How the Quick Commerce Business Model Delivers Convenience in Online Grocery Retailing

- Conference paper

- First Online: 29 April 2023

- Cite this conference paper

- Johanna Rau 2 ,

- Lina Altenburg 3 &

- Alessandro Iuffmann Ghezzi 4

Part of the book series: Springer Proceedings in Business and Economics ((SPBE))

Included in the following conference series:

- Digital Marketing & eCommerce Conference

1990 Accesses

How does the quick commerce business model deliver convenience in online grocery retailing, and how does the convenience provided disrupt the (online) grocery retail market? Taking Haas’ work on a generic retail business model as a departure point, in this book chapter we answer these questions by exploring the quick commerce business model, which is so far bypassed by research. We show how consumer convenience presents the central element of quick commerce operators’ service, being reflected in various ways in their business model dimensions and going beyond the quickness -factor of their deliveries. As a result, in contrast to the suggested framework by McNair ( 1958 ), it becomes apparent how the wheel of retailing spins differently in this context as, instead of leveraging price competitiveness, convenience becomes the competitive advantage.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Free shipping worldwide - see info

- Durable hardcover edition

- Dispatched in 3 to 5 business days

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Anderson, W.T.: Identifying the convenience-oriented consumer. J. Mark. Res. 8 (2), 179–183 (1971)

Article Google Scholar

Berry, L.L.: Revisiting “big ideas in services marketing” 30 years later. J. Serv. Mark. 30 (1), 3–6 (2016)

Berry, L.L., Seiders, K., Grewal, D.: Understanding service convenience. J. Mark. 66 (3), 1–17 (2002)

Broniarczyk, S.M., Hoyer, W.D.: Retail assortment: more ≠ better. In: Krafft, M., Mantrala, M.K. (eds.) Retailing in the 21st Century, pp. 271–284. Springer, Heidelberg (2010). https://doi.org/10.1007/978-3-540-72003-4_17

Chapter Google Scholar

Brown, S.: The wheel of retailing: Past and future. J. Retail. 66 (2), 143 (1990)

Google Scholar

Gielens, K.: From one disruption to the next: How to navigate chaos? J. Retail. 98 (3), 373–377 (2022)

Haas, Y.: Developing a generic retail business model–a qualitative comparative study. Int. J. Retail Distrib. Manage. (2019)

Hollander, S.C.: The wheel of retailing. J. Mark. 25 (1), 37–42 (1960)

Kim, S., Choi, J., Kim, S.H.: Do handwritten notes benefit online retailers? a field experiment. J. Interact. Mark. 57 (4), 651–664 (2022)

McNair, M.P.: Significant trends and developments in the postwar period. In: Smith, A.B., (ed.) Competitive Distribution in a Free High-Level Economy and its IMplications for the University, Pittsburgh, University of Pittsburgh Press (1958)

Mukhopadhyay, M.: Who moved my grocery, in 10 minutes?-A light on Indian dark stores. A light on Indian dark stores (February 18, 2022)

Nierynck, R.:Quick commerce: pioneering the next generation of delivery. Delivery Hero (2020). https://www.deliveryhero.com/blog/quick-commerce/ . Accessed 19 Dec 2022

O’Brien, P., Haeck, P.: Dark commerce’ backlash grows in cities across Europe, Politico (2022). https://www.politico.eu/article/dark-commerce-rules-ramp-up-as-stores-shut-down/ . Accessed 14 Dec 2022

Reul, M.: Gorillas to launch own private label brands (2022). https://www.retaildetail.eu/news/food/gorillas-to-launch-own-private-label-brands/ . Accessed 12 Dec 2022

Reul, M.: Quick commerce badly hit: two more companies announce cuts (2022). https://www.retaildetail.eu/news/food/quick-commerce-krijgt-klappen-nog-twee-flitsbezorgers-moeten-inkrimpen/ . Accessed 12 Dec 2022

Rinaldi, C., D’Aguilar, M., Egan, M.: Understanding the online environment for the delivery of food, alcohol and tobacco: an exploratory analysis of ‘dark kitchens’ and rapid grocery delivery services. Int. J. Environ. Res. Public Health 19 (9), 5523 (2022)

Seiders, K.B., Berry, L., Gresham, L.: Attention, retailers! How convenient is your convenience strategy? Sloan Manage. Rev. 41 , 79–89 (2000)

Shankar, V., et al.: How technology is changing retail. J. Retail. 97 (1), 13–27 (2021)

Shapiro, A.: Platform urbanism in a pandemic: dark stores, ghost kitchens, and the logistical-urban frontier. J. Consum. Cult. 23 (1), 168–187 (2022)

Download references

Author information

Authors and affiliations.

Department of Business Administration, University of Gothenburg, Gothenburg, Sweden

Johanna Rau

Faculty of Economics and Business, KU Leuven, Antwerp, Belgium

Lina Altenburg

Faculty of Economics and Law, Catholic University of the Sacred Hearth, Piacenza, Italy

Alessandro Iuffmann Ghezzi

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Johanna Rau .

Editor information

Editors and affiliations.

Department of Business Administration 1, Business School, University of Granada, Granada, Spain

Francisco J. Martínez-López

Rights and permissions

Reprints and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper.

Rau, J., Altenburg, L., Ghezzi, A.I. (2023). How the Quick Commerce Business Model Delivers Convenience in Online Grocery Retailing. In: Martínez-López, F.J. (eds) Advances in Digital Marketing and eCommerce. DMEC 2023. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-031-31836-8_10

Download citation

DOI : https://doi.org/10.1007/978-3-031-31836-8_10

Published : 29 April 2023

Publisher Name : Springer, Cham

Print ISBN : 978-3-031-31835-1

Online ISBN : 978-3-031-31836-8

eBook Packages : Business and Management Business and Management (R0)

Share this paper

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- IIMA Institutional Repository

This Institutional Repository has been created to collect, preserve and distribute the scholarly output of Indian Institute of Management, Ahmedabad. This will work as an important tool to facilitate scholarly communication and preserve the institution knowledge. The Vikram Sarabhai Library is proud to be hosting the repository for the dissemination and preservation of this valuable knowledge resource of the IIMA community.

- Working Papers

Items in IIMA Institutional Repository are protected by copyright, with all rights reserved, unless otherwise indicated.

Slider jquery of your page of your page 1 2 3 slider jquery by WOWSlider.com v8.8

By department.

- Research Publications 52381

- Researchers 5498

- Organization Units 167

- Projects 121

This repository provides metadata of IIMB Publications and aimed at creating and preserving an archive of Institution scholarship. IIMB Publications include Articles, Working Papers (FULL TEXT), Book Chapters published by Faculty, Doctoral Dissertations by FPM Scholars and Project reports of Students enrolled in various courses of IIMB.

- Students Scholar Bank

Files in This Item:

Google Scholar TM

Items in DSpace are protected by copyright, with all rights reserved, unless otherwise indicated.

- Harvard Business School →

- Faculty & Research →

- HBS Case Collection

Glovo: Expanding Quick Commerce

- Format: Print

- | Language: English

- | Pages: 30

About The Author

Antonio Moreno

Related work.

