How to Create a Startup Funding Proposal: 8 Samples and Templates to Guide You

Being a founder is difficult. Managing the day-to-day as a founder while trying to secure capital for your business can almost feel impossible. Thankfully, there are different tools and techniques that founders can use to systemize their fundraise to focus on what truly matters, building their business.

One of those tools is a startup funding proposal. In this guide, we’ll break down what a startup funding proposal is and how you can leverage it to build momentum in your fundraise.

What Is a Startup Funding Proposal?

A startup funding proposal is a document that helps startup founders share an overview of their business and make the case for why they should receive funding. A startup funding proposal can be boiled down to help founders layout 3 things:

- What — what does your startup do

- How — how does your startup or product help customers accomplish what they are seeking

- Why — why does your startup need funding and why should an investor fund your business

Related Resource: How to Write a Business Plan For Your Startup

Types of Startup Funding Proposals

Like any business document, there are many ways to approach a startup funding proposal. Ultimately it will come down to pulling the pieces and tactics that work best for your business. Investors are seeing hundreds, if not thousands, of deals a month so it is important to have your assets buttoned up to move quickly and build conviction during a raise. Check out a couple of popular types of funding proposals below:

Traditional Startup Funding Proposal

The most traditional or “standard” standard funding proposal is generally a written and visual document that is created using word processing software and/or design tools.

A traditional proposal is great because it allows you to share context with every aspect of your business. For example, if you include a chart of growth you’ll be able to explicitly write out why that was and what your plan is for future growth.

This document is generally designed to fit your brand and will hit on the key components of your business is structured and predictable way. We hit on what to include in your proposal below.

Startup Funding Proposal Pitch or Presentation

The most common approach we see to a fundraise or proposal is the pitch deck. Pitch decks take the same components as any proposal and fit them into a visual pitch deck that can be easily navigated and understood by a potential investor.

Pitch decks are not required by investors by are generally expected and are a great tool that can help you efficiently close your round. To learn more about building your pitch deck, check out a few of our key resources below:

- Tips for Creating an Investor Pitch Deck

- 18 Pitch Deck Examples for Any Startup

- Our Teaser Pitch Deck Template

1-on-1 Proposals (Elevator Pitch)

A 1 on 1 proposal or an elevator pitch is the quickest version of any proposal. Every founder should have an elevator pitch in their back pocket and is a complementary tool to any of the other funding proposals mentioned here.

As the team at VestBee puts it, “Elevator pitch” or “elevator speech” is a laconic but compelling introduction that can be communicated in the amount of time it takes someone to ride an elevator, usually around 30 seconds. It can serve you for fundraising purposes, personal introduction, or landing a prospective client.”

Email Proposal

Another common way to share a startup funding proposal via email. While the content might be similar to what is seen in a “traditional” funding proposal this allows you to hit investors where they spend their time – their inbox.

The format will follow a traditional proposal with less emphasis on visual aspects and more emphasis on the written content. Check out an example from our Update Template Library below:

Related Resource: How to Write the Perfect Investment Memo

Investor Relationship Hub

Lastly, there is an investor relationship hub or data room that can be used to share your proposal with potential investors. A hub is a great place to curate multiple documents or assets that will be needed during your fundraise. For example, you could share your funding proposal and your financials if they are requested by a potential investor.

Related Resource: What Should be in an Investor Data Room?

What to Include in Your Startup Funding Proposal

How you share your funding proposal might differ but ultimately the components are generally closely related from one proposal to the next. However, be sure that you are building this for your business. There is no prescriptive template that will work for every business.

Project Summary

First things first, you’ll want to start with a summary of your project or your business. This can be a high-level overview of what your proposal encompasses and will give an investor the context they need for the rest of the proposal. A couple of ideas that are worth hitting on:

- What your company does and how it’s different from existing solutions to pressing problems.

- Existing market gaps and how your product covers them.

- The importance of your product in your industry and how it improves the industry.

- Existing resources and manpower, investment requirements, and potential limitations.

Current Performance and Financial Report

Of course, investors want to see how your business has been performing. The data and metrics around your business are generally how an investor builds conviction and further interest in your business. We suggest using your best judgment when it comes to the level of metrics or financials that you’d like to share. A couple examples of what you might share:

- Current assets and liabilities

- MVP presentation for companies still in the ideation stage

- Appendix with financial reports

Related Resource: Building A Startup Financial Model That Works

Existing Investors and Partners

Inevitably investors will want to know who else you have raised capital from and partnered with in the past. Include a brief description of the different investors you have on your cap table and be ready to field additional questions if they have any.

Pro tip: The first place an investor will go to when performing due diligence is your current investors. Make sure you have a strong relationship and good communication with your current investors.

Market Study and Sales Goals

Investors will also care about your customer acquisition efforts and want to make sure you can repeatably find and close new customers. A couple of things that might be important to include in this section:

- Product pricing and information

- Revenue targets and goals

- Customer acquisition model and efforts

- Sales and marketing related KPIs

- Stories or testimonials from happy customers

Current Valuation, Investment Requirements, and Expected Returns

This is an opportunity to lay out your cap table and explain your current valuation, investment requirements, and what future valuations could look like. As always, we suggest using your best judgment when it comes to what level of detail you’d like to share about your cap table.

Potential Pitfalls and Solutions

There is an inherent risk when investing in any startup. It is important to make sure potential investors are aware of this. Layout the common pitfalls your startup might face and stop you from achieving your goals. Next, lay out the solutions to these problems and how you plan to tackle them if/when they arise.

8 Startup Funding Proposal Samples and Templates

Below are 8 proposal templates to help you kick off your next fundraise. Note that some of these are technically investor updates and not designed for first-time fundraising. Keep in mind that a startup funding proposal could also be utilized for additional funding after the first round of funding.

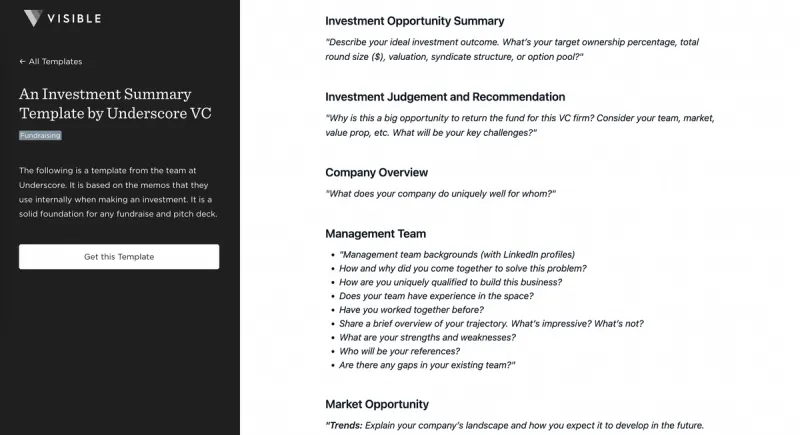

1. An Investment Summary Template by Underscore VC

Underscore VC is a seed-stage venture fund based out of Boston. As the team at Underscore writes :

“As part of this, we strongly recommend you write out a pitch narrative before you start to build a pitch deck. “Writing the prose forces you to fill in the gaps that can remain if you just put bullets on a slide,” says Lily Lyman, Underscore VC Partner. “It becomes less about how you present, and more about what you present.”

