Home • Knowledge hub • An Introduction to Data Collection within Marketing Research.

An Introduction to Data Collection within Marketing Research.

Data plays a central role in all forms of research, including marketing research. It serves as the eyes and ears for a brand’s marketing initiatives. The data you gather — and its quality — will make a massive difference to how successful your research is, how accurate your findings are, and the impact on your business goals and strategies.

Data collection is arguably the most critical market research stage. It can make or break the rest of the process, so it’s vital to do everything you can to make this stage run smoothly and successfully.

In this article, we’ll take a deep dive into why data collection matters, the different types of data you should focus on, and all the options available to you when it comes to collecting that data. Let’s start by defining what data collection means.

What is the definition of data collection in the context of market research?

Data collection encompasses the meticulous compilation of all essential raw information required for your market research. Some individuals also broaden the scope of this definition to encompass the analysis of the gathered data, extracting invaluable insights to fulfill your research objectives.

It entails a comprehensive and well-planned quest for relevant data conducted by a researcher to validate a hypothesis.

The primary objective of data collection in market research is to ensure the acquisition of dependable data for statistical analysis, thereby enabling brands to make informed decisions supported by robust data. Consequently, it is imperative that your data possesses attributes of high quality, relevance, and sufficient quantity to yield meaningful insights.

Why data collection is so important?

Data collection is a critical step in the research process, often the primary step. You can analyze and store essential information about your existing and potential customers when you collect data. This process saves your organization money and resources, as you can make data-driven decisions. Data collection also allows you to create a library or database of customers (and their information) for marketing to them in the future or retargeting them.

Three main uses of data collection in market research:

- Data collection helps you make informed decisions and analyses, building complete and insightful market research reports that can drive future product launches, market-entry campaigns, marketing strategies, and more. Data collection is the foundational step for various activities that can lead to business growth.

- Data collection allows you to build a database of information about your market for future use. While your primary goal might be to create a research report with a specific objective, the data can still be helpful for future activities.

- Data collection allows you to target marketing and outreach more efficiently, thereby allowing your organization to save money and do more with its resources.

The different types of data collection in marketing research

There are several different types of data to consider at this stage — let’s examine them more closely.

We can break down data into two main categories, which makes it easier to understand the types of data we want to focus on and helps us hone in on the research methods and channels that will be most useful.

Primary data

Primary data is collected directly by your researchers, specifically for your research purposes. This data is primarily collected from interviews, surveys, focus groups, and experiments. In other words, this data did not exist before your team collected it.

Secondary data

Secondary data refers to data that already existed before you started your research. Other researchers have already collected and compiled this data before. You can find this type of data in places like government reports, the analysis of other businesses, polls and surveys, and the work of NGOs. It’s typically cheaper and easier to obtain than your primary data, but it won’t be as relevant to your project.

Qualitative research

Qualitative research is usually the first step in data collection. It’s more textual than statistical and involves collecting non-numerical data like interview transcripts, video recordings, and survey responses.

Qualitative data is typically collected via first-hand observation through focus groups, interviews, and ethnography. It is a way of diving deep into ideas and concepts, allowing researchers to learn more about specific topics that may not be well understood.