- July 2021 (Revised October 2021)

- Faculty Research

- Glovo: Expanding Quick Commerce By: Antonio Moreno and Anibha Singh

From Quick Commerce to Instant Needs: Exploring Business Models in Rapid Delivery

What's Inside

This report examines the booming quick-commerce retail space and explores the differences between third-party delivery platforms and vertically integrated instant-needs companies. We also discuss the key players in the market.

Click here to read all Coresight Research coverage of grocery retailers.

For our Retail Innovators report on the US grocery market, click here .

Click here to view the Event Presentation.

Executive Summary

We explore the spectrum of business models in the quick-commerce retail space, which we estimate will generate $20–25 billion in US retail sales in 2021.

- The quick-commerce landscape includes longstanding same-day delivery platforms that deliver orders from local, third-party retailers, including DoorDash, Instacart and Uber Eats. In the vertically integrated instant-needs segment, Gopuff is the largest and most established player. New entrants focused on shorter delivery times include Fridge No More, Gorillas, JOKR and 1520.

- We have seen a boom in funding in the vertically integrated instant-needs segment, which we calculate totals $5.9 billion to date. Gopuff has captured over half of that: Its valuation jumped to $15 billion after a July 2021 $1 billion fundraiser.

- Instant-needs players generate their contribution margin largely through the difference between product costs and product sales. Vertical integration is key to rapid delivery: Instant-needs operators procure their own inventory and build out their own micro-fulfillment centers (MFCs) for picking orders. For delivery platforms, variable consumer fees are the principal driver of contribution margin. As they operate an asset-light model, they carry lower inventory risks and can scale faster.

- The substantial order volumes and pace of growth in the sector confirm that consumer demand for immediate fulfillment is there. We see the impact extending beyond a shift of market share: Widespread consumer use of quick commerce could ultimately result in a partial disaggregation of grocery baskets and other shopping trips.

What’s the Story?

Convenience is now more of a retail concept than a retail channel. No longer does a consumer need to walk or drive to their local convenience store to grab last-minute essentials; instead, convenience store selections (and more) come to them via quick-commerce operators. Not only has the quick-commerce sector expanded in terms of geographic coverage and product offerings, but the number of players has boomed. The explosion in industry participants is heavily concentrated on the vertically integrated segment, where players promise deliveries from their own fulfillment centers to urban consumers in as little as 10–15 minutes.

We explore the spectrum of business models in this space and examine the differences in their economic operations. We also discuss key players in the market. Our coverage of quick commerce focuses on two segments:

- Third-party delivery platforms —such as DoorDash, Instacart, Shipt and Uber Eats. These companies deliver products (largely grocery items) from third-party retail stores. In some cases, these delivery firms pick the orders while in others they only fulfill delivery. The promise has traditionally been for “same-day” delivery, although options now range from 30 minutes to several hours.

- Vertically integrated models —such as Gopuff, Fridge No More and 1520. These companies pick from a range of essential items in their own dark stores and courier them to shoppers, typically within 10–30 minutes.

Why It Matters

The online grocery boom in 2020 supported the emergence of a micro-industry of instant-need players, competing with more established operators that typically offer longer delivery windows for share of the expanding market grocery delivery market. Investors are betting big on instant needs, with a host of companies securing significant seed or sequential financing rounds since the beginning of 2021.

Coresight Research estimates that retail sales (predominantly grocery/essentials) by major players in the overall quick-commerce market will total $20–25 billion in the US this year. This equates to a 10%–13% share of our estimate for US online CPG sales, which we expect to total around $191 billion in 2021.

We factor in management commentary by public companies such as DoorDash and Uber, third-party data and our own estimates; which reflect the value of sales (gross merchandise volume) rather than revenues for delivery platforms, and exclude Amazon rapid delivery, such as Prime Now.

From Quick Commerce to Instant Needs: Coresight Research Analysis

In the below sections, we establish the quick-commerce landscape and explore business model differences and economics. We also discuss key players in the market.

1. From Same-Day to 10-Minute Delivery: The Quick-Commerce Landscape

In 2011 and 2012, respectively, Postmates (now Uber Eats) and Instacart established the quick-commerce , or hyperlocal, delivery model. Their model is built on working with third-party retailers (or restaurants) for the product itself. These quick-commerce firms are fulfillment intermediaries, traditionally promising “same-day” delivery, although the lower ranges of this (offered at a premium) have been pushed down to 30–45 minutes. Postmates collects orders from restaurants and retailers and brings them to the customer while Instacart picks and delivers from partner stores on behalf of the customer.

Established in 2013, Gopuff took quick commerce and turned it into instant needs , carving out the abovementioned vertically integrated segment, offering delivery in an average of 30 minutes. Following its move into third-party grocery in 2018, DoorDash entered the vertically integrated instant-needs space in August 2020. It has established its own DashMart convenience stores offering delivery of essentials in 30 minutes or less.

More recently, 15-minute commerce operators have intensified instant needs in terms of speed promises. Operators such as Fridge No More, JOKR and 1520 have entered the market, borrowing the vertically integrated model to promise delivery in as little as 10–15 minutes.

In Figure 1, we provide a comparison of vertically integrated firms with delivery platforms. We have added in a comparison with meal delivery platforms and the traditional e-commerce model, too. We offer a full break-out of details by company at the end of this report.

Figure 1. Overview of Online Fulfillment in the US

Quick Commerce in Retail

Source: Company reports/Coresight Research

We have seen a boom in funding in the vertically integrated instant-needs segment, which we calculate totals $5.9 billion to date. Gopuff has captured over half of that: Its valuation jumped to $15 billion after a July 2021 $1 billion fundraiser—equating to a quadrupled value in less than a year and taking its total funding to $3.4 billion. Istanbul-based Getir is valued at $7.5 billion following three funding rounds between January and June 2021.

2. Online Grocery Shopping Surge Underpins Quick-Commerce Demand

The pandemic acted as a significant catalyst in accelerating online grocery adoption, driving fundamental, lasting changes in consumer behavior. Coresight Research’s US consumer survey on October 18, 2021, found that almost half (48.8%) of respondents had bought groceries online in the past 12 months. We expect the online channel to see permanent gains as consumers retain their online shopping behaviors post pandemic.