This exercise can help you synthesize your thoughts, smooth transitions, and craft a logical, compelling story. It also helps you include all necessary information and think through your answers to tough questions.

Check out the template here .

2. The Visible “Standard” Investor Update Template

Our Standard investor update template is great for communicating with existing investors. If you are regularly sending Updates to their investors they should know when you are beginning to raise capital again and can almost be treated as an investment proposal.

Check out the template for our standard investor update template here .

3. Sharing a Fundraising Pitch via Video

Videos are a great way to give the right context to the right investors in a concise and quick way. Video is a great supporting tool for any other information or documents you might be sending over. For example, you can include a few charts or metrics and some company information and use the video to further explain the data and growth plans. Check out the template here .

4. Financial Funding Proposal

The team at Revv put together a plug-and-play financial funding proposal. As they wrote, “A funding proposal must provide details of your company’s financials to obtain the right amount of funding. Check out our funding proposal template personalized for your business.” Check out the template here .

5. Investor Proposal Template for SaaS Companies

The team at Revv put together a template to help founders grab the attention of investors. As they wrote, “With so many Investing Agencies, this Investor proposal will surely leave an impact on your company in the long run.” Check out the template here .

6. Startup Funding Proposal Sample

Template.net has created a downloadable funding proposal template that can be edited using any tool. As they wrote, “Get your business idea off the ground by winning investors for your business through this Startup Investment Proposal. Fascinate investors with how you are going to get your business into the spotlight and explain in vivid detail your goals or target for the business.” Check out the template here .

7. Simple Proposal Template

Best Templates has created a generic proposal template that can be molded to fit most use cases. As they wrote, “Use this Simple Proposal Template for any of your proposal needs. This 14-page proposal template is easily editable and fully customizable using any chosen application or program that supports MS Word or Pages file formats.”

8. Sample Investment Proposal for Morgan Stanley

Another example is from the team at Morgan Stanley. The template is commonly used by their team and can be applied to most proposal use cases.

Connect With More Investors and Tell Your Story With Visible

Being able to tie everything together and build a strategy for your fundraise will be an integral part of your fundraising success. Check out how Visible can help you every step of the way below:

Visible Connect — Finding the right investors for your business can be tricky. Using Visible Connect, filter investors by different categories (like stage, check size, geography, focus, and more) to find the right investors for your business. Give it a try here .

Pitch Deck Sharing — Once you’ve built out your target list of investors, you can start sharing your pitch deck with them directly from Visible. You can customize your sharing settings (like email gated, password gated, etc.) and even add your own domain. Give it a try here .

Fundraising CRM — Our Fundraising CRM brings all of your data together. Set up tailored stages , custom fields , take notes, and track activity for different investors to help you build momentum in your raise. We’ll show how each individual investor is engaging with your Updates, Decks, and Dashboards. Give it a try here .

This device is too small

If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience.

- Small Business

How to Maximize Your Business Plan to Secure Funding

Updated Aug. 5, 2022 - First published on May 18, 2022

By: Jennifer Post

Writing a business plan for your small business should be one of the first steps you take when a business idea pops into your head. This is how you’ll discover whether your idea can actually be a profitable business. Lenders will want to know the business you plan on starting will make enough money for you to be able to pay back a loan or other forms of investment.

Why is having a business plan important to get funding?

Investors want to invest in a business projected to be profitable within a certain amount of time, has a marketing strategy ready to go, and will exist in a receptive market. All of that information is provided in a business plan. Here are a few reasons why having a business plan is crucial to get funding.

Credibility

Before anyone invests money in your business, lenders will want to know you have a concrete, detailed plan for paying the loan back. Provide information such as:

- Market value of your product or service

- Projected sales in the first year against projected expenses

- Projected profit during your first five years in business

Going through the process of putting all of this together is just another aspect of your credibility as a future business owner, no matter how much money you’re asking for.

Why a Business Credit Card Could Transform Your Small Business

These business credit cards that offer a convenient and efficient way to separate personal and business expenses, simplifying accounting and tax reporting.

Additionally, business cards can provide valuable perks such as rewards points, cashback, and expense tracking tools, enhancing financial management and the potential to help save money in the long run.

| Offer | Our Rating | Welcome Offer | Rewards Program | APR |

|---|---|---|---|---|

| On Chase's Secure Website. | Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs. | Earn $750 bonus cash back Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. | Earn unlimited 1.5% cash back on every purchase Earn unlimited 1.5% cash back on every purchase made for your business | 0% Intro APR on Purchases Purchases: 0% Intro APR on Purchases, 12 months Balance Transfers: N/A 18.49% - 24.49% Variable |

| On Chase's Secure Website. | Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs. | Earn up to $750 bonus cash back Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening. | Earn 5% cash back in select business categories Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year. Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other card purchases with no limit to the amount you can earn. | 0% Intro APR on Purchases Purchases: 0% Intro APR on Purchases, 12 months Balance Transfers: N/A 18.49% - 24.49% Variable |

You don’t want to earn the reputation of being an ill-prepared entrepreneur. If you take your business idea seriously, show it.

Business need

Just because you’ve thought of a business idea and have outlined every aspect of it doesn’t mean investors and banks will feel the same way. Banks mostly care about whether or not you can pay back a loan, while investors tend to back businesses they connect with.

The need for your business is much more important than it might seem. In order to pay back a loan, your business needs to be profitable. In order for that to happen, you need customers. To get customers, you have to offer something they can’t get anywhere else, whether that’s a product, a service, or an experience.

What should you include in your business plan for funding?

Be detailed and thorough in every idea you present since you’ll most likely have to explain yourself and your business idea. Here’s what should be included in your business plan if you’re seeking funding.

1. Details about your business and company as a whole

It’s important to think about how you plan on setting up your business -- and for more than one reason. Some things to consider:

- Will you be a sole proprietor?

- Do you have a business partner?

- LLC vs. incorporation?

Business structure also matters for paying back a loan. If your business is unable to pay back a loan, the legal structure can be the difference between you having to pay it back somehow (with your home or other assets) or splitting the remaining balance among shareholders or partners.

2. Target market

At the risk of sounding like a broken record, your business can’t make money without customers. Take your business idea and research different locations to find your customers, and ask yourself a few questions:

- Are there a lot of other businesses like yours already out there?

- Are those businesses doing well?

- Is there a gap in what they offer?

You could also pick your target audience first. Let’s say you want young adults between the ages of 25 and 40 to be your main customers. You need to find where those people are and ask the questions noted above. Either way, those questions need to be answered and in a lot of detail.