Quantitative Research

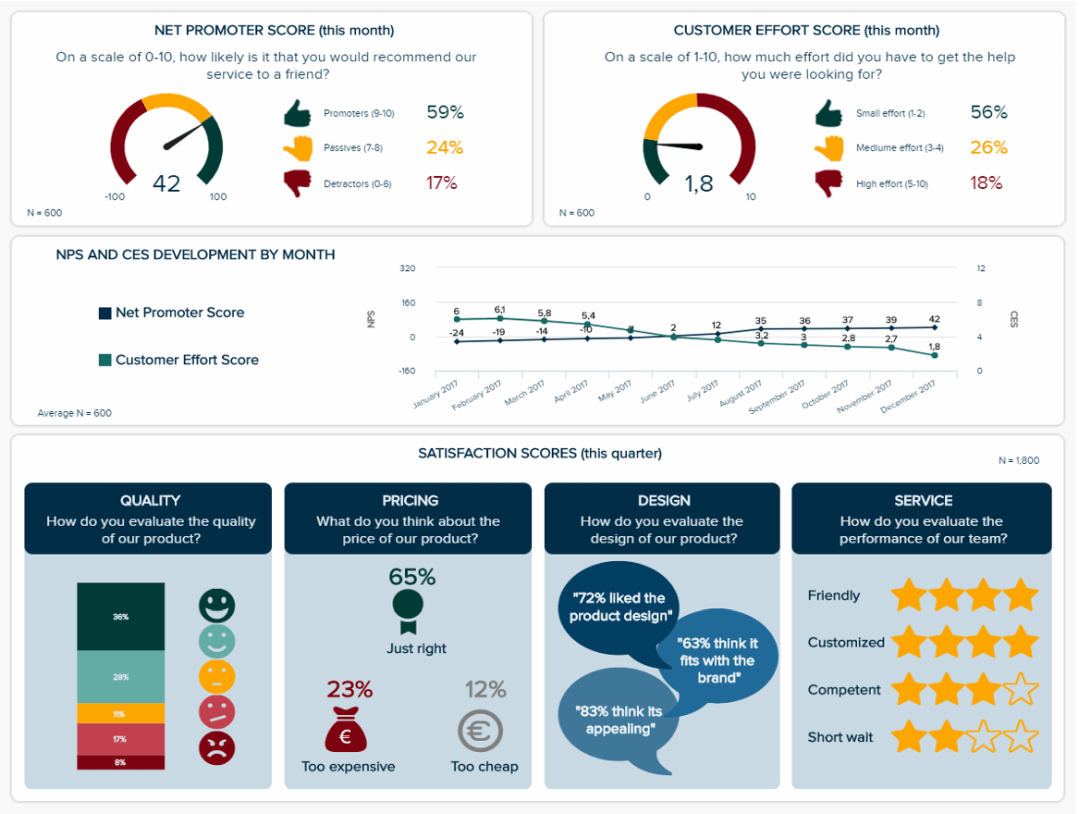

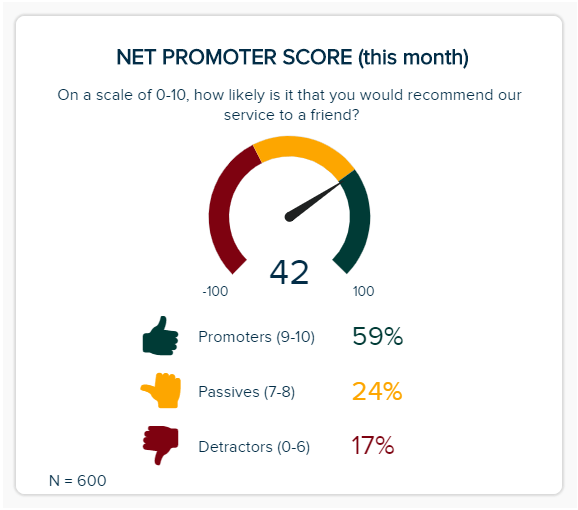

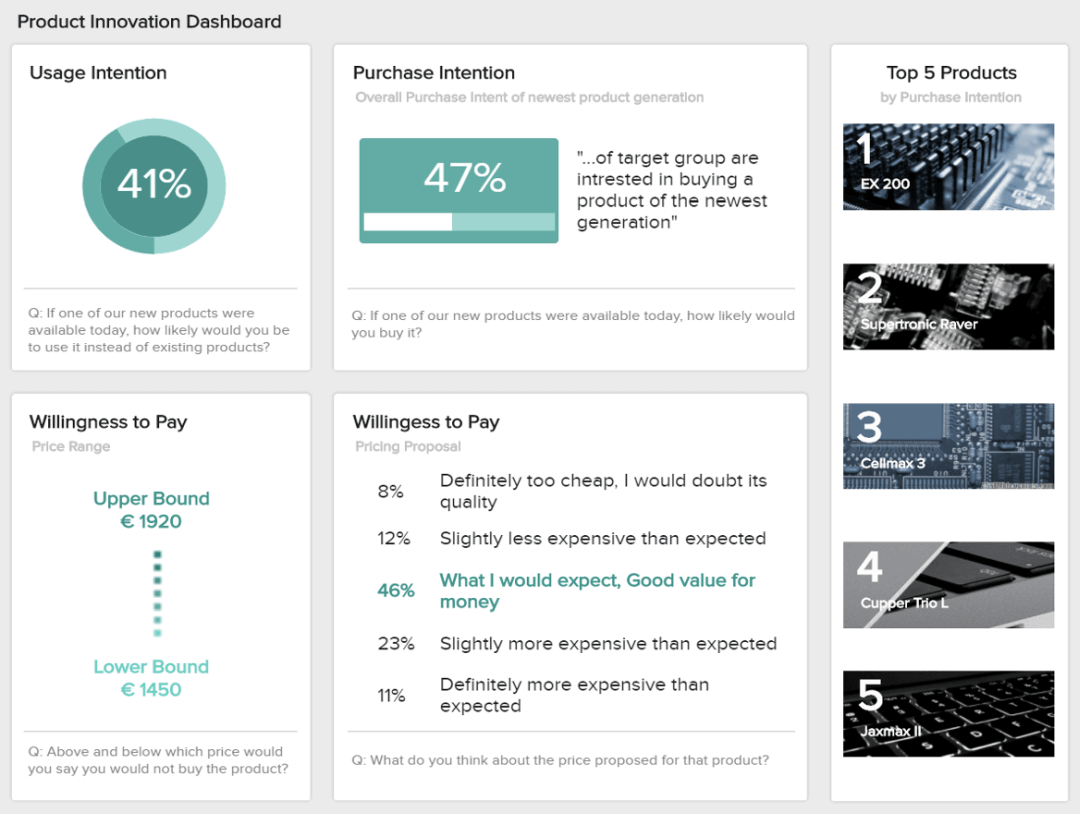

Where qualitative research is relatively more text-based, quantitative research focuses on numbers and statistics. This data is expressed in charts, graphs, and tables and is typically used to test initial findings.

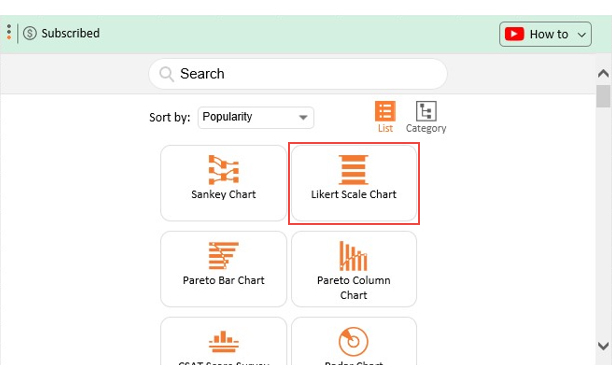

Methods used to collect quantitative data include more closed-ended survey questions, mobile surveys, and Likert scales. The main benefit of this type of data is that it allows researchers to make more broad generalizations and predictions, but it’s not well-suited for diving deep into particular questions.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

- First Name *

- Last Name *

- Business Email *

How data collection in marketing research works

There are many steps involved in the data collection process. Some of these steps begin even before you start collecting data.

Prior steps

There are several steps you should take before your data collection begins, such as:

・ Make sure you have all the necessary permission to collect your data. Today, data privacy laws are stronger than ever, so researchers need to take extra care to comply with regulations and have the full consent of their subjects and participants. It’s best to work with a legal compliance team to draft all the required documents, forms, and contracts to share with your research participants from the very beginning.

・ Make sure you have the support of any company decision-makers and stakeholders. It may be helpful at this stage to prepare a preliminary report informing any higher-ups of your plans, goals, sources , and any methods you plan to use.

・ Try to predict and pre-empt any possible challenges or problems, such as privacy regulations, collection methods, infrastructure, or budget. Anticipating any issues now will help you avoid costly problems and make the whole process run more smoothly.

・ Put together a team of skilled and qualified researchers and analysts. Data collection can be a difficult task, and you need to have the right experience and skillsets on your team.

Decide on your data collection methods.

The next stage is to decide which data collection methods you will use to collect data for your marketing research report. You will likely employ various methods here, as each has unique pros and cons. Here are the main methods you should consider:

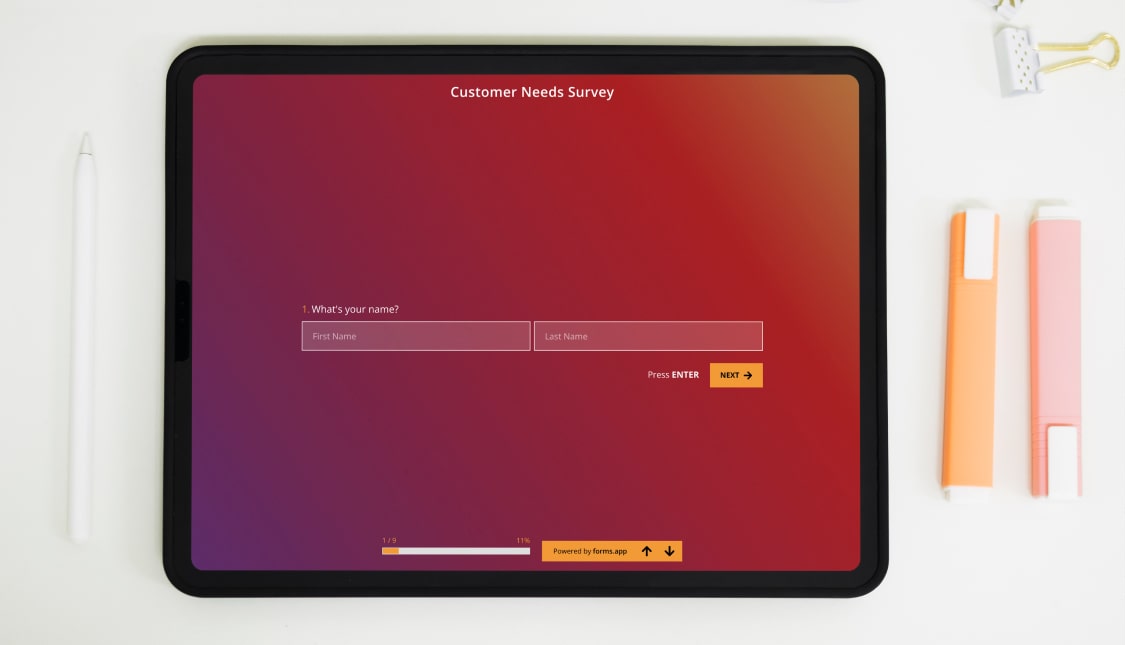

There are many ways to conduct surveys — in-person, online, post, email, mobile message, others. Surveys differ in content and structure — from simple Likert scales with just five possible numerical responses to more qualitative open-ended questions.

・ Focus groups

Focus groups allow you to bring multiple participants together to discuss the subject of your research and share their opinions. This format can be a great way to brainstorm ideas, and people can often bring good ideas out of each other. To get the best results, everyone should get a chance to speak, and no one person should dominate the group.

・ Interviews

One-to-one interviews are the best ways to dive deep into a person’s opinions about your brand or a specific product. However, they can be time-consuming and may require much planning.

・Observation and experimental research

This type of data collection involves observing individuals as they interact with specific products or services. It helps get around certain biases that people might have in interviews and surveys and cut right through to their true thoughts. However, it isn’t easy and requires an expert touch to get it right.

Identify and prepare for common challenges with data collection.

During the data collection process, you’re likely to encounter several challenges. The good news is that you can avoid these challenges and mitigate any impacts on your research report with proper preparation.

Here’s what to look out for:

・bad methodology results in poor quality data.

A lot can go wrong with your data collection methods — badly identified participants, poorly designed questions, and choosing the wrong methods are just a few examples. This can result in poor quality data, leading to erroneous conclusions and an unsuccessful research report. Take the time to work with experienced researchers and build the right data collection strategy for your needs.

・Logistical challenges

You will also come across many logistical challenges. For instance, you’ll need a big venue to hold everyone if you’re running a focus group. If you want to conduct a stream of interviews, you’ll need to hire a space for a particular time. You may need to arrange transport, refreshments, and a wide range of other logistical demands. If you fail to plan this properly in advance, your team could find itself in a highly stressful situation.

・Using the proper channels

The channels you use to connect with your audience are consequential — what works well for one demographic might completely fail for another. If you choose the wrong media (like Twitter to send surveys to an older demographic), you could have a poor response rate and lack usable data.

How to collect data effectively

Get to know your audience..

