to channel stimulus money nationally to national policies, which is beneficial for the local companies. Chinese authorities are also realizing that protectionism is worsening the business environment in China. Before the country entered the WTO in 2001, its export was experiencing growth, there was trade surplus, and China gained highest foreign reserve of 1.9 trillion. India announced a ban on toy imports from China. The USA is planning to get a protectionism plan against China. Thus, different companies willing to invest in China do not have government permission (Moore 2009).

Chinese Authorities and Their Attempts to Combat the Threats

The different Chinese authorities have been concerned with the threats faced by foreign companies. Numerous attempts to deal with this issue have been taken by the authorities. Here is how the central government attempts to clarify some dilemmas concerning the threats foreign investors face in China:

- Taking into account the continuous failure of matching the domestic savings and domestic demand, which leads to the decrease of social safety net comprising pension and healthcare systems, China needs high domestic savings, but it has low domestic demand.

- An increasing number of migrants face problems as they also strive to achieve jobs. This led to sustaining the job growth through welcoming the new entrants; however, this tendency is failing because of the worker layoff in the state-owned firms.

- Increasing corruption in almost every level of the business and government, all relevant entities will have to invest heavily to prevent corruption.

- The rapid transformation of the economy towards industrialization increased the destructive effects on the overall environment. These also affect the social structure of China.

Attempts took by the Chinese government to help the foreign investment are:

- Relevant legislation : The government of China takes many legislative actions to unify the internal system and some of these are:

Financial sector:

- Made open to foreign investments in future companies but restricting it with some bindings

- Extra investment allowances for security companies

Mineral resource:

China recently made some of its minerals open, which was forbidden before. Some of these are antimony, tin, molybdenum, and fluorite. Phosphorus is now in the encouraged category; the same goes for some other minerals that used to be restricted.

The other two sectors are real estate and power which are also becoming open by legislation for foreign investment. (Gump, Hauer & Feld, 2007)

- Importance of bilateral organizations: Chinese government is trying to reduce the threats by increasing the number of bilateral organizations. The countries that are practicing protectionism against China are the main targets. Recently the President of the USA Barrack Obama visited China and participated in many business dialogues. American Chamber of Commerce in China and the American Chamber of Commerce of Europe in China also sign several agreements bilaterally.

- Multilateral organizations: China has a bilateral agreement with ASEAN, which is an association of southeastern countries of Asia, through which it is trying to reduce the threats. Through ACFTA, it is also beneficial for China to invest in the ASEAN countries, which can attract investment from other countries (Rajan).

It is rather difficult to predict whether the Chinless economy would continue at the same rate of this decay because error or omission in forecasting can be more dangerous than no prediction. This paper considers that there is an exceptional prospect of the Chinese economy to continue speedy growth in future decays by conducting the Risk Assessment with the following parameters:

- Human Capital: The most significant reason for China to have continuous growth is the high amount of hard-working human capital that would work for the low wages. China possesses a skilled and entrepreneurial labor force, which is unquestionably the most valuable determinant of economic growth and a competitive advantage for China that no other country has.

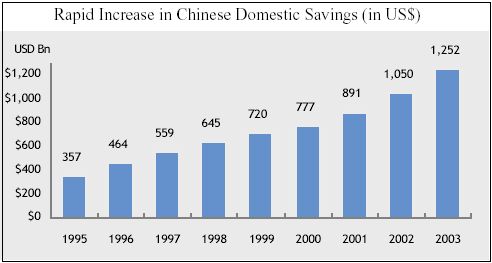

- Rapid boost of Chinese Domestic Savings: Malkiel, Mei & Yang (2005) argued that domestic savings are increasing and the deposit rates are reducing, which minimizes the risk of liquidity.

- Potential Currency Gratitude : Malkiel et al (2005) point out that investing in China may prove to be beneficial for the investors in the future because it is likely to lead to the fast growth of trade and high savings rates, which will further result in huge trade surplus and foreign currency reserve.

Current Economic Situation in China

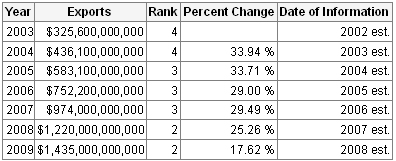

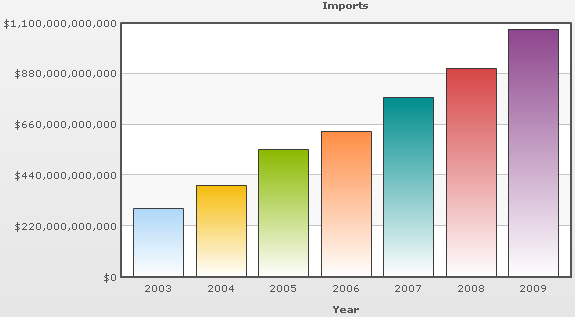

Library of Congress (2006) argued that China’s financial system during the past 30 years has changed due to the development of agricultural sectors, rapidly growing private sector, fiscal decentralization, labor forces, GDP, FDI, improved autonomy for state enterprises, the establishment of a diversified banking system, the progress of stock markets, as well as fiscal and monetary policy. According to the Indexmundi (2009), China’s total export in 2009 is $1.435 trillion and it was $1.220 trillion in 2008. On the other hand, its total import in 2009 is $1.074 trillion and it was $904.6 billion in 2008. According to the Library of Congress (2006), the main exports products are electrical and machinery products including data processing equipment, textiles, food, seed, cars, iron, steel, and other products; key imports products are oil and mineral fuels, optical and medical equipment, metal ores, plastics, and organic chemicals and so on. The following figures show the continuing development in all sectors of its economy:

Direction of Exports:

Table 2: – The main Export collaborates of China.