3. How you plan to make money

This is so much more than just saying, “by selling a lot of product,” or “having a long list of clients.” Anyone can say that. Ask yourself a few questions, just like you did with the market aspect above:

- How much will you charge for your offerings?

- Will people actually pay that amount?

- How much do you need to sell to break even? To make a profit?

Even if your product is worth x amount of dollars in market terms, the harsh reality is it’s only worth what people are actually willing to pay for it. It’s best to underestimate and over-deliver -- as long as your plan still guarantees your ability to pay off a loan.

4. How much funding you’re seeking and its intended use

You need to have a firm grasp on how much funding you need to accomplish your goal, and don’t be shy about it. If you’re seeking a bank loan, it’s a little different because you will qualify for a certain amount based on a number of factors.

Some lenders also have use case limitations, where there are restrictions on what you can use the money for. Consider that, among all of the other qualifications, before deciding if that type of loan is the way you want to go.

If you’re going with an investor, it’s not usually a make-or-break factor to detail what you plan on using the money for, but the more information you provide, the better.

How to write your business plan for funding

Now that you know why a business plan is crucial for funding and what needs to be included in one, let’s get to actually writing it. There are also business plan templates and sample business plans available online that are a good guide to get you started.

Step 1: Write your executive summary

This is generally the first section of your business plan and your first chance to make an impression. As with most introductions, this is where you’ll summarize all the other sections of the business plan, such as your mission statement , general company information, products or services, and financials.

Step 2: Explain your company overview

All that time you spent researching different business formation options will pay off in this section. You’ll explain the structure of your company, exactly what your business does, and the target market you plan on addressing. You’ll want to get into detail about the market you’ve chosen, why you fit into that market, and how you plan on expanding within it.

Step 3: Detail your market analysis

This is the section where you will dive into the nitty-gritty of your intended market. Explain the following aspects:

- What audience lives within that market?

- What do they want?

- How do you plan on providing what they want?

- How much is your product worth?

- What are your plans for growth?

- Are there setbacks you might run into? How will you overcome them?

As anyone who has started a business knows, it’s not all gains. Letting investors know that you recognize there will be obstacles shows that you’ve really thought all of this out.

Step 4: Describe your product/service

In this section, you’ll do more than just explain what you will sell, although that’s part of it. If you’ve invented something or patented something, include that in this section. Don’t only show what you’re offering but explain how it works and how it improves on what’s already out there. If it’s a service, explain how you will produce better results than others.

Additionally, if you have to source materials or equipment from somewhere else, outline whom you will work with and what the process will be to secure those materials.

Step 5: Write out your sales plan

Here are a couple of steps you’ll want to take to outline your sales plan.

- Have some branding ideas on hand: These might include a company name, logo, color scheme, and sample materials, such as business cards or brochures. This will position your product for sale.

- Explain how you’ll market your product: Decide whether you will go with free online marketing, such as social media, or paid marketing, such as online or print ads. While you can choose among options, it will come down to your target audience. Do they spend most of their time online, or do they still read the newspaper every morning? That will determine where you should put your marketing efforts, and since ad return is a business metric you’ll want to track later on, having a solid plan in the initial stages will make that process smoother.

Step 6: Detail and explain your financial projections

This section should come fairly easily once you’ve completed the others. You should have an idea of what it will cost to produce your product or service, how much you can charge for it, your market share, and how you will spend money on marketing.

Do your projections in time increments for the lifecycle of your business , such as the first year, first five years, and looking ahead at 10 years and beyond.

The first couple of years you can be pretty specific about your projections, whereas your long-term projections can be offered up more as goals you would like your company to reach in a certain period of time and how you plan to achieve them.

4 tips for writing effective business plans to secure funding

Now that you have a firm grasp on what needs to be in your business plan, how you obtain that information, and how you actually create a business plan, here are some tips to make sure you’re getting the most out of it.

1. Don’t leave anything out

Leaving bits and pieces of your business up for interpretation or guessing will only hurt your chances of securing funding. If investors are left to fill in the blanks, you have no control over what they fill them with. Make sure you’re as thorough as possible in your research and writing so that nothing is left out.

2. Write with personality

There’s a scene from Parks and Recreation where Tom is presenting a business to a potential investor. His original idea, Tom’s Bistro, is one he’s extremely passionate about. Ben comes in with another idea that has a greater chance of being profitable. Tom starts presenting that and soon finds both he and the investor are bored. As soon as he switches back to Tom’s Bistro, the mood in the room completely changes.

Even though that’s a scene from a television show, it’s a good representation of how adding a little bit of your personality and passion into your business plan can pay off, literally.

3. Don’t speak in general terms

Be as detailed as you possibly can. Use exact numbers, names, dates, etc. Doing this will not only show that you’ve done your homework, but that you’re committed to reaching those numbers by the dates you list.

It can seem daunting to feel like you’re committing to so much, but commitment is what investors are looking for. They need to see that you’re serious about your business, and the amount of detail you include in your business plan will reinforce that.

4. Be upfront about what you’re asking for

Don’t be afraid to ask for the amount you really need, even if it’s high. Being wishy-washy about the number might not present so well. As previously mentioned, bank loans are different in that you only receive an amount you qualify for. If you’re meeting with angel investors , it’s important to go in with a specific number in mind.

While the process doesn’t need to be as dramatic as Shark Tank , expect some back and forth once you present your business plan and offer up how much money you’re asking for.

Final thoughts

A business plan is one of the most important documents you’ll create for your business. It’s where you introduce who you are, what your business is, and how it will be successful. If, as most people do, you’re using your business plan to secure funding, you’ll want to be as detailed and thorough as possible in your research and writing.

You want potential investors to be as serious about your business as you are, so convey to them why you’re serious and how you’re bringing something unique to the table that they would be lucky to be a part of.

Our Research Expert

Jennifer Post writes about marketing and software for small businesses for The Ascent and The Motley Fool.

Share this page

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

Related Articles

By: Cole Tretheway | Published on June 7, 2024

By: Lyle Daly | Published on June 5, 2024

By: Christy Bieber | Published on June 5, 2024

By: Lyle Daly | Published on June 4, 2024

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

Copyright © 2018 - 2024 The Ascent. All rights reserved.

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How To Write the Funding Request for Your Business Plan

What goes into the funding request, parts of the funding request, important points to remember when writing your request, frequently asked questions (faqs).

MoMo Productions / Getty Images

A business plan contains many sections, and if you plan to seek funding for your business, you will need to include the funding request section. The good news is that this section of your business plan is only needed if you plan to ask for outside business funding. If you're not seeking financial help, you can leave it out of your business plan. There are a variety of ways to fund your business without debt or investors. Below, we'll cover how to write the funding request section of your business plan.

Key Takeaways

- The funding request section of your business plan is required if you plan to seek funding from a lender or investors.

- You'll want to include information on the business, your current financial situation, how the money will be used, and more.

- Tailor each funding request to the specific funding source, and make sure you ask for enough money to keep your business going.