You will need to have an intimate and deep understanding of your audience and the people you collect data from. This will ensure you target the right people, ask the appropriate questions, choose the correct methods and channels, and analyze the data in the proper contexts.

There are many ways to get to know your audience better in advance of data collection:

・ Use social media to spend time in the same spaces and groups as your audience members, chat with them, and find out who they are and what makes them tick.

・ Work with your sales and marketing teams — it’s their job to understand your audience, and they’ll have access to valuable insights.

・ Look at who is using your competitors’ brands and products.

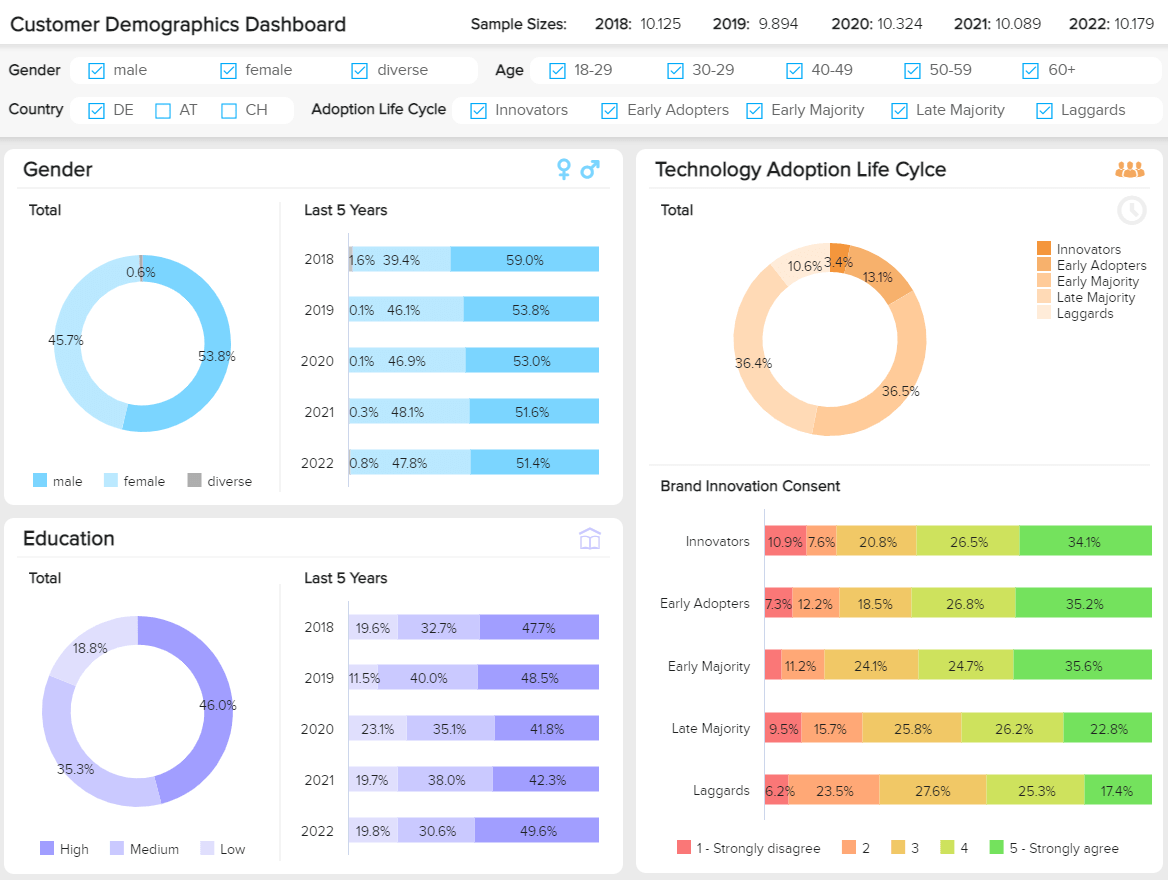

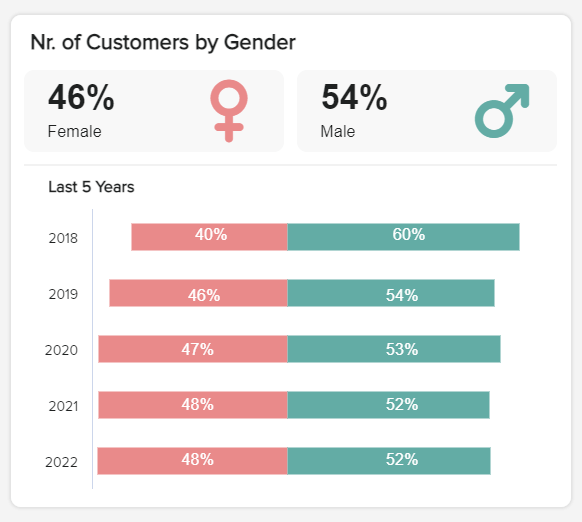

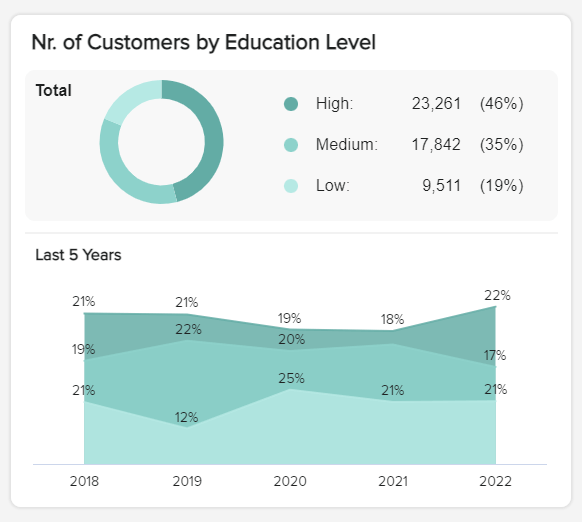

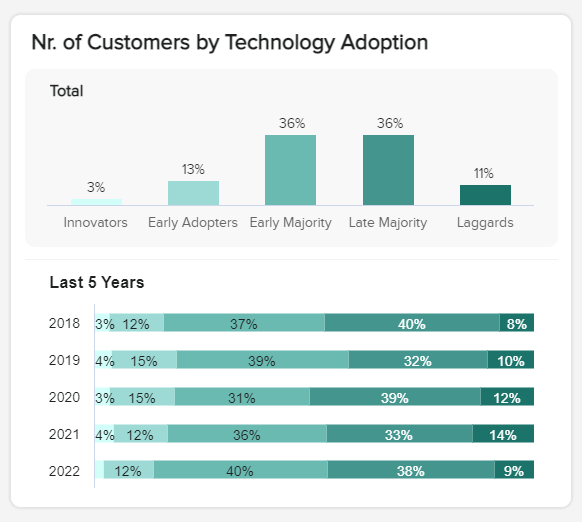

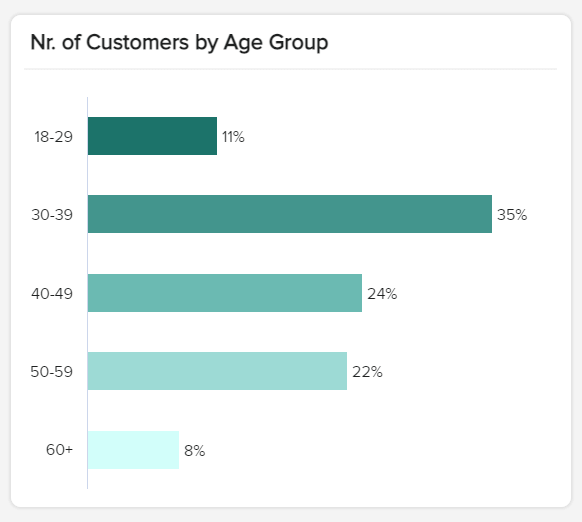

Once you understand whom you target, it often helps create detailed user personas, outlining details about your typical audience members like their age groups, income brackets, and education levels. You can then use this information to tailor your data collection strategy to be relevant and valuable.

Prepare for the analysis of your data.

Collecting data is one thing, but you should always have an eye on the analysis of that data. This is where you extract insights and draw tangible value from the data — allowing you to make informed business decisions and create a valuable and applicable market research report .

When planning your collection methods and recording the results, always remember that someone will be analyzing this data. Be organized, clear, and detailed, and work with your analysts to ensure they are aligned with your approach.