Table 4: – The main Import collaborates of China Source: – Self generated from Library of Congress (2006)

If Purchasing Power Parity of the country is taken in account, it appears to be the second prime and the hastiest growing economy internationally. The per capita income and the average annual rate is more than 8%, which is very accommodating to reduce poverty and trim down income inequalities. The per capita income of China’s people is calculated from the lower middle category, which was $3,180 USD in 2008.

Evidence Related to Current Economic Condition of China

As per the WTO, China’s trade and economic performance has significantly improved concerning governmental and world standard policies. These policies are bringing changes from limited opening until a regional field of industries and foreign trade under the legal framework of the government of China. China’s trade opening processes have changed from one way opening to a two-sided aperture between China and WTO members that now can take part in the international market with acceptance of trade rules in a passive manner. Since China has a bilateral and multilateral situation with other countries, it has brought changes in economic and trade relations with other countries to remove disputes between them in trade actions.

These changes are very few but they still have a great impact on the future by providing new opportunities for FDI. China has become a member of WTO to fulfill the commitment of earnest and responsible changes in its economic performance. According to 2,300 laws and regulations of the government of China, it is removing tariff barriers by lowering tariff level in economic level and foreign trade, which will bring a positive outcome for its economic development (United Nations 2009).

Political Evaluation

- Currency: China is restricting the value of the Yuan about the value of the Dollar. President Barack Obama also argued to raise the value of China, but the government of China ignores it. Even the director of the International Monetary Fund suggests to keep Yuan as a stronger currency, but the government of China is raising it only by 21% against the Dollar ignoring foreign pressure (The Economist 2009)

- Importance of Bilateral Relationship: China is in the most critical position of the bilateral relationship with other regions. This approach is friendly and emphasizing more power to China. For example, for the reunification of Korea, China may deprive of South Korean investment

Economic Situation

- Stock Value: Chinese Shares are closing up 1.61%, which is slightly lower than Hong Kong. The price of the stock values of the industries is also higher in comparison with other regions.

- Funds: The funds of China’s economic market have needed to improve in terms of customers’ services. China’s funds have focused on fidelity and the raising of funds regains momentum and rebound. It is also setting up $1.32 billion for technological development.

Social Condition

- Fluctuation of Commodity Price: China is always focusing on the commodities in big cities, their properties, stock markets, etc. However, the unlikely-targeted people of China were ignoring the value of common products. Now, the foreign currency transfer has been controlled into the country for targeting them and lowering prices of these products. (The Economist 2009)

- Decreasing Public Savings: Chinese consumers are not spending too much money on commodity products, but they are buying more on their credit cards. According to the global economy, Chinese people are buying more and saving less. (Moore, 2009)

Technological Advancement

- Production of Wind Power: At present, China is the biggest producer of wind power. This wind power is now bought and sold at fixed prices as a source of electricity for the state government. (The Economist, 2009)

- Sales of Cars: The demand for passenger cars is increasing in the USA; the sales growth by 45% has been registered in 2008. Earlier, the reduction in sales could be observed due to the increasing prices of petrol. At present, however, the number of passenger cars bought is so great, that any fluctuations in sales are hard to identify (The Economist, 2009)

- Sales of iPhone in China: The sales of the Apple iPhone in China have significantly increased over the past several years. This also has a considerable effect on the development of China’s economy (The Economist 2009)

Future Prospects of China’s Economic Development

Future economic development is important in terms of growth of productivity according to long-term living standards of capital and labor improvements. Productivity growth is rather low now, but it can be improved by labor productivity which is rising by 7-8%. Within 22 years of China’s economic development, potentiality and living standards are fairly lower in economic society. However, in the 21 st century, it has improved and strengthened macroeconomic conditions (The Economist 2009). To hold the development of this economy in long-term, China is adopting 10 years plan strategy from 2001 to 2010 which is targeting the following aspects:

- To sustain the rapid growth of strategic restructuring and improving quality of economic growth by increasing GDP from 2000 to 2010;

- To perfect socialist market economy and put stated enterprises according to international cooperation and competition;

- To improve the standard of life with 5% annually in disposable income of urban residents and rural residents;

- To maintain stable prices balancing international revenues and expenditures.

- To upgrade industrial structure according to the competitive edge;

- To increase urbanization;

- To develop disparity between regions with effective control.