The funding request section provides information on your future financial plans, such as when and how much money you might need. You will also include the possible sources you could consider for securing your funds, such as loans or crowdfunding. Later, you can update this section when you need outside funding again for business growth.

An Outline of the Business

Yes, you've done this already in past sections, but you want to give potential lenders and investors a recap of your business. In some cases, you might simply share the funding request section so you need to have your business details such as what you provide, information about your target market, your structure (i.e. LLC), owners' and members' information (for partnerships and corporations), and any successes you've had to date in your business.

Current Financial Situation

Again, you've provided some financial information in the financial data section , but it doesn't hurt to summarize. If you're submitting just the funding request, you'll need this information to help financial sources understand your money situation.

Provide financial details such as income and cash flow statements, and balance sheets in your funding request section.

Offer your projected financial information as well. If you're asking for a loan for which you'll be offering collateral, include information about the asset. If the business had debt, outline your plan for paying it off. Finally, share how you'll pay the loan or what sort of return on investment (ROI) investors can expect by investing in your business.

How Much Money Do You Need Now and in the Future?

Indicate what type of funding you're asking for such as a loan or investment. Outline what you need now and what you might need in the future as far as five years out.

How Will the Funds Be Used?

Detail how you'll be using the money, whether it's for inventory, paying a debt, buying equipment, hiring help, and more. If you plan to use the money for several things, highlight each and how much money will go to each.

Most financial sources would rather invest in things that grow a thriving business than things that pay for debt or overhead expenses.

Current and Future Financial Plans

Current and future financial plans include items such as loan repayment schedules or plans to sell the business. If you're getting a loan, outline your plans for repayment (although most lenders will have their own schedules). If you have plans to sell the business, let the lender know that and how it will affect them. Other issues to consider are relocation (if you move) or a buyout. Finally, let investors know how they can exit the deal, such as cashing out (and how long before they can do that).

You're asking for money, so you need to always be professional and know your business inside and out. Here are some other things to keep in mind:

- Tailor your funding request to each financial source : Lenders and investors need different information, such as loan repayment versus ROI, so create different reports for each.

- Keep your funding sources in mind : Each resource will have different questions and concerns. Do a little research so you can address them in your report.

- Ask for enough to keep your business going : Don't be stingy, as you don't want your business to fail from a lack of money. At the same time, don't be greedy, asking for more than you need.

How do you request funding for a nonprofit?

Most nonprofits seek funding in the form of grants. Write a grant proposal that includes information on the project or organization, preliminary budget needs, and more. Be sure to format it with a cover letter, proposal summary, the introduction of the organization, problem statement, objectives, methods, evaluation, future funding needs, and the budget.

What are three methods of funding?

Grants and scholarships, equity financing, and debt financing are the main three methods of funding for small businesses . Grants and scholarships do not need to be repaid and are often best for nonprofit organizations. Equity financing is when you receive money in exchange for ownership and profits. Debt financing is when you borrow money that needs to be repaid.

Want to read more content like this? Sign up for The Balance’s newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Small Business Administration. " Fund Your Business ."

Congressional Research Service. " How To Develop and Write a Grant Proposal ."

Library of Congress Research Guides. " Types of Financing ."

How to Write a Funding Proposal: A Step-by-Step Guide

Benjamin reimann, business proposals, funding proposal | funding proposal writing | proposal writing guide.

May 30, 2024

A funding proposal is a document that outlines a request for financial support for a project or initiative.

Whether you are a nonprofit organization seeking funding for a community program or an entrepreneur looking to secure investment for your startup, knowing how to write a compelling funding proposal is essential.

In this step-by-step guide, we will walk you through the process of crafting a persuasive funding proposal that will grab the attention of potential funders and increase your chances of securing the financial support you need.

Create and Send Out Proposals Faster Than Ever!

Get a Free 14-day Trial * No credit card. No obligations. Try before you buy.

- Understanding the Basics of a Funding Proposal

Before diving into the details of writing a funding proposal, it is crucial to have a clear understanding of what it entails.

A funding proposal is a persuasive document that presents a compelling case for financial support.

It outlines the project or initiative, explains its importance, and demonstrates how the requested funds will be utilized to achieve specific goals and objectives.

When crafting a funding proposal, it is essential to consider the target audience and tailor the proposal to align with their interests and priorities.

Understanding the funder’s mission and funding priorities can help you customize your proposal to resonate with their values and goals, increasing the likelihood of securing financial support.

Defining a Funding Proposal

A funding proposal is a written request for financial assistance from a potential funder.

It provides a comprehensive overview of the proposed project, including its objectives, methodology, budget, and expected outcomes.

A well-written funding proposal serves as a roadmap for both the funder and the recipient, ensuring a mutual understanding of the project’s purpose and desired outcomes.

Additionally, a funding proposal should clearly articulate the need for the project, demonstrating how it addresses a specific issue or gap in the community or field of interest.

By highlighting the significance and urgency of the project, you can create a sense of importance and relevance that resonates with potential funders.

Importance of a Well-Written Funding Proposal

A well-crafted funding proposal plays a crucial role in securing financial support for your project.

It serves as your first and often only opportunity to make a compelling case for why your project deserves funding.

A poorly written or incomplete proposal can lead to rejection, while a well-written and persuasive one increases your chances of success.

Furthermore, a well-written funding proposal not only outlines the project’s objectives and budget but also establishes a clear plan for monitoring and evaluating the project’s progress and impact.

By incorporating strategies for measuring success and demonstrating accountability, you can instill confidence in funders and stakeholders, showcasing your commitment to transparency and effectiveness.

- Preparing to Write Your Funding Proposal

Photo credlt: Freepik

Before you start writing your funding proposal, it is essential to thoroughly prepare.

Successful proposals require careful planning and research to ensure that you can effectively communicate the value and potential impact of your project to potential funders.

One crucial aspect of preparing to write a funding proposal is to clearly articulate the goals and objectives of your project.

By defining these key elements, you can provide funders with a clear understanding of what you aim to achieve and how their support can make a difference.

Consider outlining the expected outcomes and benefits of your project to demonstrate its significance and relevance.

Identifying Your Needs

Begin by clearly defining your project’s needs and determining the specific amount of funding required.

Take the time to identify the resources, materials, and personnel needed to carry out your project successfully.

This will help you create a comprehensive budget and ensure that your funding request aligns with your project’s requirements.

Moreover, conducting a thorough needs assessment can strengthen your funding proposal by providing evidence of the existing gaps or challenges that your project aims to address.

By presenting a compelling case for why your project is essential and timely, you can capture the attention of potential funders and convey the urgency of supporting your initiative.

Researching Potential Funders

To increase your chances of securing funding, it is crucial to target the right funders that align with your project’s objectives and mission.

Research potential funders who have a history of supporting projects similar to yours.

Read their guidelines and eligibility criteria to ensure that your project aligns with their priorities.

Understanding each funder’s preferences and requirements will help tailor your proposal accordingly.