Use a wide range of methods and channels.

The best data collection relies on various tools and channels instead of focusing on just one or two. By combining a number of the approaches mentioned in this article, you will connect with a broader part of your market, gaining a better understanding of how different demographics feel and leading to a more valuable and insightful analysis.

For example, if you focus solely on digital channels like social media and online surveys, your responses may skew heavily towards younger people. Some in-person interviews, focus groups, and postal surveys help target a broader range of age groups and accurately reflect your market and their views.

Data collection is a critical part of market research. It serves many important purposes, and it is essential to get it right to create effective research reports and complete a vast range of different business objectives.

At Kadence, we help companies worldwide fine-tune their data collection, laying the foundations for informed and effective market research.

Contact us to learn more about how we can help you do the same.

Helping brands uncover valuable insights

We’ve been working with Kadence on a couple of strategic projects, which influenced our product roadmap roll-out within the region. Their work has been exceptional in providing me the insights that I need. Senior Marketing Executive Arla Foods

Kadence’s reports give us the insight, conclusion and recommended execution needed to give us a different perspective, which provided us with an opportunity to relook at our go to market strategy in a different direction which we are now reaping the benefits from. Sales & Marketing Bridgestone

Kadence helped us not only conduct a thorough and insightful piece of research, its interpretation of the data provided many useful and unexpected good-news stories that we were able to use in our communications and interactions with government bodies. General Manager PR -Internal Communications & Government Affairs Mitsubishi

Kadence team is more like a partner to us. We have run a number of projects together and … the pro-activeness, out of the box thinking and delivering in spite of tight deadlines are some of the key reasons we always reach out to them. Vital Strategies

Kadence were an excellent partner on this project; they took time to really understand our business challenges, and developed a research approach that would tackle the exam question from all directions. The impact of the work is still being felt now, several years later. Customer Intelligence Director Wall Street Journal

Get In Touch

" (Required) " indicates required fields

Privacy Overview

What is Data Collection? Methods, Types, Tools, Examples

Appinio Research · 09.11.2023 · 33min read

Are you ready to unlock the power of data? In today's data-driven world, understanding the art and science of data collection is the key to informed decision-making and achieving your objectives.

This guide will walk you through the intricate data collection process, from its fundamental principles to advanced strategies and ethical considerations. Whether you're a business professional, researcher, or simply curious about the world of data, this guide will equip you with the knowledge and tools needed to harness the potential of data collection effectively.

What is Data Collection?

Data collection is the systematic process of gathering and recording information or data from various sources for analysis, interpretation, and decision-making. It is a fundamental step in research, business operations, and virtually every field where information is used to understand, improve, or make informed choices.

Key Elements of Data Collection

- Sources: Data can be collected from a wide range of sources, including surveys , interviews, observations, sensors, databases, social media, and more.

- Methods: Various methods are employed to collect data, such as questionnaires, data entry, web scraping, and sensor networks. The choice of method depends on the type of data, research objectives, and available resources.

- Data Types: Data can be qualitative (descriptive) or quantitative (numerical), structured (organized into a predefined format) or unstructured (free-form text or media), and primary (collected directly) or secondary (obtained from existing sources).

- Data Collection Tools: Technology plays a significant role in modern data collection, with software applications, mobile apps, sensors, and data collection platforms facilitating efficient and accurate data capture.

- Ethical Considerations: Ethical guidelines, including informed consent and privacy protection, must be followed to ensure that data collection respects the rights and well-being of individuals.

- Data Quality: The accuracy, completeness, and reliability of collected data are critical to its usefulness. Data quality assurance measures are implemented to minimize errors and biases.

- Data Storage: Collected data needs to be securely stored and managed to prevent loss, unauthorized access, and breaches. Data storage solutions range from on-premises servers to cloud-based platforms.

Importance of Data Collection in Modern Businesses

Data collection is of paramount importance in modern businesses for several compelling reasons:

- Informed Decision-Making: Collected data serves as the foundation for informed decision-making at all levels of an organization. It provides valuable insights into customer behavior, market trends, operational efficiency, and more.

- Competitive Advantage: Businesses that effectively collect and analyze data gain a competitive edge. Data-driven insights help identify opportunities, optimize processes, and stay ahead of competitors .

- Customer Understanding: Data collection allows businesses to better understand their customers, their preferences, and their pain points. This insight is invaluable for tailoring products, services, and marketing strategies.

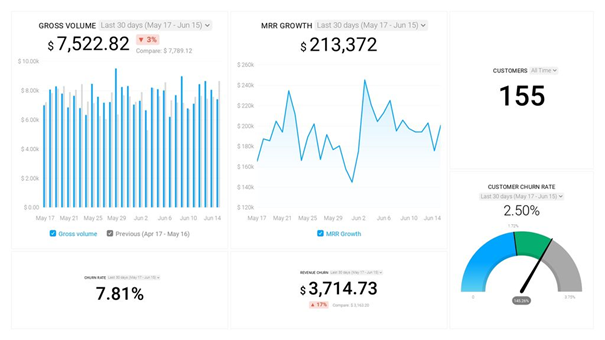

- Performance Measurement: Data collection enables organizations to assess the performance of various aspects of their operations, from marketing campaigns to production processes. This helps identify areas for improvement.

- Risk Management: Businesses can use data to identify potential risks and develop strategies to mitigate them. This includes financial risks, supply chain disruptions, and cybersecurity threats.

- Innovation: Data collection supports innovation by providing insights into emerging trends and customer demands. Businesses can use this information to develop new products or services.

- Resource Allocation: Data-driven decision-making helps allocate resources efficiently. For example, marketing budgets can be optimized based on the performance of different channels.

Goals and Objectives of Data Collection

The goals and objectives of data collection depend on the specific context and the needs of the organization or research project. However, there are some common overarching objectives:

- Information Gathering: The primary goal is to gather accurate, relevant, and reliable information that addresses specific questions or objectives.

- Analysis and Insight: Collected data is meant to be analyzed to uncover patterns, trends, relationships, and insights that can inform decision-making and strategy development.

- Measurement and Evaluation: Data collection allows for the measurement and evaluation of various factors, such as performance, customer satisfaction , or market potential.

- Problem Solving: Data collection can be directed toward solving specific problems or challenges faced by an organization, such as identifying the root causes of quality issues.

- Monitoring and Surveillance: In some cases, data collection serves as a continuous monitoring or surveillance function, allowing organizations to track ongoing processes or conditions.

- Benchmarking: Data collection can be used for benchmarking against industry standards or competitors, helping organizations assess their performance relative to others.

- Planning and Strategy: Data collected over time can support long-term planning and strategy development, ensuring that organizations adapt to changing circumstances.

In summary, data collection is a foundational activity with diverse applications across industries and sectors. Its objectives range from understanding customers and making informed decisions to improving processes, managing risks, and driving innovation. The quality and relevance of collected data are pivotal in achieving these goals.

How to Plan Your Data Collection Strategy?

Before kicking things off, we'll review the crucial steps of planning your data collection strategy. Your success in data collection largely depends on how well you define your objectives, select suitable sources, set clear goals, and choose appropriate collection methods.

Defining Your Research Questions

Defining your research questions is the foundation of any effective data collection effort. The more precise and relevant your questions, the more valuable the data you collect.

- Specificity is Key: Make sure your research questions are specific and focused. Instead of asking, "How can we improve customer satisfaction?" ask, "What specific aspects of our service do customers find most satisfying or dissatisfying?"

- Prioritize Questions: Determine the most critical questions that will have the most significant impact on your goals. Not all questions are equally important, so allocate your resources accordingly.

- Alignment with Objectives: Ensure that your research questions directly align with your overall objectives. If your goal is to increase sales, your research questions should be geared toward understanding customer buying behaviors and preferences.

Identifying Key Data Sources

Identifying the proper data sources is essential for gathering accurate and relevant information. Here are some examples of key data sources for different industries and purposes.

- Customer Data: This can include customer demographics, purchase history, website behavior, and feedback from customer service interactions.

- Market Research Reports: Utilize industry reports, competitor analyses, and market trend studies to gather external data and insights.

- Internal Records: Your organization's databases, financial records, and operational data can provide valuable insights into your business's performance.

- Social Media Platforms: Monitor social media channels to gather customer feedback, track brand mentions , and identify emerging trends in your industry.

- Web Analytics: Collect data on website traffic, user behavior, and conversion rates to optimize your online presence.