These targets have been fulfilled according to the schedule in 2005. In addition, these plans are used as a basis for the future 2006-2010 plans which are currently under development (United Nations 2009)

China is maintaining high economic growth rates and is predicted to become the world’s largest FDI by 2010. Urbanization, technological prospects, current economic conditions have a considerable impact on its future growth. These growths are important for the aging population and costs of environmental damages with the global financial crisis in 2008-2009. Therefore, China has to focus on increasing housing, restricting credit eating, lowering taxes, increasing public investments, etc.

It has been evidenced that after long criticism for the last three decades China has turned the global economic superpower. Therefore, if the Chinese government leads its economy according to its policy, rather than according to those of the IMF or the World Bank, it is likely to meet its long-term goals for economic development.

Reference List

China Contact 2000. Wireless Application Protocol (Wap) In China: A Market Analysis . Web.

Chinalist 2009. Corruption Perception Index: China . Web.

China Digital Times 2006. Figures of China Corruption – People Net . Web.

CIA. 2009. The world fact book- China. Web.

Chow, G C. 2005. Corruption and China’s Economic Reform in the Early 21st Century . Web.

IndexMundi. 2009. Exports, Import& GDP of China. Web.

Gump, A, Hauer, S & Feld, A. 2007. China Alert . Web.

Johnson, I. 2009. Foreign Businesses Say China Is Growing More Protectionist . Web.

Library of Congress 2006. Country Profile: China . Web.

Moore, M. China leads the way in protectionism. Web.

Moore, M 2009. If Chinese consumers aren’t spending, why do they have unpaid credit card bills? . Web.

Malkiel, BG. Mei, J & Yang, R 2005, Investment Strategies to Exploit Economic Growth in China. Web.

National Bureau of Statistics of China, 2008, Principal Aggregate Indicators on National Economic and Social Development and Growth Rates . Web.

Rajan, R. n.d. What Does The Economic Ascendancy Of China Imply For Asean? Web.

The Economist 2009. Investors are breathless over China’s biggest developer of wind farms. Web.

The Economist 2009. Car sales up, petrol sales flat: stockpiling, fuel-efficiency, or simply lousy data? . Web.

The Economist 2009. Chinese firms are making and exporting ever more suspect phones . Web.

The Economist 2009. The price also stinks . Web.

The Economist 2009. Why China resists foreign demands to revalue its currency . Web.

The Economist 2009. The president pays Asia the compliment of courtesy; rewards are not immediate . Web.

The Economist 2009. China’s rapid growth is due not just to heavy investment, but also to the world’s fastest productivity gains . Web.

The US China Business Council 2007. Foreign Investment in China. Web.

United Nations 2009. China’s Economic Development . Web.

United Nations 2004. Minister: Five Positive Changes for China’s Opening to Outside World. Web.

UCBC 2005. Intellectual Property Rights in China: Background and Figures . Web.

Yu, P 2007. Intellectual Property, Foreign Direct Investment and the China Exception . Web.

- Intellectual Property Rights.

- Chinese Communist Party.

Cite this paper

Select style

- Chicago (A-D)

- Chicago (N-B)

BusinessEssay. (2022, December 12). Overview of the Chinese Economy. https://business-essay.com/overview-of-the-chinese-economy/

"Overview of the Chinese Economy." BusinessEssay , 12 Dec. 2022, business-essay.com/overview-of-the-chinese-economy/.

BusinessEssay . (2022) 'Overview of the Chinese Economy'. 12 December.

BusinessEssay . 2022. "Overview of the Chinese Economy." December 12, 2022. https://business-essay.com/overview-of-the-chinese-economy/.

1. BusinessEssay . "Overview of the Chinese Economy." December 12, 2022. https://business-essay.com/overview-of-the-chinese-economy/.

Bibliography

BusinessEssay . "Overview of the Chinese Economy." December 12, 2022. https://business-essay.com/overview-of-the-chinese-economy/.

- How China’s Agricultural Reform Contributed to Its Success on Economic Growth

- Relationship Between Economic Development and Political Democratization

- The Subprime Mortgage Crisis

- The Subprime Mortgage Crisis: Causes and Consequences

- Capital Structure Theories and Company Market Value

- Effects of Outsourcing on the US Economy

- International Monetary Fund

- Analysis of Dubai’s Success

- Economic Consequences Minimum Wage Rate in Hong Kong

- Credit Crunch of 2008 in the World Financial Markets

- Work & Careers

- Life & Arts

Become an FT subscriber

Try unlimited access Only $1 for 4 weeks

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, weekend print + standard digital, weekend print + premium digital.

Today's FT newspaper for easy reading on any device. This does not include ft.com or FT App access.