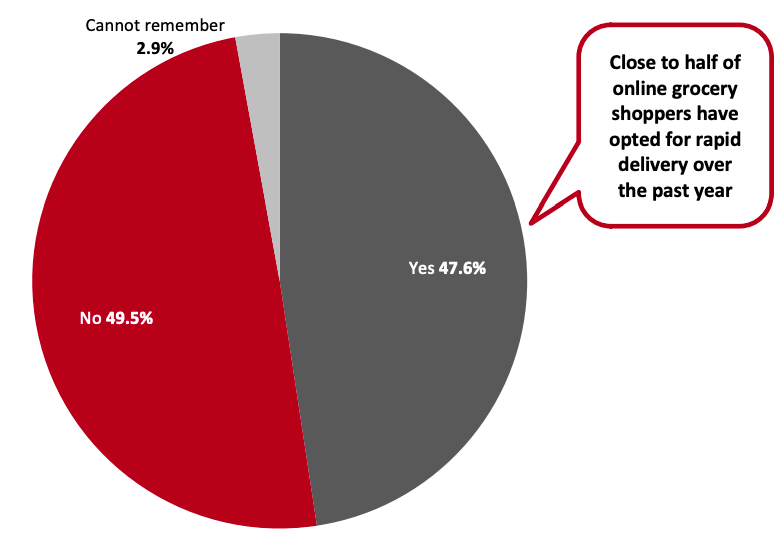

Delivery time is becoming increasingly important in online grocery shopping experiences. Our abovementioned survey found that around 48% of respondents that had purchased groceries online had selected rapid delivery, which includes same-day, one-hour and 15-minute/30-minute services.

Figure 3. Online Grocery Shoppers: Proportion That Had Used Rapid Delivery Services for Groceries in the Past Year*

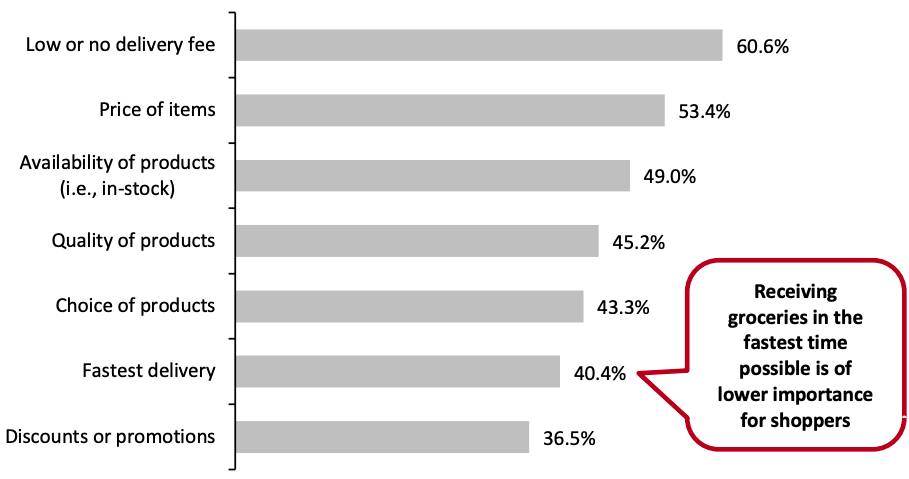

We asked online grocery shoppers which factors influence them most in choosing a rapid delivery service.

- The results suggest substantial price sensitivity in this space: Around 61% of respondents said low or no delivery fee is important, followed by 53% reporting that the price of items is key. Potential future increases in delivery fees in the near term therefore look problematic—particularly given the competitive environment—suggesting that operators will need to subsidize free or low-cost delivery, at least until the market has consolidated and competition has diminished.

- Fastest delivery is ranked lower, implying that shoppers are comfortable with slightly longer delivery times, which typically bring lower costs to the service. This relative disinterest suggests that five-minute increments in delivery times are unlikely to be a principal driver of choice among the general population (although we acknowledge that expectations of speed may be higher in large cities such as New York).

Figure 4. Online Grocery Shoppers: Factors That Are, or Would Be, Most Important to Them When Choosing a Rapid Delivery Service (% of Respondents)

3. Business Model Differences and Economics

There are significant differences between quick-commerce players—in scale, business model and delivery offering—and with these distinctions come differing advantages and economies. In this section, we compare vertically integrated companies with delivery platforms and we discuss economics below.

Vertically Integrated

These operators build out their own first-party MFCs, akin to dark stores, and engage employees to pick orders as well as couriers to deliver them.

- Vertically integrated MFCs are optimized for speedy picking and are strategically located as close to customers as possible, enabling instant-needs operators to promise such short delivery times.

- By owning inventory, vertically integrated players also have greater visibility on product quality, inventory supply and pricing.

- Instant-needs companies typically carry a fast-rotating assortment of 1,000–2,000 goods (although Gopuff offers up to 4,000) that are localized to the neighborhoods they serve. For example, Buyk takes a “hyperlocal” approach to assortment to ensure that its MFCs stock meets the specific needs and desires of shoppers in each particular area it serves.

- Some operators are planning to flex their SKU range. Instant-needs company 1520, which typically carries 1,500 items, said that it is planning to target 3,000 SKUs in the near future, targeting a wider range of consumer needs.

- Instant needs depends on a degree of population density (and moreso when the delivery time is as little as 15 minutes) and as more players enter the market, the risk of increasing rental costs for MFCs in urban locations could drive up upfront investment.

- Setting up MFCs and procuring inventory requires capital investment before entering a new city or market.

- The underlying model of investing in (dark) stores and relying on operational leverage to drive margins has some similarities to traditional brick-and-mortar retail, and comes with similar weaknesses (and strengths), such as volume sensitivity.

Delivery Platforms

Under the delivery platform model, product inventory is owned by third-party retailers and the delivery operators aggregate these third-party merchants on digital platforms.

- Delivery platforms operate an asset-light model, which does not require fulfillment centers to be deployed or supplier relationships to be established before entering a new city.

- These platforms will usually offer more choice than vertically integrated players, although the overall offer will be driven by the operating hours and the selection of the third-party retailers’ stores.

- The store-pick model employed by delivery operators is more susceptible to out-of-stocks as the platforms do not have full, real-time visibility into the retailer’s in-store inventory. Additionally, delivery platforms surrender pricing power to third-party merchants (retailers) and some retailers raise prices on delivery apps to help offset the merchant fees that they pay to the delivery firm. Some municipalities cap merchant fees, which can push up consumer fees.

- A reliance on per-transaction fees suggests a relatively straight line for costs as sales grow, meaning delivery platforms have a lesser degree of operational leverage than the dark-store model.

DoorDash has adopted a hybrid approach with third-party delivery capabilities (marketplace and Drive) as well as operating a vertically integrated model through its DashMart dark stores. Each of its 25 DashMart locations carries around 2,000 SKUs and provides both delivery and pickup options.

Economics: Scale

Scale is a key component of profitability for vertically integrated instant-needs players. Since they are vertically integrated, instant-needs operators can secure more advantageous prices from suppliers as they scale. And, as in regular retail, greater volumes equate to a leveraging of fixed operating costs, driving margins.

Like conventional retailers, instant-needs players generate their contribution margin largely through the difference between product costs and product sales. This is a key distinction from delivery platform models, where variable consumer fees are the principal driver of contribution margin, topped up by fees charged to merchants.

Delivery platforms do not need to build out physical infrastructure or inventories. As a result, these businesses are able to scale relatively quickly. From July 2020 to July 2021, Instacart increased its delivery reach from 30,000 stores to nearly 55,000 stores in North America, and is available to over 85% of US households.