Setting Clear Data Collection Goals

Setting clear and measurable goals is essential to ensure your data collection efforts remain on track and deliver valuable results. Goals should be:

- Specific: Clearly define what you aim to achieve with your data collection. For instance, increasing website traffic by 20% in six months is a specific goal.

- Measurable: Establish criteria to measure your progress and success. Use metrics such as revenue growth, customer satisfaction scores, or conversion rates.

- Achievable: Set realistic goals that your team can realistically work towards. Overly ambitious goals can lead to frustration and burnout.

- Relevant : Ensure your goals align with your organization's broader objectives and strategic initiatives.

- Time-Bound: Set a timeframe within which you plan to achieve your goals. This adds a sense of urgency and helps you track progress effectively.

Choosing Data Collection Methods

Selecting the correct data collection methods is crucial for obtaining accurate and reliable data. Your choice should align with your research questions and goals. Here's a closer look at various data collection methods and their practical applications.

Types of Data Collection Methods

Now, let's explore different data collection methods in greater detail, including examples of when and how to use them effectively:

Surveys and Questionnaires

Surveys and questionnaires are versatile tools for gathering data from a large number of respondents. They are commonly used for:

- Customer Feedback: Collecting opinions and feedback on products, services, and overall satisfaction.

- Market Research: Assessing market preferences, identifying trends, and evaluating consumer behavior .

- Employee Surveys : Measuring employee engagement, job satisfaction, and feedback on workplace conditions.

Example: If you're running an e-commerce business and want to understand customer preferences, you can create an online survey asking customers about their favorite product categories, preferred payment methods, and shopping frequency.

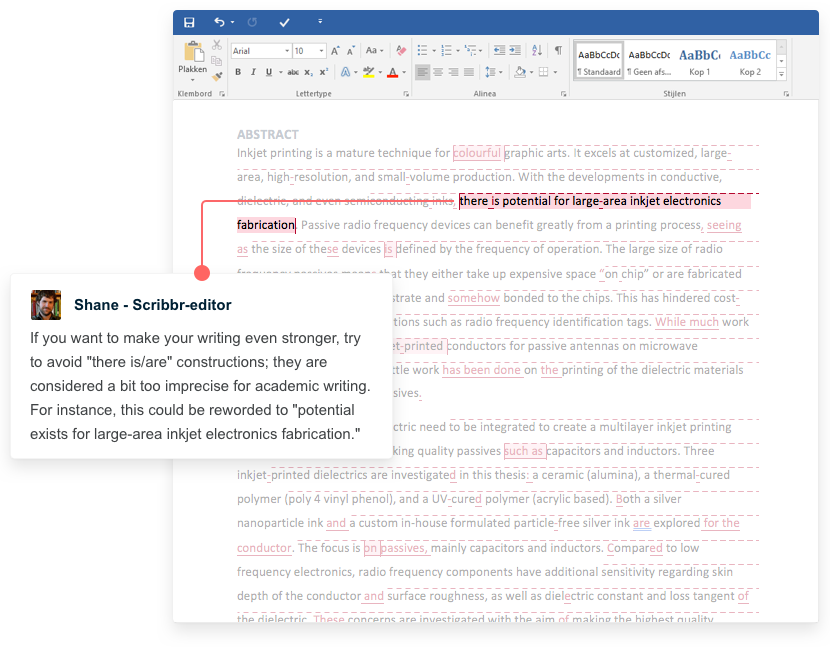

To enhance your data collection endeavors, check out Appinio , a modern research platform that simplifies the process and maximizes the quality of insights. Appinio offers user-friendly survey and questionnaire tools that enable you to effortlessly design surveys tailored to your needs. It also provides seamless integration with interview and observation data, allowing you to consolidate your findings in one place.

Discover how Appinio can elevate your data collection efforts. Book a demo today to unlock a world of possibilities in gathering valuable insights!

Book a Demo

Interviews involve one-on-one or group conversations with participants to gather detailed insights. They are particularly useful for:

- Qualitative Research: Exploring complex topics, motivations, and personal experiences.

- In-Depth Analysis: Gaining a deep understanding of specific issues or situations.

- Expert Opinions: Interviewing industry experts or thought leaders to gather valuable insights.

Example: If you're a healthcare provider aiming to improve patient experiences, conducting interviews with patients can help you uncover specific pain points and suggestions for improvement.

Observations

Observations entail watching and recording behaviors or events in their natural context. This method is ideal for:

- Behavioral Studies: Analyzing how people interact with products or environments.

- Field Research: Collecting data in real-world settings, such as retail stores, public spaces, or classrooms.

- Ethnographic Research: Immersing yourself in a specific culture or community to understand their practices and customs.

Example: If you manage a retail store, observing customer traffic flow and purchasing behaviors can help optimize store layout and product placement.

Document Analysis

Document analysis involves reviewing and extracting information from written or digital documents. It is valuable for:

- Historical Research: Studying historical records, manuscripts, and archives.

- Content Analysis: Analyzing textual or visual content from websites, reports, or publications.

- Legal and Compliance: Reviewing contracts, policies, and legal documents for compliance purposes.

Example: If you're a content marketer, you can analyze competitor blog posts to identify common topics and keywords used in your industry.

Web Scraping

Web scraping is the automated process of extracting data from websites. It's suitable for:

- Competitor Analysis: Gathering data on competitor product prices, descriptions, and customer reviews.

- Market Research: Collecting data on product listings, reviews, and trends from e-commerce websites.

- News and Social Media Monitoring: Tracking news articles, social media posts, and comments related to your brand or industry.

Example: If you're in the travel industry, web scraping can help you collect pricing data for flights and accommodations from various travel booking websites to stay competitive.

Social Media Monitoring

Social media monitoring involves tracking and analyzing conversations and activities on social media platforms. It's valuable for:

- Brand Reputation Management: Monitoring brand mentions and sentiment to address customer concerns or capitalize on positive feedback.

- Competitor Analysis: Keeping tabs on competitors' social media strategies and customer engagement.

- Trend Identification: Identifying emerging trends and viral content within your industry.

Example: If you run a restaurant, social media monitoring can help you track customer reviews, comments, and hashtags related to your establishment, allowing you to respond promptly to customer feedback and trends.

By understanding the nuances and applications of these data collection methods, you can choose the most appropriate approach to gather valuable insights for your specific objectives. Remember that a well-thought-out data collection strategy is the cornerstone of informed decision-making and business success.

How to Design Your Data Collection Instruments?

Now that you've defined your research questions, identified data sources, set clear goals, and chosen appropriate data collection methods, it's time to design the instruments you'll use to collect data effectively.

Design Effective Survey Questions

Designing survey questions is a crucial step in gathering accurate and meaningful data. Here are some key considerations:

- Clarity: Ensure that your questions are clear and concise. Avoid jargon or ambiguous language that may confuse respondents.

- Relevance: Ask questions that directly relate to your research objectives. Avoid unnecessary or irrelevant questions that can lead to survey fatigue.

- Avoid Leading Questions: Formulate questions that do not guide respondents toward a particular answer. Maintain neutrality to get unbiased responses.

- Response Options: Provide appropriate response options, including multiple-choice, Likert scales, or open-ended formats, depending on the type of data you need.

- Pilot Testing: Before deploying your survey, conduct pilot tests with a small group to identify any issues with question wording or response options.

Craft Interview Questions for Insightful Conversations

Developing interview questions requires thoughtful consideration to elicit valuable insights from participants:

- Open-Ended Questions: Use open-ended questions to encourage participants to share their thoughts, experiences, and perspectives without being constrained by predefined answers.

- Probing Questions: Prepare follow-up questions to delve deeper into specific topics or clarify responses.

- Structured vs. Semi-Structured Interviews: Decide whether your interviews will follow a structured format with predefined questions or a semi-structured approach that allows flexibility.

- Avoid Biased Questions: Ensure your questions do not steer participants toward desired responses. Maintain objectivity throughout the interview.

Build an Observation Checklist for Data Collection

When conducting observations, having a well-structured checklist is essential:

- Clearly Defined Variables: Identify the specific variables or behaviors you are observing and ensure they are well-defined.

- Checklist Format: Create a checklist format that is easy to use and follow during observations. This may include checkboxes, scales, or space for notes.

- Training Observers: If you have a team of observers, provide thorough training to ensure consistency and accuracy in data collection.