- 10 additional gift articles per month

- Global news & analysis

- Exclusive FT analysis

- Videos & Podcasts

- FT App on Android & iOS

- Everything in Standard Digital

- Premium newsletters

- Weekday Print Edition

- FT Weekend Print delivery

- Everything in Premium Digital

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- Everything in Print

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

- Environment

- Information Science

- Social Issues

- Argumentative

- Cause and Effect

- Classification

- Compare and Contrast

- Descriptive

- Exemplification

- Informative

- Controversial

- Exploratory

- What Is an Essay

- Length of an Essay

- Generate Ideas

- Types of Essays

- Structuring an Essay

- Outline For Essay

- Essay Introduction

- Thesis Statement

- Body of an Essay

- Writing a Conclusion

- Essay Writing Tips

- Drafting an Essay

- Revision Process

- Fix a Broken Essay

- Format of an Essay

- Essay Examples

- Essay Checklist

- Essay Writing Service

- Pay for Research Paper

- Write My Research Paper

- Write My Essay

- Custom Essay Writing Service

- Admission Essay Writing Service

- Pay for Essay

- Academic Ghostwriting

- Write My Book Report

- Case Study Writing Service

- Dissertation Writing Service

- Coursework Writing Service

- Lab Report Writing Service

- Do My Assignment

- Buy College Papers

- Capstone Project Writing Service

- Buy Research Paper

- Custom Essays for Sale

Can’t find a perfect paper?

- Free Essay Samples

- Corporations

The Chinese Economy

Updated 04 September 2023

Subject Corporations , Politics , Asia

Downloads 25

Category Business , Economics , Government , World

Topic China

China is the second largest economy in the world. It leads all other countries in other areas such as population. A bank that is seeking to establish operations in the country will see an opportunity to grow as a reputable finial institution in one of the fastest growing economies in the world. At the same time, the bank will be faced with several challenges that it will have to overcome as it roots itself in the country's economic system. These include stringent government regulation and government intervention.

China has about 1.4 billion citizens. It has numerous ethnic groups although a majority of the people belong to the Han Chinese group. The country has a constitution that guarantees freedom of religion and as such its people practice a wide variety of religions if they choose to be religious. The country’s culture has however been influenced by religious movements such as Taoism, Buddhism, and Confucianism (Mastel, 2016). There are hundreds of languages spoken in the country. The languages can be grouped into Austronesian, Altaic, Austro-Asiatic, Sino-Tibetan, and Indo-European (Mastel, 2016). Chinese more of a language family rather than a single language. It is made up of several regional dialects. The official language is Mandarin. Food in China is a vital component of culture. Rice is a staple food, and it makes up many dishes (Mastel, 2016). Cuisines depend on the region that a person is focusing on. Regions next to the sea have cuisines that use a variety of seafood ingredients. Elsewhere, pork and chicken are the main sources of protein. China has a high literacy rate of about 96% of people above 15 years of age. This can be attributed to a well-developed educational system. The Chinese social system has four components namely scholars, farmers, artisans, and merchants. These components have been ranked in changing ways as the country seeks to incorporate non-communist aspects into its system.

China is a single party state and is governed by the Communist party. A single party is believed to provide stability and organizational efficiency necessary for managing such a large country. The party is involved in charting the economic path that the country follows. As an expatriate, one has to obtain a working visa and meet other requirements regarding health and criminal records. There is a strong political will in China to make the country a suitable place to conduct business. As such, there are various incentives such as a well-developed infrastructure, low-power, and other utility costs, and highly competitive labor wages (Mastel, 2016). The main labor union in the country is government affiliated and as such presents the interests of the government before those of workers. As such, low wages in China have seen many manufacturing corporations shift their production processes to the country.

The Chinese legal environment faces several challenges especially in the formulation and implementation of policies that improve the welfare of workers. The country is known for its lax labor laws and the existence of sweatshops with poor working environments that endanger the lives of workers. Workers are often compensated poorly, and child labor has also been reported to exist. Furthermore, Chin is grappling with corruption issues and is on the process of developing a legal framework that addresses this issue effectively. Corruption is blamed for most of the evils that occur in that laws are not enforced as they should be due to corrupt officials.

The government plays an extensive role in planning the Chinese economy. This differs from most western economies where business is often left to private parties and property is owned by individuals. In China, most property is owned by the state. The government plans and manages the national economy by coming up with the national economic plan and the national budget. In the last four decades, this system has been successful as it has led to the rapid growth of the economy and the subsequent lifting of hundreds of millions of Chinese people from poverty. After planning, the national government proceeds to delegate implementation processes to hundreds of institutions in the form of commissions, bureaus, academies, corporations, administrations, and ministries. Although the government is heavily involved in regulating the economy, its influence is limited by the size of the economy and the desire to open up the economy to the world. A bank that is setting up operations in China will have to adhere to state regulations, and it should embark on a path that follows the state-led economic blueprint. However, the country has been stepping up the effort to diversify ownership of financial institutions, corporate governance reform, risk management and internal controls in a bid to ensure that the sector thrives (Mastel, 2016).