To increase network density, delivery platforms are adding new retail partners outside the core grocery business. Instacart has added apparel (H&M), beauty (Sephora), general merchandise (Big Lots) and prescription delivery (Costco) to its portfolio. In addition, Shipt has also expanded beyond grocery to include apparel delivery from Target stores. For traditional grocery players that had outsourced delivery and pickup, diversification will be essential in bringing more last-mile operations in-house. Globally, the online grocery market tends to see retailers take more control of last-mile logistics (such as truck fleets) than in nonfood retail.

For all models , greater scale opens more opportunities for secondary revenue streams, notably retail media or in-app advertising. The shift of grocery sales online is driving advertising to where shoppers are—on retailers’ websites and apps. Kroger and Walmart are among the established grocery retailers pursuing opportunities in retail media. In May 2020, Instacart launched a new self-serve advertising program that CPG brands can use to promote their products on its website and app. Furthermore, Gopuff launched its Gopuff Ad Solutions business in June 2021. At the Groceryshop 2021 conference , Yakir Gola, Co-Founder and Co-CEO of Gopuff, pointed to the company’s opportunities in retail media, stating that as an instant-needs platform, it can influence the customer’s decision at the moment of consumption. DoorDash launched a new advertising offering in October 2021.

Instant-needs players generate their contribution margin largely through the difference between product costs and product sales. This is a key distinction from delivery-platform models, where variable consumer fees are the principal driver of contribution margin, topped up by fees charged to merchants.

Delivery times can impact the economics of quick commerce: With extended delivery times comes the ability to pool multiple orders in one delivery.

Figure 5 summarizes the different economics of the vertically integrated instant-needs model and delivery model discussed.

All of the vertically integrated instant-needs players discussed are privately owned. Nazim Salur, CEO and Founder of Getir (not yet in the US market), told the New York Times in 2021 that a neighborhood can be profitable after a year or two. Similarly, Gopuff management has stated it has achieved profitability in every market that it has operated in for more than 18 months. Furthermore, German online grocery and restaurant delivery company Delivery Hero has disclosed a profit contribution of €1.3 ($1.5) per order in its DMart dark-store business.

Among the delivery platforms , Uber’s “Delivery” segment Uber Eats remains loss-making, with an adjusted EBITDA margin (as a percentage of gross bookings, which is akin to gross merchandise volume) of (1.6)% in the first quarter of 2021 and (1.2)% in the second quarter. Uber’s Delivery gross bookings increased by 85% year over year to $12.9 billion in the second quarter; this is worldwide and largely restaurant bookings—in the second quarter, management commented that “grocery and new verticals” (which includes convenience and alcohol) accounted for about 5%–6% of total gross bookings.

At DoorDash, adjusted EBITDA as a percentage of gross order volume stood at 0.4% in the first quarter of 2021 and 1.1% in the second quarter. DoorDash reported $10.5 billion in gross order volume in the second quarter, up 70% year over year, largely comprised of restaurant orders. Management stated that “nonrestaurant orders now are totaling over 7% of our total orders” in the first quarter (latest indication). On a statutory basis, DoorDash’s EBIT margin was (9.2)% in the first quarter of 2021 and (8.0)% in the second quarter.

4. Key Players

In Figure 6, we expand on details provided in this report to provide an overview of the operations and offerings of significant players in US quick-commerce retail. Gopuff has a 70+% share of the US vertically integrated instant-needs market, according to data firm YipitData. Buyk is a new entrant and Getir is reportedly soon to launch in the US market.

The retail propositions from DoorDash and Uber Eats emerged from restaurant delivery operations and their retail operations contribute only a single-digit share of their order volumes, as discussed above. In September 2021, Kroger partnered with Instacart to launch Kroger Delivery Now, with orders fulfilled from Kroger stores in around 30 minutes. Services offered directly by retailers include 7NOW from 7-Eleven.

What We Think

Following the influx of new entrants, the instant-needs space is looking unsustainably over-supplied and profit-challenged. Consolidation, with some nascent players falling out of the market, looks inevitable given the glut of businesses competing on such similar unique selling points and often on the same turf. This will likely be compounded by longer-standing players (from both the first-party and third-party sides) continuing to expand aggressively.

It is challenging to discern a medium-term path to profit for small operators promising ultrafast deliveries and no fees. Our survey data suggest that consumers are currently willing to trade off some delivery speed for low or no fees and competitive product prices. Longer term, reduced competition in a more concentrated market—and one with a greater proportion of consumers accustomed to quick commerce—suggests that there will be greater opportunities for firms to pass reasonable costs on to customers. However, emerging players in a capital-intensive sector will need to have the financial support to survive such a consolidation.

Implications for Retail

The substantial order volumes and pace of growth in the sector confirm that consumer demand for rapid fulfillment is there. Given their different business models, delivery platforms and instant-needs players will have different impacts—the former relies on partnering with legacy retailers while the latter competes with those retailers for share. The competitive pressures are already prompting major chains to embark on ventures into immediate fulfillment.

However, we see the impact extending beyond a shift of market share: Widespread consumer use of quick commerce could ultimately result in a partial disaggregation of grocery baskets and other shopping missions—pulling purchases out of larger, more regular shopping trips and into standalone, “as-needs” purchases. This would echo multiyear trends that we have seen in other markets, including in Europe in recent years, where expansion of convenience formats propelled a partial fragmentation of the traditional weekly shop into multiple, smaller grocery trips. This could be replicated in the US—the distinction now is that this would be driven by a new retail model rather than a rival retail channel.

John Mercer, Head of Global Research and Managing Director of Data-Driven Research

Sujeet Naik, Analyst

This document was generated for

Other research you may be interested in:

Earnings Insights 4Q23, Week 2: Alibaba, Amazon and CVS See Strong Sales Growth; Under Armour Witnesses Weak Demand

Consumers Cut Back Amid Inflation Concerns: US Consumer Survey Insights

Weekly US and UK Store Openings and Closures Tracker 2023, Week 15: Closures Up in US and UK

March 2023 US Retail Sales: Growth Decelerates from February

New York • Hong Kong • Lagos • London • Mangaluru (India) • Shanghai

Copyright © 2021 by CORESIGHT RESEARCH . All Rights Reserved

Register for Our Free Daily Newsletter!

Stay up to date with our latest insights and events by subscribing to our newsletter.

Questions? Get in Touch.

- Research Subscriptions

Get In Touch

- Become a Client

Quick Links

- Research Portal

- The Retaili$tic Podcast

Dynamic title for modals

Are you sure.

South Asia Newsletter

Quick commerce is reshaping user behavior in india — and that’s a problem, speed and reliability have ensured high customer delight, but critics worry about rider safety..

By Nilesh Christopher

Nilesh Christopher is a reporter based in Bengaluru, India.

South Asia Newsletter This essay is from our South Asia newsletter. You can read past editions of the newsletter here.

Quick commerce is shaking up the Indian e-grocery industry, drawing in impulse buyers with the promise of superfast delivery in under 10 minutes.