Furthermore, establishing a personal connection with potential funders can significantly enhance your proposal’s success rate.

Consider attending networking events or reaching out directly to funders to introduce them to your project and build a relationship based on mutual interests.

Building rapport and trust with funders can not only increase your chances of securing funding but also lead to potential long-term partnerships and collaborations.

- Crafting the Proposal

With careful preparation, you are now ready to dive into the actual writing of your funding proposal.

This section will guide you through the key components of a persuasive funding proposal.

Before you begin writing your proposal , it’s essential to conduct thorough research on the funder’s priorities, past funding decisions, and any specific requirements they may have.

Understanding the funder’s preferences and areas of interest will help you tailor your proposal to align with their expectations, increasing your chances of success.

Writing an Executive Summary

The executive summary is a concise overview of your proposal.

It should grab the reader’s attention and provide a clear snapshot of your project’s objectives, outcomes, and budget.

Keep it brief but compelling, highlighting the most critical aspects of your proposal that make it worthy of consideration.

In addition to summarizing your project, the executive summary should also include a brief introduction to your organization or team.

Highlight key achievements, relevant experience, and any unique qualifications that demonstrate your capacity to successfully execute the proposed project.

Detailing Your Goals and Objectives

In this section, clearly state the goals and objectives of your project.

Explain what you aim to achieve and how your project will make a positive impact in the community or industry it serves.

Use strong and persuasive language to convey the importance of your project and the value it will bring to the funder.

When outlining your goals, ensure they are specific, measurable, achievable, relevant, and time-bound (SMART).

Clearly define the outcomes you expect to accomplish and explain how you will measure success.

By setting clear and realistic goals, you demonstrate your project’s feasibility and your commitment to achieving tangible results.

Outlining Your Methodology

Provide a detailed description of your project’s methodology.

Explain the step-by-step process you will follow to achieve your goals.

Highlight any unique or innovative approaches you will employ and emphasize how they align with the funder’s objectives.

Be concise yet thorough in explaining your methodology to ensure the funder understands your proposed approach.

When outlining your methodology, consider including a timeline or Gantt chart to visually represent the project’s workflow and key milestones.

This visual aid can help the funder better understand the sequencing of activities and the overall project timeline.

Additionally, clearly explain any potential risks or challenges you anticipate and how you plan to mitigate them to ensure the project’s success.

- Budgeting and Financial Planning

Developing a comprehensive and well-thought-out budget is essential to demonstrate the financial feasibility of your project.

In this section, you will outline your project’s financial needs and detail how the requested funds will be allocated.

When creating a budget, it is crucial to consider not only the direct costs associated with your project but also any indirect expenses that may arise.

These could include unexpected contingencies, regulatory fees, or even inflationary factors that might impact your budget over time.

By conducting a thorough analysis and accounting for all possible financial scenarios, you can present a more robust and reliable budget to potential funders.

Creating a Budget

Start by creating a detailed budget that includes all projected expenses and revenues related to your project.

Break down your expenses into categories such as personnel, materials, marketing, and overhead costs.

Be thorough and realistic in your budgeting to demonstrate that you have carefully considered all financial aspects of your project.

Moreover, consider incorporating a financial buffer into your budget to account for any unforeseen circumstances that may arise during the project’s implementation.

This contingency fund can provide a safety net and ensure that your project remains financially stable even in the face of unexpected challenges.

By showing foresight and prudence in your budget planning, you can instill confidence in potential investors or donors regarding your project’s financial management.

Explaining Your Financial Needs

In this section, clearly explain why the requested funds are necessary for the success of your project.

Break down the budget and provide a detailed justification for each expense.

Demonstrate that the funds will be used efficiently and effectively to achieve the desired outcomes.

The more transparent and well-reasoned your explanation, the more likely the funder will be convinced of the value of supporting your project.

Additionally, consider outlining the potential return on investment (ROI) that funders can expect from supporting your project.

Whether it be in the form of social impact, financial gains, or long-term sustainability, showcasing the benefits that funders can reap from their investment can further strengthen your case for financial support.

By aligning your project’s financial needs with the interests and objectives of potential funders, you can increase the likelihood of securing the necessary funding for your project’s success.

- Polishing Your Proposal

After completing the initial draft of your funding proposal, it is essential to review, edit, and polish it to ensure that it is clear, concise, and impactful.

Polishing your proposal goes beyond just fixing typos and grammar errors.

It involves refining the language to make it more engaging and persuasive.

Consider the tone of your proposal – is it formal and professional, or does it need a touch of creativity to stand out? By paying attention to these details, you can elevate your proposal from good to outstanding.

Reviewing and Editing Your Proposal

Take the time to thoroughly review your proposal for clarity, grammar, and coherence.

Pay attention to the flow of your ideas and make sure that each section seamlessly transitions to the next.

Edit out any unnecessary jargon or technical language that might confuse the reader.

Aim for a polished and professional final product.

Another aspect to consider during the editing process is the overall structure of your proposal.

Ensure that your introduction grabs the reader’s attention, the body provides compelling evidence to support your request, and the conclusion leaves a lasting impression.

A well-structured proposal not only conveys your message effectively but also shows your attention to detail and organization.

Seeking Professional Feedback

Consider seeking feedback from colleagues, mentors, or professionals in your field.

They can offer valuable insights and suggestions to improve the overall quality and persuasiveness of your proposal.

Act on their feedback and revise your proposal accordingly for the best possible results.

When seeking feedback, be open to constructive criticism and different perspectives.

Remember, the goal is not just to make your proposal better but to make it the best it can be.

Embrace feedback as an opportunity for growth and refinement, and use it to your advantage in perfecting your proposal.

- Submitting Your Proposal

Once you are satisfied with your final proposal, it is time to submit it to potential funders.

However, before hitting that submit button, take a moment to familiarize yourself with the submission guidelines of each funder you are targeting.

Submitting a proposal is a crucial step in securing funding for your project.

It is not just about the content of your proposal but also about how you present it.

Make sure your proposal is well-organized, visually appealing, and error-free.

Consider seeking feedback from colleagues or mentors to ensure that your proposal is polished and professional.

Understanding Submission Guidelines

Carefully read and follow the submission guidelines provided by each funder.

Pay attention to formatting requirements, document length limitations, and any specific instructions provided.

Adhering to these guidelines will demonstrate your professionalism and attention to detail.

Each funder may have unique preferences and requirements when it comes to proposals.

Some may prefer a concise summary, while others may expect a detailed breakdown of your project plan.

Tailor your proposal to meet the specific guidelines of each funder to increase your chances of success.

Following Up After Submission

After submitting your proposal, it is essential to follow up with potential funders. Wait for a reasonable amount of time before reaching out to inquire about the status of your proposal.

Express your continued interest and enthusiasm for the opportunity to discuss your project further if selected for funding.

Building relationships with funders is key to securing future funding opportunities.

Even if your current proposal is not successful, maintaining a positive and professional rapport with funders can open doors for collaboration and support in the future.