- Pilot Observations: Before starting formal data collection, conduct pilot observations to refine your checklist and ensure it captures the necessary information.

Streamline Data Collection with Forms and Templates

Creating user-friendly data collection forms and templates helps streamline the process:

- Consistency: Ensure that all data collection forms follow a consistent format and structure, making it easier to compare and analyze data.

- Data Validation: Incorporate data validation checks to reduce errors during data entry. This can include dropdown menus, date pickers, or required fields.

- Digital vs. Paper Forms: Decide whether digital forms or traditional paper forms are more suitable for your data collection needs. Digital forms often offer real-time data validation and remote access.

- Accessibility: Make sure your forms and templates are accessible to all team members involved in data collection. Provide training if necessary.

The Data Collection Process

Now that your data collection instruments are ready, it's time to embark on the data collection process itself. This section covers the practical steps involved in collecting high-quality data.

1. Preparing for Data Collection

Adequate preparation is essential to ensure a smooth data collection process:

- Resource Allocation: Allocate the necessary resources, including personnel, technology, and materials, to support data collection activities.

- Training: Train data collection teams or individuals on the use of data collection instruments and adherence to protocols.

- Pilot Testing: Conduct pilot data collection runs to identify and resolve any issues or challenges that may arise.

- Ethical Considerations: Ensure that data collection adheres to ethical standards and legal requirements. Obtain necessary permissions or consent as applicable.

2. Conducting Data Collection

During data collection, it's crucial to maintain consistency and accuracy:

- Follow Protocols: Ensure that data collection teams adhere to established protocols and procedures to maintain data integrity.

- Supervision: Supervise data collection teams to address questions, provide guidance, and resolve any issues that may arise.

- Documentation: Maintain detailed records of the data collection process, including dates, locations, and any deviations from the plan.

- Data Security: Implement data security measures to protect collected information from unauthorized access or breaches.

3. Ensuring Data Quality and Reliability

After collecting data, it's essential to validate and ensure its quality:

- Data Cleaning: Review collected data for errors, inconsistencies, and missing values. Clean and preprocess the data to ensure accuracy.

- Quality Checks: Perform quality checks to identify outliers or anomalies that may require further investigation or correction.

- Data Validation: Cross-check data with source documents or original records to verify its accuracy and reliability.

- Data Auditing: Conduct periodic audits to assess the overall quality of the collected data and make necessary adjustments.

4. Managing Data Collection Teams

If you have multiple team members involved in data collection, effective management is crucial:

- Communication: Maintain open and transparent communication channels with team members to address questions, provide guidance, and ensure consistency.

- Performance Monitoring: Regularly monitor the performance of data collection teams, identifying areas for improvement or additional training.

- Problem Resolution: Be prepared to promptly address any challenges or issues that arise during data collection.

- Feedback Loop: Establish a feedback loop for data collection teams to share insights and best practices, promoting continuous improvement.

By following these steps and best practices in the data collection process, you can ensure that the data you collect is reliable, accurate, and aligned with your research objectives. This lays the foundation for meaningful analysis and informed decision-making.

How to Store and Manage Data?

It's time to explore the critical aspects of data storage and management, which are pivotal in ensuring the security, accessibility, and usability of your collected data.

Choosing Data Storage Solutions

Selecting the proper data storage solutions is a strategic decision that impacts data accessibility, scalability, and security. Consider the following factors:

- Cloud vs. On-Premises: Decide whether to store your data in the cloud or on-premises. Cloud solutions offer scalability, accessibility, and automatic backups, while on-premises solutions provide more control but require significant infrastructure investments.

- Data Types: Assess the types of data you're collecting, such as structured, semi-structured, or unstructured data. Choose storage solutions that accommodate your data formats efficiently.

- Scalability: Ensure that your chosen solution can scale as your data volume grows. This is crucial for preventing storage bottlenecks.

- Data Accessibility: Opt for storage solutions that provide easy and secure access to authorized users, whether they are on-site or remote.

- Data Recovery and Backup: Implement robust data backup and recovery mechanisms to safeguard against data loss due to hardware failures or disasters.

Data Security and Privacy

Data security and privacy are paramount, especially when handling sensitive or personal information.

- Encryption: Implement encryption for data at rest and in transit. Use encryption protocols like SSL/TLS for communication and robust encryption algorithms for storage.

- Access Control: Set up role-based access control (RBAC) to restrict access to data based on job roles and responsibilities. Limit access to only those who need it.

- Compliance: Ensure that your data storage and management practices comply with relevant data protection regulations, such as GDPR, HIPAA, or CCPA.

- Data Masking: Use data masking techniques to conceal sensitive information in non-production environments.

- Monitoring and Auditing: Continuously monitor access logs and perform regular audits to detect unauthorized activities and maintain compliance.

Data Organization and Cataloging

Organizing and cataloging your data is essential for efficient retrieval, analysis, and decision-making.

- Metadata Management: Maintain detailed metadata for each dataset, including data source, date of collection, data owner, and description. This makes it easier to locate and understand your data.

- Taxonomies and Categories: Develop taxonomies or data categorization schemes to classify data into logical groups, making it easier to find and manage.

- Data Versioning: Implement data versioning to track changes and updates over time. This ensures data lineage and transparency.

- Data Catalogs: Use data cataloging tools and platforms to create a searchable inventory of your data assets, facilitating discovery and reuse.

- Data Retention Policies: Establish clear data retention policies that specify how long data should be retained and when it should be securely deleted or archived.

How to Analyze and Interpret Data?

Once you've collected your data, let's take a look at the process of extracting valuable insights from your collected data through analysis and interpretation.

Data Cleaning and Preprocessing

Data cleaning and preprocessing are essential steps to ensure that your data is accurate and ready for analysis.

- Handling Missing Data: Develop strategies for dealing with missing data, such as imputation or removal, based on the nature of your data and research objectives.

- Outlier Detection: Identify and address outliers that can skew analysis results. Consider whether outliers should be corrected, removed, or retained based on their significance.

- Normalization and Scaling: Normalize or scale data to bring it within a common range, making it suitable for certain algorithms and models.

- Data Transformation: Apply data transformations, such as logarithmic scaling or categorical encoding, to prepare data for specific types of analysis.

- Data Imbalance: Address class imbalance issues in datasets, particularly machine learning applications, to avoid biased model training.

Exploratory Data Analysis (EDA)

EDA is the process of visually and statistically exploring your data to uncover patterns, trends, and potential insights.

- Descriptive Statistics: Calculate basic statistics like mean, median, and standard deviation to summarize data distributions.

- Data Visualization: Create visualizations such as histograms, scatter plots, and heatmaps to reveal relationships and patterns within the data.

- Correlation Analysis: Examine correlations between variables to understand how they influence each other.

- Hypothesis Testing: Conduct hypothesis tests to assess the significance of observed differences or relationships in your data.

Statistical Analysis Techniques

Choose appropriate statistical analysis techniques based on your research questions and data types.

- Descriptive Statistics: Use descriptive statistics to summarize and describe your data, providing an initial overview of key features.

- Inferential Statistics: Apply inferential statistics, including t-tests, ANOVA, or regression analysis, to test hypotheses and draw conclusions about population parameters.

- Non-parametric Tests: Employ non-parametric tests when assumptions of normality are not met or when dealing with ordinal or nominal data.

- Time Series Analysis: Analyze time-series data to uncover trends, seasonality, and temporal patterns.

Data Visualization

Data visualization is a powerful tool for conveying complex information in a digestible format.

- Charts and Graphs: Utilize various charts and graphs, such as bar charts, line charts, pie charts, and heatmaps, to represent data visually.

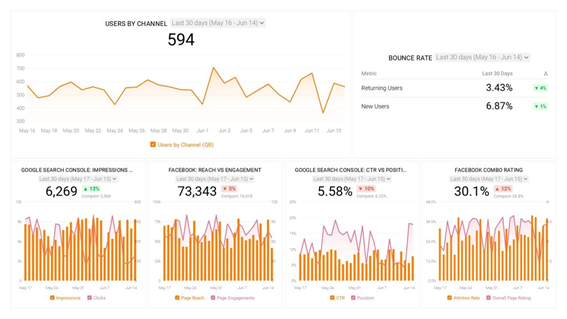

- Interactive Dashboards: Create interactive dashboards using tools like Tableau, Power BI, or custom web applications to allow stakeholders to explore data dynamically.