Regretfully, I too have fallen for quick commerce. Until a couple of months ago, I would diligently plan my grocery shopping and place well-thought-out fortnightly weekend delivery orders on BigBasket, a decade old e-grocer. But now, the option of 10-minute delivery has broken my system. Lately, there have been too many unplanned purchases — thrice a week top-up on protein bars, greek yogurt, and instant coffee! I’m spending more money on delivery than I did a couple of months ago, and there are way more Coke cans in my fridge than I need.

I am not alone.

A September survey by market research firm RedSeer found there has been an increase in unplanned purchases of consumables by Gen Z and millennial Indians in the past 12 months. “There’s a fundamental shift in consumer behavior,” Abhishek Gupta, a consultant with RedSeer, told me. In December, the quick commerce industry clocked a revenue of $100 million, 70% of which came from Bengaluru, Mumbai, and Delhi, according to RedSeer.

The cost of this contrived behavioral shift is being paid by delivery workers. There’s been a spike in the number of reported vehicle accidents and increased public outcry over the pressure to deliver in less than 10 minutes, which leads to rash driving and traffic violations.

Industry participants themselves are flustered. Quick commerce is “force-fitting a consumer need which is actually not there in the market,” Flipkart Group CEO Kalyan Krishnamurthy told The Economic Times . Despite its reticence, the Walmart-owned e-commerce giant rolled out Flipkart Quick this week, halving its delivery time to 45 minutes. While 45 minutes doesn’t sound “quick,” it still falls under the “Q-commerce” category and is an illustration of market pressures forcing players.

Startups such as Zepto, Blinkit, Dunzo, and Swiggy are at the forefront of quick commerce in India currently. These firms have set up small warehouses, known as “dark stores,” that employ full-time staff. The new business model is chipping away at the 25 million customer base of incumbent BigBasket, which is trying to catch up. BigBasket, in December, introduced “BB Now,” a service that promises 20-minute delivery in Bengaluru. The company plans to expand this service across India by March.

More brands are acquiescing to the idea of quick commerce, as they are able to sell larger volumes; iD Fresh , which manufactures savory rice cake batter, witnessed its order volumes on quick commerce platforms surpass BigBasket in December. Beverage brand Paper Boat also reported an increase in impulse purchases.

Gupta says rider safety and stickiness are increasingly becoming a thorny issue for quick commerce firms as they scale operations. RedSeer’s survey found that less than 10% of riders see this as a long-term job. However, the business model is here to stay, with RedSeer estimating the addressable market for instant delivery to be around $5 billion by 2025.

This essay was originally published in our South Asia newsletter. You can read more coverage from the region here .

Creator Economy Mexico is in a crisis. Political candidates are busy dancing on TikTok Amid a critical election season, digital campaign strategies amount to chasing memes and sharing cringey dance moves rather than seriously engaging on policy. By Lorena Ríos

Exporter Newsletter Why Southeast Asia became a spyware hotspot A new Amnesty International report raises difficult questions. By Russell Brandom

3 Minutes With The Chinese founder who is betting on the Western appetite for short soaps Mega Matrix and FlexTV want to succeed where Quibi has failed by embracing the allure of “so bad it’s good” shows. By Caiwei Chen

The Quick Commerce industry is driven by dynamically changing consumer behavior from value seeking to convenience seeking, resulting in weekly small-sized purchases compared to larger monthly purchases: Ken Research

Request for sample report.

- Quick Commerce players are opting dark store’s model to deliver the groceries in minutes.

- Quick commerce companies provide convenience and flexibility of fast deliveries by managing a focussed set of ~2000 SKUs within the dark stores and gets it all delivered within 75 mins.

- Convenience Seekers inclined towards Unplanned Purchases are the major addressable audience for India Quick Commerce Market.

Express Delivery is possible with the help of Dark Store Model: Majority of the Quick Commerce Companies follow the Dark Store Model for Delivering Groceries at doorstep in minutes.

In this Model, the user places the order on the mobile application, after which the order is received by the nearest dark store or the micro-fulfilment centre. These dark stores are located in close proximity in the regions that the company is operational.

The dark store then has trained professionals who pick and pack the order and delivery partner reaches the customer’s doorstep with the order in minutes.

This model accurately justifies the delivery of grocery in minutes of ordering online.

Target Addressable Audience for Quick Commerce: Smartphone users in the urban region aged 15-45 are considered as the target audience for ordering consumables online as they are young, experimental, convenience seekers who tend to do unplanned purchases. Consumer behavior is dynamically changing from value seeking to convenience seeking, resulting in weekly, small-sized purchases compared to larger, monthly purchases. This is the major factor which is driving the Quick Commerce Market in India.

Technologies Facilitating Business Operations: Companies have been constantly on the look out to adapt new technologies in their operations. Fleet management software, real time inventory monitoring & business analytics have driven the day-to-day operations in the industry. Artificial Intelligence has helped the companies to offer personalize experience to customer.

Analysts at Ken Research in their latest publication “ India Quick Commerce Market Outlook to FY’27F – Driven by Increasing demand for Faster Delivery & Convenience and Shifting Customer behavior towards Unplanned Purchases ” believe that the Quick Commerce market in India is expected to demonstrate strong growth owing to the increase in demand for faster deliveries, wide product assortment, convenient & hassle-free shopping experience. The market is expected to register a positive CAGR of 27.9% in terms of revenue during the period FY’22P-FY’27F.

Key Segments Covered:-

By Product Category

Fruits & Vegetables

Packed food & Beverages

Beauty & Personal Care

Metro & Tier I

Tier II and below

By Business Model

Dark Store Platform

Third Party Delivery Platform

By Customer’s Gender

By Delivery Time

0-20 Minute

20-40 Minute

40-60 Minute

60-75 Minute

By Average Order Value

< INR 300

INR 300 – INR 600

INR 600 – INR 1,000

> INR 1000

Companies Covered:-

Swiggy Instamart

Flipkart Quick

Request For Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTYxNDE4

Key Target Audience:-

Quick Commerce Companies

E-commerce Companies

E-Grocery Companies

Logistics Companies

Cold Chain Companies

Investors & Venture Capitalists

Time Period Captured in the Report:-

Historical Period : FY’22

Forecast Period : FY’23-FY’27F

Key Topics Covered in the Report:-

How is the Quick Commerce Market positioned in India?