Keep track of your interactions and follow-ups to ensure that you are nurturing these important connections.

Writing a funding proposal may seem daunting, but with careful planning, thorough research, and persuasive writing, you can create a compelling case for financial support.

Follow this step-by-step guide to ensure that your funding proposal stands out and increases your chances of securing the funding you need to turn your project into a reality.

Simplified business systems for busy people.

Systems Simplified. The top strategies and tools to streamline your sales process and close deals faster, in your inbox, every now and then.

Join hundreds of business leaders who receive Systems Simplified.

You May Also Like…

Pandadoc integration with hubspot.

In the digital age, businesses are constantly seeking ways to streamline their operations and improve efficiency. One...

How to Write a Sponsorship Proposal

Sponsorship proposals are essential documents for individuals and organizations seeking financial support for their...

How to Write a Consulting Proposal

Writing a consulting proposal is an essential part of the consulting process. It serves as a formal document that...

Automated page speed optimizations for fast site performance

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

- Business Loans

How To Write A Successful Business Plan For A Loan

Updated: Aug 18, 2022, 12:46pm

A business plan is a document that lays out a company’s strategy and, in some cases, how a business owner plans to use loan funds, investments and capital. It demonstrates that a business is already producing income and has a plan to continue doing so moving forward.

A successful business plan is well-written, realistic, concise and, most importantly, convinces financial institutions that approving your business for a loan is a smart choice.

Here’s what you need to know about each section of a business plan and how to write a plan that will earn a lender’s stamp of approval.

Featured Partner Offers

$5,000 to $250,000

Varies by loan

Via Ondeck's Website

American Express Business Blueprint™

$2,000 to $250,000

Varies by loan term

of at least 660 FICO at the time of application

Via American Express's Website

National Funding

$10,000 to $500,000

Buy rates start at 1.11%

On National Funding's Website

What Does a Successful Business Plan Include?

A successful business plan outlines your entire business and effectively explains how it makes money and why it’s likely to succeed. This is especially important if you’re trying to get a small business loan .

The content of a business plan should vary from company to company, but there are a few common sections that will help lenders better understand your business and help you qualify for financing.

Executive Summary

An executive summary concisely summarizes your business plan—usually on one page. The goals of this section are to inform the reader about the business as a whole, summarize what is contained in the rest of the document and capture their interest. That said, the best use of this section may depend on the age of your business.

- Startups. Startup owners typically use the executive summary to discuss the business opportunity, their target market and their planned strategy for building the business. The section also may touch on relevant market competition. Startup companies in particular should use the executive summary to build a lender’s confidence in the business.

- Established businesses. Companies that have been in business for several years usually orient their executive summaries around past achievements and growth plans. In this case, the section may begin with the company’s mission statement and provide information about business operations and financials before outlining future goals.

Industry Analysis

The industry analysis section of a business plan defines the business’ industry and mentions current trends—with a focus on risks and opportunities. The section also informs the reader about how the industry works and where the business fits in the industry as a whole.

This section should start by defining the industry, as well as what products and services it provides, and what consumer demand it fulfills. Next, identify the most important influences in the industry. In the case of a bank, this may include applicable government regulations; for a clothing boutique, it may be consumer trends and budget.

The industry analysis should also define the company’s intended niche in the industry.

Market Analysis

The market analysis zooms into the specific market niche mentioned in the previous section. Market analysis aims to detail the segment of the broader market the business is intended to fit within. For example, a fashion brand or boutique may target high-income consumers.

Use this section to explain how the segment differs from the wider industry. In the fashion boutique example, a market analysis may reveal that high-income consumers in the fashion industry pay substantially more for brands that are considered exclusive.

Also, describe the size of your business’ niche and how it fits into the wider industry. This should include mention of how many existing businesses operate in this niche and how they target consumers.

Competitor Analysis

A competitor analysis explains what competitors in your niche do and informs the reader of the current market environment. Start with an overall assessment of your competitors. Then, discuss the most relevant competitors for your niche. When conducting a competitor analysis, ask yourself the following questions:

- Where do your ideal customers currently shop?

- How do these competitors differentiate themselves?

- How are competitor products and services priced?

- Why do customers choose those products or service providers?

Using the example above, many clothing boutiques compete by providing higher quality products or a unique, luxury shopping experience. If your store has a single location, your competitor might be another clothing store with a similar price-point or signature style.

Target Market Segmentation

In the target market segmentation, you’ll identify your business’ target market and describe how you will meet its needs. This section aims to instill confidence in the lender by providing a clear and objective strategy for building revenue.

Begin the section by informing how your products or services meet your shoppers’ needs. Next, explain how consumers can access your products or services—including a brief outline of your marketing strategy and how it is tailored to your target clients. Contrast this to your competitors’ strategy as defined in the previous section. After reading this portion of the business plan, the lender should know exactly how your business intends to compete.

Services or Products Offered

Use this section of the plan to explain what your business offers its ideal customers and to contrast your product and service offering to that of your competitors. Start by defining your product and service offering, including pricing. Also, inform the reader what equipment or materials you need to provide your products and services. For instance, a fashion apparel brand needs access to textile manufacturers.

Marketing Plan and Sales Strategy

Now that the lender understands what you offer, explain how you plan to market it in greater detail. This section outlines how you’ll attract and convince consumers to buy from you. The goal is to provide a flexible and realistic marketing and sales plan that convinces the reader you know how to attract consumers.

The sales strategy section of your business plan also should include the company’s revenue goals and explain how your marketing and sales department will achieve them. Provide in-depth details on the marketing and sales challenges you’ll face and how to overcome them. While this information is always relevant, it’s particularly important to lenders reviewing your loan application as they will want to know how you plan to make money.

Operations Plan

The operations plan details your company’s day-to-day operations. This detail-oriented section should comprehensively explain how your business will operate, beginning with a list of your company’s daily activities.

As a high-end clothing boutique, your daily operations may include:

- A manager reconciling sales receipts and inventory numbers

- Stylists researching future trends and sourcing new inventory

- A marketing team building an online and social media presence

Note: This section is more about your business’s daily processes rather than its organizational structure—which is the next section.

Management Team

Use the management section of your business plan to tell the lender who does what in the company and how they’re compensated. Help the lender better understand the people behind the company by including biographical and background information on the company’s owners and key executives.

The best way to present this information is often with an organizational flowchart. You can also include other information about the company in this section, like your mission statement and values.

Financial Plan

Your financial plan tells a prospective lender two things: how much you plan to spend each year and how much you’ll earn in revenue. This section is the most important for most businesses, as it can make or break a lender’s confidence and willingness to extend credit.

Always include the following documents in the financial section of your business plan:

- Cash flow statements

- Income statements

- Capital expenditure budgets

- Balance sheets

Most lenders ask established businesses for at least three years of financial data, and some may ask for five. Preferably, include as much financial data as possible. If you’re a startup, include estimated costs and projected revenue, and supplement your data with industry averages or financial data from competitors.