The Chinese economic system can be termed a mix of capitalism and socialism. While the government plays an immense part in planning and structuring the economy, private players are also involved. This system is partly necessary due to the large size of the country and its diversity. Full-blown socialism that relies on a centrally planned economy cannot work in such a context. In a liberal market economic system, resources are allocated according to the forces of demand. Individuals can freely own resources, and they can buy and sell property or labor as they will. A centrally planned economic system relies on the government to set the terms of the economy such as wages, prices, and what and how much to produce. In pure socialist systems, all resources are owned by the state. Individual provide labor to various industries and are compensated by state institutions according to its plans (Mastel, 2016). China takes from these two systems. China had a communist economic system since it became a republic in 1949 (Qi et al., 2016). In 1980, the country opened up to the world and began to ease some of the hard traits of communism in its economic system (Qi et al., 2016). At the moment, although it is not a capitalist economy, it can be classified as a mixed economy.

China is heavily involved in international trade. It imports and exports trillions of dollars’ worth of products annually. China has become a manufacturing hub of the world. As such, it imports raw materials that it doesn’t produce as well as energy in the form of fossil fuel to power its industries. It then exports finished products to almost all countries on earth. Apart from manufactured products, China also exports agricultural products and capital goods such as machinery and transportation equipment. Due to the large volume of imports and exports, the country is the major trading partner of many nations. The Chinese government has limited influence on trade despite getting involved in foreign currency markets. The government decides regimes of the exchange rate that favor Chinese exports given they drive the economic growth in the country. The Yuan’s value in relation to other currencies is determined by both market and regulatory forces. China seeks to have the value of the Yuan stable to give certainty to future transactions conducted in the currency. Banks are often involved in the foreign currency market. As such, the bank will have to buy and sell currency at the prevailing rate of the Yuan. Given the currency is relatively stable, the bank can be assured of certain patterns in cash flow and costs while operating in the country.

China can be classified as a developing country. The bank’s presence in this country will be a prelude to the bank’s expansion to other developing countries. The successes or failures in China will serve to inform on the best practices for financial institutions as they seek to expand to emerging economies. Developing economies are characterized by fast-growing economies and high central bank rates. Furthermore, most of developing countries are diverse, and their cultural distances to developed countries pose a challenge for multinational companies. If the bank is successful in China, it can then begin on the trail of expanding its operations to other countries. However, it is essential to tailor the financial services to the key goals of an economy. For instance, China's core aims are to develop industrially and then shift the economy to a market-based system.

China is involved in regional integration efforts. The country is a leader in Asia, and it, therefore, seeks to galvanize its position by developing infrastructure, logistics, and policy linkages with its neighbors. At this moment, the US is engaging in protectionist policies that have reduced its standing among its Asiatic partners. This has given China an opportunity to rise and increase economic integration through trade and economic assistance. China has several infrastructure projects in mind that could help boost interdependence among its neighbors and even far away countries. These projects include rail and road projects as well as power transmission lines that foster economic output in the region (Qi et al., 2016).

I chose China for the bank due to several reasons. First, it is an emerging economy whose GDP is increasing at fast rates. If its growth rate continues at its current trajectory, it could surpass the US to become the world’s largest economy in about or less than a decade. The economy also has reliable inflation management instruments. Furthermore, the economy has almost one and a half billion people. Such a large population is a market for the products that will be offered by the bank.

Furthermore, China is at the center of economic boom witnessed in various developing economies in the world. As such, successful business in China would offer the bank a platform to catapult into other developing markets. As a manager, I would conduct feasibility studies that analyze the barriers to entry in the banking sector in China and compare them to the projected earnings from the move. This would give me an idea of whether this would be an ideal investment with good returns or not.

The financial risks, in this case, are worth taking. Given the size and the growth rate of the economy, the demand for financial services has never been greater. More so, the economy needs stimulus to boost its growth rate that has slowed compared to rates seen in past years. By injecting capital into the economy, the bank will be assured of impressive returns. Furthermore, the Chinese regulatory framework is strong, and it requires banks to comply with its guidelines. As such, investments will be guaranteed by the strong economy and the regulatory regime in the country (Qi et al., 2016). The establishment of the bank in China will be beneficial to all stakeholder. Shareholders will gain from the diversification of their investment and impressive returns. The bank’s management will learn about the upsides and limitations of operating in a developing country that is highly diverse. Furthermore, the Chinese people will gain from employment and quality services provided by the bank. The Chinese government will see an increase in its revenue from taxes.

The bank can be present in major cities and industrial centers. This will concentrate the bank’s operations on the places where its services are likely to be demanded. The plant can be financed by a portion of earnings or by funds from independent investors. Hedging foreign exchange is a vital practice when seeking to reduce risk from variations in the value of a currency. This risk is limited in China due to the stable domestic currency, Yuan. However, the risk is still prevalent when conducting business in other currencies. As such, forward foreign exchange agreements are vital to ensure that transactions do not become liabilities due to currency value changes. Foreign exchange agreements can include spots. Spot rates involve transactions taking place within a limited time, often one day after the time of the agreement. A second instrument is known as a currency swap. This involves buying and selling currencies with different value dates simultaneously (Qi et al., 2016). Outright forwards are used to exchanging currency at a forward rate within a time agreed upon by the parties involved. Government regulations that would impact earnings of cash flow may be related to taxation practices or exchange rate regime changes.