India Quick Commerce Market Flowchart

Evolution of the Quick Commerce Industry

Target Addressable Audience for India Quick Commerce Market

Consumer Purchase Behavior

Channels available for shopping consumables

Comparison of E-Grocery and Quick Commerce Platform

Value Chain Model – Dark Store Delivery Platform

Supply Ecosystem and Challenges

Market Size and Segmentation

SWOT Analysis

Current Technologies Facilitating Quick Commerce Industry

Upcoming Technologies in Quick Commerce Industry

Investment and Funding in Quick Commerce Companies in India

Competitive Landscape – Cross Comparison of Major Players

Company Profiles

Case study & Analyst Recommendations

Research Methodology

For More Information on the research report, refer to below link:-

India Quick Commerce Market

Related Reports:-

Vietnam Online Grocery Market Outlook to 2026 – Market Driven by Increasing Smartphone Penetration, Changing Shopping Habits of Consumers and Regional Expansion of the Online Grocery Players

Indonesia Online Grocery Market Outlook to 2026 – Driven by Changing Shopping Habits of Consumers and Regional Expansion of Local & International Players in the Archipalego

KSA Online Grocery Delivery Market Outlook to 2025- Driven by Changing Shopping Habits of Consumers and Regional Expansion of Local & International Players in the Kingdom

Contact Us:- Ken Research Ankur Gupta, Head Marketing & Communications [email protected] +91-9015378249

Tags: Annual Growth Rate India Quick Commerce Market , BB Now Quick Commerce Market , Blinkit Quick Commerce Market , Covid-19 Impact India Quick Commerce Industry , Covid-19 Impact India Quick Commerce Market , Dunzo Quick Commerce Market , Evaluation Study India Quick Commerce Market , Evaluation Summary Report India Quick Commerce Market , Evaluative Survey India Quick Commerce Market , Flipkart Quick Commerce Market , India Beauty and Personal Care Quick Commerce Market , India E-Commerce v/s Quick Commerce , India Fruits and Vegetables Quick Commerce Market , India Packed food and Beverages Quick Commerce Market , India Quick Commerce Companies , India Quick Commerce Due Diligence Report , India Quick Commerce Growth Strategy Market Report , India Quick Commerce Industry , India Quick Commerce Industry Research Report , India Quick Commerce Market , India Quick Commerce Market Analysis , India Quick Commerce Market Competition , India Quick Commerce Market Competition Benchmarking , India Quick Commerce Market Evaluation Report , India Quick Commerce Market Forecast , India Quick Commerce Market Future Outlook , India Quick Commerce Market Growth , India Quick Commerce Market Major Players , India Quick Commerce Market Research Report , India Quick Commerce Market Revenue , India Quick Commerce Market Revenue Forecasting , India Quick Commerce Market Sales , India Quick Commerce Market Shares , India Quick Commerce Market Size , India Quick Commerce Market Trends , India Staples Quick Commerce Market , Industry Research Report Of India Quick Commerce , Market Research Report Of India Quick Commerce , Ola Dash Quick Commerce Market , Quick Commerce Delivery Charge , Quick Commerce Delivery Time , Quick Commerce Industry In India , Quick Commerce Market In India , Social Evaluation Research India Quick Commerce Market , Swiggy Instamart Annual Orders , Swiggy Instamart Quick Commerce Market , Swiggy Instamart Recent Funding , Swiggy Instamart Recent News , Write An Evaluation Report On India Quick Commerce Market , Zepto Annual Orders , Zepto Instamart Recent News , Zepto Market Share , Zepto Quick Commerce Market , Zepto Recent Funding

In Case of Emergency: How to Use a Window Breaker Tool Effectively

Confidence Restored: How Adult Briefs Empower Individuals with Incontinence

Sensing the Future: Driving Growth in the Dynamic UK Sensors and Actuators Industry

US Bio-Stimulate Market Analysis: Growth, Trends, and Future Outlook (2022-2029)

Paid Press Release Registration

1 Credits Maximum Words 2000 1 Infographic / Pic Hyperlinks 2

Professional

10 Credits Maximum Words 2000 1 Infographic / Pic Hyperlinks 2

100 Credits Maximum Words 2000 1 Infographic / Pic Hyperlinks 2

Paid Hyperlink

Hyperlinks 1 No follow link

Schedule A Meeting

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here . By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service .

New to Zacks? Get started here.

Member Sign In

Don't Know Your Password?

- Zacks #1 Rank

- Zacks Industry Rank

- Zacks Sector Rank

- Equity Research

- Mutual Funds

- Mutual Fund Screener

- ETF Screener

- Earnings Calendar

- Earnings Releases

- Earnings ESP

- Earnings ESP Filter

- Stock Screener

- Premium Screens

- Basic Screens

- Research Wizard

- Personal Finance

- Money Management

- Retirement Planning

- Tax Information

- My Portfolio

- Create Portfolio

- Style Scores

- Testimonials

- Zacks.com Tutorial

Services Overview

- Zacks Ultimate

- Zacks Investor Collection

- Zacks Premium

Investor Services

- ETF Investor

- Home Run Investor

- Income Investor

- Stocks Under $10

- Value Investor

- Top 10 Stocks

Other Services

- Method for Trading

- Zacks Confidential

Trading Services

- Black Box Trader

- Counterstrike

- Headline Trader

- Insider Trader

- Large-Cap Trader

- Options Trader

- Short Sell List

- Surprise Trader

- Alternative Energy

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK . If you do not, click Cancel.

Image: Bigstock

4 Paper & Related Products Stocks to Watch in the Promising Industry

The Zacks Paper and Related Products industry is set to benefit from increased packaging needs, driven by rising e-commerce activities. Sustained demand from consumer-oriented sectors, such as food, beverages and healthcare, lends further support. The industry's growth is propelled by the escalating consumer inclination toward paper as an environmentally friendly packaging choice amid rising environmental awareness. Key players, such as Stora Enso Oyj ( SEOAY Quick Quote SEOAY - Free Report ) , Klabin S.A. ( KLBAY Quick Quote KLBAY - Free Report ) , Sylvamo ( SLVM Quick Quote SLVM - Free Report ) and Rayonier Advanced Materials ( RYAM Quick Quote RYAM - Free Report ) , are well-positioned to capitalize on these trends as they continue to position themselves favorably in the evolving market landscape.

About the Industry

The Zacks Paper and Related Products industry comprises companies that manufacture and sell paper and paper products. The industry is highly diversified in terms of products ranging from graphic paper and packaging paper to absorbent hygiene products. Graphic papers, which include printing and writing papers, and newsprint, are utilized for communication purposes. The industry provides packaging solutions for liquid, food, pharmaceutical, beauty, household, commercial and industrial products. It also produces fluff and specialty pulps utilized in absorbent hygiene products, tissues and paper products. The industry caters to a wide array of industries, including food and beverage, farming, home and personal care, health, retail, e-commerce and transport. Industry players meet customers’ shipping, storage and display requirements with sustainable solutions.

Major Trends Shaping the Future of the Paper and Related Products Industry

E-commerce & Consumer Products to Support Packaging Demand : The industry’s significant exposure to consumer-focused markets, such as food, beverages and healthcare, ensures steady earnings growth. With the rise of e-commerce, packaging has gained the utmost importance, as it helps maintain the integrity of the product and withstand the complexities of delivery. According to Statista, global e-commerce sales were $5.8 trillion in 2023, and this figure is expected to reach $8 trillion by 2027, seeing a CAGR of 8.4%. This presents a major growth opportunity for the Paper and Related Products industry. In 2022, e-commerce accounted for nearly 19% of retail sales worldwide and this share is expected to increase to 25% by 2027. The United States is expected to lead the retail e-commerce development, witnessing a CAGR of 11.82% over 2024-2028. The current valuation of the U.S. e-commerce market is $843 billion and it is anticipated to surpass the $1-trillion mark in 2026. India and Mexico are expected to follow the suit, seeing a CAGR of 11.79% and 11.71%, respectively.