Exit Strategy

Your business plan should always include an exit strategy in case things go wrong or you simply decide to close up shop. This may include everything from taking on new partners to selling your business or even declaring bankruptcy. Having an exit strategy is another way to show lenders that you have thought about the risks involved with your business and are prepared for them.

The appendix of a business plan normally contains financial information and other documents the reader may need to gain a comprehensive understanding of the business. Established businesses typically include financial statements and projections, at a minimum. In contrast, a startup could include the research they conducted to make the business plan.

Also consider including relevant resumes, marketing materials, letters of recommendation or references. For ease, your appendix should have a table of contents directing lenders to the most important documents.

What Lenders Look for In a Business Plan

There are five things that lenders typically look at when making business lending decisions: character, capacity, capital, conditions and collateral. By understanding these key considerations, you can draft a business plan that speaks to a lender’s interests and concerns.

A business’ character includes subjective, intangible qualities like whether its owners are perceived as honest, competent or determined. Stated another way, lenders want to know that you are honest and have integrity. These qualities can be critical for evaluating candidates because most lenders don’t want to lend to someone they don’t feel they can trust.

To evaluate the character of you and your business, lenders look at your personal credit history as well as your business’ financial history. Use your business plan to bolster your character by including ample financial records, letters of recommendation and other relevant documents.

Lenders want to know that you have the ability to repay the loan. They evaluate this by looking at your business’ financial history to see how much revenue you have generated in the past and how much profit you have made.

Lenders might also judge your capacity based on your business’ financial projections as well as your personal credit history and household income. Where relevant, lenders look at your management team to see if they have the experience needed to grow your business or keep it on a path toward success.

When reviewing your loan application, lenders read your business plan to see how much money you need to borrow and how you will repay the loan. They also look at your financial statements to see how much cash you have on hand and how much debt you are carrying.

Likewise, lenders often prefer business owners who have made larger personal financial investments in their enterprises. A personal financial investment reveals your commitment to the business and demonstrates you have the resources to pay off a large loan.

Ultimately, a lender’s biggest concern is whether your business can realistically succeed. So, they judge your company’s chances of success using your business plan as well as current market conditions. A good business plan can improve your lender’s confidence by convincing the lender that market conditions and your business strategy increase your odds of success.

In some cases, lenders want to know that you have something of value that they can use to secure the loan. This can be property, equipment, inventory or even receivables. If you don’t have any collateral, lenders may still approve a loan if you have a good credit history and a solid business plan.

Find the Best Small Business Loans of 2024

- Best Small Business Loans

- Best No Credit Check Business Loans

- Best Business Lines Of Credit

- Best Startup Business Loans

- Best Business Loans For Bad Credit

- Best Startup Business Loans For Bad Credit

- Best Fast Business Loans

- Best LLC Loans

- Best Same-Day Business Loans

- Best Business Loans For Low-Revenue Companies

- National Funding Business Loans Review

- OnDeck Business Loans Review

- Bluevine Business Loan Review

- American Express Business Blueprint Review

- Fundbox Business Loans Review

- Lendio Business Loans Review

- Funding Circle Business Loans Review

- Rapid Finance Business Loans Review

- QuickBridge Business Loans Review

- Business Loan Calculator

- SBA Loan Calculator

- How To Get A Business Loan

- How Do Business Loans Work?

- How To Get A Startup Business Loan

- How To Get A Business Line Of Credit

- Guide To No-Doc Business Loans

- How To Get A Business Loan With No Money

- How To Get A Loan To Buy A Business

- How To Get a Small Business Grant

- 13 Business Grants For Women

- How Do I Find My EIN Online?

- Small Business Loan Terms

FundThrough Review 2024

How Hard Is It To Get A Business Loan?

Pros And Cons Of Business Loans

Balboa Capital Business Loans Review 2024

TD Bank Business Loans Review 2024

What Credit Score Do I Need For A Business Loan?

Kiah Treece is a small business owner and personal finance expert with experience in loans, business and personal finance, insurance and real estate. Her focus is on demystifying debt to help individuals and business owners take control of their finances. She has also been featured by Investopedia, Los Angeles Times, Money.com and other financial publications.

We use essential cookies to make Venngage work. By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Manage Cookies

Cookies and similar technologies collect certain information about how you’re using our website. Some of them are essential, and without them you wouldn’t be able to use Venngage. But others are optional, and you get to choose whether we use them or not.

Strictly Necessary Cookies

These cookies are always on, as they’re essential for making Venngage work, and making it safe. Without these cookies, services you’ve asked for can’t be provided.

Show cookie providers

- Google Login

Functionality Cookies

These cookies help us provide enhanced functionality and personalisation, and remember your settings. They may be set by us or by third party providers.

Performance Cookies

These cookies help us analyze how many people are using Venngage, where they come from and how they're using it. If you opt out of these cookies, we can’t get feedback to make Venngage better for you and all our users.

- Google Analytics

Targeting Cookies

These cookies are set by our advertising partners to track your activity and show you relevant Venngage ads on other sites as you browse the internet.

- Google Tag Manager

- Infographics

- Daily Infographics

- Popular Templates

- Accessibility

- Graphic Design

- Graphs and Charts

- Data Visualization

- Human Resources

- Beginner Guides

Blog Business How to Write Business Proposal (Examples + Free Templates)

How to Write Business Proposal (Examples + Free Templates)

Written by: Aditya Sheth Jan 25, 2024

The great Mark Cuban once said, “Sales cure all.” If a business doesn’t sell, it doesn’t make money and by extension the business fails. That’s why you need to write business proposals .

A well-written business proposal can often mean the difference between winning or losing a prospective client.

In this in-depth guide to creating business proposals, we show you how to close more deals, make more sales and crush your business goals — all by using easy-to-edit professional business proposal templates .

Here’s what this guide will cover (click to jump ahead):

What is a business proposal, what are the components of a business proposal.

- How to write a business proposal step by step

More business proposal examples + writing and design tips

What should you include in a business proposal, what are the types of business proposals.

- FAQs about business proposals

Looking for a shortcut? Watch this quick video for an overview of everything to include in your business proposal:

A business proposal is a document designed to outline a business plan to convince potential client, investor or partner to engage in a business agreement with you or your company. It’s basically a sales pitch in writing to persuade potential clients to show them benefits of working with you or your company for their business success.

A business proposal outlines what your business does and what you can do for your client . It can be general like this business proposal example:

Or it can be more specific, like this business proposal template which focuses on proposing a project for the Newton Center Rail:

Or this business proposal sample, which presents a plan for a social media strategy and campaign:

To design a business proposal that holds the client’s attention, identify their pain points. Then provide your buyer with the right solution to alleviate those frustrations.

Working on a new project? These project proposal examples might come in handy for you.

The components of a business proposal can change depending on the field, company size and client needs. While details may differ, strong proposals typically introduce your company, explain the problem, offer a solution and its benefits, highlight your team’s skills, and outline timeline, cost and next steps.