Mastel, G. (2016). The Rise of the Chinese Economy: The Middle Kingdom Emerges: The Middle Kingdom Emerges. Routledge.

Qi, Y., Stern, N., Wu, T., Lu, J., " Green, F. (2016). China's post-coal growth. Nature Geoscience, 9(8), 564-566.

Deadline is approaching?

Wait no more. Let us write you an essay from scratch

Related Essays

Related topics.

Find Out the Cost of Your Paper

Type your email

By clicking “Submit”, you agree to our Terms of Use and Privacy policy. Sometimes you will receive account related emails.

Chinese Economy and Export-Based Growth Essay

Introduction, why china is failing to grow relying on exports, what would be the new growth engines for the country, how fast would be the new normal growth for china, economic, political, & social reforms to maintain sustained economic growth, annotations, reference list.

This research aims to assess certain features of the Chinese economy to identify why the country is currently failing to uphold export-based growth, and what factors are preventing the country from boosting the export sector further. Moreover, the paper would analyze the fresh growth engines, evaluate how fast would be the ‘new normal’ growth, and scrutinize the economic, political, and social reforms critical for China to maintain sustained and strong economic growth in the future. Even though the extensive reforms allowed China to experience increased efficiency resulting in a tenfold rise in the gross domestic product since 1978, after the global financial crisis, the country has lost its vitality in the export sector, making the overall economic growth slower. Luckily, China has found new growth sectors to boost its economy over a longer period, and the government is nurturing these segments through different mechanisms.

With the widespread reorganization of the economy through the means of fiscal decentralization, rising independence of the state-own organizations, the rapid expansion of the private sector, and liberated trade and foreign direct investments since the 1970s, China has shifted from a centrally planned to a more market-oriented economy, becoming the biggest exporter of the globe in 2010,

According to Yao (2016), China is failing to retain constant economic growth from the export sector in the recent years due to a number of reasons; however, one of the major factors is that the country’s export-led growth model has reached its limits and the credit-driven investments can merely provide transitory support in this area,

In addition, when global economic downturn started to haunt the entire world, international trade mechanisms faced an abrupt disintegration, posing serious threats to China’s export competitiveness because as the global leader in trade, the country is critically reliant on the foreign markets, and it cannot continue to accumulate sufficient gross domestic product if export demands continue to fall,

It has been further suggested that even though the world has recovered from the financial crisis, according to recent statistics, international trade is persistently diminishing in volume, reducing China’s chances to revive its exports by means of different political and fiscal strategies,

The State Council (2016) reported that China has recently sat in a dialogue with the President of World Bank, Managing Director of International Monetary Fund, and the Director-General of World Trade Organization to discuss the new growth engines of the country and the overall economic transition that occurred because of the shift in the sectors affecting growth,

It has been noted that the fresh driving forces are expanding, reflecting the country’s central planning to reform and boost growth with a structural shift in the macro-economy – the speakers stated that the new growth engines include great innovations, new types of businesses (such as crowd-based businesses), together with rising foreign investment, rapid urbanization, and most importantly, booming service sector,

The State Council (2016) further suggested that all these fresh growth factors are promoting the country’s economic development, structural change, and employment situation, and the government is fully supporting the change by leveraging human capital advantage, overseeing industry-wide reforms, and strengthening the new sources of growth,

Yao (2016) noted that since the international financial crisis, growth rates have declined from double digits to around eight percent each year; as a result, Zhang and Chen (2017) stated that in China the economy is entering the period of a ‘new normal’ because the past growth factors can no longer promise lucrative output in the post-recessionary world,

Yao (2016) suggested that exports have turned out to be less significant for economic growth because export growth has dropped from a yearly rate of 29% (from 2001 to 2008) to below 10% in current years, and since 2014, the service sector has contributed to above 50 percent of the nation’s expansion, representing the new normal with strong expansion rate. The author further analyzed that the ‘new normal growth’ is expected to be truly fast, and it is likely that the country will see a rapid expansion of this fresh economic sector within the next ten years,

Hye (2012) noted that there are a number of economic, political, and social transformations vital for the country to uphold powerful growth in the upcoming years; in addition, Zhu (2012) argued that social factors like rapid urbanization, inequality, and poverty, and political factors like governmental policy and ownership reforms could have an enormous influence on sustainable growth,

Shambaugh (2014) stated that the economic reforms critical to maintaining sustained growth in the future include modifying the macroeconomic growth model, reducing monopolies and state-owned enterprises, forming a true national labor market, relaxing the financial sector, deregulating the central regulations, establishing free trade zones, boosting budget transparency, and revising the tax policies,

The social reforms include diminishing social inequalities, eradicating frustrations and unrest, maintaining communal harmony, lowering income disparities, and creating job opportunities. Shambaugh (2014) added that the political reforms should involve ensuring transparency, controlling corruption, defending human rights, and improving diplomatic relations and foreign ties,