- Storytelling: Use data visualization to tell a compelling data-driven story, highlighting key findings and insights.

- Accessibility: Ensure that data visualizations are accessible to all audiences, including those with disabilities, by following accessibility guidelines.

Drawing Conclusions and Insights

Finally, drawing conclusions and insights from your data analysis is the ultimate goal.

- Contextual Interpretation: Interpret your findings in the context of your research objectives and the broader business or research landscape.

- Actionable Insights: Identify actionable insights that can inform decision-making, strategy development, or future research directions.

- Report Generation: Create comprehensive reports or presentations that communicate your findings clearly and concisely to stakeholders.

- Validation: Cross-check your conclusions with domain experts or subject matter specialists to ensure accuracy and relevance.

By following these steps in data analysis and interpretation, you can transform raw data into valuable insights that drive informed decisions, optimize processes, and create new opportunities for your organization.

How to Report and Present Data?

Now, let's explore the crucial steps of reporting and presenting data effectively, ensuring that your findings are communicated clearly and meaningfully to stakeholders.

1. Create Data Reports

Data reports are the culmination of your data analysis efforts, presenting your findings in a structured and comprehensible manner.

- Report Structure: Organize your report with a clear structure, including an introduction, methodology, results, discussion, and conclusions.

- Visualization Integration: Incorporate data visualizations, charts, and graphs to illustrate key points and trends.

- Clarity and Conciseness: Use clear and concise language, avoiding technical jargon, to make your report accessible to a diverse audience.

- Actionable Insights: Highlight actionable insights and recommendations that stakeholders can use to make informed decisions.

- Appendices: Include appendices with detailed methodology, data sources, and any additional information that supports your findings.

2. Leverage Data Visualization Tools

Data visualization tools can significantly enhance your ability to convey complex information effectively. Top data visualization tools include:

- Tableau: Tableau offers a wide range of visualization options and interactive dashboards, making it a popular choice for data professionals.

- Power BI: Microsoft's Power BI provides powerful data visualization and business intelligence capabilities, suitable for creating dynamic reports and dashboards.

- Python Libraries: Utilize Python libraries such as Matplotlib, Seaborn, and Plotly for custom data visualizations and analysis.

- Excel: Microsoft Excel remains a versatile tool for creating basic charts and graphs, particularly for smaller datasets.

- Custom Development: Consider custom development for specialized visualization needs or when existing tools don't meet your requirements.

3. Communicate Findings to Stakeholders

Effectively communicating your findings to stakeholders is essential for driving action and decision-making.

- Audience Understanding : Tailor your communication to the specific needs and background knowledge of your audience. Avoid technical jargon when speaking to non-technical stakeholders.

- Visual Storytelling: Craft a narrative that guides stakeholders through the data, highlighting key insights and their implications.

- Engagement: Use engaging and interactive presentations or reports to maintain the audience's interest and encourage participation.

- Question Handling: Be prepared to answer questions and provide clarifications during presentations or discussions. Anticipate potential concerns or objections.

- Feedback Loop: Encourage feedback and open dialogue with stakeholders to ensure your findings align with their objectives and expectations.

Data Collection Examples

To better understand the practical application of data collection in various domains, let's explore some real-world examples, including those in the business context. These examples illustrate how data collection can drive informed decision-making and lead to meaningful insights.

Business Customer Feedback Surveys

Scenario: A retail company wants to enhance its customer experience and improve product offerings. To achieve this, they initiate customer feedback surveys.

Data Collection Approach:

- Survey Creation: The company designs a survey with specific questions about customer preferences , shopping experiences , and product satisfaction.

- Distribution: Surveys are distributed through various channels, including email, in-store kiosks, and the company's website.

- Data Gathering: Responses from thousands of customers are collected and stored in a centralized database.

Data Analysis and Insights:

- Customer Sentiment Analysis: Using natural language processing (NLP) techniques, the company analyzes open-ended responses to gauge customer sentiment.

- Product Performance: Analyzing survey data, the company identifies which products receive the highest and lowest ratings, leading to decisions on which products to improve or discontinue.

- Store Layout Optimization: By examining feedback related to in-store experiences, the company can adjust store layouts and signage to enhance customer flow and convenience.

Healthcare Patient Record Digitization

Scenario: A healthcare facility aims to transition from paper-based patient records to digital records for improved efficiency and patient care.

- Scanning and Data Entry: Existing paper records are scanned, and data entry personnel convert them into digital format.

- Electronic Health Record (EHR) Implementation: The facility adopts an EHR system to store and manage patient data securely.

- Continuous Data Entry: As new patient information is collected, it is directly entered into the EHR system.

- Patient History Access: Physicians and nurses gain instant access to patient records, improving diagnostic accuracy and treatment.

- Data Analytics: Aggregated patient data can be analyzed to identify trends in diseases, treatment outcomes, and healthcare resource utilization.

- Resource Optimization: Analysis of patient data allows the facility to allocate resources more efficiently, such as staff scheduling based on patient admission patterns.

Social Media Engagement Monitoring

Scenario: A digital marketing agency manages social media campaigns for various clients and wants to track campaign performance and audience engagement.

- Social Media Monitoring Tools: The agency employs social media monitoring tools to collect data on post engagement, reach, likes, shares, and comments.

- Custom Tracking Links: Unique tracking links are created for each campaign to monitor traffic and conversions.

- Audience Demographics: Data on the demographics of engaged users is gathered from platform analytics.

- Campaign Effectiveness: The agency assesses which campaigns are most effective in terms of engagement and conversion rates.

- Audience Segmentation: Insights into audience demographics help tailor future campaigns to specific target demographics.

- Content Strategy: Analyzing which types of content (e.g., videos, infographics) generate the most engagement informs content strategy decisions.

These examples showcase how data collection serves as the foundation for informed decision-making and strategy development across diverse sectors. Whether improving customer experiences, enhancing healthcare services, or optimizing marketing efforts, data collection empowers organizations to harness valuable insights for growth and improvement.

Ethical Considerations in Data Collection

Ethical considerations are paramount in data collection to ensure privacy, fairness, and transparency. Addressing these issues is not only responsible but also crucial for building trust with stakeholders.

Informed Consent

Obtaining informed consent from participants is an ethical imperative. Transparency is critical, and participants should fully understand the purpose of data collection, how their data will be used, and any potential risks or benefits involved. Consent should be voluntary, and participants should have the option to withdraw their consent at any time without consequences.

Consent forms should be clear and comprehensible, avoiding overly complex language or legal jargon. Special care should be taken when collecting sensitive or personal data to ensure privacy rights are respected.

Privacy Protection

Protecting individuals' privacy is essential to maintain trust and comply with data protection regulations. Data anonymization or pseudonymization should be used to prevent the identification of individuals, especially when sharing or publishing data. Data encryption methods should be implemented to protect data both in transit and at rest, safeguarding it from unauthorized access.

Strict access controls should be in place to restrict data access to authorized personnel only, and clear data retention policies should be established and adhered to, preventing unnecessary data storage. Regular privacy audits should be conducted to identify and address potential vulnerabilities or compliance issues.

Bias and Fairness in Data Collection

Addressing bias and ensuring fairness in data collection is critical to avoid perpetuating inequalities. Data collection methods should be designed to minimize potential biases , such as selection bias or response bias. Efforts should be made to achieve diverse and representative samples , ensuring that data accurately reflects the population of interest. Fair treatment of all participants and data sources is essential, with discrimination based on characteristics such as race, gender, or socioeconomic status strictly avoided.

If algorithms are used in data collection or analysis, biases that may arise from automated processes should be assessed and mitigated. Ethical reviews or expert consultations may be considered when dealing with sensitive or potentially biased data. By adhering to ethical principles throughout the data collection process, individuals' rights are protected, and a foundation for responsible and trustworthy data-driven decision-making is established.

Data collection is the cornerstone of informed decision-making and insight generation in today's data-driven world. Whether you're a business seeking to understand your customers better, a researcher uncovering valuable trends, or anyone eager to harness the power of data, this guide has equipped you with the essential knowledge and tools. Remember, ethical considerations are paramount, and the quality of data matters.

Furthermore, as you embark on your data collection journey, always keep in mind the impact and potential of the information you gather. Each data point is a piece of the puzzle that can help you shape strategies, optimize operations, and make a positive difference. Data collection is not just a task; it's a powerful tool that empowers you to unlock opportunities, solve challenges, and stay ahead in a dynamic and ever-changing landscape. So, continue to explore, analyze, and draw valuable insights from your data, and let it be your compass on the path to success.