Sometimes, the complexity of crafting a business proposal, especially in projects requiring thorough market analysis or technical details, calls for professional insight. Seeking research proposal writing help can be invaluable in these instances, ensuring that your business proposals are not only well-structured but also highly persuasive and tailored to meet specific client needs.

How to write a business proposal step by step

Before you start creating your business proposal template, you need to understand the business proposal format. At a high level, your effective business proposal should include the following:

- Create a compelling business proposal title

- Build a table of contents

- Craft the executive summary

- Write a detailed problem statement

- Propose your solutions

- Showcase your team’s expertise

- Create a realistic timeline

- Present your payment structure

- Specify the terms and conditions

- Receiving the decision

Below, you can see business proposal examples that demonstrate how to include these 10 sections.

1. Create a compelling business proposal title

A compelling title could mean the difference between someone reading your proposal or ignoring it in favor of a competitor’s.

What makes a good title page? Here are the essential elements to include:

- Your name along with your company’s name

- The name of the prospect (or their business)

- The date you’re submitting the proposal

The gray business consulting proposal template above contains all the details a prospect would want to know. The title also offers a strong tangible benefit to the prospective buyer. Honestly, “Who doesn’t want to grow their business?”

2. Build a table of contents

The table of contents is a fundamental part of every winning business proposal template. It makes your proposal scannable and easy to read.

The people you will be pitching to are usually C-level executives like the CEO (Chief Executive Officer), COO (Chief Operating Officer), or fractional executives who work part-time. These are busy people who don’t have time to read your entire proposal in one go.

That’s why most of the business proposal examples in this list include a table of contents.

Adding a table of contents to your document makes it easy for them to go through it at their own pace. They can also skim through parts of the proposal that they deem more important. You can see how this abstract business proposal template uses the table of contents:

You can also make your business proposal template easier to navigate by adding hyperlinks to the document, particularly in the table of contents. This way your clients can jump to specific sections without having to scroll through the entire document. Ensuring your business plan format follows a clear structure can greatly enhance readability and comprehension for potential investors or partners.

It’s easy to add hyperlinks in the Venngage editor. Select the text you’d like to turn into a link, then click the link icon in the top bar. From there, select the page you want to link to! Then download your completed design as an Interactive PDF .

3. Craft the executive summary

The executive summary is a staple in all kinds of annual reports , leadership development plan, project plans and even marketing plans. It is a concise summary of the entire contents of your document. In other words, write a business proposal outline that is easy to glance over and that highlights your value proposition.

The goals of your executive summary are:

- Introduce your company to your buyer

- Provide an overview of your company goals

- Showcase your company’s milestones, overall vision and future plans

- Include any other relevant details

This gray business proposal example has a detailed yet short executive summary including some social proof in the form of clients they’ve worked with:

Take note of how precise this business proposal example is. You want to keep your executive summary concise and clear from the get-go. This sets the right tone for the rest of your proposal. It also gives your buyer a reason to continue reading your proposal.

Crafting an executive summary and keeping it concise and compelling can be challenging, but you can use an AI summarizer online or an AI proposal generator to create a polished document or executive summary. Such tools are trained on relevant AI models that can extract core points from a given text. You can get such a point either in bullet form or in abstract summary form.

Pro Tip: Try to write an executive summary such that, even if your prospective client doesn’t read the entire proposal (with a good executive summary, they most likely will), they should have a clear idea about what your company does and how you can help them.

4. Write a detailed problem statement

The point of writing a business proposal is to solve a buyer’s problem. Your goal is to outline the problem statement as clearly as possible. This develops a sense of urgency in your prospect. They will want to find a solution to the problem. And you have that solution.

A well-defined problem statement does two things:

- It shows the prospect you have done your homework instead of sending a generic pitch

- It creates an opportunity for you to point out a problem your prospect might not be aware they had in the first place.

This bold business proposal template above clearly outlines the problem at hand and also offers a ray of hope i.e. how you can solve your prospect’s problem. This brings me to…

5. P ropose your solutions

The good stuff. In the proposed solution section, you show how you can alleviate your prospective buyer’s pain points. This can fit onto the problem statement section but if you have a comprehensive solution or prefer to elaborate on the details, a separate section is a good idea.

Spare no details regarding the solution you will provide. When you write a business proposal, explain how you plan to deliver the solution. Include an estimated timeline of when they can expect your solution and other relevant details.

For inspiration, look at how this business proposal template quickly and succinctly outlines the project plan, deliverables and metrics:

6. Showcase your team’s expertise

At this point, the prospect you’re pitching your solution to likes what they’re reading. But they may not trust you to deliver on your promises. Why is this?

It’s because they don’t know you. Your job is to convince them that you can fix their problem. This section is important because it acts as social proof. You can highlight what your company does best and how qualified your team is when you write a business proposal for a potential client.

This free business proposal template showcases the company’s accolades, client testimonials, relevant case studies, and industry awards. You can also include other forms of social proof to establish yourself as a credible business. This makes it that much more likely that they will say yes!

Pro Tip: Attaching in-depth case studies of your work is a great way to build trust with a potential client by showcasing how you’ve solved similar problems for other clients in the past. Our case study examples post can show you how to do just that.

7. Create a realistic timeline

To further demonstrate just how prepared you are, it’s important to outline the next steps you will take should your buyer decide to work with you.

Provide a timeline of how and when you will complete all your deliverables. You can do this by designing a flow chart . Or add a roadmap with deadlines. Pitching a long-term project? A timeline infographic would be a better fit.

If you look at this abstract business proposal template below, even something as simple as a table can do the trick.

The timeline is not always set in stone, rather it’s an estimation. The goal is to clarify any questions your potential client might have about how you will deliver for the underlying B2B sales process.

8. Present your payment and terms

On this page, you can outline your fees, payment schedule, invoice payment terms, as well as legal aspects involved in this deal. You can even use the Excel Invoice Template to create professional-looking invoices (including brand logo and other elements) and add them to this page.

The adoption of invoice templates is beneficial for small businesses as it streamlines the invoicing process and maintains professionalism in financial dealings. Also, by utilizing small business invoice templates, you can efficiently manage invoicing tasks while upholding a polished and structured approach to financial transactions.

The key to good pricing is to provide your buyer with options. A pricing comparison table can help with this. You want to give your client some room to work with. Make sure you’re not scaring off your client with a high price, nor undervaluing yourself.

Breaking up your pricing in stages is another great way to make sure your potential client knows what he’s paying for. Look at how this simple business proposal template does this:

The legal aspects can slot right into the terms and conditions section. Alternatively, you can add them to the signature section of the proposal to keep things simple.

9. Specify the terms and conditions

Summarize everything you have promised to deliver so far. Include what you expect from your prospective buyer in return. Add the overall project timeline from start to end, as well as payment methods and payment schedule, incorporating these details into an online project management tool. This way, both of you will be clear on what is being agreed on.