Hye, Q, (2012), Exports, imports, and economic growth in China: an ARDL analysis, Journal of Chinese Economic and Foreign Trade Studies, 5 (1), 42-55,

Hye provided an exhaustive analysis of China’s export-related growth and trade deficit sustainability, whilst assessing the deep-rooted link that lies within the economic expansion and the exports sector of the country,

Zhang, J, & Chen, J, (2017), Introduction to China’s new normal economy, Journal of Chinese Economic and Business Studies, 15 (1), 1-4,

The authors evaluated Chinese economic reforms, challenges to market growth, and corruption, and found that the growth rate has fallen significantly; moreover, the research also focused on the governmental attempts to revive the economy using a ‘new normal’,

Zhu, X, (2012), Understanding China’s growth: past, present, and future, Journal of Economic Perspectives, 26 (4), 103-124,

Zhu conducted a thorough historical analysis of the Chinese growth trends in order to understand the country’s future growth potentials; in addition, he also investigated the factors that could allow the country to ensure future sustainable growth,

It is notable that even after the downfall of the export sector caused by the global economic turmoil, the Chinese economy is still managing a generous growth rate throughout the last few years due to the governmental support for the new growth sectors. This new normal growth is expected to be truly rapid, and the country is now trying to maintain sustained strong economic growth in the future through certain economic, political, and social reforms.

Hye, Q. (2012). Exports, imports, and economic growth in China: an ARDL analysis. Journal of Chinese Economic and Foreign Trade Studies, 5 (1), 42-55.

Shambaugh, D. (2014). China at the crossroads: ten major reform challenges. Web.

The State Council. (2016). Full text: joint press release on the ‘1+6’ round table. Web.

Yao, Y. (2016). A new normal, but with robust growth: China’s growth prospects in the next 10 years. Web.

Zhang, J., & Chen, J. (2017). Introduction to China’s new normal economy. Journal of Chinese Economic and Business Studies, 15 (1), 1-4.

Zhu, X. (2012). Understanding China’s growth: past, present, and future. Journal of Economic Perspectives, 26 (4), 103-124.

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2024, February 2). Chinese Economy and Export-Based Growth. https://ivypanda.com/essays/chinese-economy-and-export-based-growth/

"Chinese Economy and Export-Based Growth." IvyPanda , 2 Feb. 2024, ivypanda.com/essays/chinese-economy-and-export-based-growth/.

IvyPanda . (2024) 'Chinese Economy and Export-Based Growth'. 2 February.

IvyPanda . 2024. "Chinese Economy and Export-Based Growth." February 2, 2024. https://ivypanda.com/essays/chinese-economy-and-export-based-growth/.

1. IvyPanda . "Chinese Economy and Export-Based Growth." February 2, 2024. https://ivypanda.com/essays/chinese-economy-and-export-based-growth/.

Bibliography

IvyPanda . "Chinese Economy and Export-Based Growth." February 2, 2024. https://ivypanda.com/essays/chinese-economy-and-export-based-growth/.

- Pitt County: Urban Economics and Export-Based Theories

- Equity Investment and Export-Base Strategies

- Post-War South Korean Patriarchy and US Hegemony

- Analysis of Confucianism in The Analects by Yao

- Description of a Person: Yao Ming, Indomitable Energy of Life

- "An Undergraduate Major’s Perspective" by M. Zhu

- Contributions of Jiang Zemin and Zhu Rongji to China

- Reflection on Confucianism

- Reading the Notes of Desolate Man: Zhu Tianwen and Her Postmodernist Talent

- "A Bite of China" by Chen Xiaoqing Documentary

- The UAE Financial Performance and Predictable Earnings

- Saudi Arabian Human Capital and Economic Growth

- Economics and Technology in Europe

- Measuring Economic Development: Human Development Index

- The UAE Ministry of Economy

We use cookies to enhance our website for you. Proceed if you agree to this policy or learn more about it.

- Essay Database >

- Essay Examples >

- Essays Topics >

- Essay on China

Sample Essay On Chinese Economy

Type of paper: Essay

Topic: China , Europe , Confucianism , Technology , Productivity , World , Time Management , War