Rise in M&A Activity to Transform the Paper and Packaging Landscape : Recently, there has been a surge in merger and acquisition activity within the industry as companies position themselves to seize growth opportunities, and enhance their packaging and sustainability offerings, among other strategic objectives. WestRock’s pending merger with Smurfit Kappa Group Plc will create one of the world’s largest paper and packaging companies with an unmatched geographic reach spanning 42 countries. Given this scale and equipped with the two companies’ highly complementary portfolios and innovative sustainability capabilities, the merged entity is likely to be the global “Go-To ” packaging partner for companies and customers across the globe. International Paper ( ( IP Quick Quote IP - Free Report ) ) has entered an agreement to acquire the entire issued share capital of DS Smith, outbidding rival Mondi Plc . This marks a strategic move to strengthen its corrugated packaging business in Europe and prioritize sustainable packaging. Meanwhile, per reports, Suzano has approached International Paper about a potential all-cash offer.

Sustainability Acts as the Key Driver : Increasing demand for sustainable packaging options and eco-friendly packaging solutions will support the paper market in the days ahead. The paper industry has already begun incorporating recycled content into production methods. By maximizing recycling, the industry will be able to implement environmentally and economically sustainable production methods. Investment in breakthrough technologies will propel the demand for high-quality paper products. Pricing Actions, Improving Efficiency to Offset Cost Inflation : The industry is witnessing rising costs of transportation, chemical and fuel, and supply-chain headwinds. Therefore, industry players are increasingly focusing on pricing actions and cost reduction, and resorting to automation in manufacturing to boost productivity and efficiency.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Paper and Related Products industry is a 12-stock group within the broader Basic Materials sector. The industry currently carries a Zacks Industry Rank #12, which places it in the top 5% of the 252 Zacks industries. The group’s Zacks Industry Rank, basically the average of the Zacks Rank of all the member stocks, indicates bullish prospects in the near term. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1. Before we present a few Paper and Related Products stocks that investors can keep an eye on, it is worth looking at the industry’s stock-market performance and its valuation picture.

Industry Versus S&P 500 & Sector

The Paper and Related Products industry has outperformed the sector and the S&P 500 over the past year. The stocks in this industry have gained 41.9%, whereas the Basic Materials sector has moved up 10%. The S&P 500 has grown 26.3% in the said time frame.

One-Year Price Performance

Industry's Current Valuation

On the basis of the trailing 12-month EV/EBITDA ratio, a commonly-used multiple for valuing Paper and Related Products companies, we see that the industry is currently trading at 8.61X compared with the S&P 500’s 14.00X and the Basic Material sector’s trailing 12-month EV/EBITDA of 11.73X. This is shown in the charts below.

Enterprise Value/EBITDA (EV/EBITDA) Ratio (TTM)

Over the last five years, the industry traded as high as 11.25X and as low as 3.98X, the median being 7.02X.

4 Paper and Related Products Stocks to Watch

Sylvamo : Stronger order books, and higher pulp and paper prices will aid its top-line growth. The company has initiated a cost-reduction program called Project Horizon, which is focused on streamlining its organization and cost structures in an effort to make a leaner, stronger company. SLVM is on track to realize savings of at least $110 million by the end of 2024. Around $80 million of the target will come from operational improvements in its mills and supply chains, and the balance from the reduction in selling and administrative expenses. The company continues to lower its debt levels and maintains a strong financial position that enables it to invest in its business. It has a pipeline of more than $200 million of high-return capital projects, which will boost its earnings and cash flow profile. The company’s shares have gained 55% in the past year. Earnings estimates for Sylvamo’s fiscal 2024 have moved 7% north over the past 30 days. Memphis, TN-based SLVM has a trailing four-quarter earnings surprise of 24.3%, on average. The company sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here .

Price & Consensus: SLVM

Klabin : In the first quarter of 2024, the company achieved a total sales volume of around 922,000 tons, up 5% year over year. The paperboard segment made a significant contribution, with a 15% increase in volume sold, reflecting the ramp-up of Paper Machine 28. In September 2023, KLBAY inaugurated the Puma II project, with R$12.9 billion invested in the installation of two paper machines — MP27 and MP28 — with a total annual production capacity of 910,000 tons of paper. The MP28 machine also marked Klabin’s debut in the white paperboard market, reinforcing the expansion of its product portfolio. In the corrugated cardboard segment, KLBAY recorded a 5.6% increase in volume sold in the first quarter, in sync with the growth trend of the Brazilian corrugated cardboard market. Klabin recently began operations at its new corrugated cardboard packaging factory, Figueira Project, located in Piracicaba, São Paulo. The unit has an annual production capacity of 240 thousand tons per year and will allow KLBAY to reach 1.2 million tons of corrugated cardboard conversion capacity per year. The company’s efforts to improve efficiency in its operations and lowering costs will also aid earnings. KLBAY shares have gained 6% in the past year. The Zacks Consensus Estimate for the São Paulo, Brazil-based company’s fiscal 2024 earnings has moved up 61% over the past 30 days. The consensus estimate suggests year-over-year growth of 24.7%. Klabin currently carries a Zacks Rank #2 (Buy).

Price & Consensus: KLBAY

Rayonier Advanced Materials : In the High Purity Cellulose segment, average sales prices for cellulose specialties are expected to increase as the company prioritizes value over volume. Sales volumes will gain from the closure of a competitor’s plant and a modest increase in ethers sales. The company’s bioethanol facility in Tartas, France, became operational in the first quarter of 2024 and is expected to deliver $3-$4 million of EBITDA in 2024, growing to $8-$10 million beginning in 2025. The Paperboard segment is expected to benefit from stable prices and higher volumes, reflecting customer demand. In October 2023, the company announced that it was exploring the potential sale of its Paperboard and High-Yield Pulp assets located at its Temiscaming site. This will align its portfolio with its long-term growth strategy, and provide flexibility to pay down debt, reduce leverage and minimize earnings volatility. The indefinite suspension of operations at the Temiscaming High Purity Cellulose plant, announced on Apr 29, 2024, is anticipated to mitigate the plant’s ongoing operating losses and high capital needs, thereby improving RYAM’s consolidated free cash flow. It is focused on lowering debt levels, and investing in high-return projects and acquisitions to drive growth.

Earnings estimates for fiscal 2024 for Jacksonville, FL-based Rayonier Advanced Materials indicate year-over-year growth of 58%. Estimates have been unchanged over the past 30 days. RYAM carries a Zacks Rank #3 (Hold) at present.

Price & Consensus: RYAM

Stora Enso : The company’s sales were impacted in the first quarter of 2024 due to the political strike in Finland. Stora Enso anticipates a gradual recovery in market conditions in 2024, with increased demand for consumer boards, higher pulp demand and prices. It initiated a profit improvement program in February 2024, which is progressing well. The annual profit improvement target has been increased to EUR 120 million from the initial EUR 80 million, driven by additional fixed cost reductions. The consumer board investment at the Oulu site in Finland is progressing on schedule. Production is expected to start in the first half of 2025, with the full capacity estimated to be reached during 2027. It will support SEOAY’s long-term strategy to build market share in renewable and circular packaging solutions, which matter the most to its customers. The company plans to improve its cash flow through working capital management and intends to lower debt levels. SEOAY shares have gained 8.8% in the past year. The Zacks Consensus Estimate for 2024 for the Helsinki, Finland-based company has moved up 2% in the past 30 days. The consensus estimate for Stora Enso indicates year-over-year growth of 159%. SEOAY currently carries a Zacks Rank #3.