How to Collect Data in Minutes?

Imagine having the power to conduct your own market research in minutes, without the need for a PhD in research. Appinio is the real-time market research platform that empowers you to get instant consumer insights, fueling your data-driven decisions. We've transformed market research from boring and intimidating to exciting and intuitive.

Here's why Appinio is your go-to platform:

- Lightning-Fast Insights: From questions to insights in minutes. When you need answers, Appinio delivers swiftly.

- User-Friendly: Our platform is so intuitive that anyone can use it; no research degree required.

- Global Reach: Define your target group from over 1200 characteristics and survey them in 90+ countries.

- Guided Expertise: Our dedicated research consultants will support you every step of the way, ensuring your research journey is seamless and effective.

Join the loop 💌

Be the first to hear about new updates, product news, and data insights. We'll send it all straight to your inbox.

Get the latest market research news straight to your inbox! 💌

Wait, there's more

28.03.2024 | 27min read

What is Sampling Error? Definition, Types, Examples

27.03.2024 | 31min read

Situational Analysis: Definition, Methods, Process, Examples

26.03.2024 | 31min read

What is Ad Hoc Analysis and Reporting? Process, Examples

- Mobile Forms

- INTEGRATIONS

- See 100+ integrations

- FEATURED INTEGRATIONS

- See more Integrations

- See more CRM Integrations

- See more Storage Integrations

- See more Payment Integrations

- See more Email Integrations

- Jotform Teams

- Enterprise Mobile

- Prefill Forms

- HIPAA Forms

- Secure Forms

- Assign Forms

- Online Payments

- See more features

- Multiple Users

- Admin Console

- White Labeling

- See more Enterprise Features

- Contact Sales

- Contact Support

- Help Center

- The Ultimate Guide to Online Forms NEW

- Jotform Academy

Get a dedicated support team with Jotform Enterprise.

Apply to Jotform Enterprise for a dedicated support team.

- Sign Up for Free

- Market Research

How to conduct data collection in market research

Market research should be a critical part of every organization’s business strategy. It enables businesses to learn more about their target audience, what they look for in a product or service, what’s important to them, and how they want to engage with a business.

When you’re conducting marketing research, you need to ensure that the data you gather is reliable and valid. Read on to learn about the importance of data collection in market research, different methods for collecting data, and software that makes market research data collection easy and effective.

Why data collection is important

Collecting data is integral to conducting market research. Organizations connect with stakeholders — such as prospects, customers, competitors, investors, and employees — to learn more about their target market and how they can better serve them. The data an organization collects can steer its entire business strategy, so it’s vital for the data to be high- quality, secure, and relevant.

“Data collection is the first and most-needed step to research the market,” says Daniela Sawyer, the founder of FindPeopleFast , a SaaS platform. “Product demand and the possible price are fixed after researching the market.”

Collecting data directly from a source (meaning firsthand feedback from your audiences, as opposed to secondhand data from other sources) ensures its accuracy. For example, if your business is considering going after a new target market, you may want to survey that audience to see whether they’re actually interested in the company’s offerings.

If you use secondhand data, such as a report on a similar demographic, you may not achieve the same results. Because the data doesn’t apply to your company and its products/services specifically, it may not be as reliable for developing a successful business strategy.

Data collection methods for marketing teams

There are different ways to collect data in market research. Here are a few examples:

- Market survey: Sawyer notes this is one of the most effective methods of market research because you hear directly from the target audience about their level of interest in your product or service.

- Online forms: This is a quick and easy way to get information from website visitors, such as their contact information and preferences about what types of information they want to receive from your company.

- Customer service questionnaires: This is a great way for businesses to evaluate their customer service performance.

- Focus group surveys: “Direct interviews with the [product’s] users can give the most accurate data,” says Sawyer. This is a good way to get nuanced insights.

Depending on the goals of data collection, organizations may want to gather demographic data — such as age, income, location — from their prospects. If you want to improve your offerings, you may poll existing customers to learn more about their levels of engagement and satisfaction. Organizations can also conduct market research by surveying their employees and learning about their experiences with specific types of customers.

Better data collection with Jotform

Regardless of how an organization collects data for market research, it’s important to use the right software to ensure the process is seamless for both the company and its audience.

Jotform offers market research teams a wide array of templates to enhance the data collection process, so organizations can learn more about their audience, what they want and don’t want, and how they can better serve them.

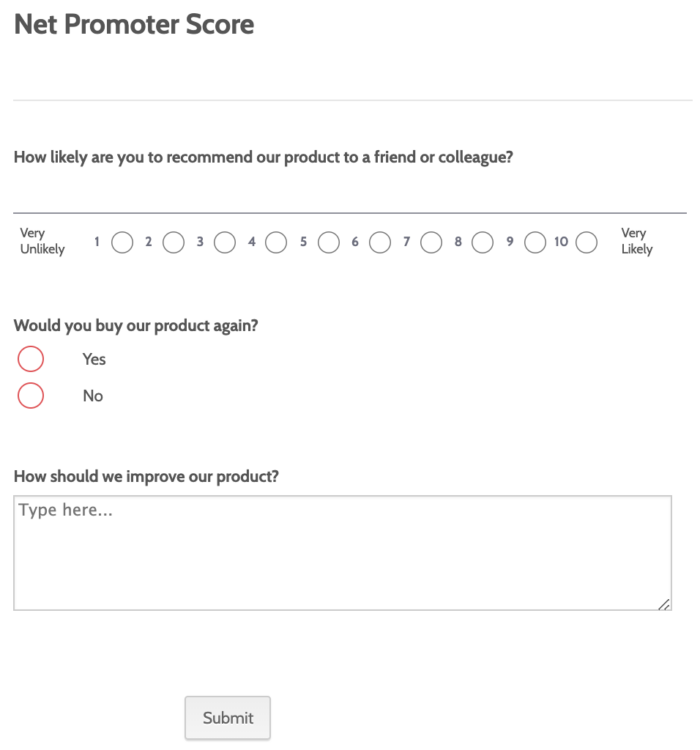

Examples of templates a marketing team can use include demographic surveys, subscribe forms, Net Promoter Score forms, pre-sales questionnaires, user experience surveys, and more. Each template is fully customizable, so you can add or change form fields based on your needs to gather the right kind of data. You can also add your own branding to the templates to create a consistent user experience.

So, you’ve learned about the importance of data collection in market research and the different ways to collect data. And now you know which software to use for gathering insights. There’s no better time to get started with your own market research efforts.

Thank you for helping improve the Jotform Blog. 🎉

- Data Collection

- Data Collection Tools

RECOMMENDED ARTICLES

How to Do Market Research

How to do customer research

Quantitative research question examples

6 insights for running effective marketing research surveys

4 expert tips for conducting qualitative market research

7 common types of market research

5 quantitative market research best practices

What is the population of interest?

4 ways to conduct online market research

9 customer-focused market research survey questions

7 market research tools you should start using today

Send Comment :

1 Comments:

More than a year ago

Nice Blog. Thank for sharing. We are market research and data collection company having a proprietary panel of 600K+ respondents spread across the USA, India, China, Saudi Arabia, Morocco, UAE, and Egypt,

How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry. The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

Primary vs. secondary market research

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

1. Surveys and questionnaires

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

5. Online research tools

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

2. Identify your target audience

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.

The more specific your target audience, the more accurate and actionable your research will be. Additionally, segment your audience if your research objectives involve studying different groups, such as current customers and potential leads.

If you already have existing customers, you can also hold conversations with them to better understand your target market. From there, you can refine your buyer personas and tailor your research methods accordingly.

3. Choose your research methods

Selecting the right research methods is crucial for gathering high-quality data. Start by considering the nature of your research objectives. If you’re exploring consumer preferences, surveys and interviews can provide valuable insights. For in-depth understanding, focus groups or observational research might be suitable. Consider using a mix of quantitative and qualitative methods to gain a well-rounded perspective.

You’ll also need to consider your budget. Think about what you can realistically achieve using the time and resources available to you. If you have a fairly generous budget, you may want to try a mix of primary and secondary research approaches. If you’re doing market research for a startup , on the other hand, chances are your budget is somewhat limited. If that’s the case, try addressing your goals with secondary research tools before investing time and effort in a primary research study.

4. Use the right market research tools