Published: 02/20/2023

ORDER PAPER LIKE THIS

1. Even as both China and most of the European region had similar geographical conditions during the nineteenth century, China lagged behind Europe mainly because of poor technological innovations. As for agriculture, the gap in productivity between Europe and China was very less as both countries had to take up similar soil and water management practices (Zanden, 2011). On the other hand, the productivity gap between Europe and China was much higher in industry and other services. For instance, during the medieval period, the prevailing wage rate in the Netherlands was seventy percent higher than the wage rate in the Yangzi delta of China (Allen et.al. 2011). The reason was attributed to technology-driven high productivity in Europe. Chinese farmers carried out water management practices by using hand-operated machines as their European counterparts used wind mill technology to pump water. The technology lag applies to extraction of oil that was popular both in Europe and China. Similarly, Chinese printing technology was highly labor intensive as European printing relied on capital-intensive machineries that increased productivity many folds when compared to China. The Chinese communist regime that upholds a strong bureaucracy is responsible for the country’s fast economic growth. The concept of mass production has helped China to export its less-expensive products across the world. More employment and business opportunities within China restricted the movement of talent outside the country. Recently, China has begun relying on the spending of its own domestic customers rather than exporting its produce outside (Denlinger, 2011). Earlier, the Chinese government had insisted on producing more that led manufacturers to compromise on their profit margins. Currently, the government is shutting down unprofitable units, and encouraging manufacturers to climb up the value chain to pursue profitable businesses. As a result, many manufacturers switched over to businesses that require greater skills while moving their labor-intensive manufacturing units to neighboring countries like India 2. Frankly, I would have embraced Confucianism had I lived in the nineteenth century. Confucius taught self-realization as the ultimate objective of education (Weiming, 2016). His inspiring philosophy would have helped me to follow these virtues: taking counsel from what I have learned, doing what is right, and reforming myself when I realize I have deficiencies. These thoughts would have helped me to evaluate my defects regularly. On a wider perspective, I would have evaluated the defects of my society and the country. At that time, China feared to go global and completely shut its trade ties with the outside world. The philosophy of Confucius would have helped me to spread his message of looking deeply into China’s defects and renew its ties with the outside world so as to avert possible foreign invasion. The opium war that took place between 1839 and1842, which was a disastrous experience for China for having shut its doors down to the outside world, would have greatly influenced me (Moody, 2012). It was a powerful lesson China learnt for relying upon its own indigenous technology and shying away from learning from the outside world. Chinese primitive technology was no match to British war ships and fighting techniques that led to the foreigners taking control of most of the Chinese ports. I would have lived 60 years as a successful businessman following the philosophy of Confucius. Firstly, his principle of “do not adjust your goals, adjust your steps to reach your goal” would have always given me the energy to pursue different steps to reach my business goals. Confucius said: success depends on one’s preparation to face the future. This would have guided me to foresee possible opportunities even as China was devastated by the war during the time, and develop my business towards improving the productivity of my country.

Allen, R. C., Bassino, J. P., Christine M.M., and Zanden, J.L. (2011), Wages, Prices, and Living Standards in China, Japan, and Europe, 1738-1925, Economic History Review, 64 (1). Denlinger, P. (2011). China’s economy hits its first hard wall. Forbes.com. Retrieved from http://www.forbes.com/sites/pauldenlinger/2011/07/06/chinas-economy-hits-its-first-hard-wall/#5f2cbc0861cc Moody, A. (2012). Lessons of the Opium War. Retrieved from http://usa. chinadaily. com.cn/weekly/2012-02/24/content_14681839.htm Weiming, T. (2016). Confucianism. Encyclopaedia Britannica. Regtrieved from http://www.britannica.com/topic/Confucianism Zanden, J, L. (2011). Before the Great Divergence: The modernity of China at the onset of the industrial revolution. Retrieved from http://www.voxeu.org/article/why-china-missed-industrial-revolution

Cite this page

Share with friends using:

Removal Request

Finished papers: 2653

This paper is created by writer with

If you want your paper to be:

Well-researched, fact-checked, and accurate

Original, fresh, based on current data

Eloquently written and immaculately formatted

275 words = 1 page double-spaced

Get your papers done by pros!

Other Pages

Geography research proposals, aptly movie reviews, daunting movie reviews, auteurism movie reviews, shoes research proposals, bath research proposals, domains research proposals, henry king essays, lucy larcom essays, tomas rivera essays, hyphal essays, epithelial cells essays, chills essays, endocytosis essays, azoles essays, stomatitis essays, agglutinin essays, cheilitis essays, lotto essays, natick essays, republic of korea essays, sample essay on what is the impact of smoking on chest, cultural diversity and ethical relativism essay examples, good example of essay on analysis of these 5 movies, good cyber security essay example, engineering disasters essay example, tourism case study critical thinkings example, tourism type to use as a writing model, proper essay example about prevention through design, free hotel math fundamentals discussion questions essay sample, draw topic writing ideas from this article review on entrepreneurial mindset, good essay about marketing essays, perfect model research paper on attentional blink and repetition blindness, network management systems a top quality essay for your inspiration, good corrections essay example, free masculinity in hills like white elephants literature review sample, evaluation of the interview a top quality research paper for your inspiration, climate change in new york city study outline a top quality essay for your inspiration, criminal law free sample essay to follow 2, write by example of this criminal law essay, salome by oscar wilde essay examples, example of essay on alternate dispute resolution.

Password recovery email has been sent to [email protected]

Use your new password to log in

You are not register!

By clicking Register, you agree to our Terms of Service and that you have read our Privacy Policy .

Now you can download documents directly to your device!

Check your email! An email with your password has already been sent to you! Now you can download documents directly to your device.

or Use the QR code to Save this Paper to Your Phone

The sample is NOT original!

Short on a deadline?

Don't waste time. Get help with 11% off using code - GETWOWED

No, thanks! I'm fine with missing my deadline

Economy of China