Price & Consensus: SEOAY

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report free:.

International Paper Company (IP) - free report >>

Klabin SA (KLBAY) - free report >>

Stora Enso Oyj (SEOAY) - free report >>

Rayonier Advanced Materials Inc. (RYAM) - free report >>

Sylvamo Corporation (SLVM) - free report >>

Published in

This file is used for Yahoo remarketing pixel add

Due to inactivity, you will be signed out in approximately:

IMAGES

VIDEO

COMMENTS

Purpose - This study aims to understand the drivers of Quick Commerce in the direct-to-consumer market and its influences on online consumer behavior. Design/methodology/approach - The approach is divided into three parts. Firstly, we introduce the concept of Quick Commerce (QC) by differentiating it from traditional Electronic Commerce (EC).

In quick commerce, a new development in online-to-offline commerce, fast delivery times are the key service promise; quick commerce promises to deliver products to consumers within minutes, ensuring the satisfaction of instant needs (Coresight Research, 2021).Because instant needs are inherently time-sensitive, the utility of satisfying them varies significantly depending on the speed of the ...

Implications - through this research paper one can come to know about the present and future scop0e of the quick commerce platforms and also the factors which motivate and demotivate customers to use these platforms. Originality/ value - The plagiarism of the research paper was checked with the Turnitin software

Q-commerce (quick commerce, q-com) is a type of online commerce in which goods are delivered quickly, usually in less than 30 minutes. Fulfillment takes place either via a network of small warehouses or via stores, which may be "dark stores," and delivery is with micro-mobility bicycles or motorbikes within a small radius of the picking ...

the delivery time in the e-commerce industry was not fast, which is why quick commerce is thriving today. Almost every essential and commodity of life falls under the category of quick commerce, including grocery deliveries and food. Speedy delivery is a model that differentiates the quick commerce model from (Černikovaitė, 2021).

Fourth, some research efforts have been done on quick commerce in Paris, including by the Paris urban planning agency (Apur, 2022), strengthening a basis for in-depth study. Fifth and final, the City of Paris is a particularly interesting case because of its historic insistence on local retail and its openness to integrating logistics ...

With the accelerating pace of life, convenience is increasingly becoming a guiding principle in the contemporary economy and one of the main drivers of retail innovations (Gielens 2022; Seiders et al. 2000).The underlying idea of convenience is to reduce consumers' time and effort investments (Berry et al. 2002).Consumers' continuous need for convenience challenges retailers to constantly ...

The demand was accompanied by instant delivery expectations, leading to the emergence of the quick commerce business. It is estimated that the industry will grow at a CAGR of 27.9% between FY 2022 and FY 2027 (Pratik and Arora, 2022). Today, many players operate in the quick commerce business.

Quick commerce or deli very -on-demand (or Q-commerce for short) is. an upgraded fo rm of e-commerce in which the delivery of physical products. takes place within extremel y short inte rvals from ...

Q-commerce, also known as quick commerce, is a type of e-commerce that focuses on fast deliveries, typically in less than a n hour. Q-commerce began with food deliver y, and it still accounts for ...

commerce) has emerged as a disruptive force, redefining the traditional retail paradigm. This research paper delves into the intricate facets of Quick Commerce within the context of the burgeoning Indian market. The study aims to provide a comprehensive analysis of the Quick Commerce ecosystem, Its evolution,

Still, traditional companies like Reliance (Dunzo) and Tata (Big basket now) have also established their presence recently in this segment. Quick commerce clocked in 20% - 25% more sales than e-commerce over the last year and is expected to reach 5 billion USD value in 2025 from the current 0.3 billion USD. We would like to understand, through ...

This paper follows the qualitative research method to provide richer explanations based on evidence from the 25 papers that we analysed (Boell & Cecez-Kecmanovic, 2014; Okoli, 2012; Rowe, 2014). Within the qualitative research method, we use thematic analysis to analyse the papers.

The quick-commerce or q-commerce is the faster version of e-commerce focused majorly on the j ust-intime type of customers who have seen a growth in numbers due to the supply chain rehaul due to the Covid-19 pandemic. It is characterized by a unique business model where the goods and services are delivered within 10 to 30 minutes of placing an ...

"Glovo: Expanding Quick Commerce." Harvard Business School Case 621-094, April 2021. Educators; ... Related Work. July 2021 (Revised October 2021) Faculty Research; Glovo: Expanding Quick Commerce. By: Antonio Moreno and Anibha Singh. July 2021; Faculty Research; Glovo: Expanding Quick Commerce. By: Antonio Moreno and Anibha Singh

The Indian Q-com landscape. India's1 Q-com market is expected to witness a 15x growth by 2025, reaching a market size of close to USD 5.5 billion. According to this report, an increase in consumer demand to fulfill top-ups, along with impulse purchases, is driving the growth and expansion of this space,. Most of this demand is generated by ...

Purpose: The purpose of this research paper is to conduct a comprehensive literature review on consumer decision-making in the context of e-commerce, with a specific focus on identifying and ...

We explore the spectrum of business models in the quick-commerce retail space, which we estimate will generate $20-25 billion in US retail sales in 2021. The quick-commerce landscape includes longstanding same-day delivery platforms that deliver orders from local, third-party retailers, including DoorDash, Instacart and Uber Eats.

In December, the quick commerce industry clocked a revenue of $100 million, 70% of which came from Bengaluru, Mumbai, and Delhi, according to RedSeer. The cost of this contrived behavioral shift is being paid by delivery workers. There's been a spike in the number of reported vehicle accidents and increased public outcry over the pressure to ...

Key Figures On Quick Commerce. • The market size of q-commerce in India in 2020 was about USD $49 billion. • By 2025, quick commerce is likely to grow 12% to 13% in India. • According to a ...

sector is one of the largest growing sectors in India at present, which is expected to grow in future with. an increasing rate. Table 1.2 and Graph 1.2 show the growth of ecommerce sales from 2015 ...

Analysts at Ken Research in their latest publication " India Quick Commerce Market Outlook to FY'27F - Driven by Increasing demand for Faster Delivery & Convenience and Shifting Customer behavior towards Unplanned Purchases " believe that the Quick Commerce market in India is expected to demonstrate strong growth owing to the increase ...

The Zacks Paper and Related Products industry's prospects look upbeat, backed by strong demand on a rise in e-commerce and growing interest in sustainable packaging solutions. Stocks like SEOAY ...

Consumer perception and awar eness of e-commerce play a crucial role in shapin g the success and growth of online shoppin g. platforms. This ar ticle has pr ovided a comprehensive a nalysis of ...